- ADA buying pressure subsided as the coin’s price fell below the 20-day EMA

- The Futures Open Interest has also fallen since early June

Cardano [ADA] fell below the 20-day exponential moving average (EMA) on June 7, and its value has fallen almost 10% since then. At the time of writing, the altcoin was valued at $0.41 CoinMarketCap.

ADA’s 20-day EMA represents the average price over the past 20 days. When the price falls below this level, the coin will trade at a level lower than the average price of the last 20 days.

Source: TradingView

It is a bearish signal that indicates a decrease in buying pressure and a rally in coin sales. The spike in the ADA sell-off over the past week can be partially attributed to how profitable sell-offs have been with the altcoin during that period.

AMBCrypto assessed ADA’s daily profit-to-loss trade volume ratio (using a seven-day moving average) and returned a value of 1.01 at the time of writing.

This metric tracks the ratio of an asset’s daily trades that produce a profit to those that end in a loss. At the time of writing, for every ADA trade that incurred a loss over the past week, 1.01 trades returned a profit. Santiment revealed.

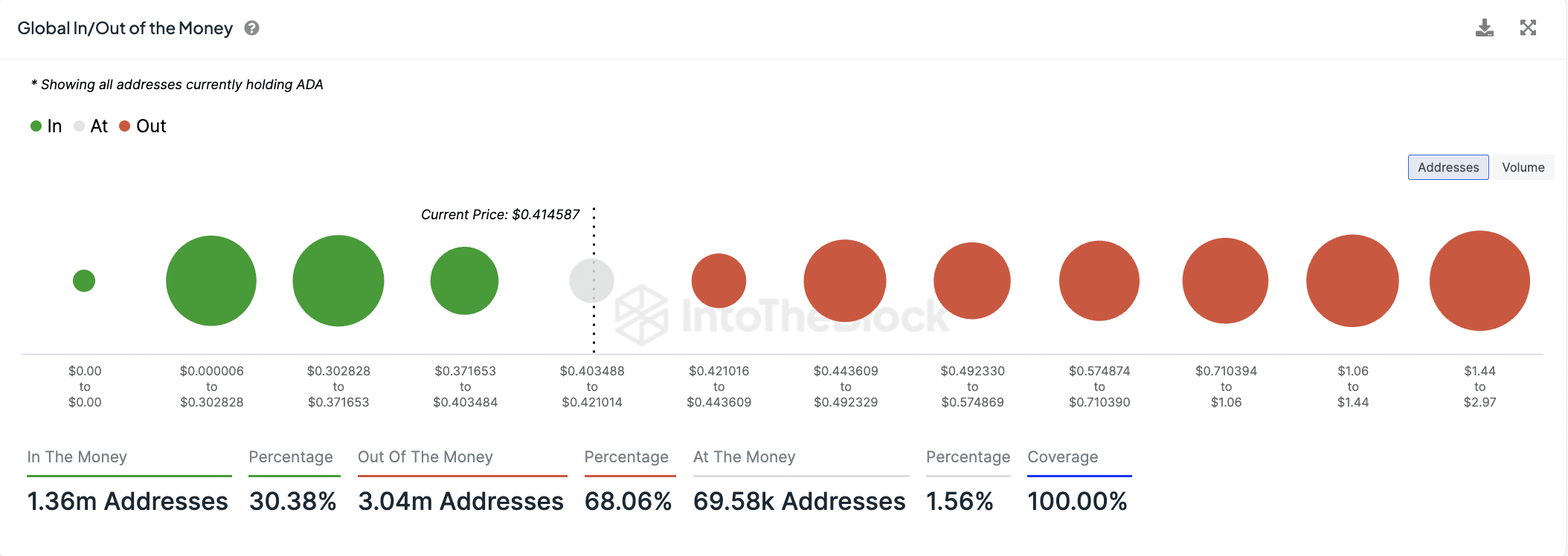

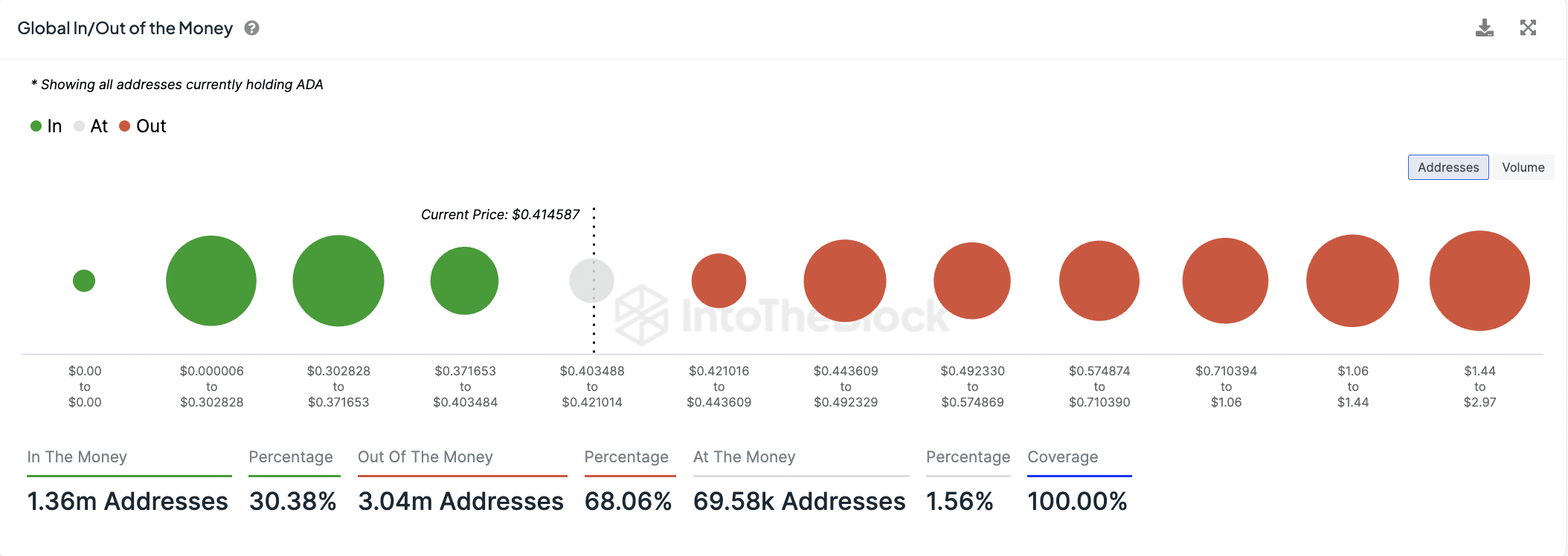

However, a significant number of ADA investors are left sitting on unrealized losses. According to InTheBlokFor example, 3.04 million addresses, representing 68.06% of the investor class, are currently out of the money. This means that this cohort of ADA investors are currently holding the coin at a price lower than their cost basis.

Conversely, 1.36 million wallet addresses, which make up 30.38% of all ADA holders, appear to be making a profit.

Source: IntoTheBlock

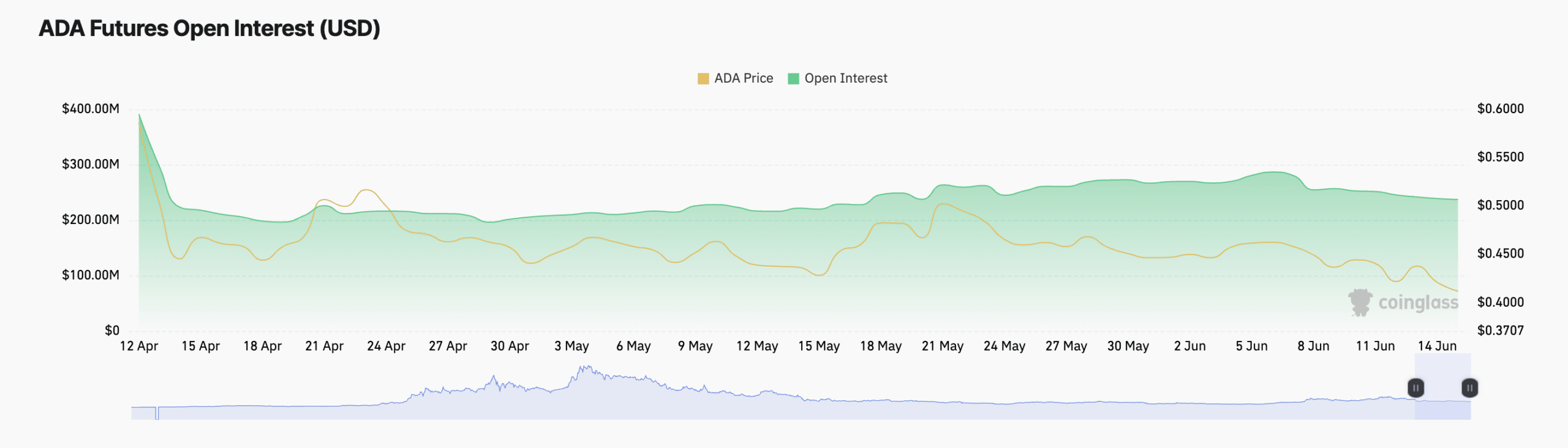

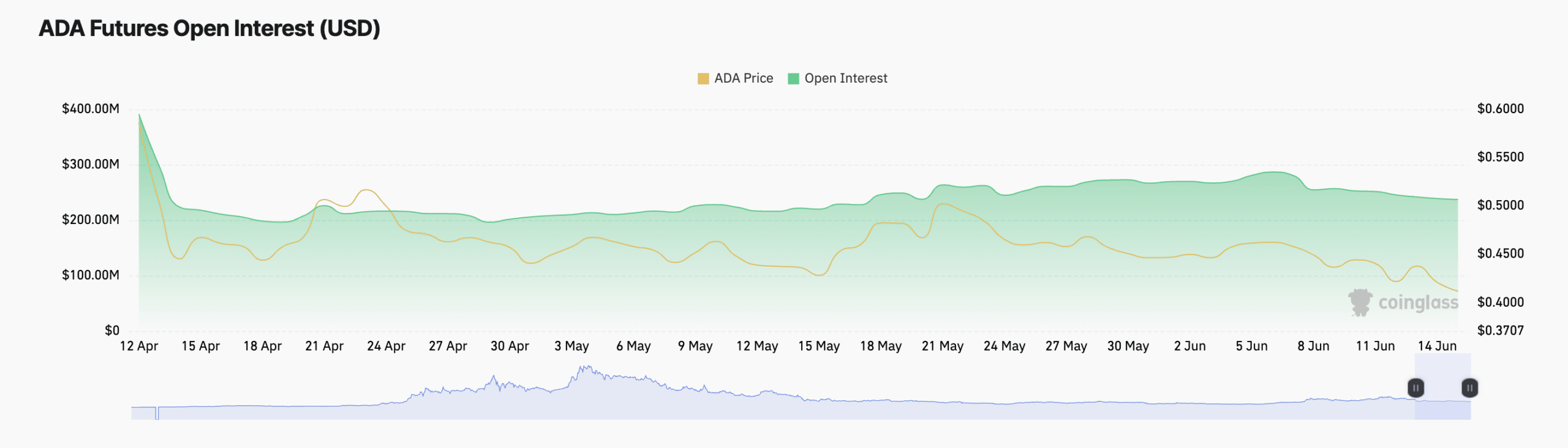

ADA Futures open interest is falling

As a result of the price drop, ADA’s Futures open interest has also fallen steadily over the past two weeks, according to Mint glass.

This metric tracks the total number of outstanding futures contracts or positions that have not yet been closed or settled. When it falls, it indicates an increase in the number of traders leaving the market without opening new positions.

Is your portfolio green? Check out the ADA profit calculator

It is often seen as a bearish signal, one that indicates a strong increase in negative bias towards an asset. At the time of writing, ADA’s Futures open interest was $237.14 million.

But more importantly: it is The value has fallen by 12% since the beginning of the month.

Source: Coinglass