- One benchmark suggested that Ethereum’s price was undervalued.

- Ethereum had a strong support level around $2,300.

Ethereums [ETH] witnessed a price correction in recent days as its value fell below $2,400.

While this might have raised concerns among investors, a whale took this opportunity to stock up on more ETH before regaining bullish momentum.

Ethereum whales took advantage of this opportunity

The past week has been a bloodbath for Ethereum as it lost much of its value. The week started with ETH trading above $2,600, but things quickly turned bearish.

According to CoinMarketCapETH is down more than 7% in the past seven days. At the time of writing, ETH was trading at $2,346.75 with a market cap of over $282 billion.

As the value of the token plummeted, whales used this as an opportunity to store more ETH. Lookonchain recently posted a tweet highlighting this incident.

According to the tweet, whales collected a total of 26,841 ETH, which was worth more than $64.5 million.

Whales stack up $ETH today, with a total of 26,841 $ETH($64.5 million).

0x55C1 withdrew 7,779 $ETH($18.7 million) from #Binance 2 hours ago.https://t.co/k5s2t0kKec

0xDa17 and 0x278f (possibly the same person) withdrew 8,077 $ETH ($19.4 million) from #Bitfinex.https://t.co/CyfU4ZMcV8… pic.twitter.com/YDJqpeTLTU

— Lookonchain (@lookonchain) January 22, 2024

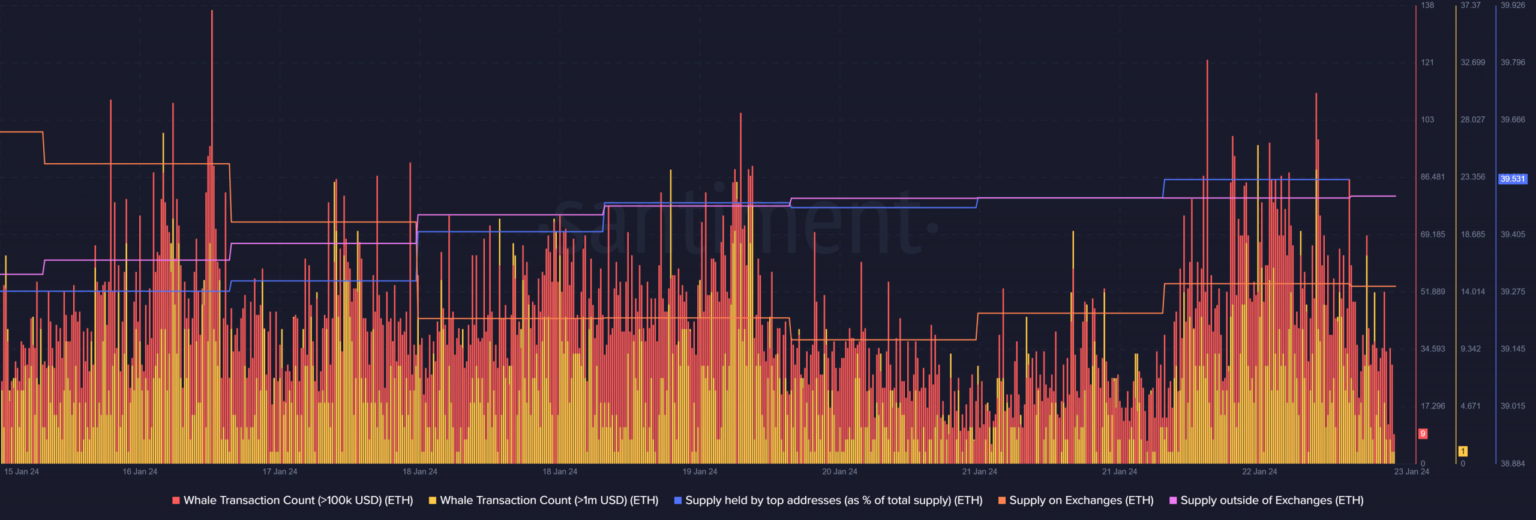

To double check this trend, AMBCrypto took a look at Santiment’s data. Our analysis found that whale activity around ETH increased last week as the number of whale transactions increased.

The supply of the top addresses also increased, indicating high accumulation.

Source: Santiment

The broader market also appeared to have accumulated more ETH while the price remained low.

This was evident from the fact that ETHThe supply on the exchanges fell, while the supply outside the exchanges increased last week.

This could have been the right time to accumulate ETH before its price rises.

AMBCrypto’s look at Glassnode’s data revealed that ETH’s Network Value to Transactions (NVT) ratio fell sharply on January 21.

When the measure falls, it means the asset is undervalued, signaling a trend reversal for Ethereum.

Source: Glassnode

Ethereum to start a bull rally soon?

To understand whether Ethereum would start a rally in the coming days, we checked its liquidation levels. According to our analysis, ETH has a strong support zone around $2,300.

Therefore, it will not be surprising to see ETH hit that level before it regains bullish momentum.

Source: Hyblock Capital

Read Ethereums [ETH] Price prediction 2024-25

Ethereum’s MACD showed a clear bearish upper hand on the market at the time of writing.

The Money Flow Index (MFI) also registered a decline, indicating that the possibility of ETH reaching $2,300 before a bull rally begins is high.

Source: TradingView