- The number of active addresses has fallen to the lowest figure in the past 90 days.

- Amid bearish sentiment, technical analysis indicated that the ADA could fall to $0.40.

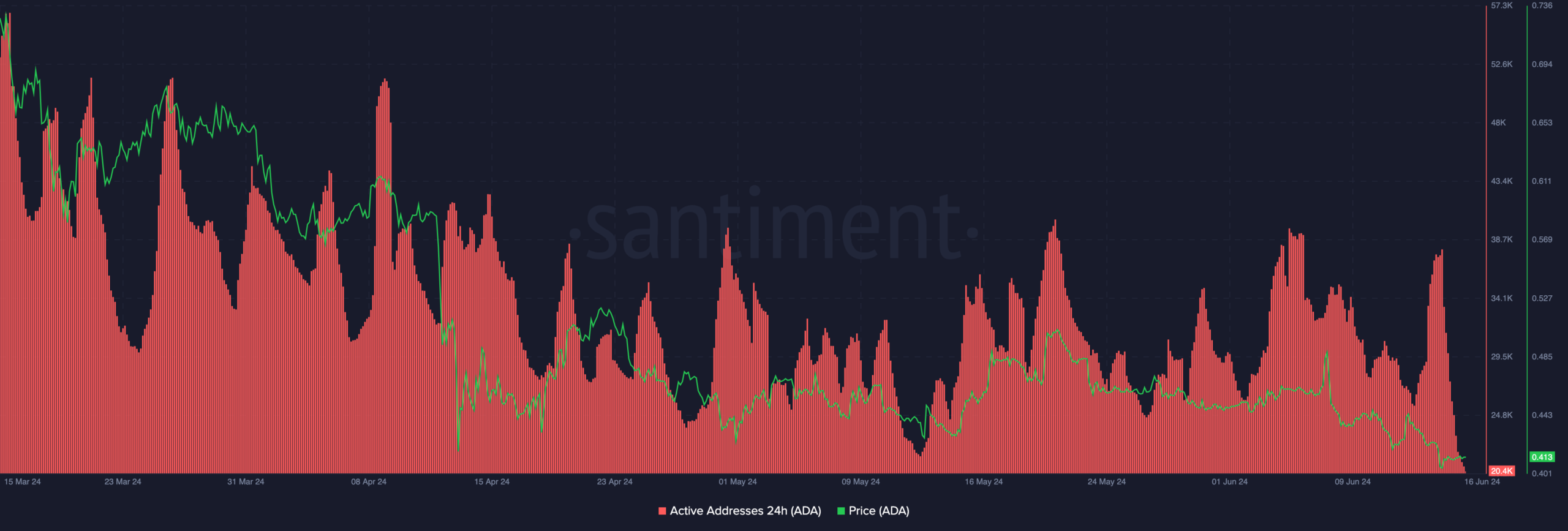

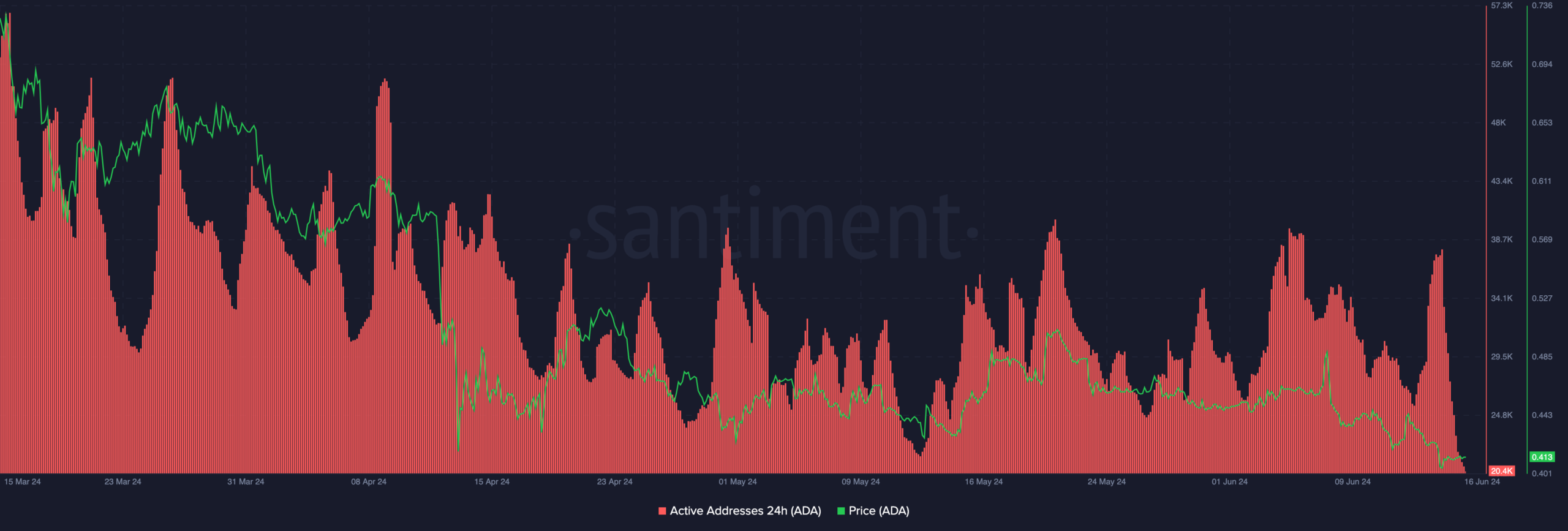

Activity on Cardano [ADA] According to data from the chain, the value has fallen to the lowest level in three months. Before reaching this conclusion, AMBCrypto evaluated the 24-hour active addresses on the network.

Active addresses represent the total number of users interacting with a blockchain. Over a 24-hour period, this metric counts the number of unique users who have sent or received a cryptocurrency on a network.

At the time of writing, the number of 24-hour active addresses on Cardano was 20,400. In the last three months, the metric has not reached this figure.

Cardano’s future is at stake

Therefore, this decline indicates that market participants chose to engage with other blockchain over Cardano. A few days ago we announced how the activity had improved.

However, this recent data shows that the previous increase was short-lived. Further this decrease could affect the price of ADA.

A look at the data provided by Santiment showed that ADA’s price and network activity appear to have a strong correlation. At the time of writing, ADA changed hands for $0.41. This was a decline of 14.25% in the past 30 days.

Source: Santiment

Should the number continue to decline, ADA’s value could drop to $0.40. In a very bearish situation, the token’s price could drop to $0.38.

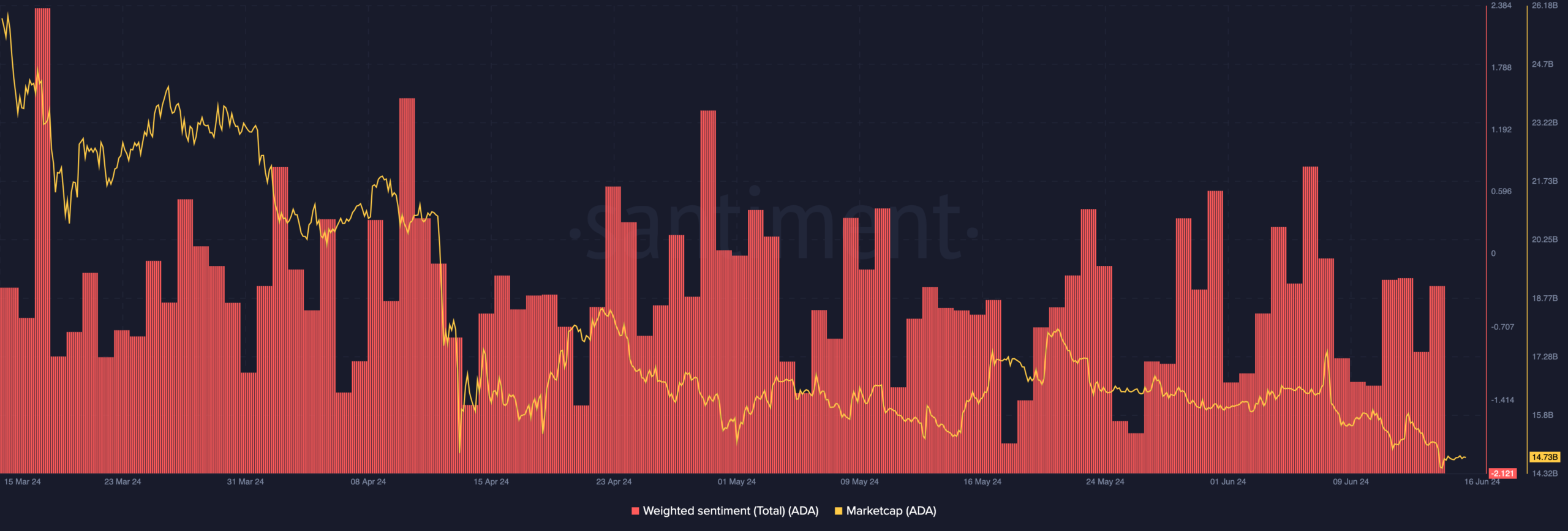

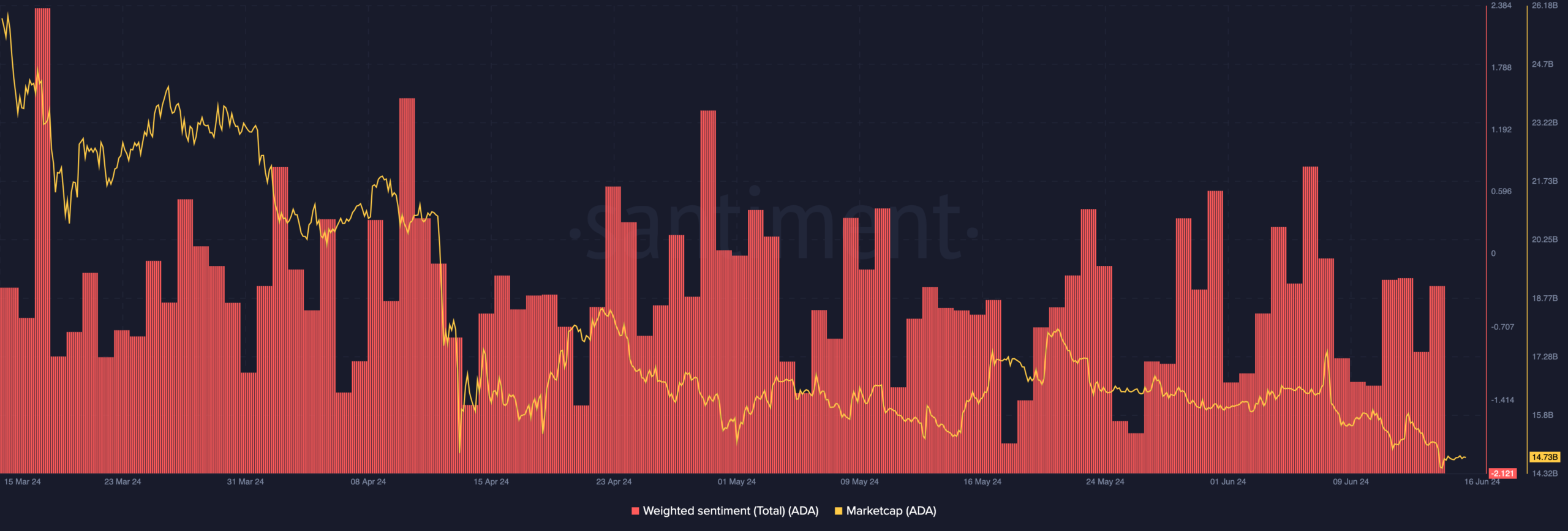

Apart from the above metric, weighted sentiment is another indicator that can influence the price of the token. Weighted Sentiment shows the perception that market participants have about a project online.

If the result is positive, it means that most conversations are bullish. However, a negative sentiment value implies that many reactions are bearish. For Cardano it was the latter.

One thing we also noticed was that the sentiment value was at a three-month low, just like the active addresses. If there is no postponement, this could be concerning for ADA.

Source: Santiment

The price of ADA may not exceed $0.40

A possible consequence could be a drop from the top 10 by market capitalization. At the time of writing, Cardano’s market capitalization had fallen to $14.73 billion.

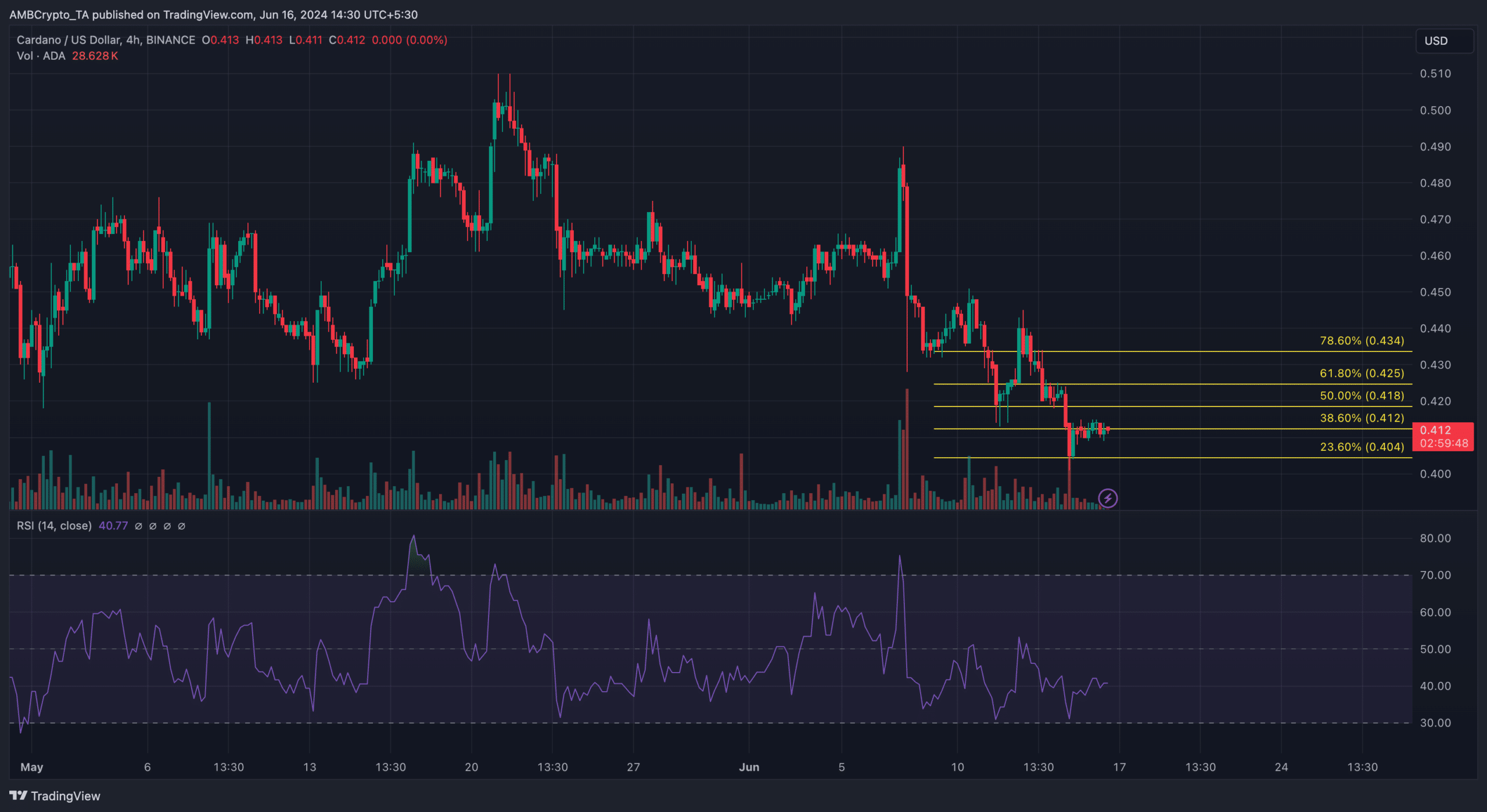

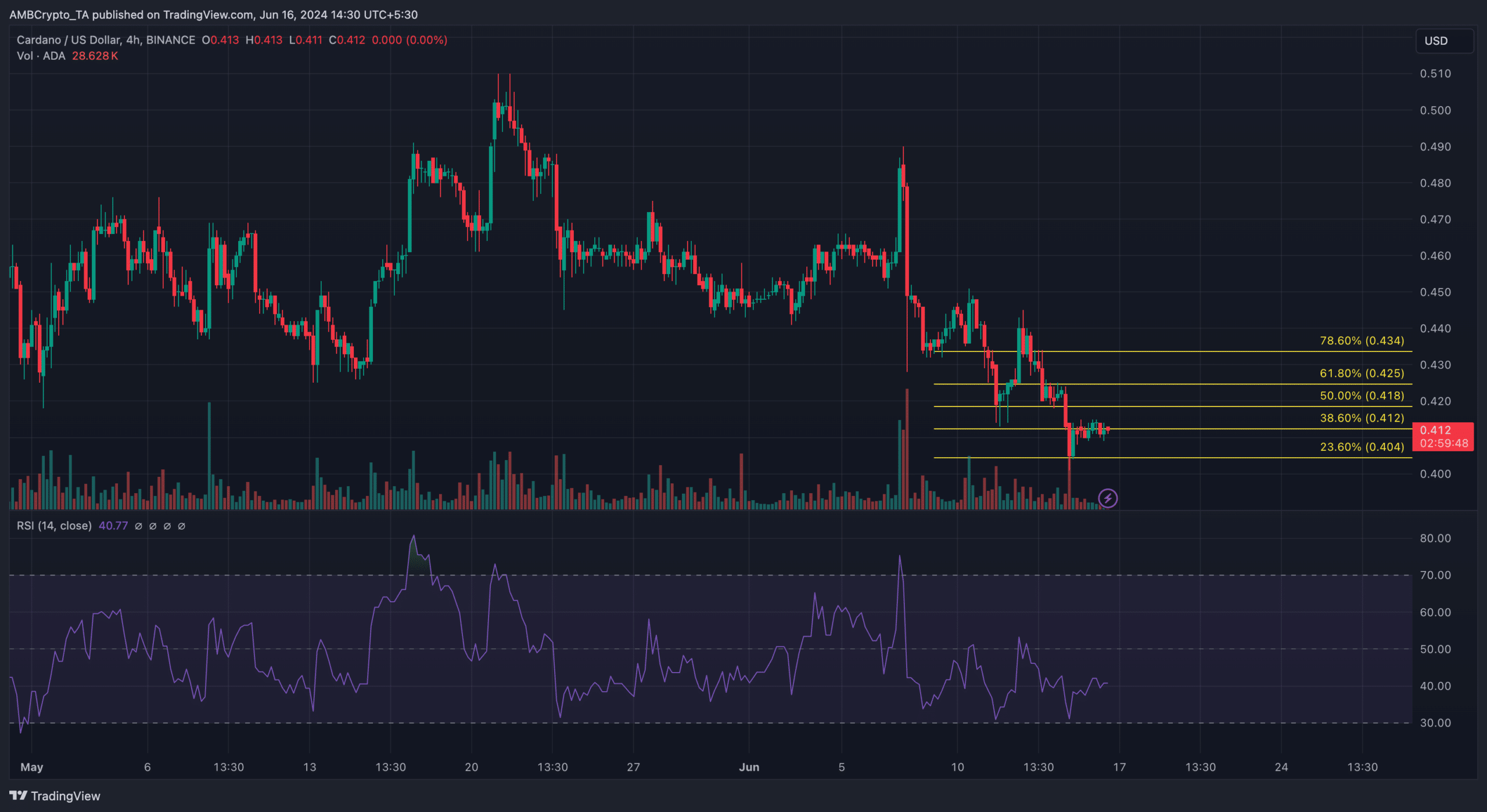

Additionally, the technical perspective provided insight into how ADA could perform in the future. First, AMBCrypto looked at the Relative Strength Index (RSI).

The RSI measures momentum. Values above 30 indicate that an asset is overbought. On the other hand, values lower than 30 indicate that an asset is oversold.

At the time of writing, the RSI on the ADA/USD chart was 40.77. Since it was below the 50.00 midpoint, it meant that momentum was bearish. This statement was reinforced by the Fibonacci retracement levels.

Source: TradingView

Is your portfolio green? View the Cardano Profit Calculator

This indicator shows specific price points that can act as support or resistance for a token. At the time of writing, the 23.6% Fib level stood at $0.40. This indicates that the ADA could return to levels in the short term.

However, if the price recovers, the next target could be $0.43, where the 78.6% Fib level was located.