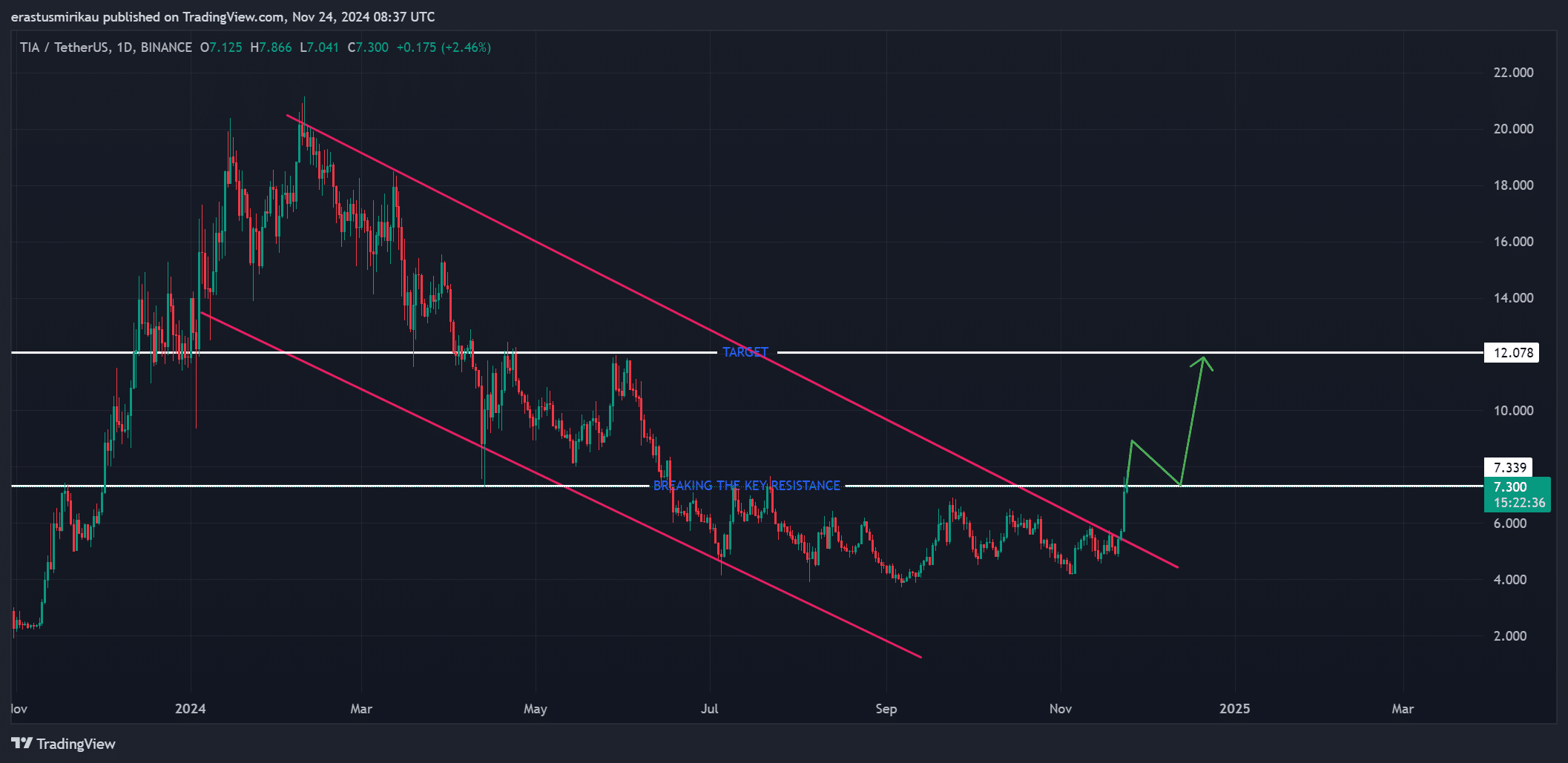

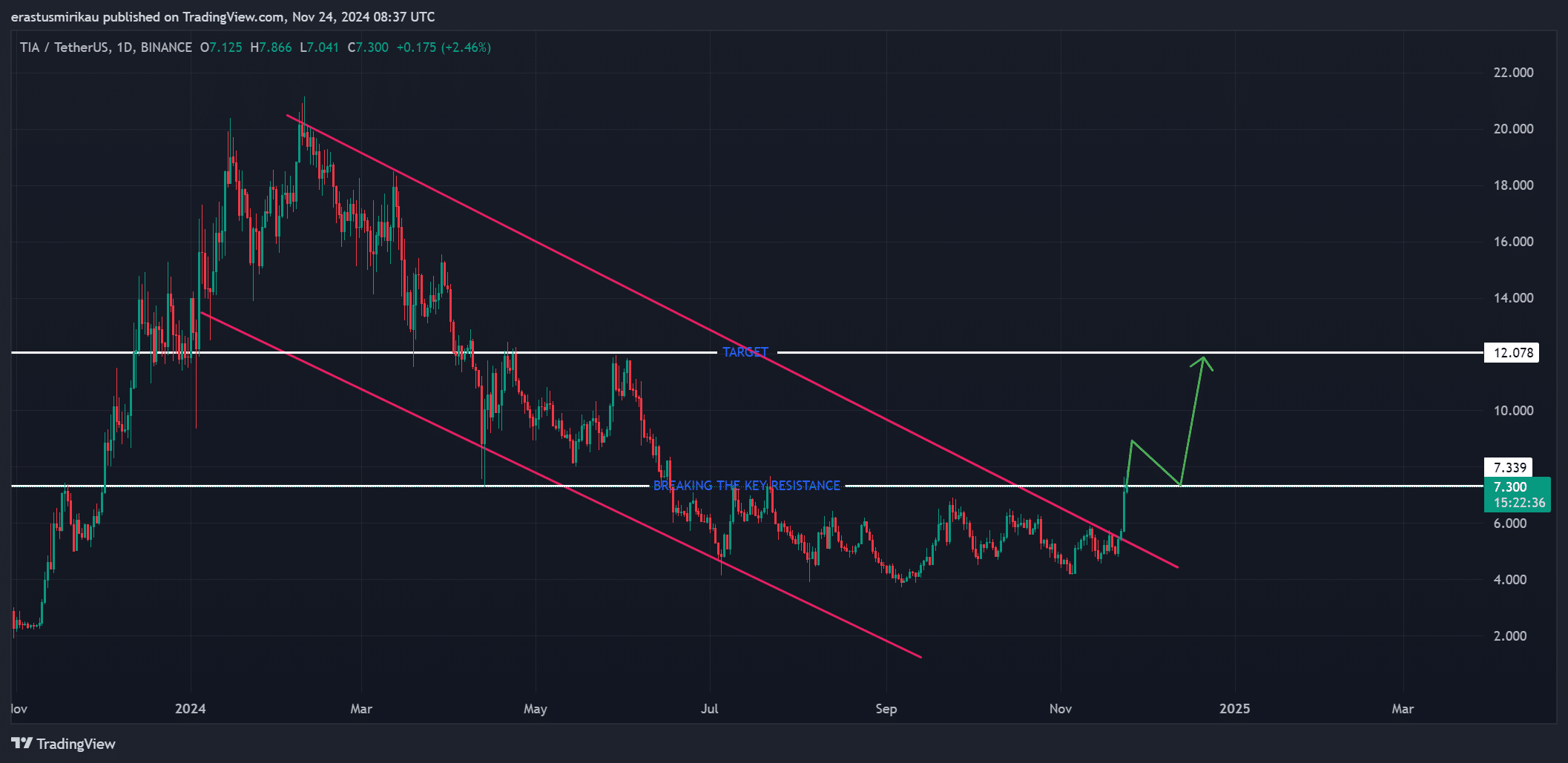

- TIA’s break above $7.34 marked a trend reversal, with a $12.08 target in sight.

- The bullish momentum was supported by increased social dominance, liquidations and rising open interest.

Celestia [TIA] has made a decisive step by breaking the descending channel and crossing the key resistance level at $7.34.

This development has brought bullish enthusiasm to the market, with traders now targeting $12.08 as the next potential milestone.

The token has seen a notable 16.28% price increase and was trading at $7.34 at the time of writing, accompanied by a 152% spike in 24-hour trading volume to $1.28 billion.

Therefore, market participants are keeping a close eye on whether this breakout can support the bullish momentum.

Breaking the resistance at $7.34: a new rally begins?

Celestia’s break above $7.34 marks a crucial point in its price action. After months of being stuck in a descending channel, this upward move signals a potential trend reversal.

Notably, the next target of $12.08 is within reach if momentum continues.

Additionally, TIA’s market capitalization increased 16.9% to $3.14 billion, demonstrating renewed investor confidence.

This momentum could strengthen further if the breakout level continues, creating a solid foundation for continued upward movement.

Source: TradingView

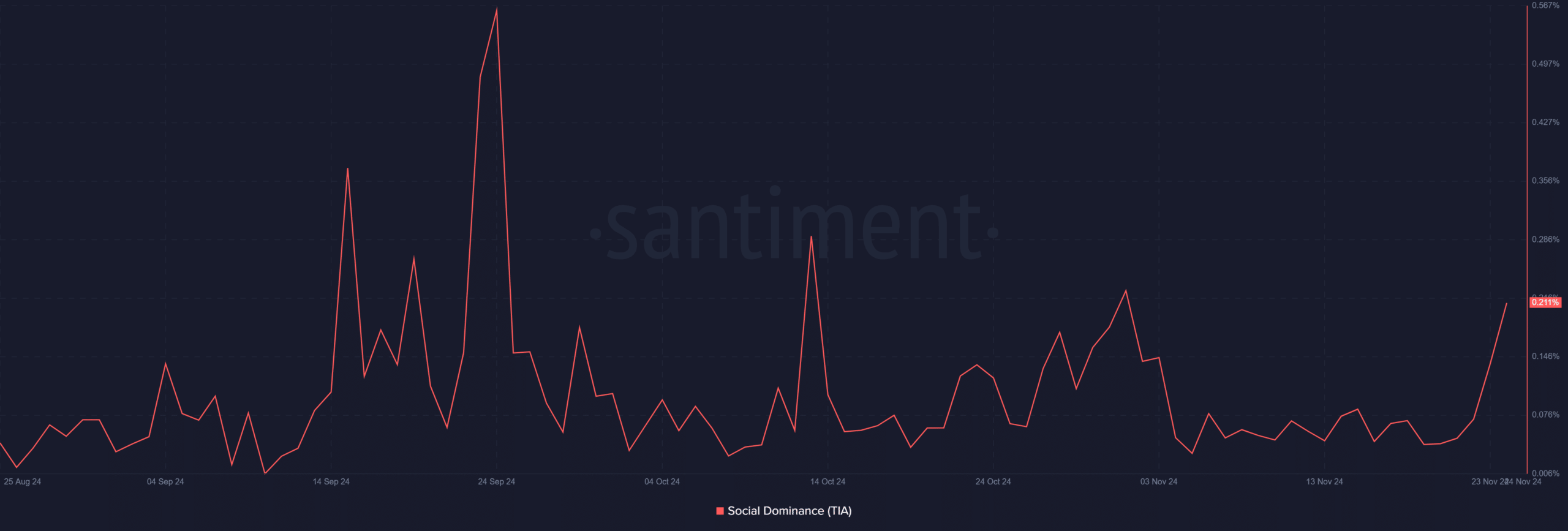

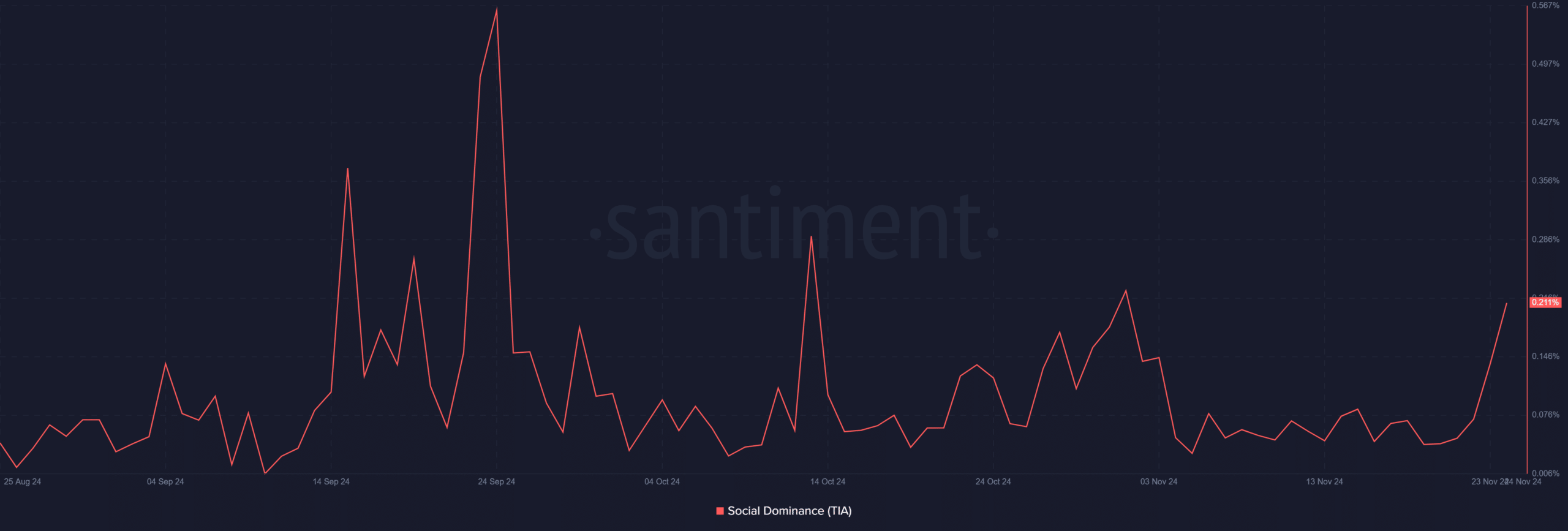

TIA’s social dominance is gaining strength

Interestingly, TIA’s social dominance has increased significantly, from 0.137% the day before to 0.211% at the time of writing. This increase underlines the growing attention of the crypto community.

Greater social engagement often translates into more active trading and investment, further fueling price momentum.

Therefore, growing community interest could act as a major catalyst to help TIA reach its $12.08 goal.

Source: Santiment

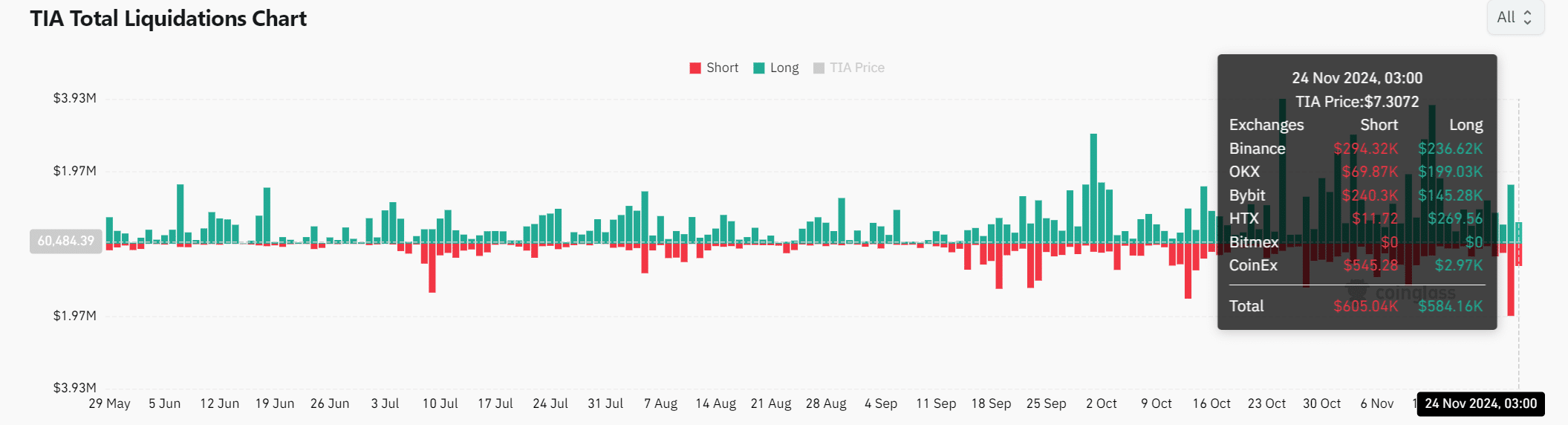

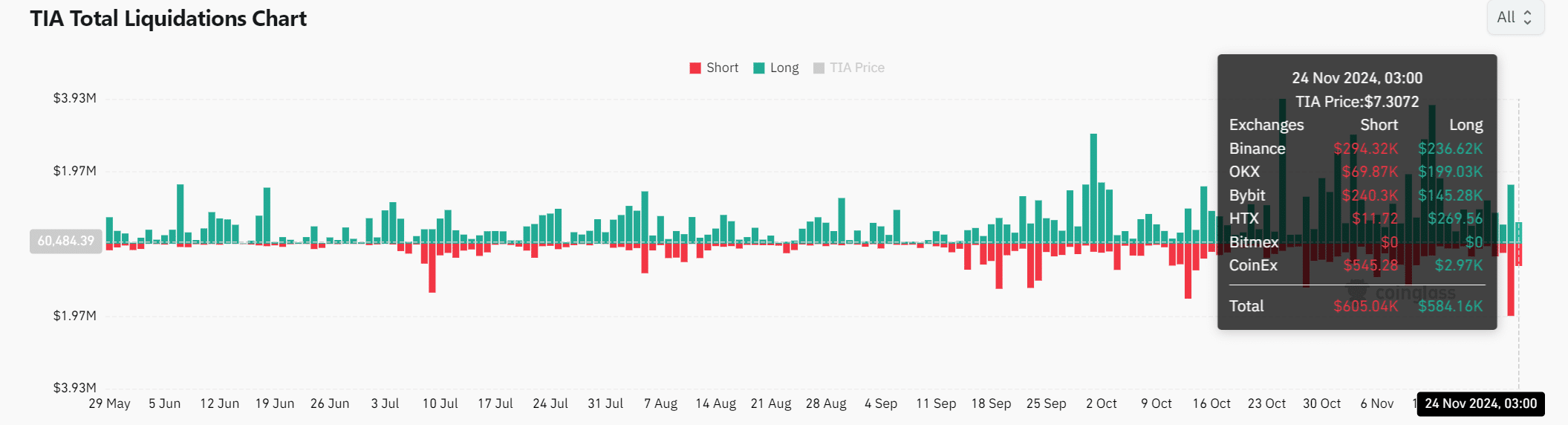

Liquidation data points to bullish pressure

Liquidation data showed strong bullish pressure on TIA’s price. On November 24, $1.19 million in liquidations were recorded, with shorts contributing $605,000 to the total.

Clearing short positions fueled the upward rally as bearish bets were voided. This imbalance underlines the strength of buying pressure, which is critical to sustaining the outbreak.

Source: Coinglass

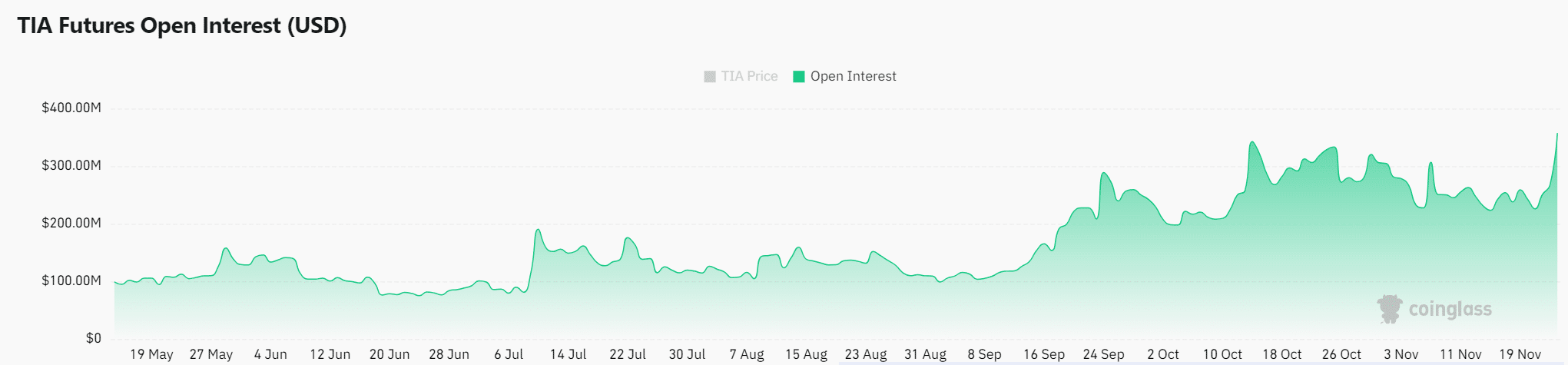

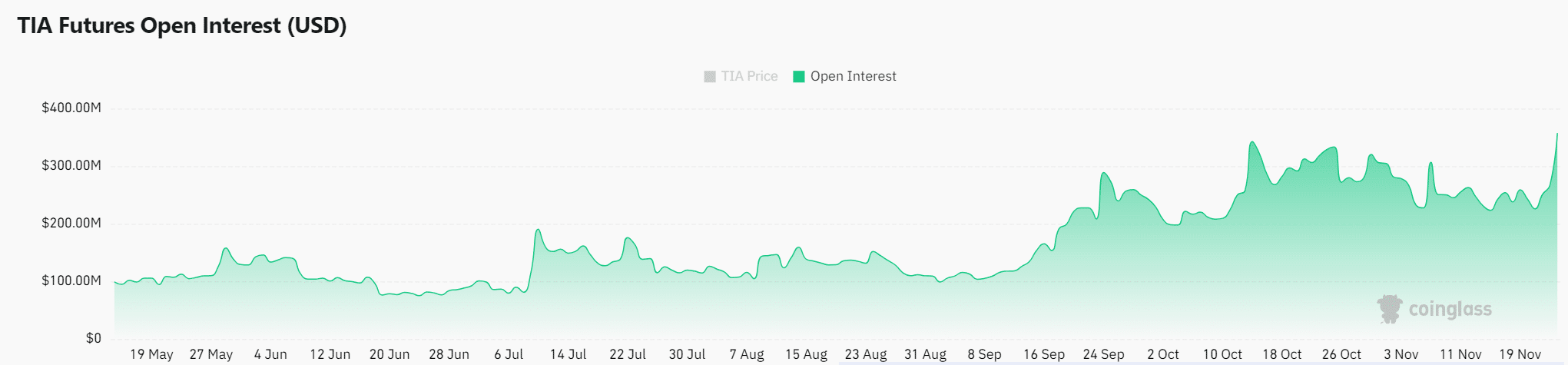

Rising Open Interest confirms market participation

Open interest in TIA Futures contracts increased by 21.19% and now stands at $373.91 million. This increase signals growing market participation as more traders position themselves in the middle of the rally.

Rising open interest often complements bullish moves, indicating increasing confidence in the uptrend. Therefore, this metric supports the case for further gains.

Source: Coinglass

Is your portfolio green? View the TIA profit calculator

Conclusion: TIA on target at $12.08?

Celestia’s break above $7.34, coupled with increased volume, social engagement and open interest, strongly suggests that bullish momentum can continue.

If the token remains above critical resistance, the $12.08 target appears achievable. Therefore, TIA appears to be on a solid path toward further gains.