- ADA whales were determined to hold rather than sell, which has positively impacted the recent price action.

- At the same time, both high transaction volumes and overall sales activity had declined, further supporting a potential recovery.

Cardano [ADA] appears positioned to recoup the losses of recent weeks, where the price was previously down 3.87% and 4.87% on weekly and monthly terms respectively.

With the Whales pulling out of the sale and opting to hold the asset, the asset has posted a gain of 0.50% in the last 24 hours.

This reinforced the coin’s gradual upward trend.

Whales show a long-standing commitment to ADA

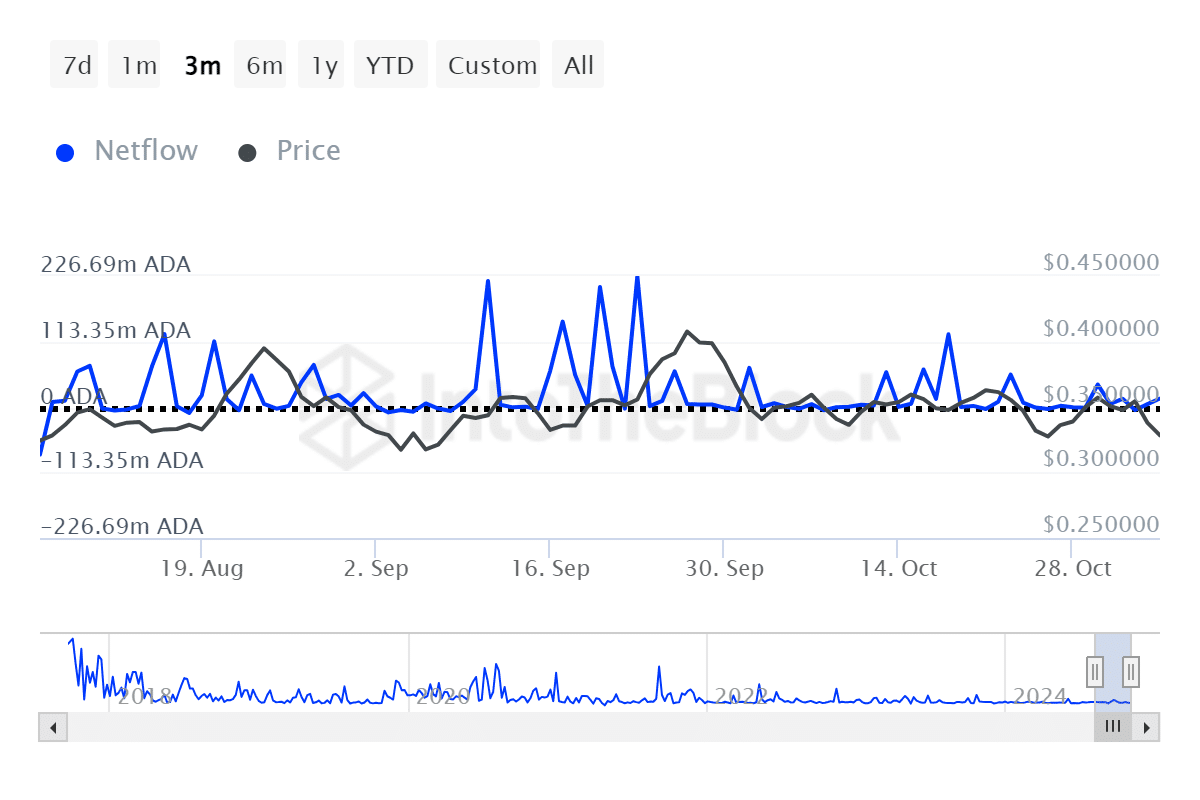

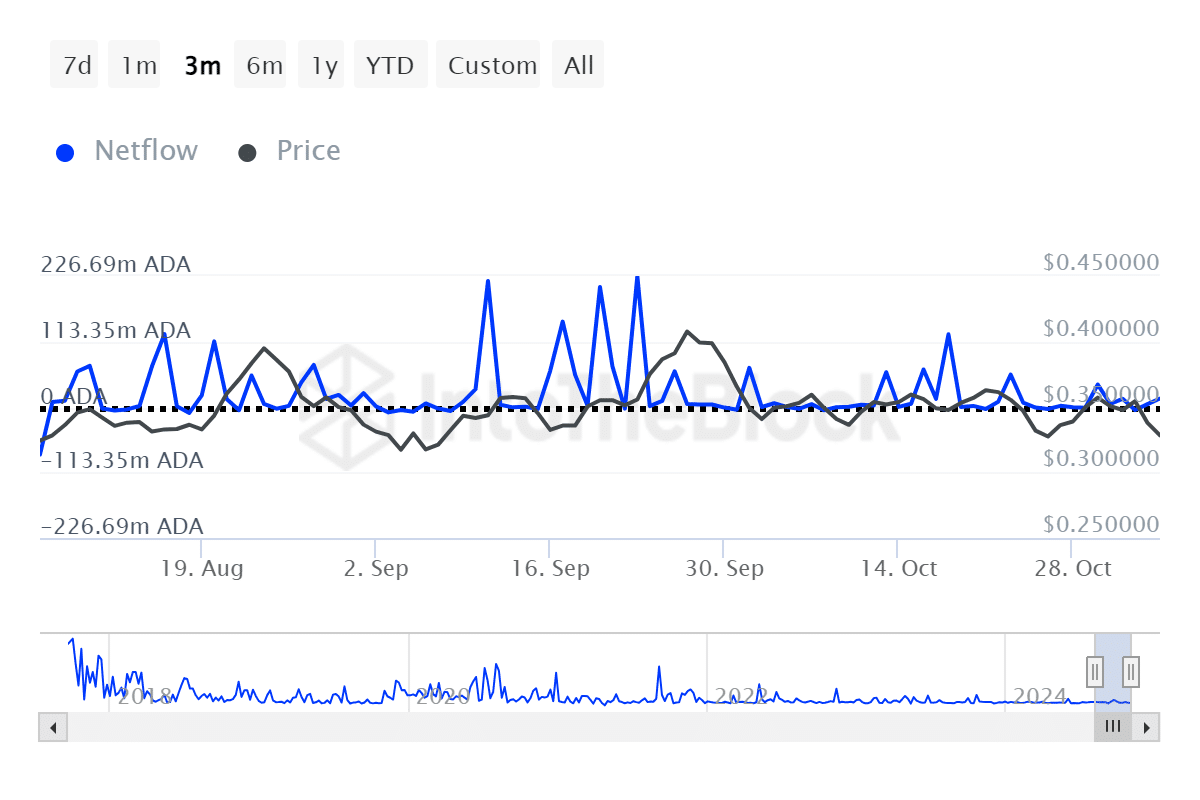

According to data from InTheBlokThe number of large holders controlling at least one percent of the ADA’s supply has seen a substantial decline in large holders’ Netflow.

Large Holder Netflow is a measure that tracks the net inflow or outflow of assets.

Currently, this metric is negative for the altcoin after falling 1181.52% over the past week.

Source: IntoTheBlock

A decline of this magnitude suggested that large holders are moving their ADA from exchanges to private wallets, signaling a shift toward long-term investing.

This activity could lead to a supply squeeze, which could push up ADA’s price as the company continues its recent upward momentum, gaining over the past 24 hours.

Bullish activity may indicate a potential rally

Further analysis by AMBCrypto revealed signs that the altcoin was gradually positioning itself for a potential price rally.

An important metric to note is the large trade volume, which tracks the amount of ADA traded by large holders with significant assets.

A total of 18.39 billion ADA transactions took place in the past 24 hours.

This metric can signal bullish or bearish sentiment depending on whether volume trends are up or down.

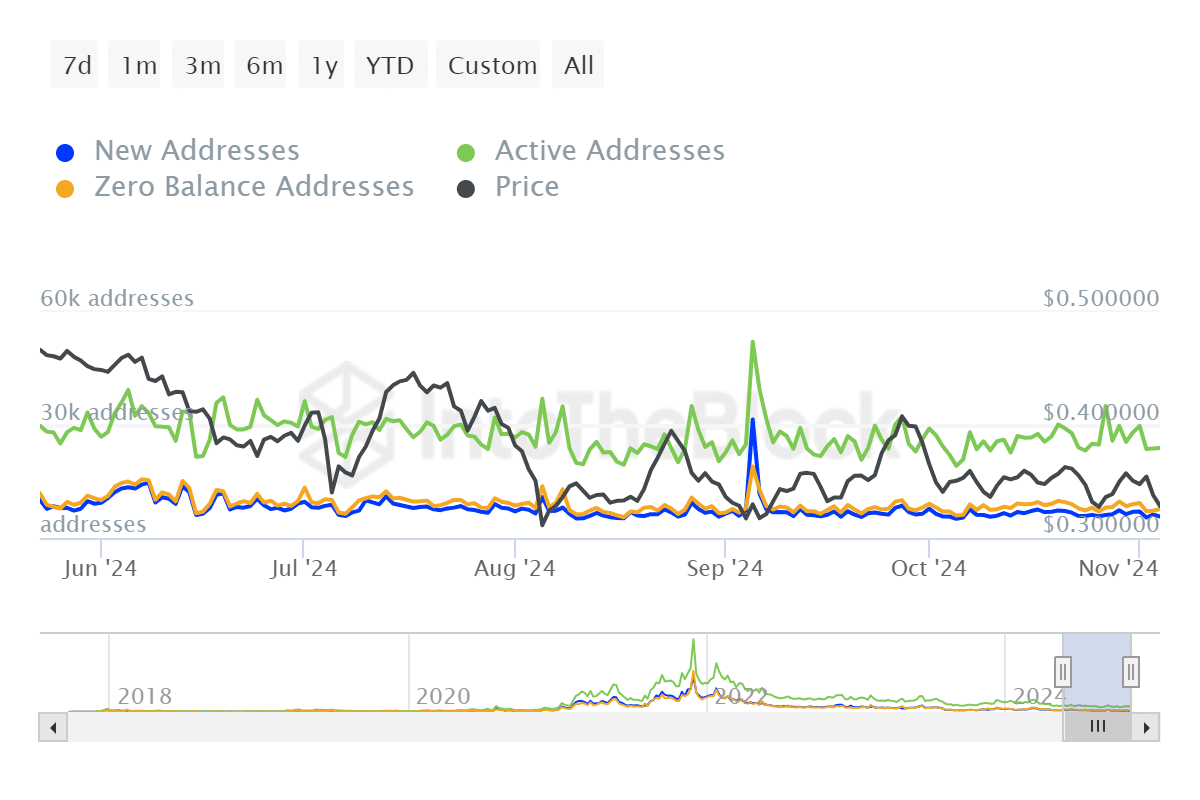

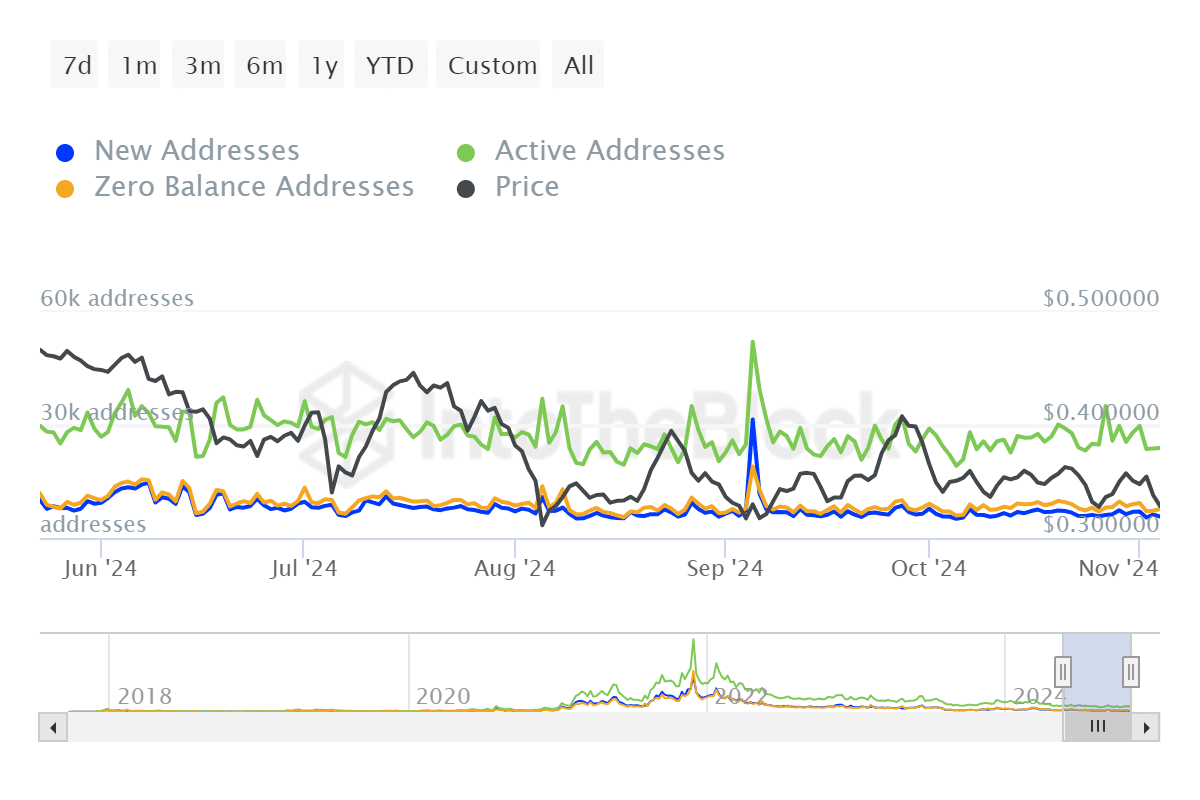

AMBCrypto also highlighted a slight decline in the number of Daily Active Addresses (DAA), while the price of ADA saw a small increase.

This, combined with a decline in net flows from large holders, suggested that market participants are no longer selling their assets and are increasingly holding more.

Source: IntoTheBlock

This accumulation trend could support ADA price growth, potentially leading to higher trading levels in the coming sessions.

Gradual increase in purchasing activity

According to Mint glass.

This increase indicated that more long contracts are being opened and actively funded, potentially supporting positive price movement for ADA.

Source: Defilama

Realistic or not, here is ADA’s market cap in BTC terms

Despite this bullish signal, Total Value Locked (TVL) within the ADA ecosystem has remained flat Defillamaindicating neutral sentiment in the broader market.

TVL represents the total capital held within a DeFi platform and reflects the amount users have staked, deposited or invested.

A rise in TVL would likely confirm the bullish trend and strengthen ADA’s upward momentum.