- Cardano’s key support level at $0.3172 remains in place with potential for a break above the downtrend line.

- Currency outflows and the long/short ratio indicate growing bullish sentiment.

Cardano [ADA] has witnessed a positive movement in recent times. At the time of writing, ADA’s share price stood at $0.3409, up 2.68% in the past 24 hours and up 4.44% in the past week.

The main support level remains strong

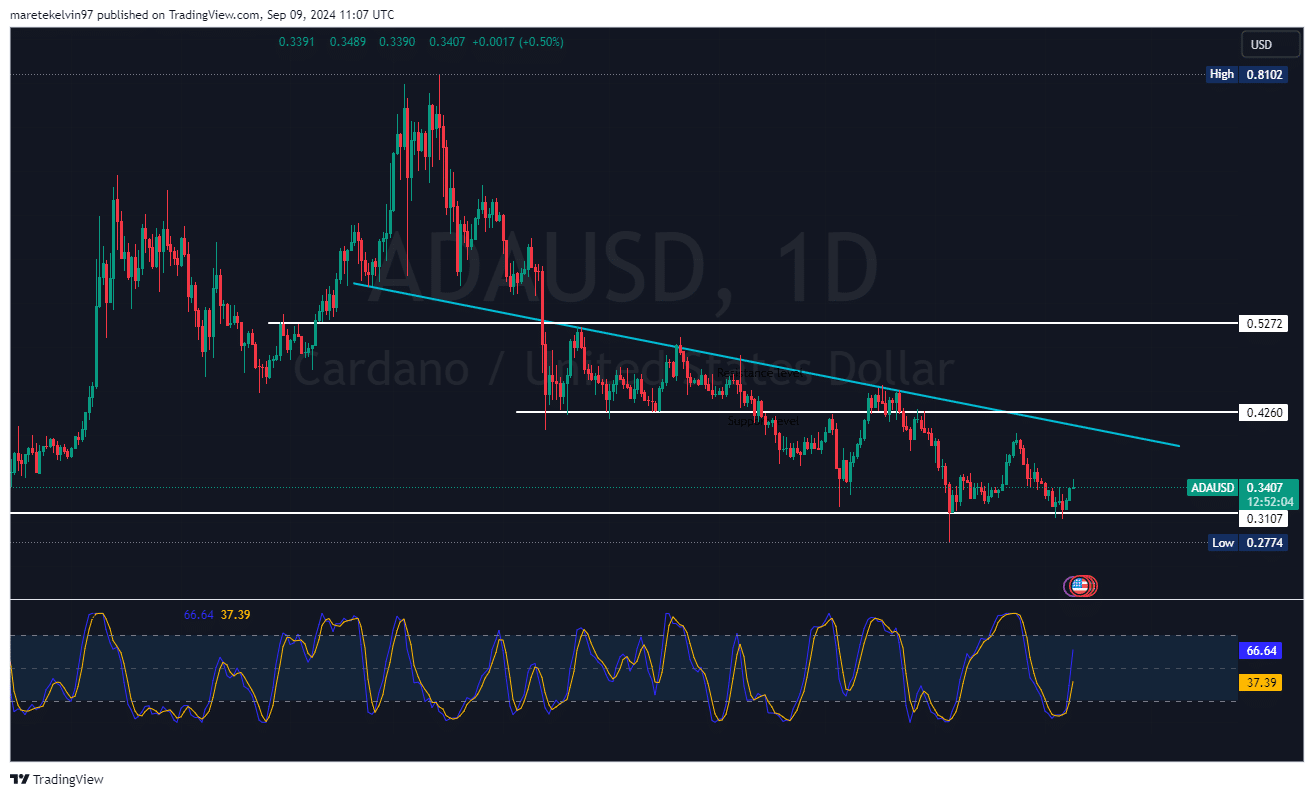

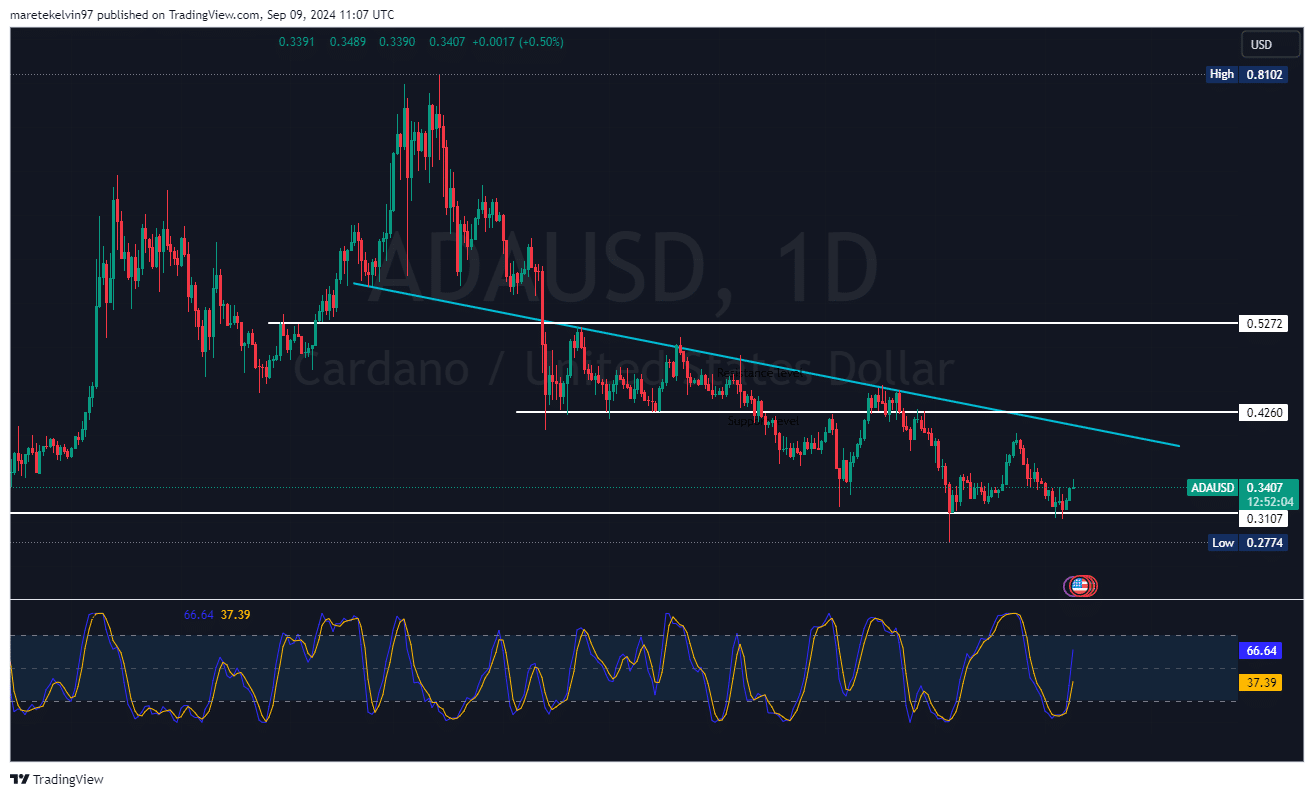

At the time of writing, ADA was gathering bullish momentum from a significant support level at $0.3172, which has been serving as historic psychological support for several weeks. On the chart, Cardano prices consolidated in an ascending triangle pattern.

ADA was currently approaching a downward trend line dating back to earlier in 2024.

Although prices have tested this resistance several times, Cardano has not quite broken out yet.

A break above this trendline, coupled with the strong support level, could signal a bullish reversal.

Source: Tradingview

Source: Tradingview

The chart shows a clear downward trendline with a series of lower formation highs. However, the stochastic RSI indicates a bullish crossover, with the RSI rising from the oversold region.

This bullish divergence could signal a potential near-term rally as momentum begins to move in the bulls’ favor.

The Cardano exchange’s net flow paints a bullish picture

According to Coinglass’ net flow data, Cardano’s outflows have dominated inflows. This suggests that investors are moving their ADA tokens from the exchanges to cold storage.

This is usually a bullish sign, indicating lower willingness to sell in the short term.

Source: Coinglass

Liquidation pressure eases Cardano’s upward rally

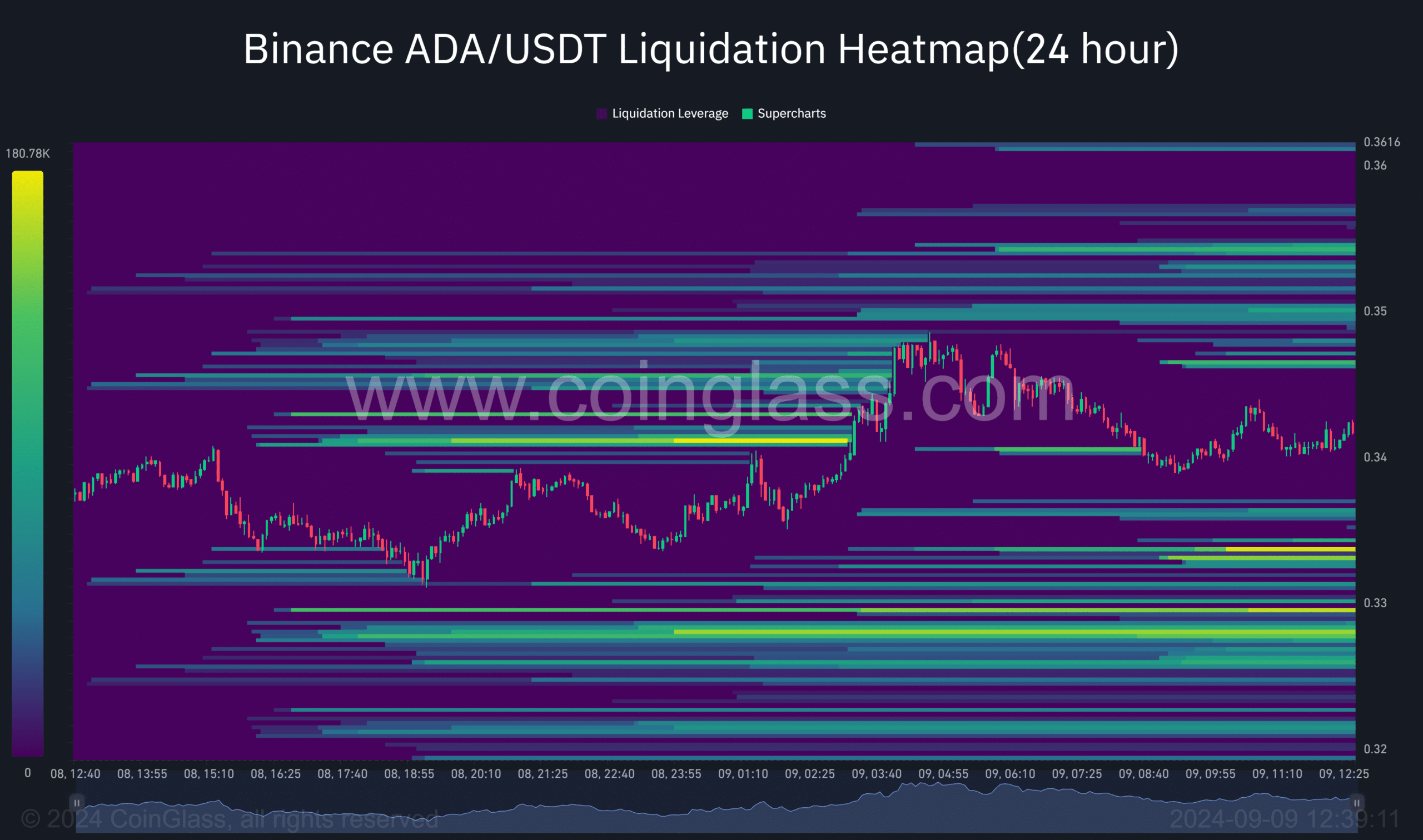

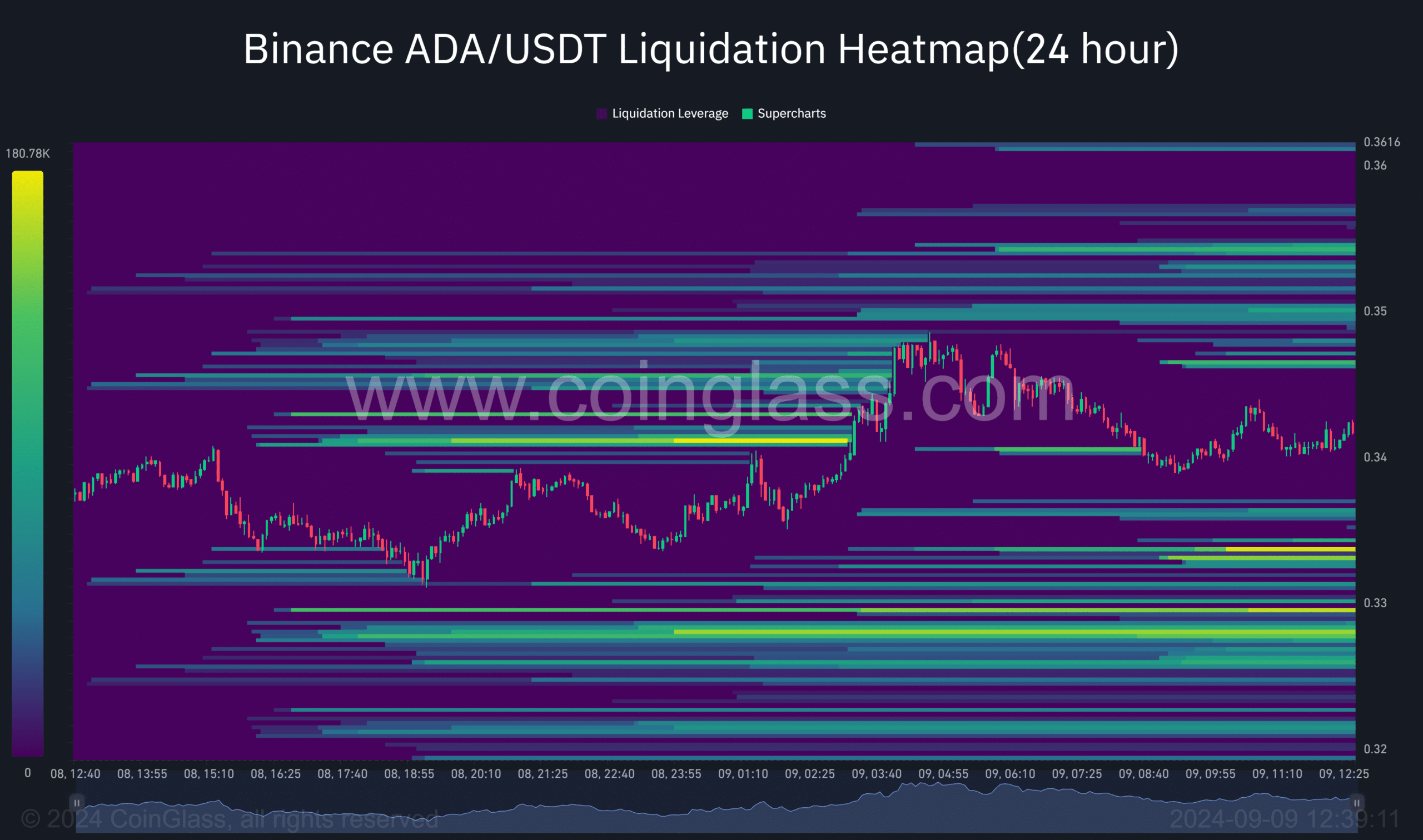

AMBCrypto analysis of liquidation heatmap data from Coinglass highlights a key area of liquidation pressure around $0.34-$0.36.

This indicates that short positions are under pressure, potentially leading to upward price action as bears are forced to hedge their positions.

Source: Coinglass

Realistic or not, here is the market cap of ADA in terms of BTC

Bears vs. Bulls

In addition to the above, Cardano’s long-short ratio currently favors the longs. There is a spike in the long-short ratio, which currently stands at 1.31.

Source: Coinglass

With the aforementioned positive metrics and indicators, Cardano is positioned for a potential bullish breakout if it can hold above the $0.3172 support and break through the overhead resistance levels.