- LINK recovered from a critical level of support after holding out for years

- The RSI heatmap revealed the lowest average as sector performance underlined bullish sentiment

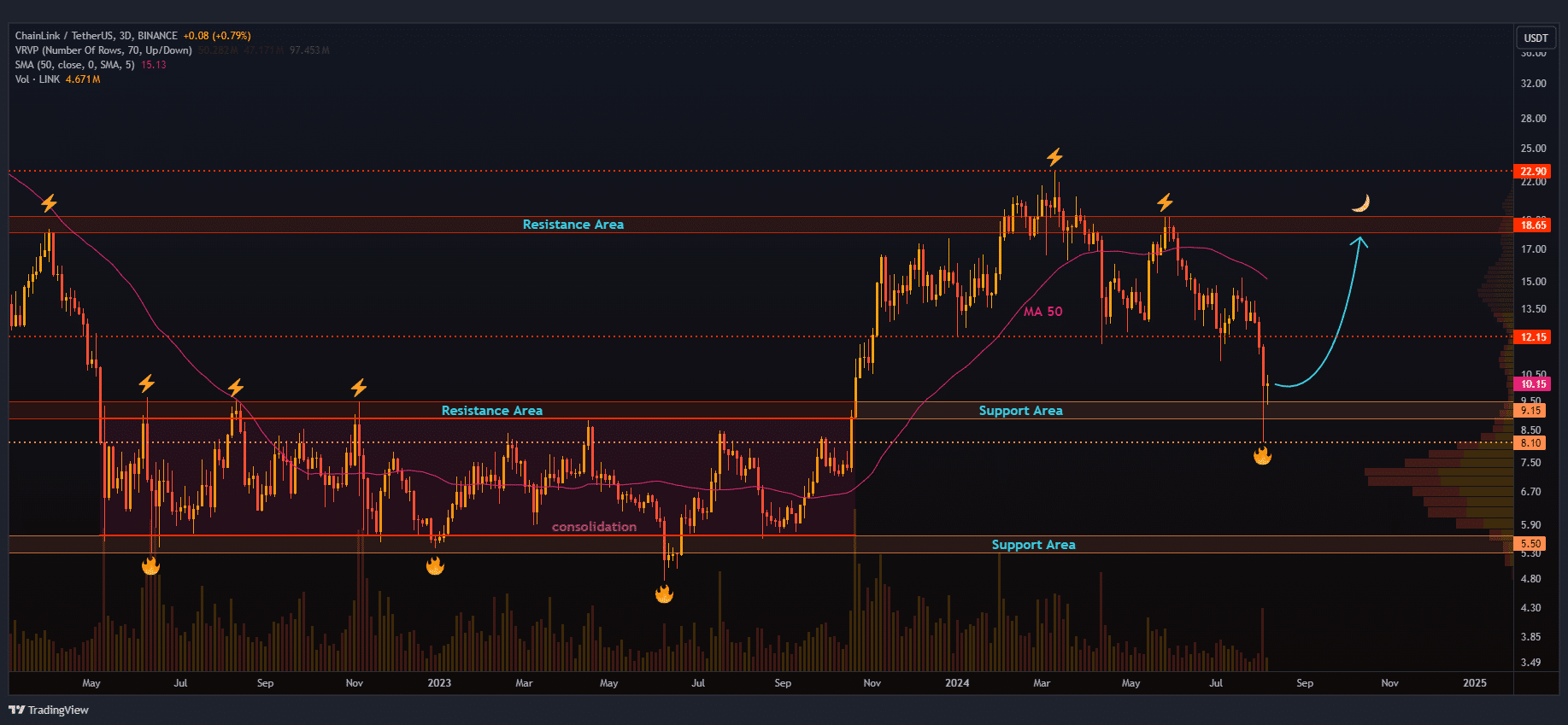

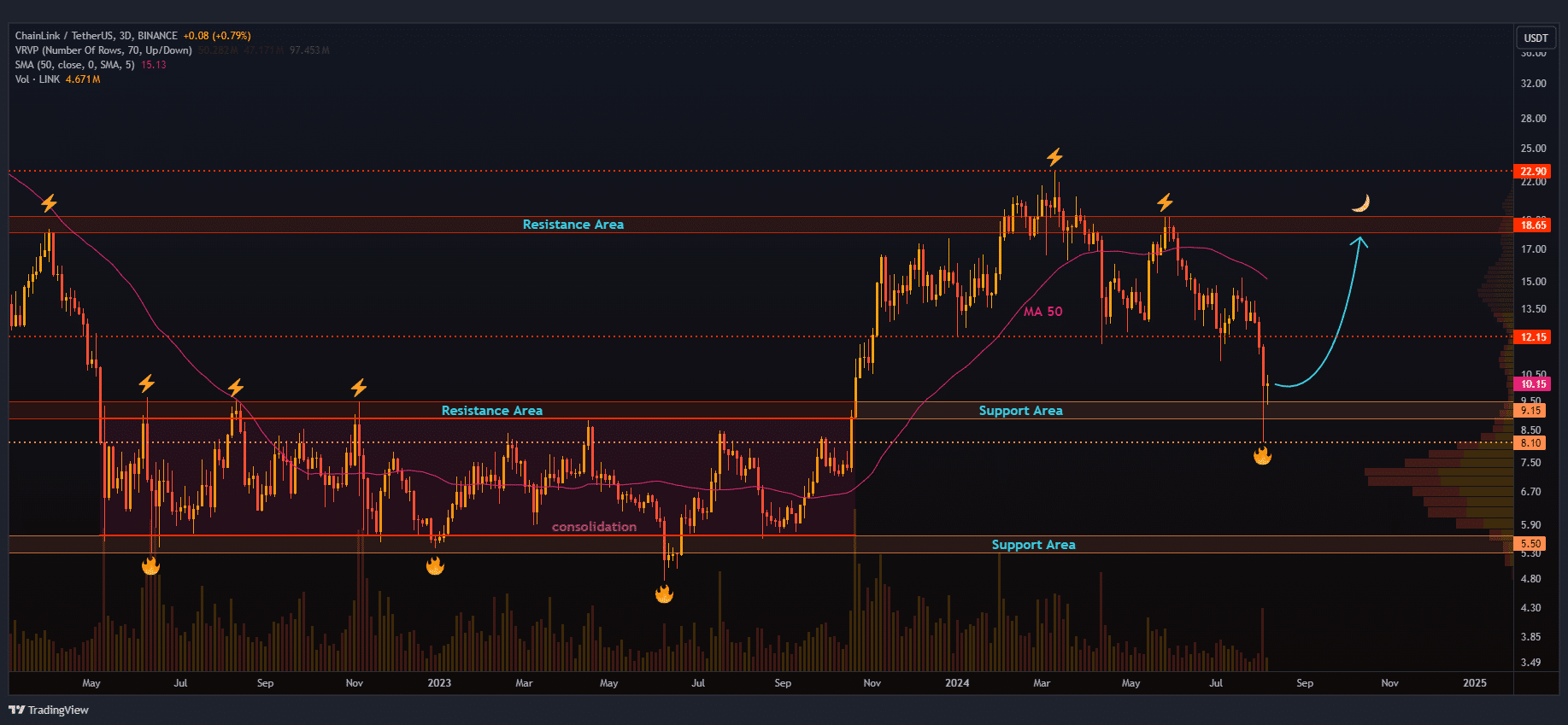

Chain link [LINK]at the time of writing, appeared to be recovering from a critical support and resistance level on the charts – a level it held for years.

A successful retest of this zone could pave the way for LINK to reach new highs in the coming months.

Buying near the $12.71 zone looked promising due to the key support level there. Recently, the price even reached the gold zone around $9.8. This could signal a bullish continuation if $12.71 is reclaimed as support.

However, there is a possibility for a further dip to complete a bearish pattern. If $9.39 is breached this week, another test of the gold zone could occur.

Source: LINK/USD, TradingView

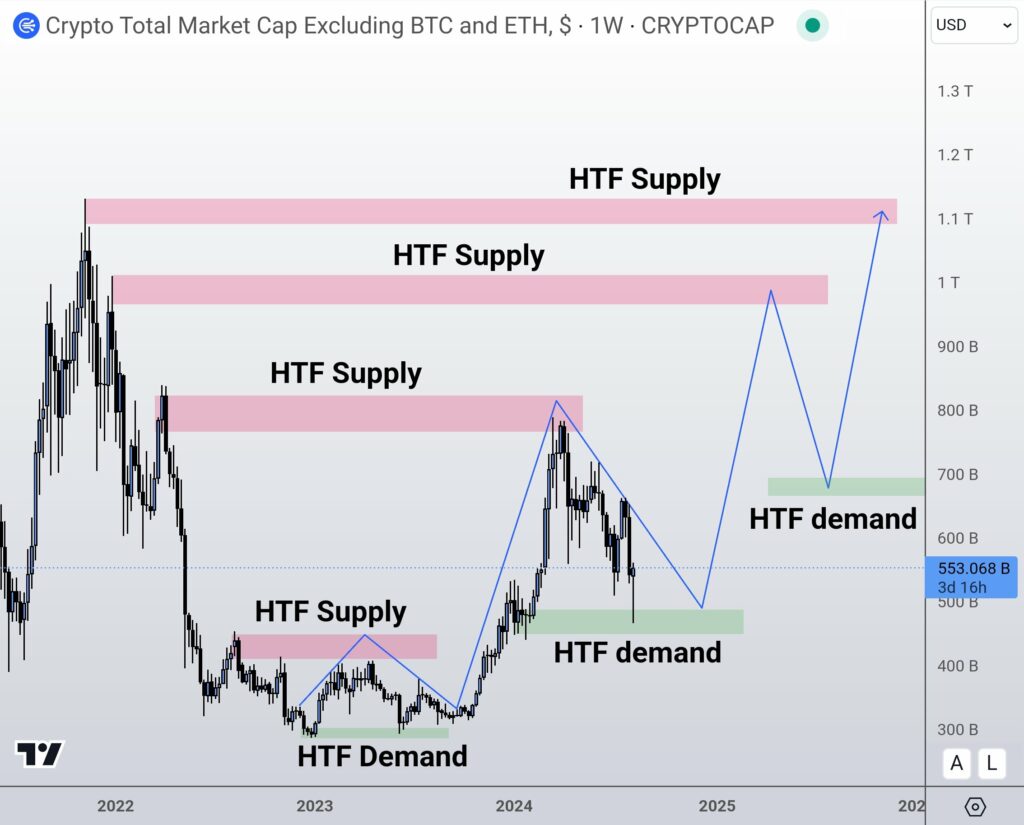

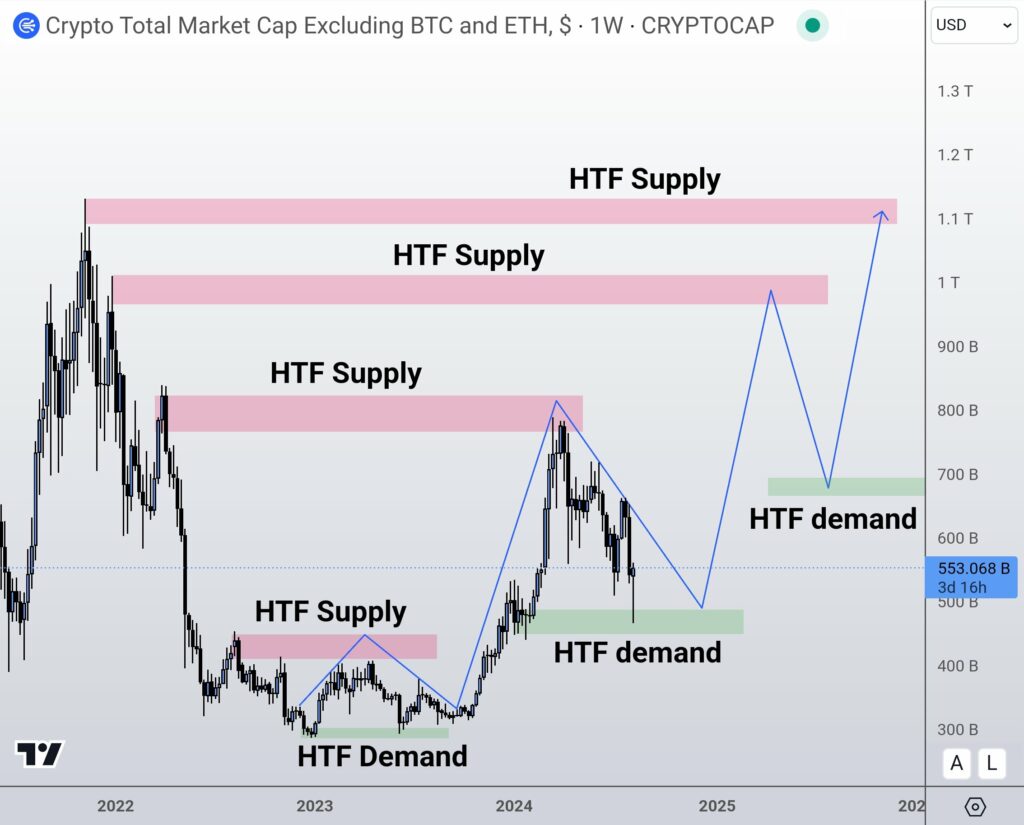

HTF demand zone for altcoins

Altcoins have rebounded strongly lately, with several posting big gains this week. Besides BTC closing above $60,000 and ETH holding steady, this could mark the start of a bull cycle.

Altcoins have bounced back after rejecting a key support zone on their charts, suggesting they may also be poised for further gains

Keeping an eye on LINK is crucial as it could perform exceptionally well in the coming months due to its role in decentralized data management.

Source: TradingView

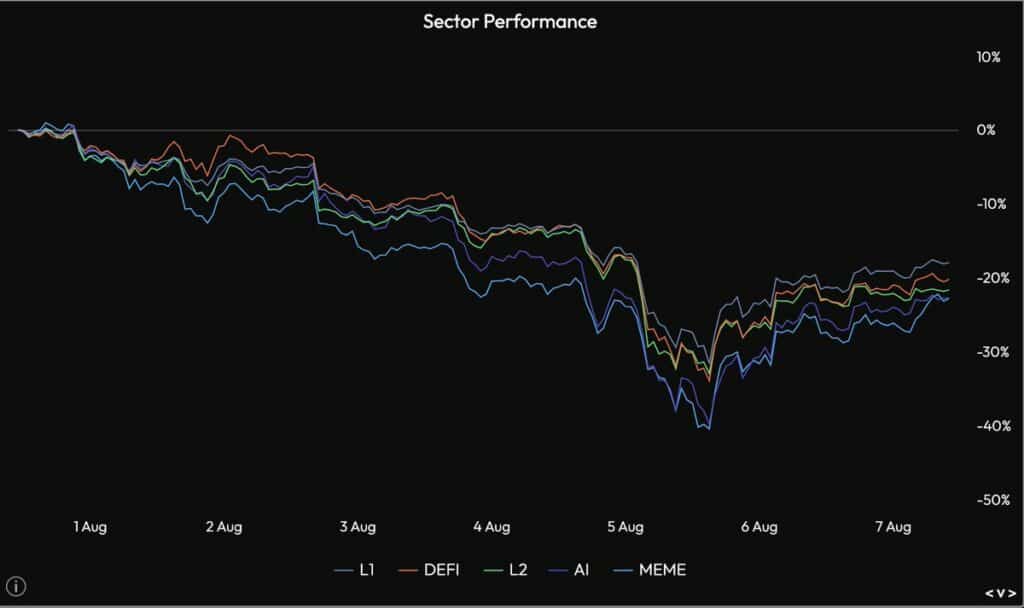

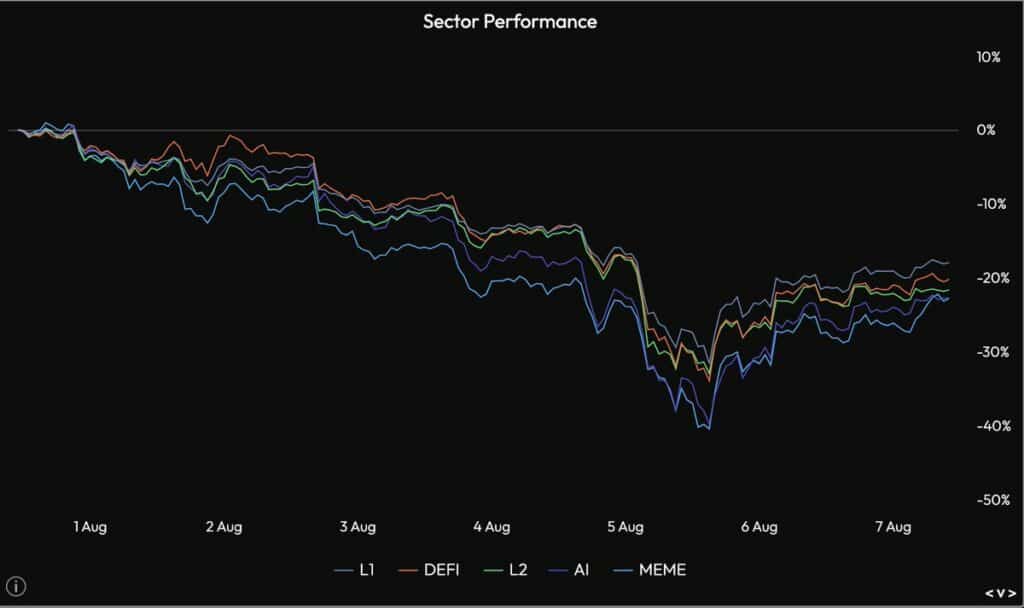

Sector performance in crypto

However, the past week has been challenging for altcoins, with many losing around 40% of their value from the week before.

However, approximately half of these losses have now been recovered. However, no specific sector stood out as most sectors developed in the same way, despite some positive sentiments.

This broad recovery is a sign that Chainlink will likely join the uptrend of the current market cycle.

Source: Velo protocol

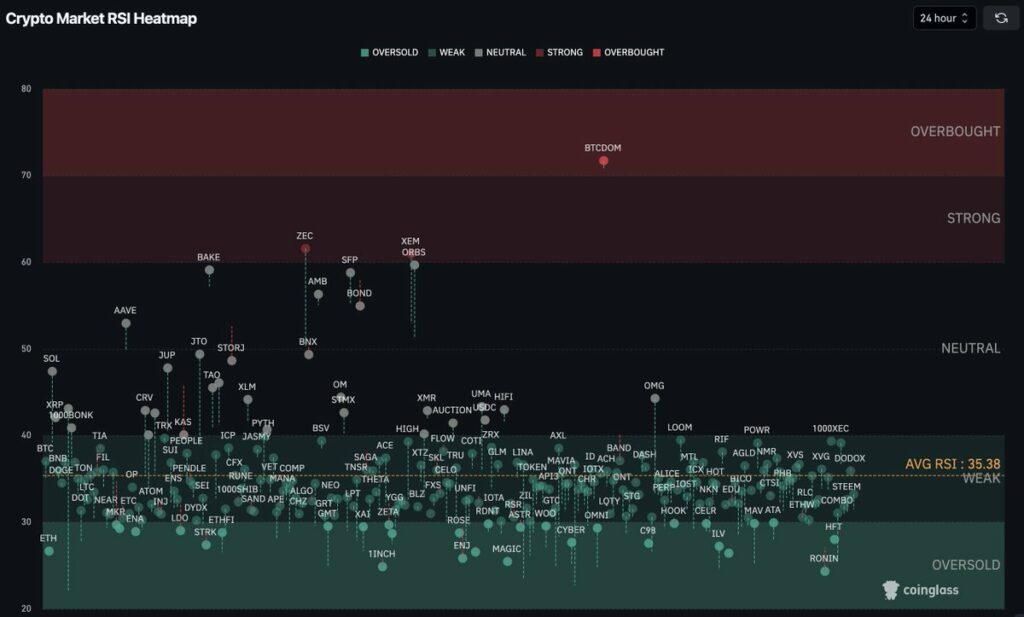

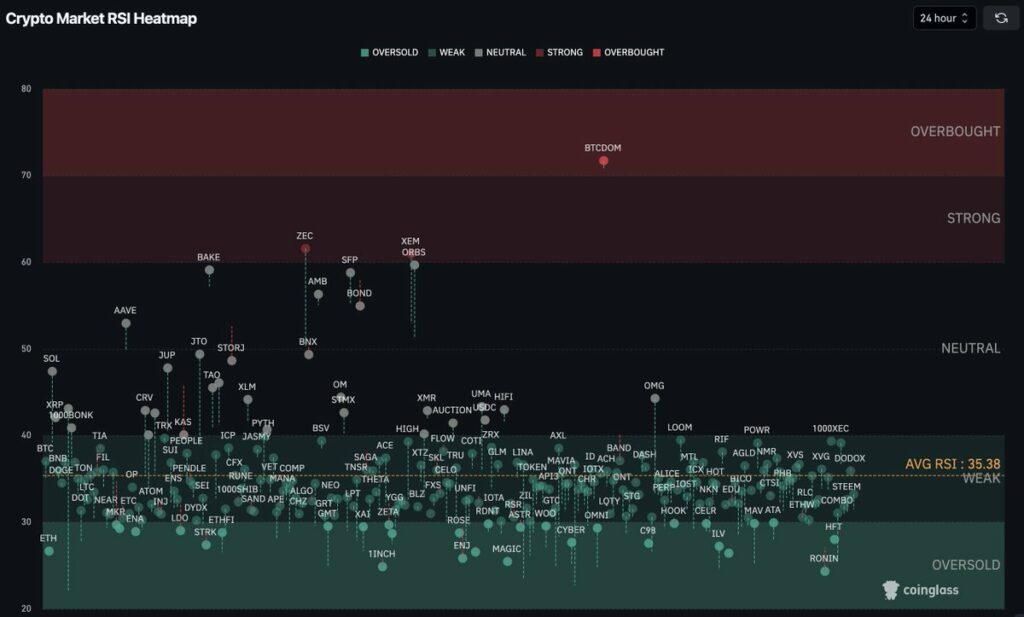

‘Lowest average’

Finally, the Crypto Daily RSI Heatmap revealed that the average RSI was at its lowest point in a long time – around 35% – which is typical of a bear market.

This can be interpreted as a sign that prices are at a very low level, making it an ideal time for traders and investors to buy.

However, it is worth noting that these numbers can change quickly, as evidenced by the significant price movements of several coins over the past week.

Source: Coinglass

![Chain link [LINK] ready for an outbreak? Here are the signs that say yes…!](https://bitcoinplatform.com/wp-content/uploads/2024/08/LINK-1000x600.webp)