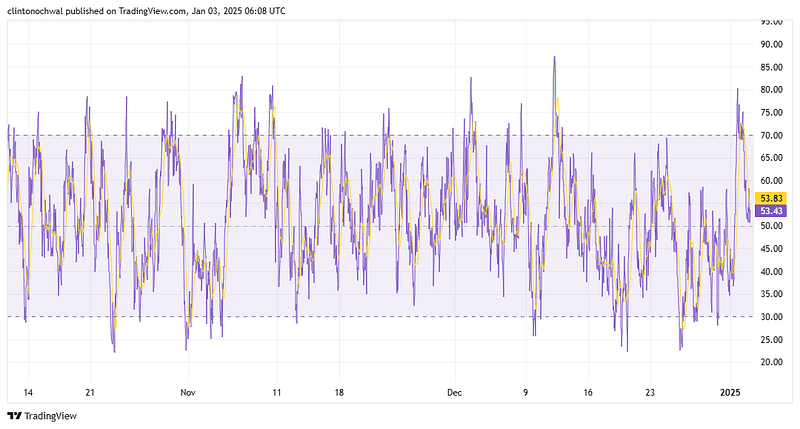

- LINK found significant support at $22.54, previously a resistance level.

- Historically, rising Open Interest during a consolidation phase, as seen in LINK’s chart, often precedes significant price movement.

Chain link [LINK] is known for its crucial role in connecting smart contracts with real-world data. Recently, it has shown promising price movements on its chart.

This resilience at new support levels signals the possibility of an upside breakout, potentially pushing support towards new all-time highs.

However, past trends and external metrics are showing mixed signals, prompting traders to remain vigilant.

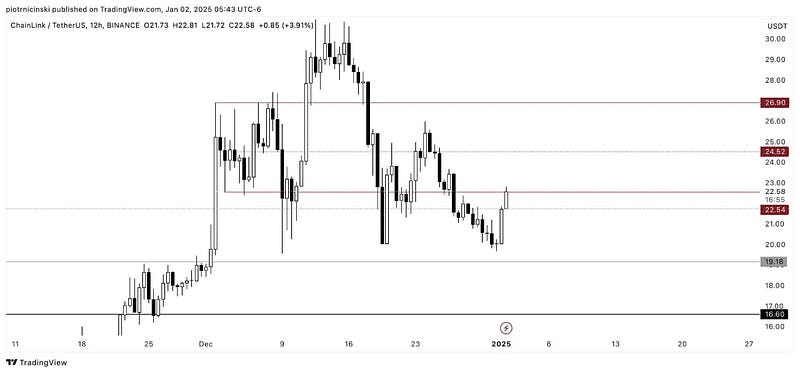

Resistance turns into support

On the 12-hour chart, LINK found significant support at $22.54, previously a resistance level. This classic “support flip” has traders speculating whether the coin will resume its upward momentum.

The Relative Strength Index (RSI), a key technical indicator, was hovering around 50 at the time of writing, reflecting neutral market sentiment.

Trading view

The current consolidation signals market indecision, in line with LINK’s struggle to close decisively above $22.58. This pattern often precedes an outbreak or slump.

If LINK rises above the next resistance level at $24.52, it could target $26.90 or higher. However, failure to hold $22.54 as support could lead to a retest of the $19.16 region.

Trading view

Given the doubling of revenue for Chainlink software services between 2022 and 2023, institutional interest could provide a bullish push.

However, historical price patterns indicate that LINK may remain subdued within this range, especially with its volatile lower time frames. Traders should keep a close eye on the RSI and price action for clearer signals.

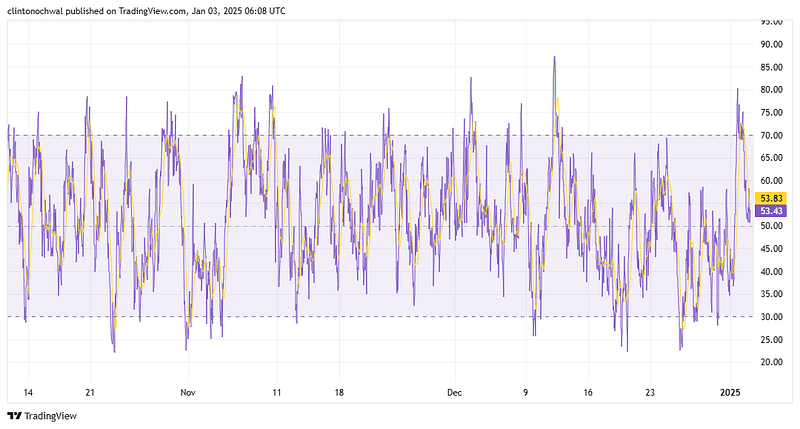

Open interest analysis

Open Interest (OI) for LINK has been steadily increasing in recent days, indicating increased trading activity and interest in the market. Currently, LINK’s OI is up about 8%, reflecting renewed commitment from both bulls and bears.

Historically, rising OI during a consolidation phase, as seen in LINK’s chart, often precedes significant price movement. If the price breaks above the resistance at $24.52, we could see an influx of new positions, pushing the OI further higher.

However, if LINK falters and falls below $22.01, the OI could fall as traders liquidate their positions to minimize risk. This trend highlights the importance of monitoring OI alongside price action to effectively predict potential breakouts or breakdowns.

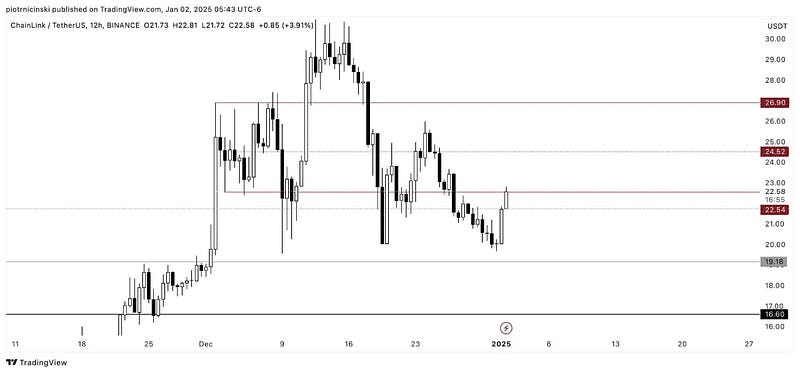

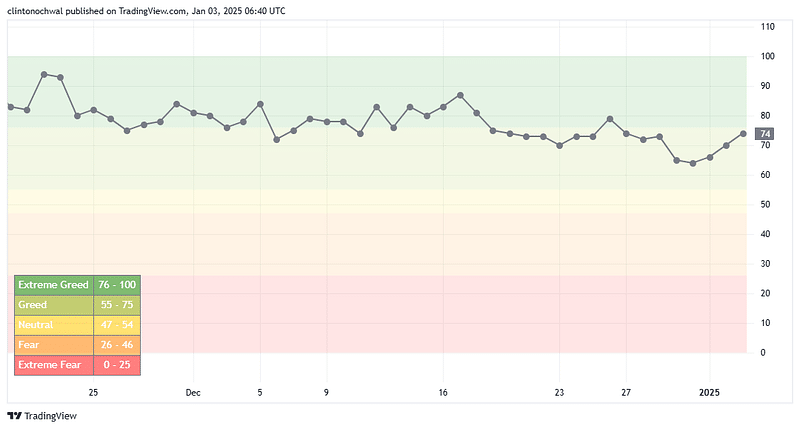

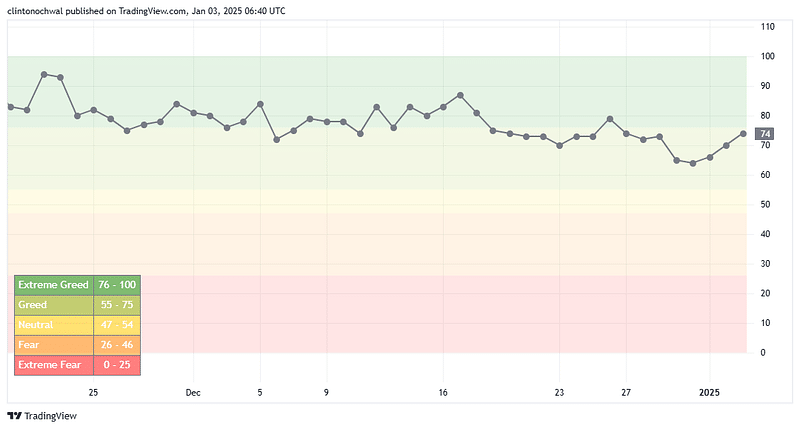

Market sentiment remains neutral

The Crypto Fear and Greed Index recently registered a reading of 64, indicating increased bullish sentiment. This marks a shift from previous neutral readings and reflects growing optimism among market participants.

Trading view

Historically, scores above 60 indicate rising confidence, often in line with price increases or asset accumulation. For LINK, this growing greed sentiment could lead to continued buying pressure, potentially pushing the price above the current resistance at $24.52.

However, traders should remain cautious. Increased greed usually precedes short-term corrections, as profit-taking tends to increase in overheated conditions.

If sentiment moves further into the extreme greed zone (above 76), LINK may look to challenge the $26.90 level or higher. Conversely, a pullback in sentiment to neutral levels could coincide with a retest of $22.01 or lower.

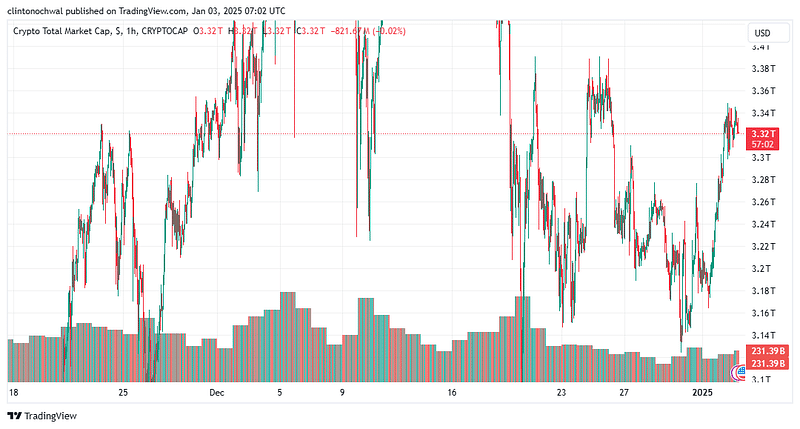

Broader market trends

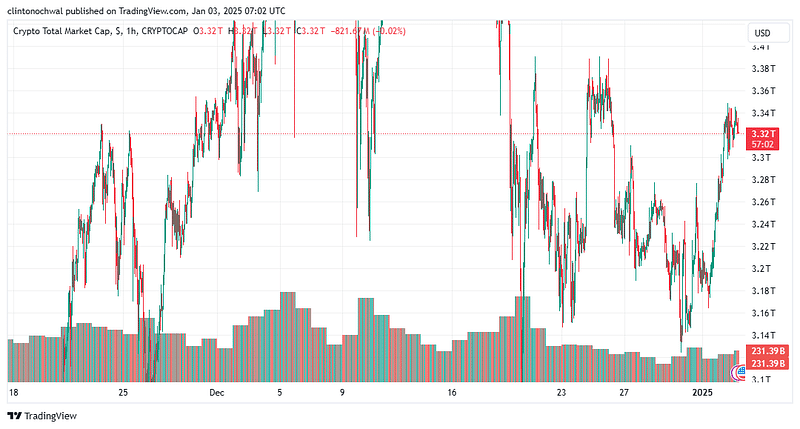

The Total Crypto Market Cap, a key metric for evaluating the overall health of the cryptocurrency market, recently recovered from $3.2 trillion and is now around $3.3 trillion.

This recovery is in line with the broader market’s cautious optimism, supported by growing institutional interest in altcoins such as LINK, Solana’s [SOL]and Ethena [ENA].

However, the total market capitalization remains below the previous record of $3.65 trillion, indicating that the market is still in a corrective phase.

Trading view

Chainlink’s performance reflects broader market dynamics. The coin’s consolidation around the $22.54 support level reflects the market’s hesitation to make significant upward moves.

A continued rise in total market cap above $3.65 trillion could serve as a bullish catalyst for LINK, pushing it towards $26.90 and possibly $30+. Conversely, a drop below $3.2 trillion could strengthen bearish sentiment, causing LINK to retest lower levels.

Is your portfolio green? View the LINK Profit Calculator

External factors, such as regulatory developments and macroeconomic trends, continue to influence overall market capitalization and, by extension, LINK.

Recent UK government documents showing Chainlink’s revenue doubling by 2023 underline the growing practicality of blockchain technologies, potentially attracting more capital to the market.

Chainlink remains one of the most promising projects in the crypto space, with robust revenue growth and increasing institutional interest. While the current technical situation and market sentiment suggest consolidation, the potential for a breakout cannot be ignored.