Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

In a new interview with Bloomberg, the founder of Ark Investment Management Cathie Wood again confirmed her ambitious price objective for Bitcoin, predictively that it could increase by 2030 to $ 1.5 million per coin. Despite the recent market volatility and a distinct “risky” environment, wood remains stable in its conviction that will continue the leading cryptocurrency, its long-term-upward process will continue.

“Yes, it’s our opinion,” Wood answered When asked if she still expects Bitcoin to reach her declaration target. “I think we are now in a risk-out period.

Cathie Wood still mentions $ 1.5 million bitcoin by 2030

According to Wood, analyzes on chains indicate that Bitcoin is currently “in the middle of just more than halfway through a four-year cycle”-a reference to the historically repetitive 4-year cycle of BTC. She emphasized that “we think we are still in a bull market” and expects that “deregulation” in the United States will play a crucial role in encouraging more institutions to enter the activa class.

Wood further argued that institutional asset spends “should have a position on this new activa class” and that the inclusion of Bitcoin in portfolios will probably improve the risk-corrected return.

Related lecture

In the midst of a wider market sales, Wood suggested that a scenario may already unfold ‘rolling recession’. She mentioned increasing concern about job security and increasing savings as proof: “We see the savings interest rise.

She claimed that such economic stress could force the Federal Reserve to return the course later this year: “It would not surprise us to see two or three cuts. […] We think that inflation will surprise the low side of expectations. “

Wood pointed to falling gasoline prices, egg prices and rental prices such as signals that inflation can cool faster than many expect, which means that in the second half of this year the Fed “more freedom of freedom”.

With regard to regulations, wood was particularly optimistic about the “relaxation of the regulating environment” around cryptocurrency. She emphasized the approach of the US Securities and Exchange Commission (SEC) of meme -coins and noted that “by these meme coins did not declare effects”, the supervisors essentially said: […] We think that most of them will not be worth much. […] What we think will happen […] There is nothing like losing money for people to learn. “

Wood, however, underlined that Bitcoin, Ethereum and Solana are core activa with “use cases […] Multiplication ‘and probably remain integrated in the crypto ecosystem, in stark contrast to the’ millions of meme -coins’ that she believes will ultimately lose their value.

Related lecture

Wood also discussed its investment thesis for Robinhood and Coinbase, which showed that Ark regards both companies as front runners in the battle for digital wallet -Dathinance. She compared digital portfolios with credit cards, which suggests that “most of us do not have many credit cards” – and with expansion, most users will not contain more than a few digital portfolios.

Moreover, she drawn attention to the rise of tokenization and noticed that BlackRock’s interest in tokenizing activa is a signal that large -scale players propose a “complicated players […] New world ”in capital formation. […] They use Bitcoin […] But also Stablecoins, which is effective the dollar as backstops for their purchasing power and wealth. “

Cathie Wood is not deterred by short -term fluctuations or market jits. While re-confirming her controversial bets on Tesla, Bitcoin and disruptive technologies such as artificial intelligence, she repeated her umbrella thesis: innovation and blockchain-based platforms will continue to stimulate deflatory powers and create new possibilities for growth. “We are known for our Tesla call and our Bitcoin call. […] I would add AI platforms as a service company such as Palantir. “

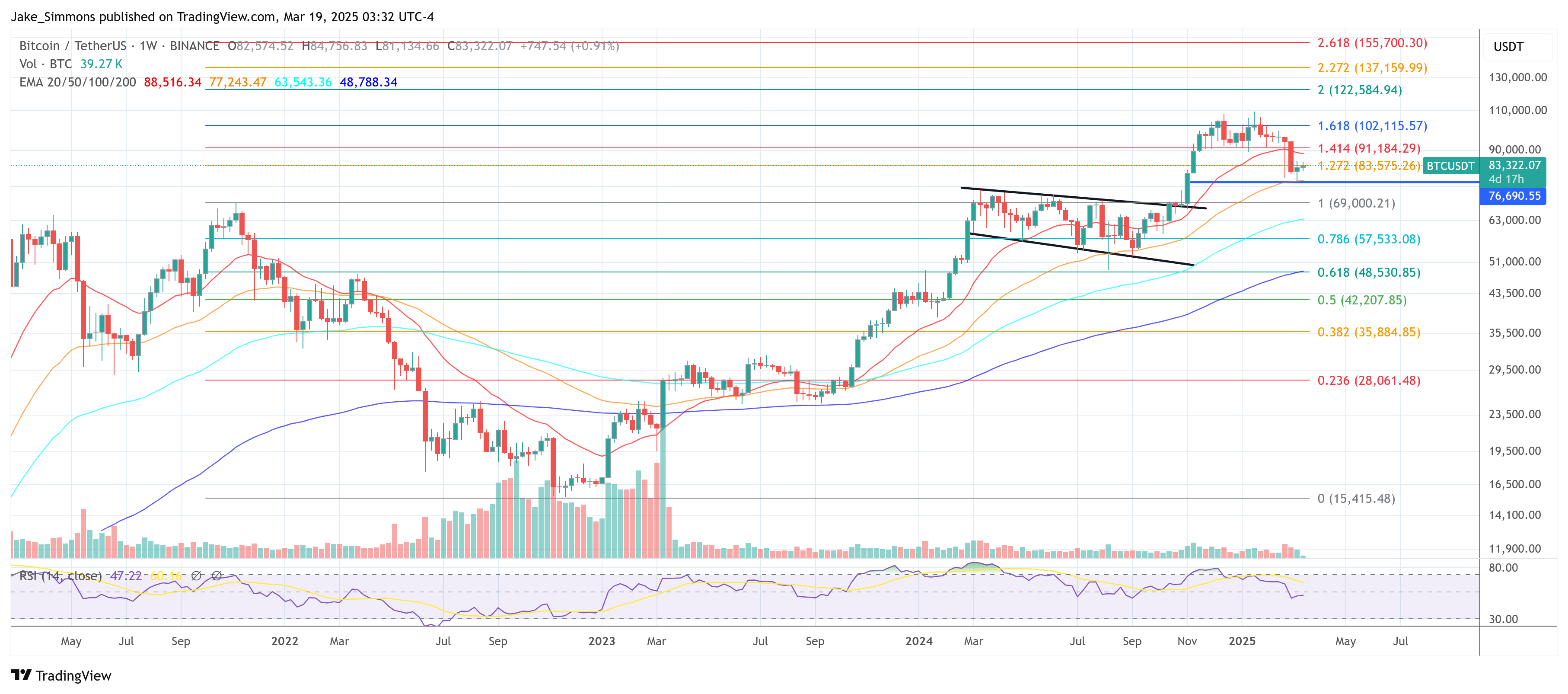

At the time of the press, BTC traded at $ 83.322.

Featured image of YouTube, graph of TradingView.com