Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

In the midst of the current market correction, Chainlink (link) has lost its recent profits and fall back on a crucial level of support. An analyst suggests that a monthly close to his current reach could position the cryptocurrency for an increase of 35%.

Related lecture

Chainlink Restest Crucial Price Zone

Chainlink has been withdrawn 9.1% over the past 24 hours to re -test the most important support zone of $ 14. The cryptocurrency rose by 15.7% of last Friday’s lows to reach an 18-day high point of $ 16 on Wednesday, and recovered 35% compared to the low point of this month.

The recent market correction, however, stopped the momentum of most cryptocurrencies, with Bitcoin (BTC) returning to the $ 83,700 and Ethereum (ETH) that immersed the $ 1,860 support zone.

Today link fell from $ 15 to $ 14.07 and lost all Wednesday profits. Earlier, analyst Ali Martinez noted that the cryptocurrency has been in an increasing parallel channel since July 2023.

Chainlink floats between the upper and lower limit of the pattern for the past year and a half and rose to the upper trendline of the channel every time it tested the lower zone before it fell.

In the midst of his recent price performance, the Cryptocurrency tests the re -testing of the lower limit of the channel, which suggests that a bouncer could come to the upper range if it retains its current price levels.

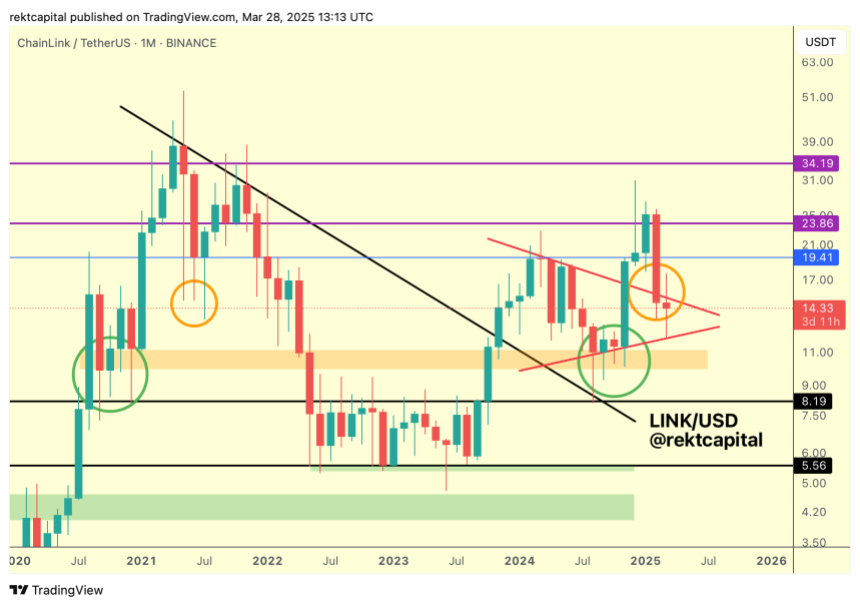

Meanwhile, Capital stretches marked That the token are multi-months symmetrical triangular pattern tests, which could determine the next move of the cryptocurrency.

As the analyst has explained, consolidated in a “macro -corner market structure” during most of 2024 in a “macro -corner market structure” before he broke out of the pattern during the November market trally.

During the Q4 2024 breakout, the cryptocurrency reached a highlight of $ 30.9, but could not hold this level in the following weeks. As a result, it has been in a downward trend in the last three months, with the price of Link back in the Macro triangle.

“The main objective for Link here is to re -test the top of the pattern to take a successful retest after excretion,” Capital Detailed, adding to it: “It is possible that this is a volatile retest after the outbreak.”

Link must hold this level

Capital pointed out that Chainlink historically had the deviations in this price range: “Within mid -2021, Link produced a downward deviation in this price surface in the form of several monthly downward wanks.”

Nevertheless, the cryptocurrency is disadvantage of “but in the form of actual candles closes this time instead of Neerwaartse Lonten”.

The analyst has also emphasized that link, as in 2021, acts in a historic demand area, around $ 13-5 and $ 15.5, which tests this zone as support. Based on this, the cryptocurrency must successfully hold this area to ‘position itself for the top’.

Related lecture

Moreover, the retest is the key to reclaim the top of the triangular market structure. Breaking and repairing that level would “a successful retest after expanding the breakout requirements” and enable the price to focus the resistance of $ 19 in the future.

The analyst concluded that if Link closes the month above the Triangle top, “the price would position for a successful retesting, despite the close deviation.”

Chainlink is currently acting at $ 14.09, a decrease of 6.9% in the monthly period.

Featured image of unsplash.com, graph of TradingView.com