- There has been a rally in ADA whale activity in recent months.

- However, demand for ADA continues to decline.

Cardano [ADA] has seen a sharp increase in whale activity in recent months. In a January 18 post on X (formerly Twitter), on-chain data provider IntoTheBlock noted that ADA processes an average of $13 billion in whale transactions every day.

Cardano whales have been quite active in recent months. On average, $13 billion in large transactions ($100,000) are processed on Cardano every day. A significant amount, when you compare it to Ethereum’s seven-day average of $5 billion. pic.twitter.com/8rjeQZaonU

— IntoTheBlock (@intotheblock) January 18, 2024

This was 160% more than that of Ethereum [ETH] The daily transaction volume for whales is $5 billion, the data provider said.

Price sings another tune

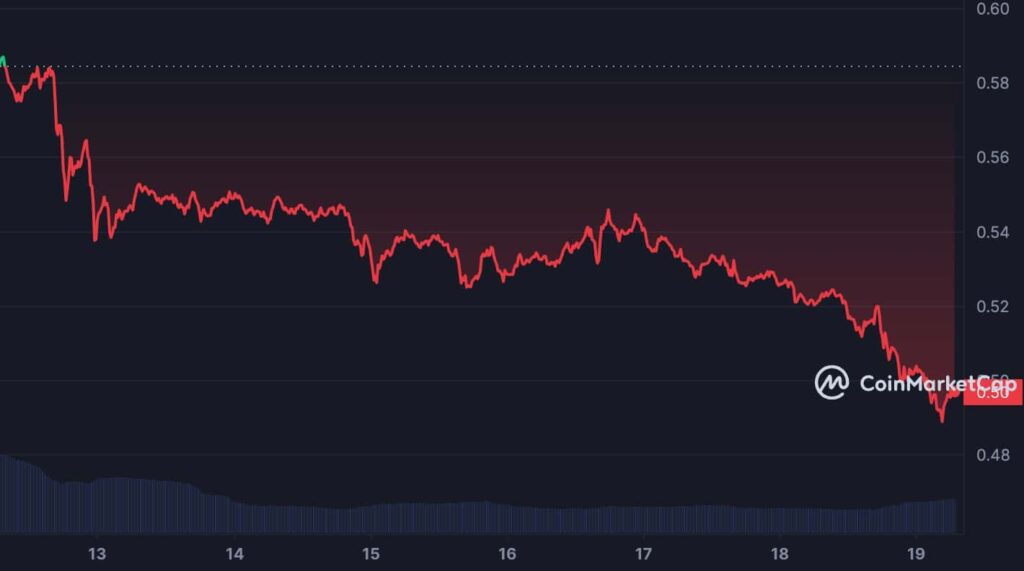

Despite the surge in whale activity, the price of ADA has refused to increase significantly. Exchanging hands at $0.49 at the time of writing, the value of the alt has fallen 19% in the past month.

In the past week alone, the price of ADA has fallen 15%, data shows CoinMarketCap showed.

Source: CoinMarketCap

At its current value, ADA has returned to its pre-ETF approval price level. Reflecting the general rally in the altcoin market that followed the approval of Bitcoin Spot ETF on January 10, ADA’s price quickly rose to a high of $0.61 on January 11, marking a 21% increase.

However, as the excitement surrounding the ETF’s approval waned, the ADA’s revival, supported by a lack of real demand for the coin, caused a reversal. The price of ADA has fallen 20% since January 11.

A clear indication of the decline in ADA demand was the key momentum indicators observed on a 24-hour chart. At the time of writing, the currency’s Relative Strength Index (RSI) and Money Flow Index (MFI) were trading below their respective center lines.

ADA’s RSI was in a downtrend at 41.11, while MFI was at 48.53. At these values, these indicators showed that the sell-off of coins exceeded the accumulation.

The Chaikin Money Flow (CMF) at the time of writing was -0.04, indicating increased liquidity exit from ADA’s spot market.

A CMF value below zero is a sign of weakness in the market because it reflects capital removal. This is known to put downward pressure on the price of an asset.

Source TradingView

Is your portfolio green? Check out the ADA profit calculator

Due to ADA’s low price action since the beginning of the year, the market value to realized value (MVRV) ratio has been negative since January 4. This means that most ADA investors hold their coins at unrealized losses.

With an MVRV ratio of -11.77% at the time of writing, any trader selling their coins at the current price would, on average, make a loss on the investment of 12%.

Source: Santiment