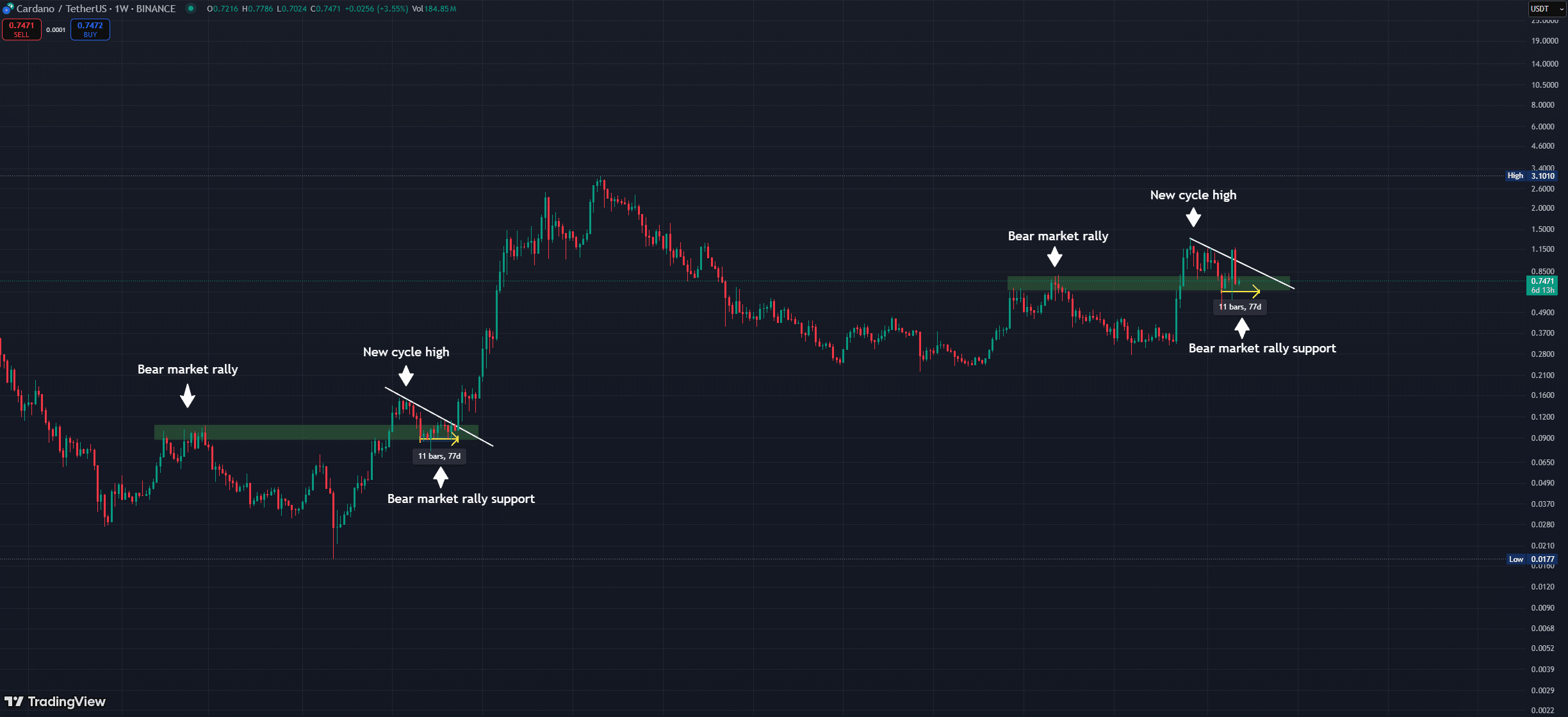

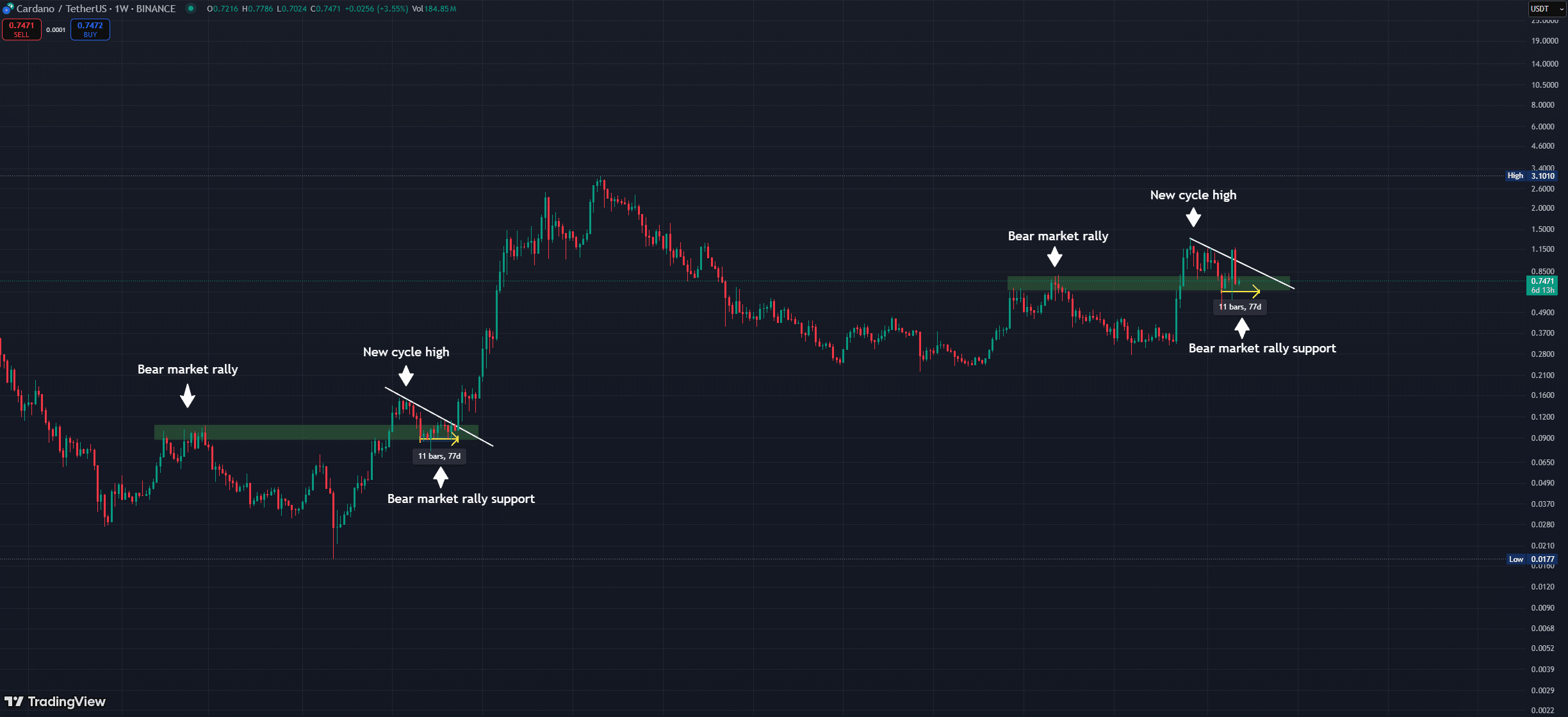

- Ada’s historical price promotion and key technicians were tailored to the 2021 cycle.

- If history rhymes, another major outbreak could be on the horizon?

Ten days after Cardanos [ADA] Historical rise from a single day from 72% to $ 1.14, the price has been completely withdrawn and drops back to the range of $ 0.70.

This sharp pullback comes in the midst of a broader risk-off sentiment. Nevertheless, the ADA/BTC purple is flashing green, which suggests that investors may switch to high-cap assets for stability.

It is striking that the weekly structure of ADA is reflected 2021 cycle, when a decrease of 52% led to a consolidation of 11 weeks before an outbreak of 4,000% to $ 3.10.

At the time of the press, ADA had fallen 47% and consolidated for five weeks from the high of this cycle.

Source: TradingView (ADA/USDT)

Despite the total bearish market sentiment, Ada has demonstrated the relative strength, with 110% above the opening price of the election day of $ 0.34.

On the 1D graph the price action of the Altcoin is within an important support zone, whereby the RSI is approaching over -sold circumstances. If on-chain statistics confirm the accumulation, this setup may indicate a reversal of high probability.

Could the current position of ADA the current position be a hose trap before the next explosive outbreak with historical price trends and important technical indicators?

Looking at the long -term provision of ADA

Derivative data emphasizes the risks, with open interest (OI) 11.79% falling to $ 734.16 million, since $ 750 million was settled within two weeks.

In the meantime, the Spotmarkt demand remains strong, with withdrawal Exciting the inflow and trade volume that rises by 12% to $ 2.01 billion. This suggests persistent purchasing pressure.

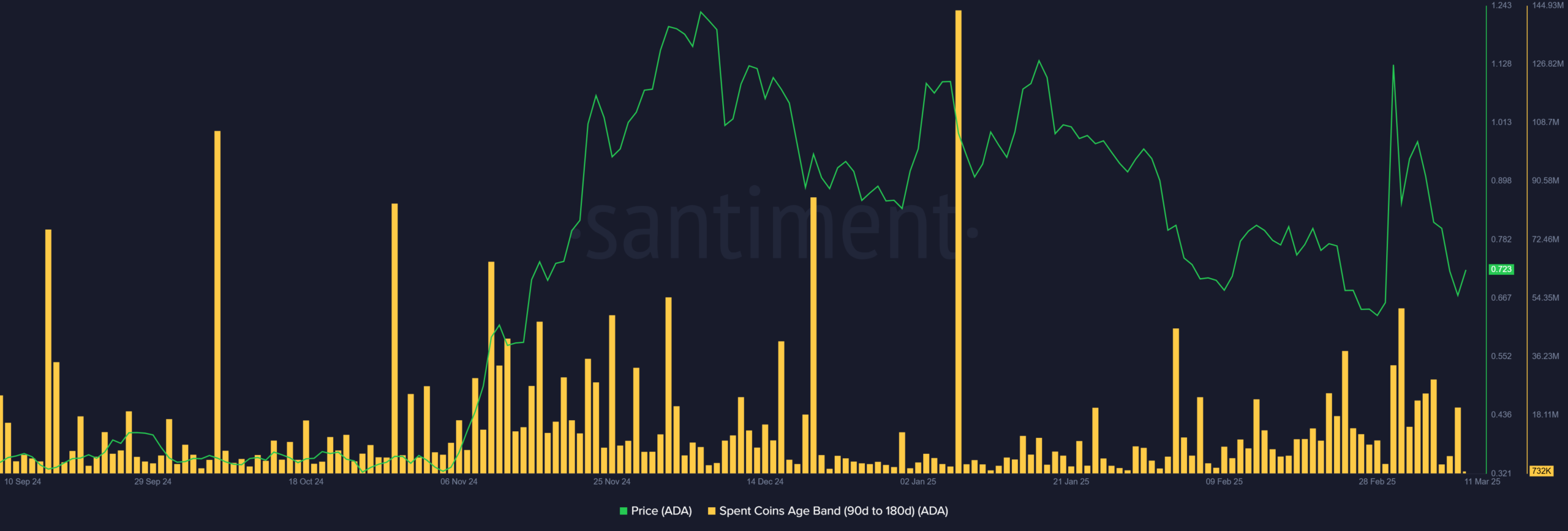

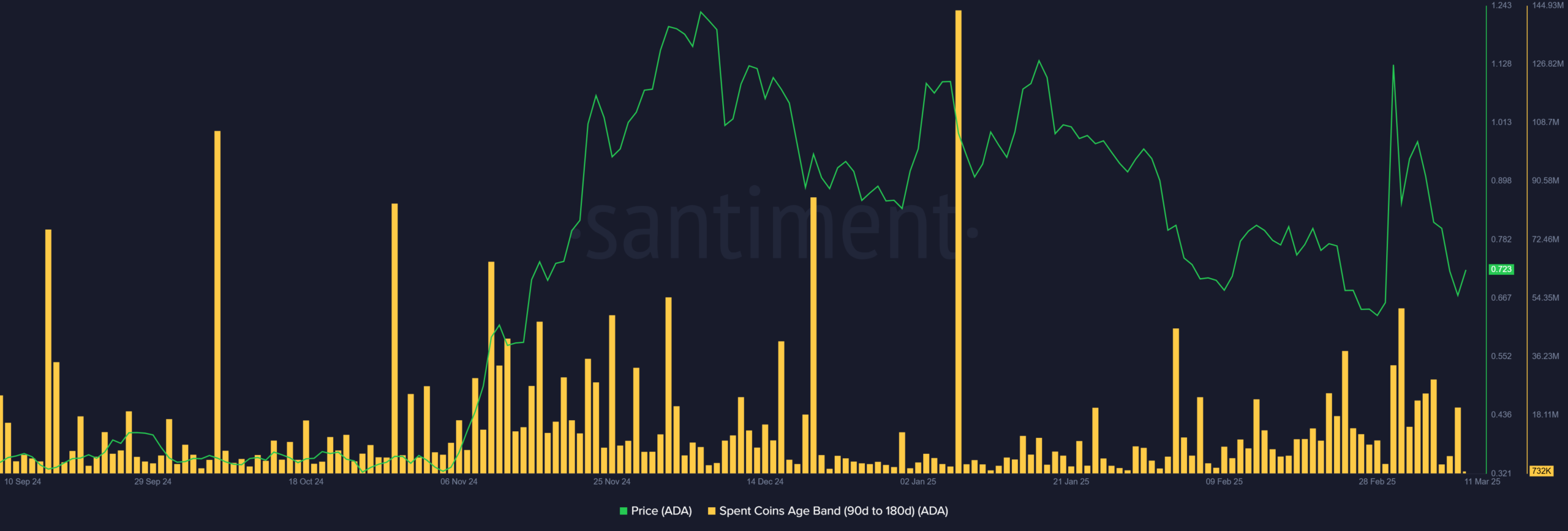

In the meantime, a 15 million ADA Uptick suggests funds in the medium-term coin age band (90-180 days). This can indicate distribution at an early stage.

Source: Santiment

Now that the liquidity on the sales side is being absorbed, Ada can set up for deeper consolidation below $ 1, because Futures Unwonding meets a stable spot demand.

In the coming days, the market will reveal whether this consolidation phase will last. If it applies, a pear trap could arise, which makes it possible to activate the liquidations of the short seller as market conditions shift. This can clear the road for a rally reminiscent of 2021.