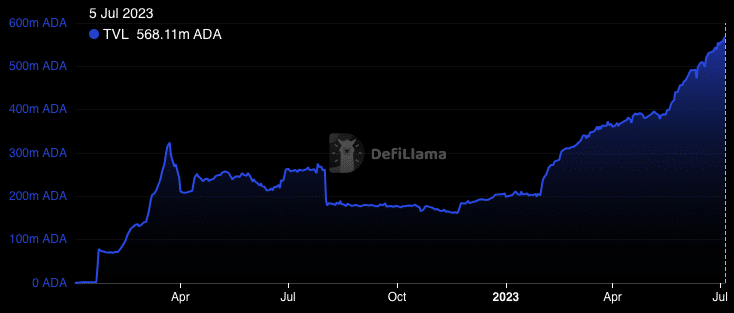

- The TVL rose to a new high amid increased activity on the underlying protocols.

- ADA’s momentum could turn bullish, but it depends on the demand created.

Thanks to the seven-day performance of the protocols and smart contracts that work under Cardano [ADA]locked the total value reaches the highest point of the year. According to DefiLlama, Cardano’s TVL was $166.39 million.

Is your wallet green? Check the Cardano Profit Calculator

Cardano’s TVL reaching a Year-To-Date (YTD) high indicates growing confidence and activity on the platform. By definition, the TVL measures the amount of unique smart contract deposits in a network.

Source: DefiLlama

So this milestone reflects the increasing adoption and use of Cardano’s decentralized applications (dApps), including, but not limited to, lending protocols Liqwid and Optim Finance, DEXes Minswap and SundaeSwap.

All of these protocols, and others combined, had notable increases that helped Cardano reach the milestone.

Fewer ADA moves; handling holders

However, the scenario with ADA circulation was a different scenario. According to Santiment, the seven-day circulation had fallen to 1.07 billion. Often the circulation shows the number of unique tokens traded within a certain trading range.

So the fall suggested that many ADA tokens have not moved since a significant increase in stats on June 25.

Also, the difference between market value and realized value (MVRV) long/short has plunged to the negative region. At the time of writing, the MVRV long/short difference was -7.262%.

The idea behind the MVRV difference is to measure how much each asset holder initially paid for their tokens and compare that acquisition cost to the asset’s current price.

Usually, positive values of this measure would mean that long-term holders have realized more profit than short-term participants.

So the drop into the negative area is consistent with the earlier one discussed concept that short-term holders will realize higher profits than long-term holders. And this can be attributed to ADA’s 90.53% take-up of its All-Time High (ATH).

Source: Sentiment

Red in sight at small opportunities

According to the price action, CoinMarketCap showed that ADA switched hands at $0.28. This was after losing 2.19% of its value in the past 24 hours.

It also seemed that the price might go below the aforementioned value. This was due to the Exponential Moving Average (EMA) Slingshot cut a bearish pattern. There were consecutive red candles and the second candle had a higher low than the first.

Realistic or not, here it is ADA’s market cap in BTC terms

Meanwhile, the Moving Average Convergence Divergence (MACD) showed positive signs at 0.004. When this happens, it means there is one tendency for upward force. With this value, traders may want to refrain from opening short positions.

In addition, the blue dynamic line rising above the orange suggests that buyers may be ready to take back control. But that would only be the case if demand does not decrease.

![Cardano [ADA] price action](https://statics.ambcrypto.com/wp-content/uploads/2023/07/ADAUSD_2023-07-05_11-47-25.png)

Source: TradingView