- The accumulation of whales was underway, setting ADA up for the next big price increase.

- In the derivatives market, traders bet heavily on a rebound, with long positions dominating sentiment.

Cardanos [ADA] Performance continues to be excellent as of late, with a gain of 216.78% over the past month. The recent 20.55% increase in the past 24 hours further reflected continued bullish momentum.

This rally is mainly driven by the accumulation of whales and increased buying activity in the derivatives markets. Insights from AMBCrypto suggested that even more benefits could be in store.

Accumulation of whales behind ADA’s rally?

Analyst Ali Charts noticed this X (formerly Twitter) that Cardano’s recent rally in the ADA has been significantly impacted by whaling activity, with large holders accumulating significant amounts of the assets.

According to the analyst, the current rally is “nothing compared to what is to come,” citing several bullish indicators.

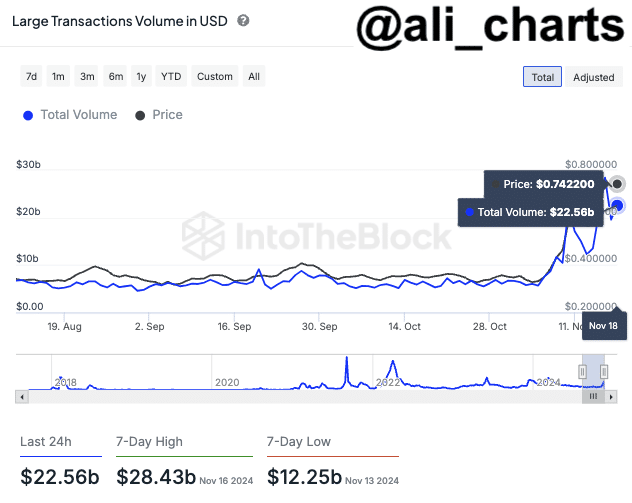

Ali Charts highlighted an increase in ADA transaction volume, which has consistently maintained a level of $22 billion per day over the past week, peaking at $28.43 billion – the highest in seven days.

This increase in activity is related to whales and institutional investors increasing their positions.

Source:

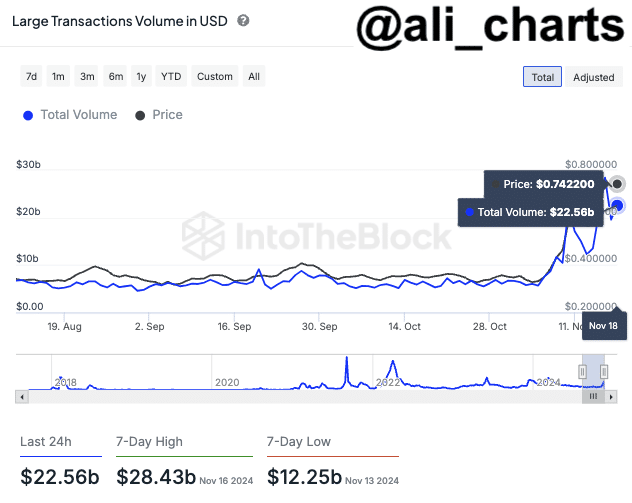

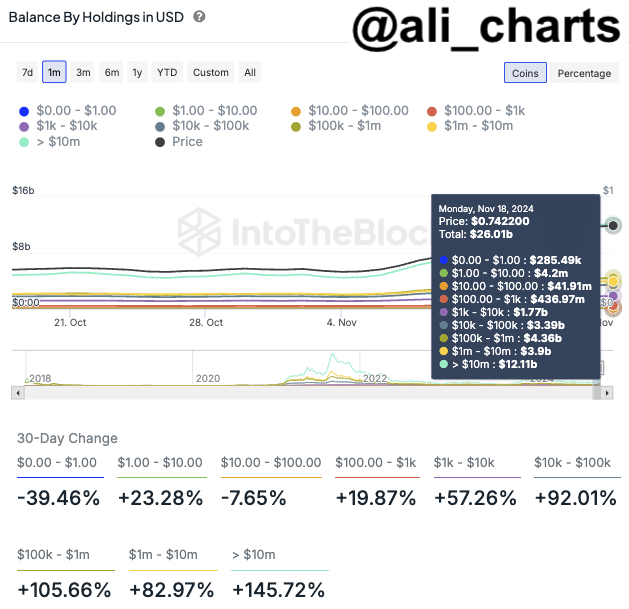

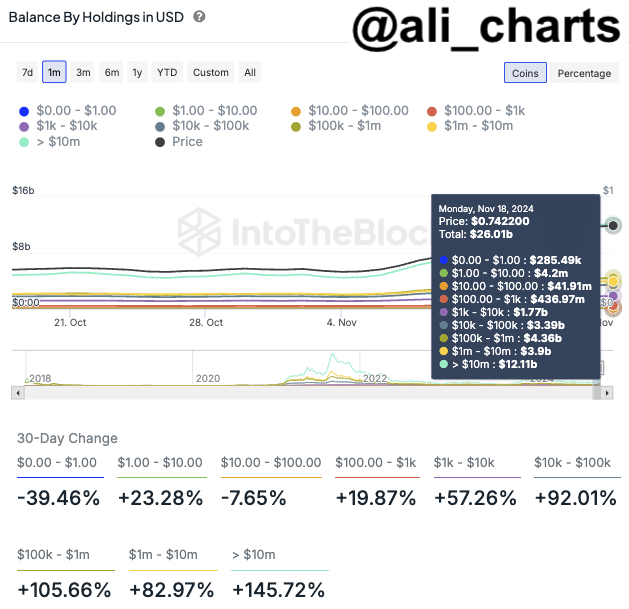

The analyst pointed to a notable increase in ‘Balance By Holding in USD’, which tracks ADA shares across portfolio balances. This increase reflected large accumulation by large owners.

Whales – portfolios containing up to 1% of the total asset supply – have shown tremendous growth.

Specifically, wallets with between $1 million and $10 million in ADA have increased their balances by 82.97%, while wallets with more than $10 million have seen a 145.72% increase in the last 30 days.

Source:

Price movements indicate a possible ADA rally

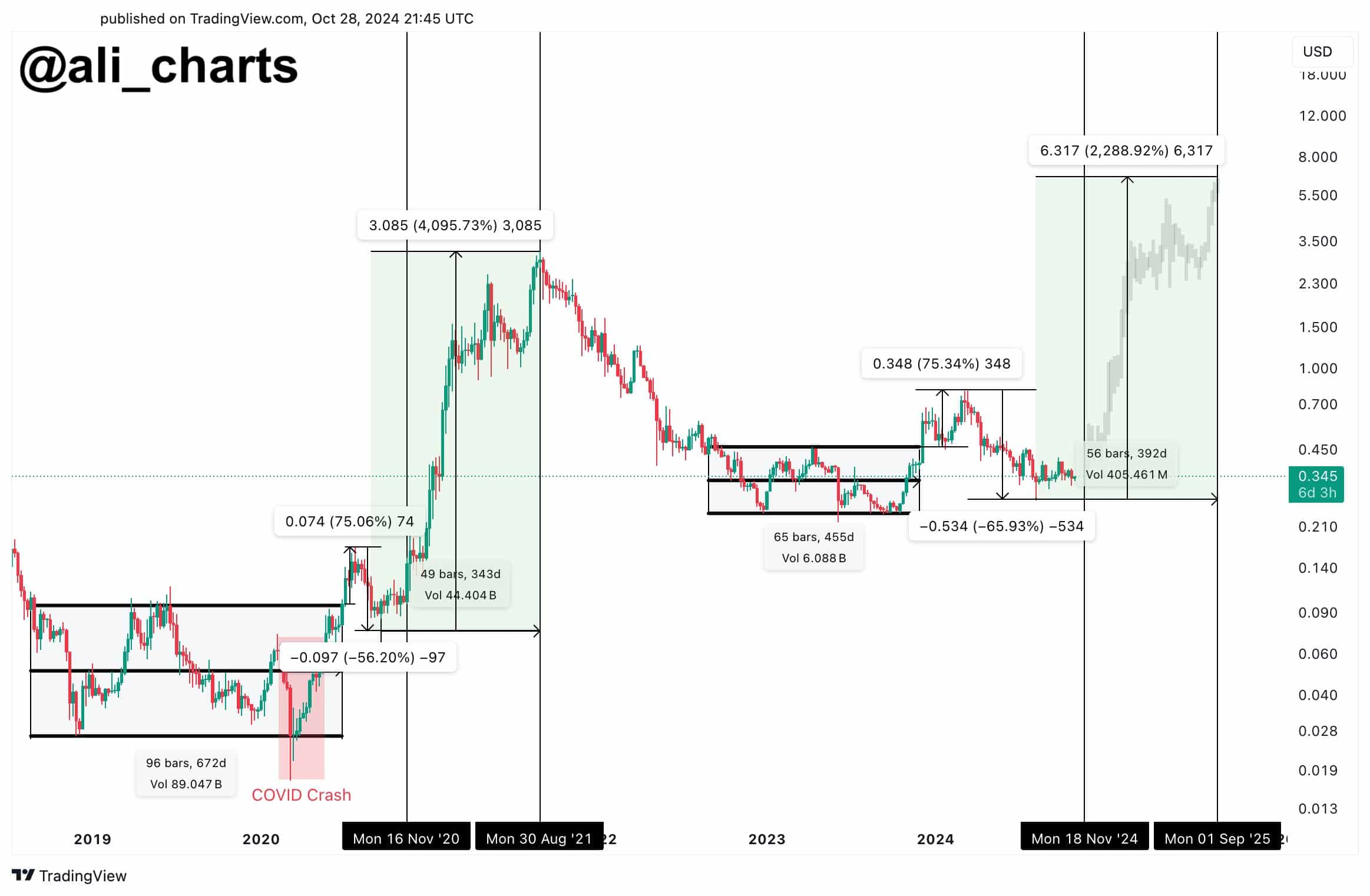

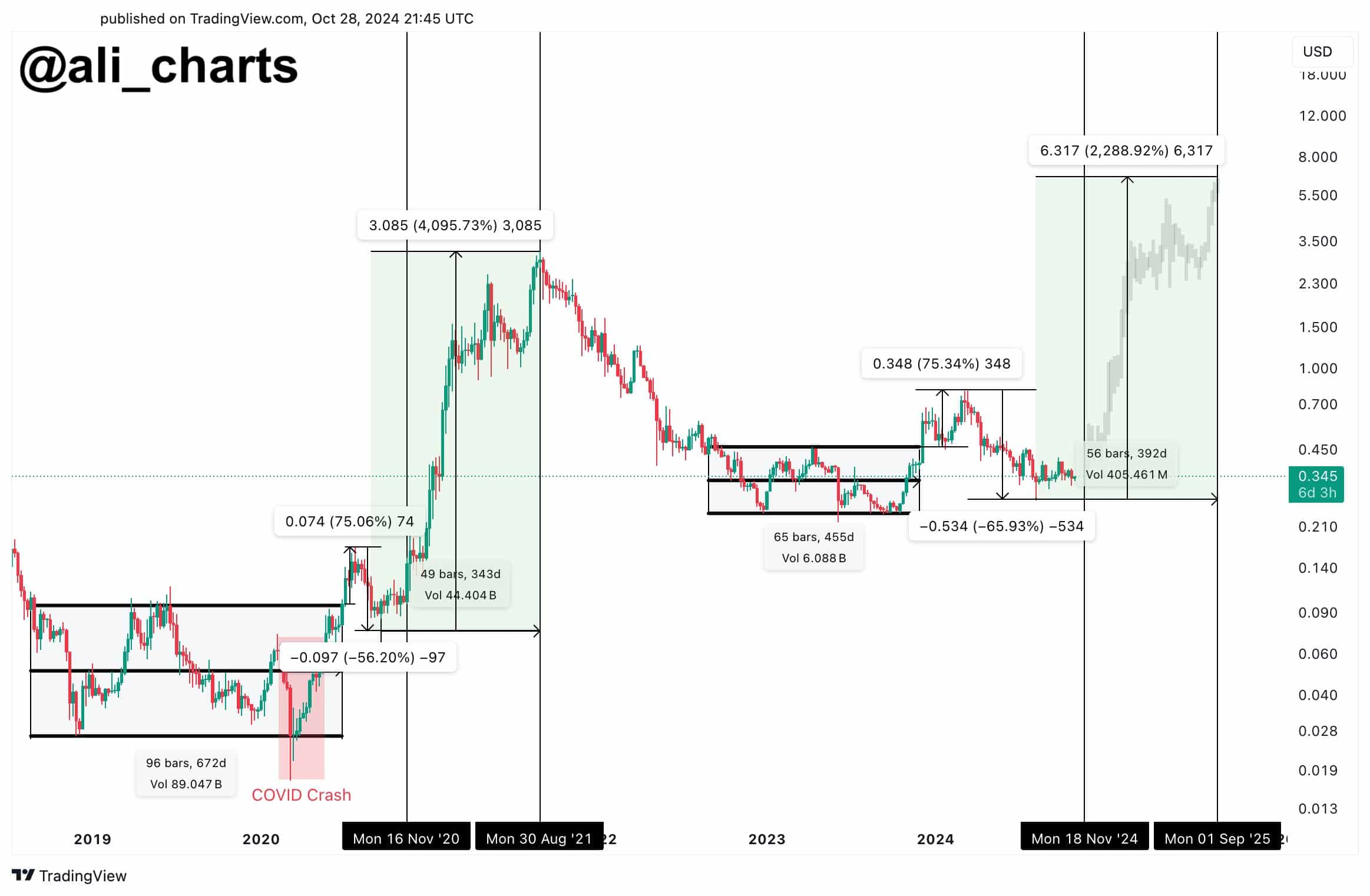

Ali Charts noted that ADA’s price movement resembled a fractal pattern, mirroring the 2020 trajectory.

This pattern includes the accumulation phase, the COVID-19 crash, and the subsequent November 2020 rally that took ADA to an all-time high of $3,085.

ADA seemed to be on a similar path, having exited an accumulation phase, experienced a crash and now showed signs of an uptrend.

If this fractal occurs, ADA could potentially rise 2,288.92% to reach $6.30 – a move that is already underway.

Nevertheless, there is a chance that ADA could temporarily slow down as it gathers additional momentum to climb higher.

In such a scenario, the value could return to $0.80, with significant buying interest reigniting the rally.

Source:

At this level, data shows that there is a large purchase order for 1.19 billion ADA, spread across approximately 48,000 addresses. This underlines the strong interest from investors and points to a potential catalyst for the next price increase.

Derivatives traders are fueling the bullish pressure

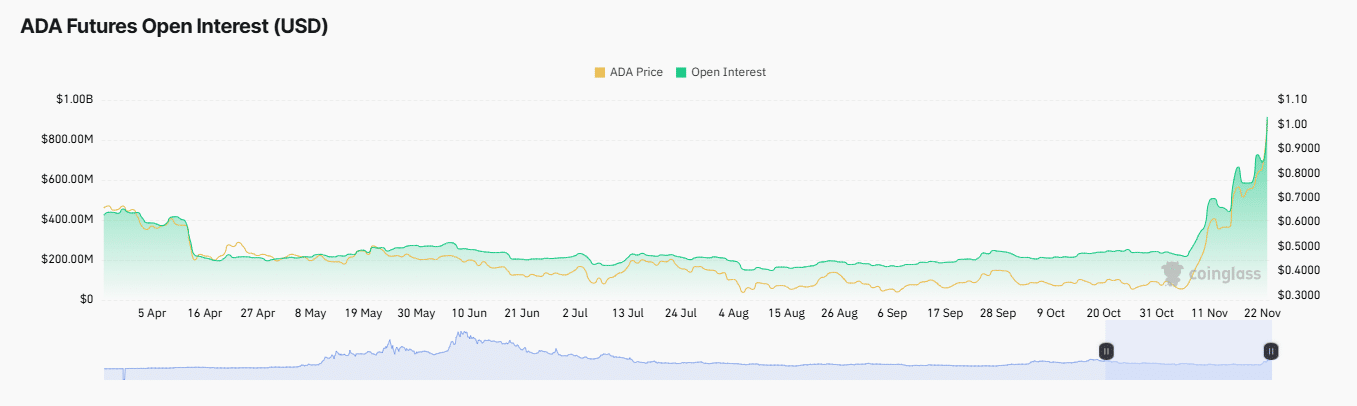

AMBCrypto’s look on Mint glass revealed growing interest among derivatives traders, with a significant increase in long positions. This trend is expected to continue as bullish sentiment strengthens.

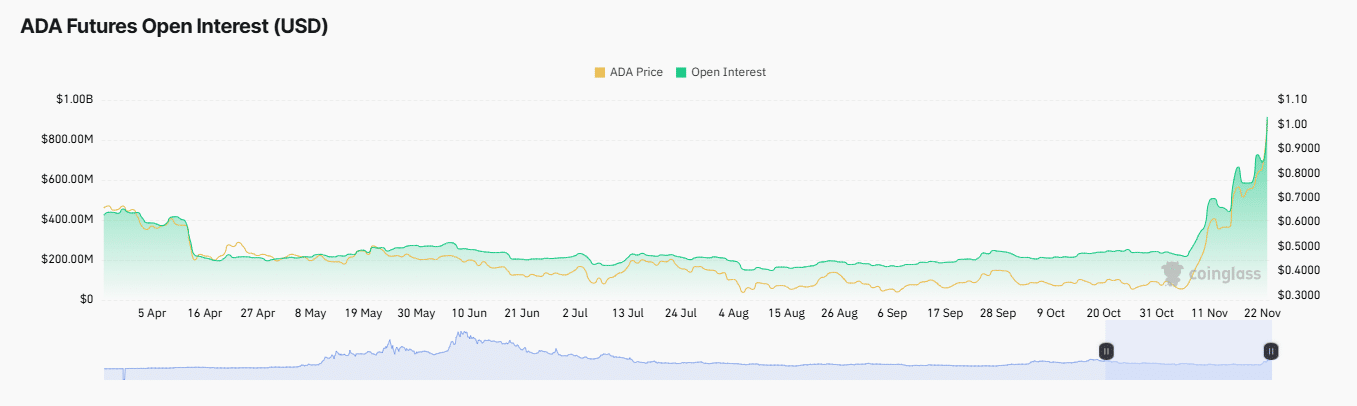

Open Interest, used to gauge market sentiment based on the total value of unsettled derivatives contracts, had moved decisively bullish at the time of writing. It rose 35.37% to reach $1.02 billion.

Source: Coinglass

Read Cardanos [ADA] Price forecast 2024–2025

At the same time, a number of short liquidations took place totaling $11.12 million, as traders betting on a price drop were forced to close their positions due to ADA’s uptrend.

Adding to the bullish outlook is the rising financing rate, which stood at 0.0572% at the time of writing. A positive and rising funding rate, as we see in this case, signals dominance of long traders, further reinforcing expectations of a rally.