- ADA showed strong bullish signals and appeared to trade near a classic breakout pattern

- Derivatives data indicated increasing interest from traders, while critical support and resistance levels could quickly change ADA’s trajectory

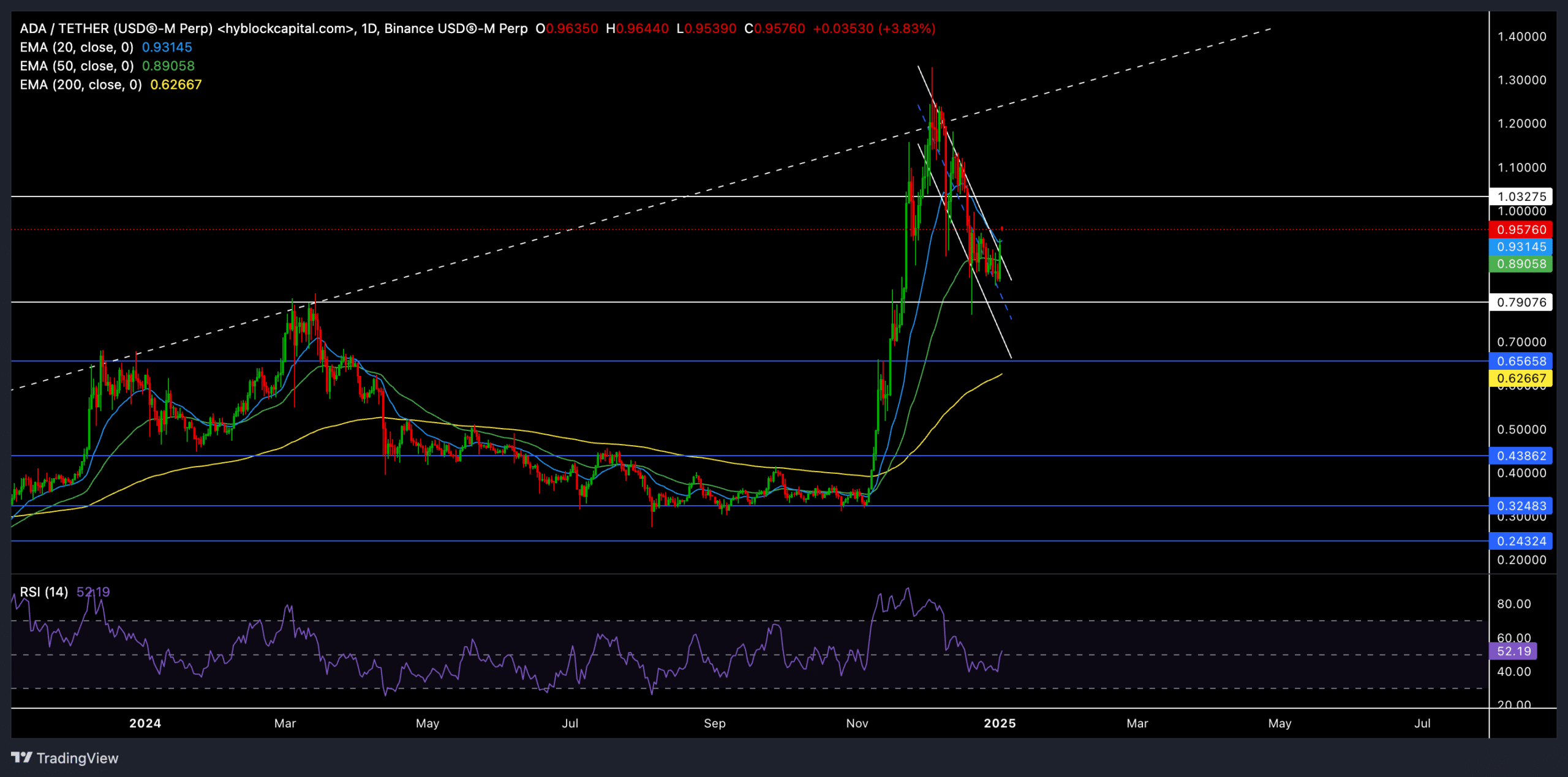

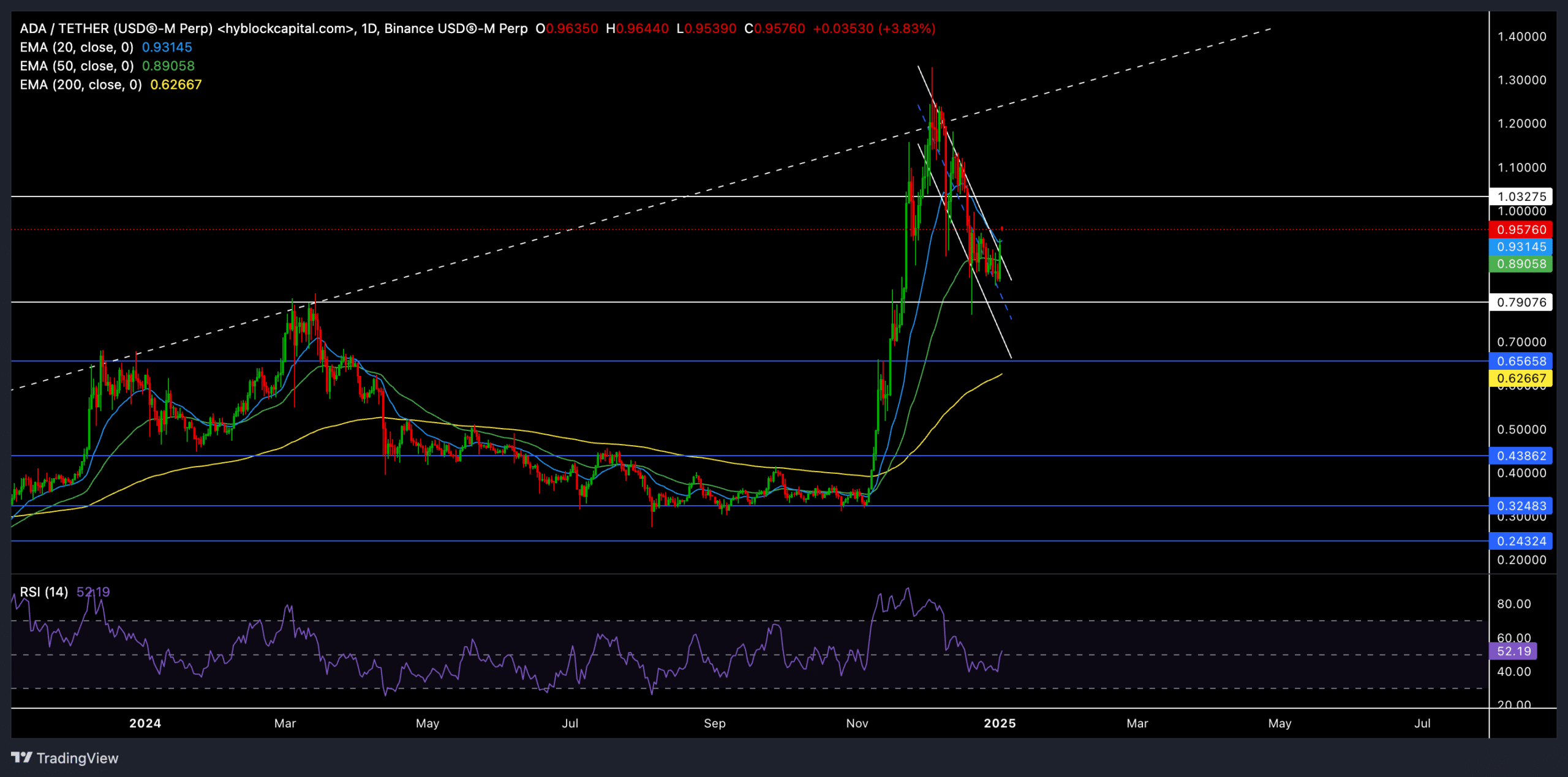

Cardano [ADA] recorded a massive 270% rally between early November and early December before reversing long-term trendline resistance. However, despite this pullback, the altcoin’s price action remained well above the 20/50/200-day EMAs, underscoring a strong bullish edge.

With broader market sentiment still wavering, ADA’s near-term volatility could provide traders with lucrative opportunities.

Can Cardano maintain its bullish edge?

Source: TradingView, ADA/USDT

ADA has maintained strong bullish sentiment by holding above the 20-day, 50-day, and 200-day EMAs. This reaffirms a strong bullish upside despite ongoing consolidation.

At the time of writing, the altcoin appeared to be trading near a classic bullish flag setup on its daily time frame. A close above the resistance at $1.03 could confirm the breakout of this flag. In this case, the bulls could be eyeing the $1.21 zone, which was close to the long-term trendline resistance.

On the other hand, a break below the $0.80 support could negate the bullish trends. A drop below this level could pull the ADA toward its 200-day EMA ($0.62) and slow the uptrend.

The daily Relative Strength Index was hovering around 52 at the time of writing, indicating mildly bullish momentum. A sustained position above the midline can help buyers regain immediate resistance in the coming sessions.

ADA’s 24-hour trading volume rose above $1.7 billion, marking a share price gain of almost 12% over the past day. Such volume increases are usually ideal for short-term trading setups.

Derivative data revealed THIS

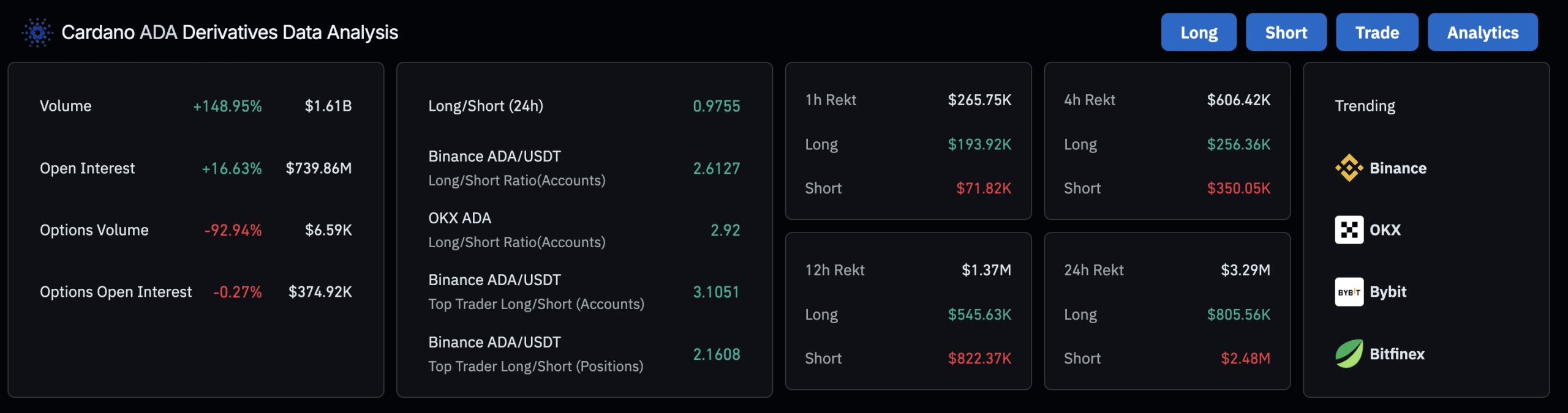

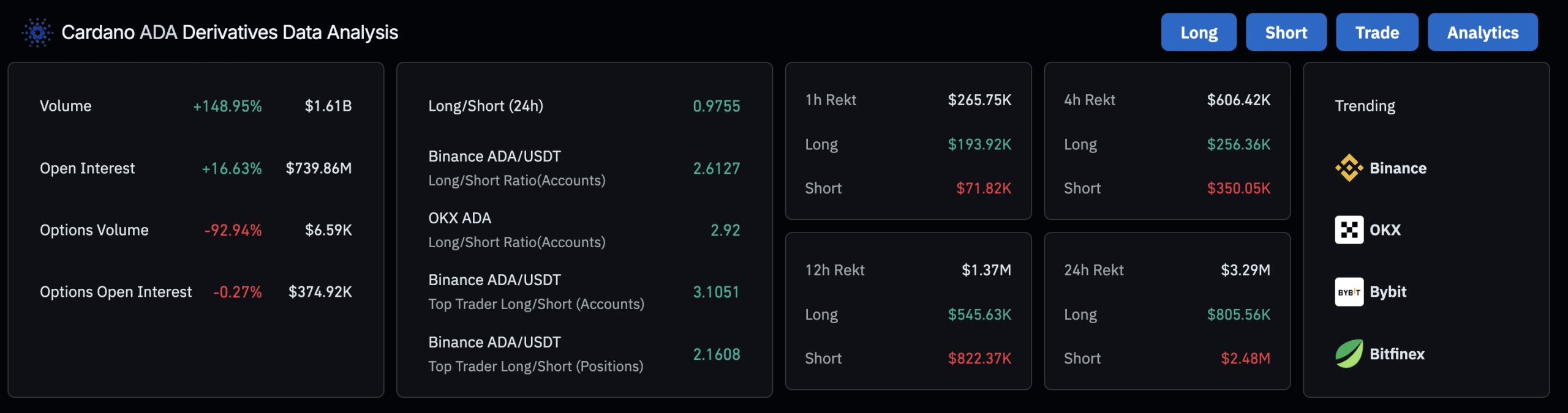

Source: Coinglass

According to the latest data, ADA Open Interest Derivatives rose 16.63% to $739.86 million – a sign that new positions have flooded the market.

While the overall 24-hour Long/Short ratio was close to 0.9755, indicating a somewhat neutral position, the exchange-specific ratios (e.g. Binance ADA/USDT at 2.6127) underlined a high bullish tilt among certain traders.

As always, it is wise to monitor Bitcoin’s broader market sentiment given ADA’s high correlation with BTC. Any sudden shift in Bitcoin’s price action could quickly impact Cardano’s short-term trajectory.