- Cardano is gearing up for the first phase of its Chang hard fork.

- We explore what ADA price and on-chain data reveal about the state of demand.

Like Cardano [ADA] prepares for the long-awaited Chang hard fork, the crypto community is abuzz with speculation. So let’s dive in and see what all the fuss is about and what the potential impact is on ADA’s price action.

Before we dive into the Chang hard fork, it’s worth noting that this isn’t the first Cardano hard fork. That designation is for the Shelly hardfork in 2020, allowing the network to be decentralized.

There have been other hard forks over the years. These include the Vasil hard fork in 2022 and the more recent Alonzo hard fork in 2023, which enabled smart contracts.

The Chang hard fork will enable the Cardano network to implement a distributed governance framework. This will see the network transition to a fully community-controlled governance model.

The main benefit of this change is that it gives the Cardano network a more decentralized structure. The latest update on the Chang hardfork revealed that the exchanges were beginning to prepare.

Coinbase and Bitfinex were among the first exchanges to initiate the process.

Will the Chang hard fork affect ADA’s price action?

Technically, the Chang hard fork is purely about implementing changes to the network infrastructure. Therefore, it may not have a direct impact on ADA’s price performance.

Nevertheless, it will be an achievement in line with Cardano’s roadmap.

Despite the low probability that the Chang hard fork will affect ADA, there may still be some speculation surrounding the event. ADA has been trying to recover from the selling pressure it experienced in the second quarter of 2024. At the time of writing, it was trading at $0.40.

Source: TradingView

ADA’s selling pressure has been limited, especially after the latest retracement over the past two weeks. This was clearly visible in the MACD, which indicated low sales volume. This outcome could favor ADA bulls in the first week of August.

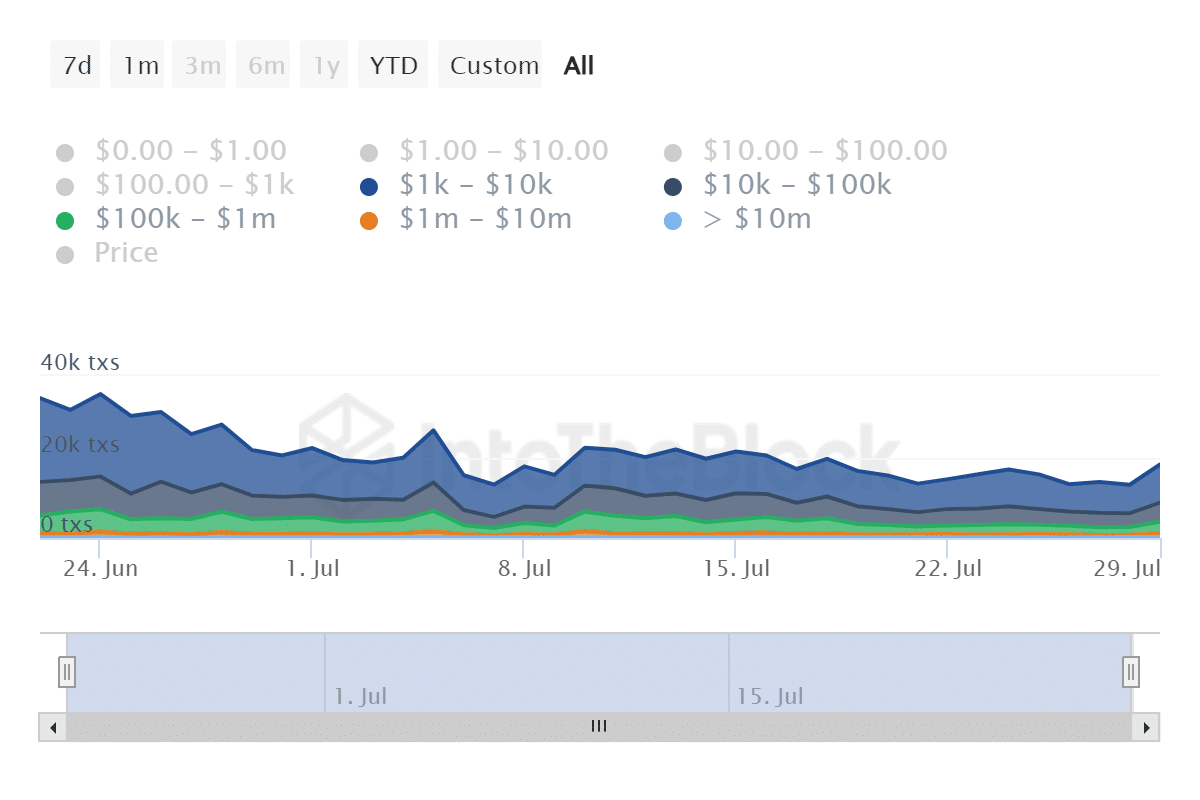

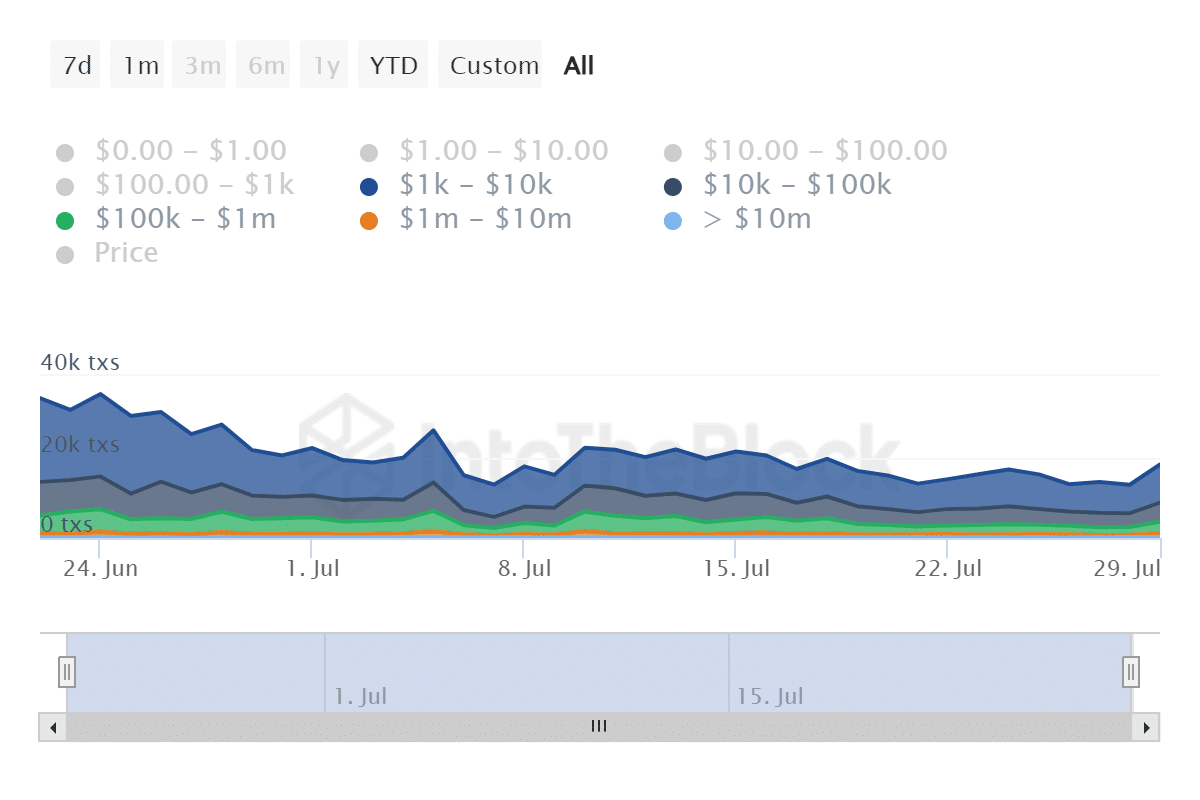

The latest on-chain data shows that activity at large addresses decreased between the last week of June and the last week of July.

Except for the period between July 7 and 10, which coincides with the short rally that lasted until mid-July. However, the number of large address transactions (over $100,000) is starting to pick up again.

Source: IntoTheBlock

An increase in activity at major addresses could indicate that whales are cooking something. However, this observation did not necessarily indicate whether whales were buying or selling.

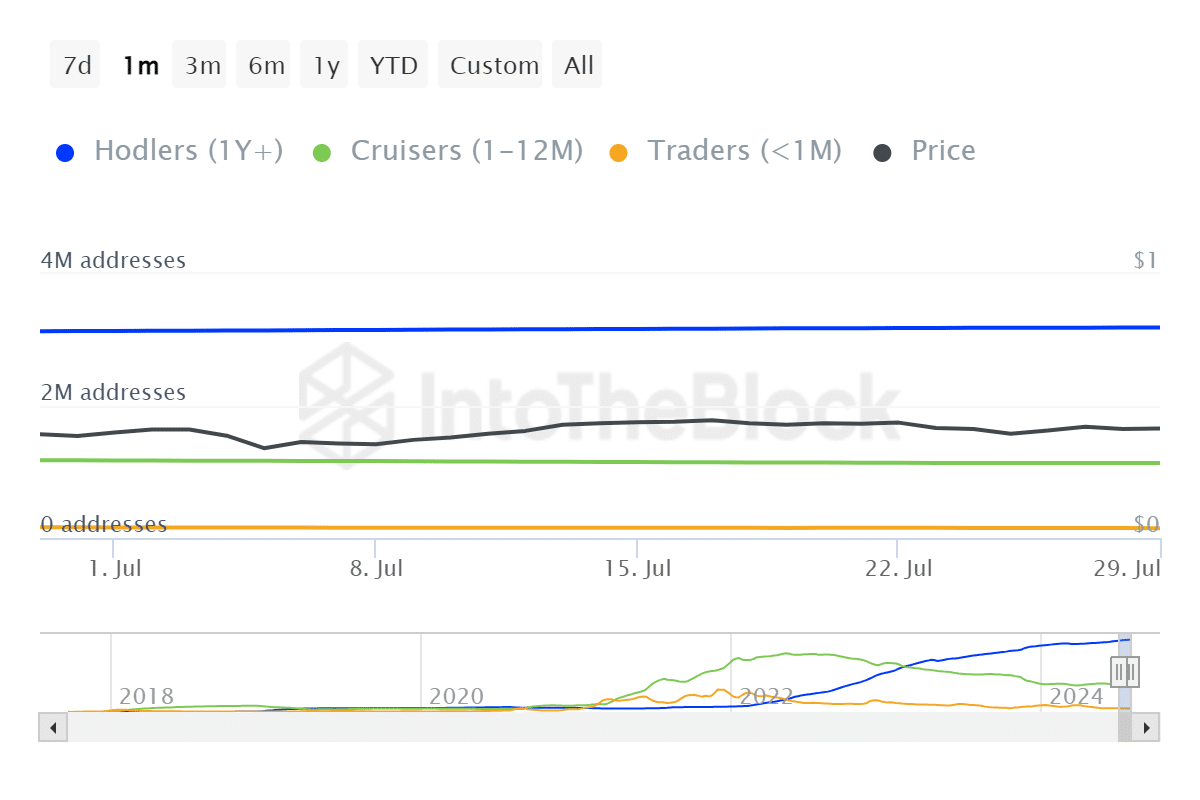

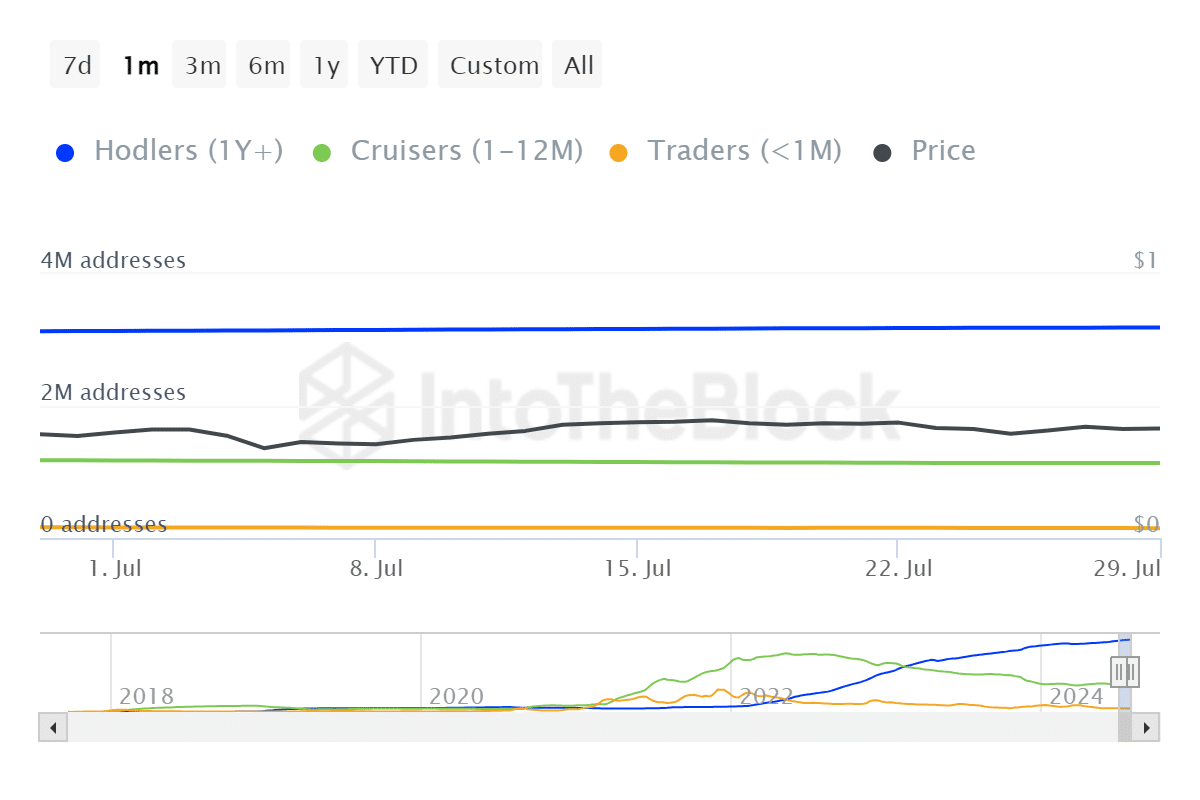

Further research showed that the number of HODLers (+1 year) grew from approximately 3.13 million to 3.18 million in July.

Source: IntoTheBlock

Is your portfolio green? View the Cardano Profit Calculator

Meanwhile, the number of traders dropped significantly during the month. An indication that there was a growing focus on HODLing rather than short-term trading.

Perhaps a sign that ADA bulls are ready to take the lead again.