- On the price charts, cardano [ADA] fell on a rising trendline with a strong history of activating price outlets

- The large transaction volume of ADA decreased by 8%and showed a decrease in whale participation

The last 24 hours were crucial for the cryptocurrency industry because of a huge crypto -hack of $ 1.4 billion targeting bybit. This robbery has influenced the total market for cryptocurrency. And yet, Ada, the native token of the Cardano -Blockchain, has remained fairly stable and has offered it above the crucial support due to the rising trend line.

Current price momentum

During this period, the Altcoin registered a price drop of 4%, with ADA trade near $ 0.76 at the time.

Despite the decline and the negative sentiment, however, the trade volume increased by 50% – a sign of increased participation of traders and investors compared to the previous day.

Everything about his price action

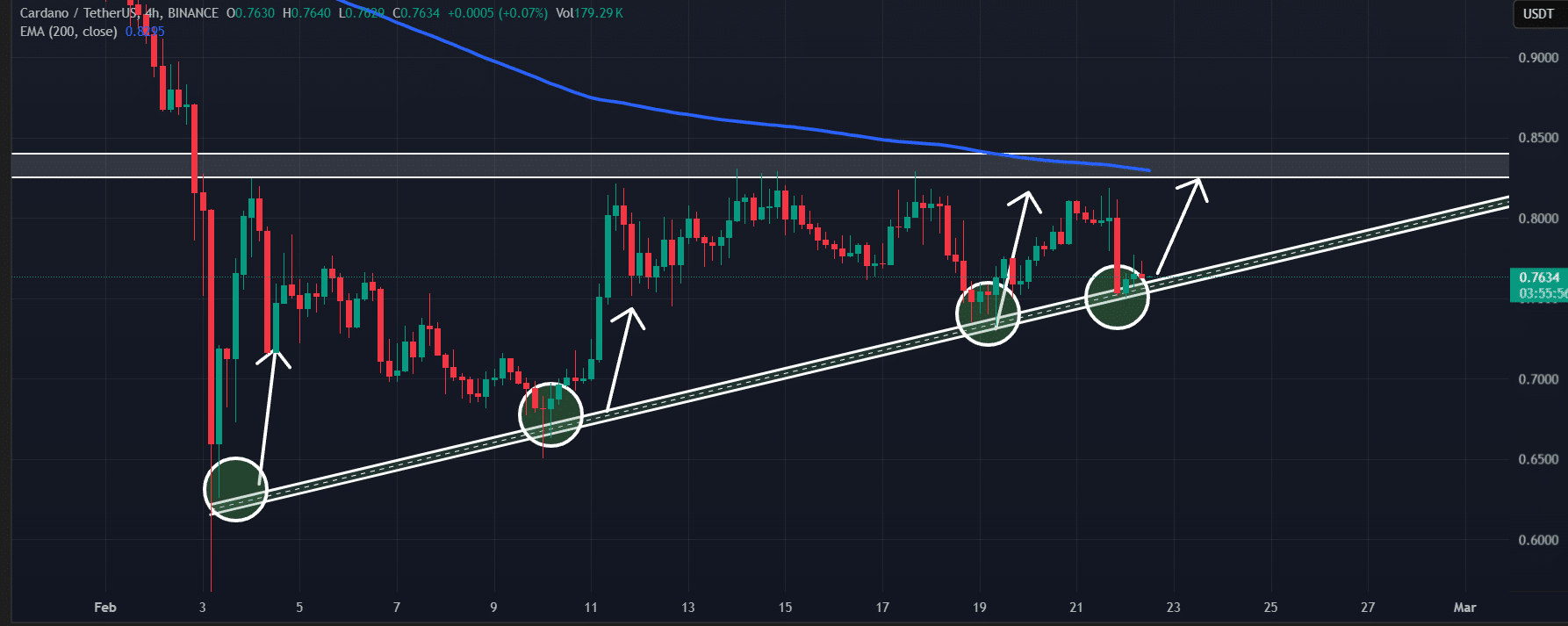

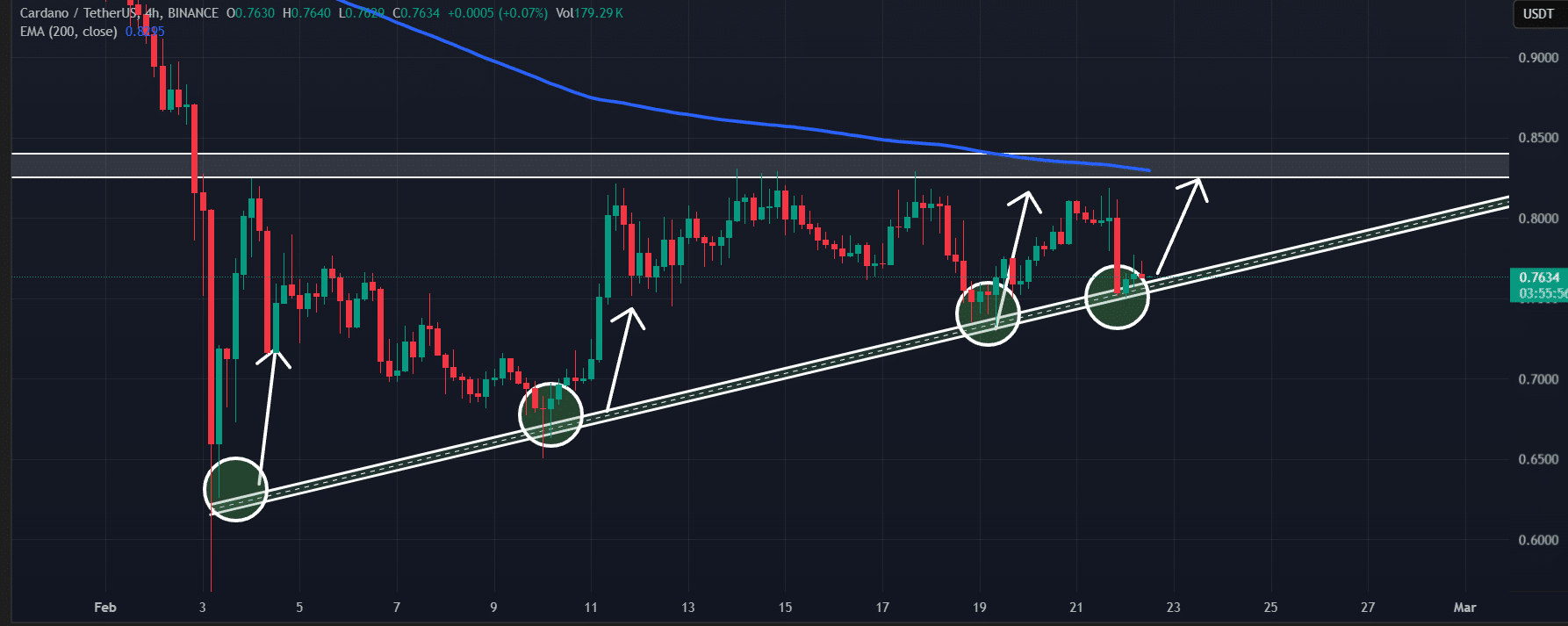

Thanks to the aforementioned price fall, ADA fell the support level of a rising trend line, which it has followed since the beginning of February 2025.

The four -hour map of Cardano revealed that this trend line has a strong history of activating price outlets. For example – in the last 20 days alone, when the price of the actual trend line reached the trend line, it consistently saw some forward momentum.

Source: TradingView

Looking at the historic momentum, it is clear that traders and investors have shown a strong interest in token. Most of them expect more benefits for Ada in the charts.

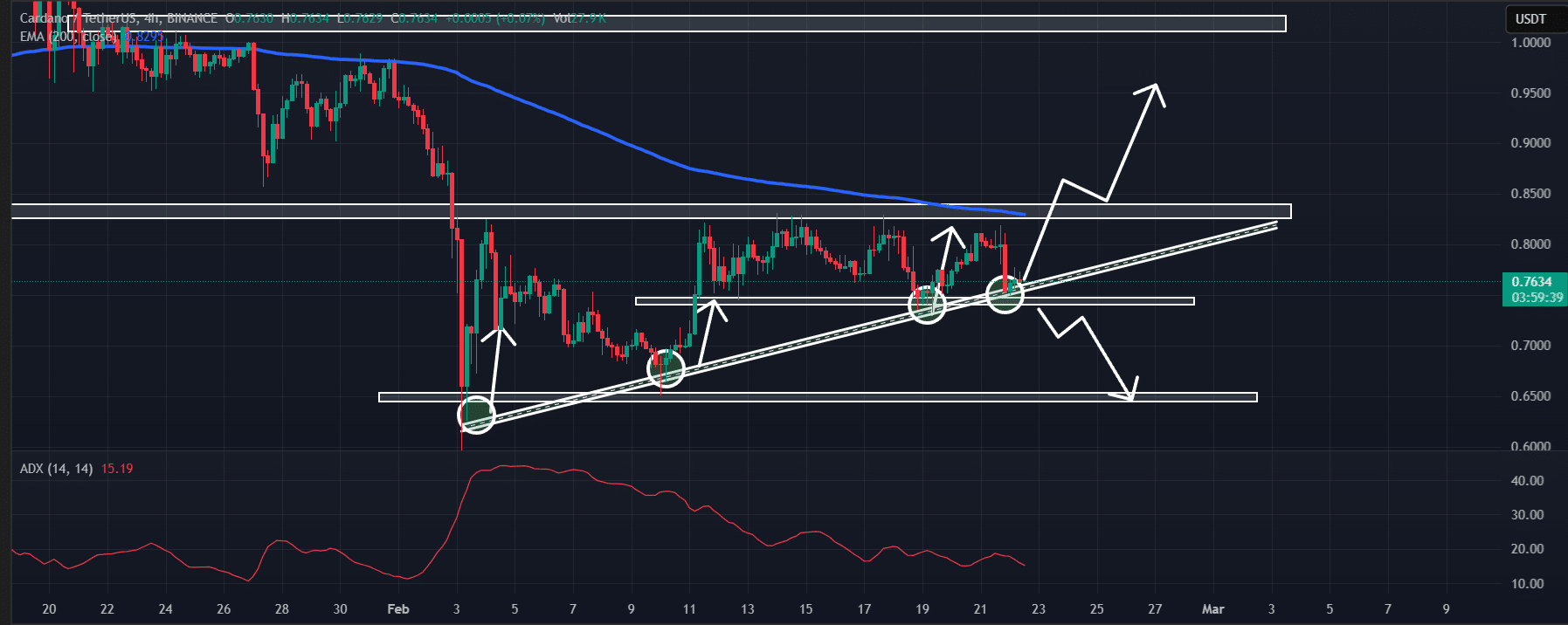

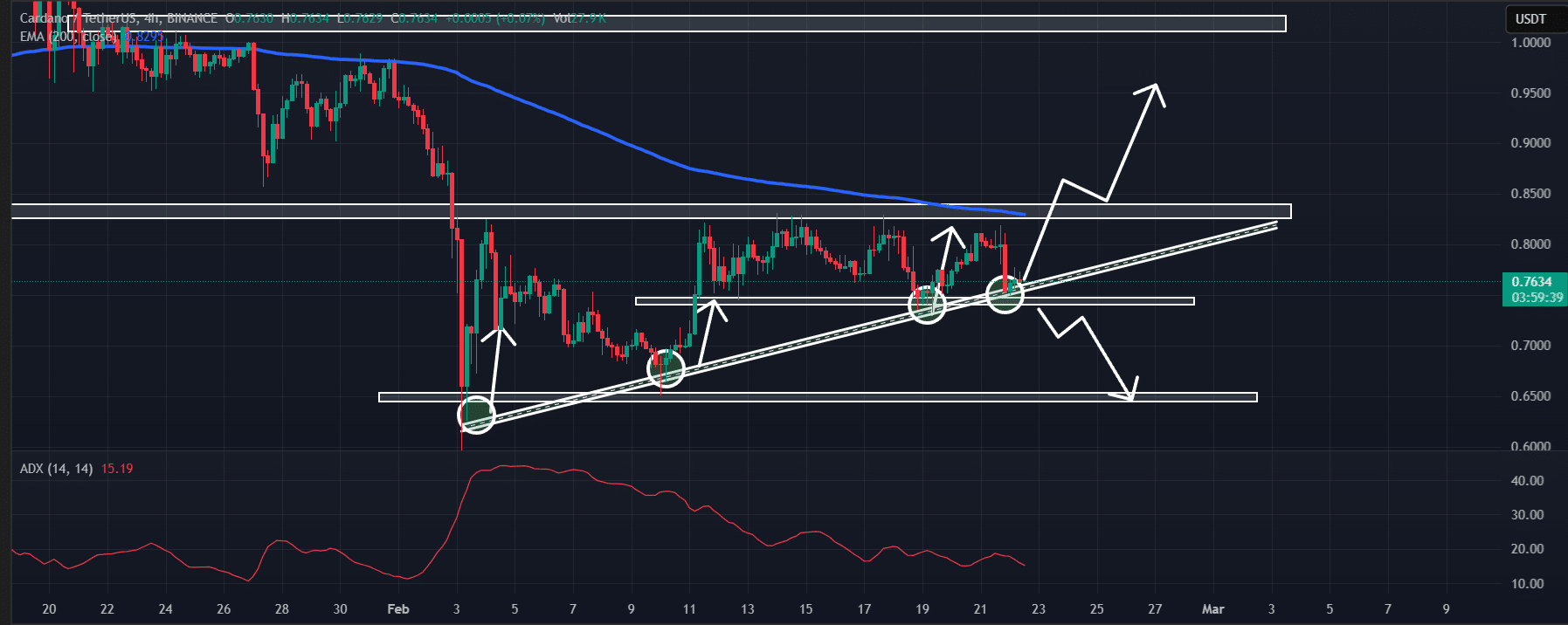

According to the technical analysis of Ambcrypto, Cardano is currently at a crucial level, currently in a make-or-break situation and forms an increasing price pattern of the triangle. In addition to supporting the rising trendline, it has also received horizontal support at the level of $ 0.745.

However, it is worth noting that, given the uncertain market sentiment, it is difficult to know whether the price will gather or sinks.

Technical analysis and price prediction

At the time of writing, the average directional index (ADX) of the assets was 16 – which indicates a weak strength, which can contribute to the slower price recovery of the Altcoin. Moreover, it still acted actively under the 200 exponential advancing average (EMA) on the four -hour period.

Given that these factors, if ADA applies above the $ 0.745 level, there is a strong possibility that it can rise by 10% to reach $ 0.85. Conversely, if it does not retain this level and closes a four -hour candle under $ 0.74, this can fall by 10% to $ 0.65 in the coming days.

Source: TradingView

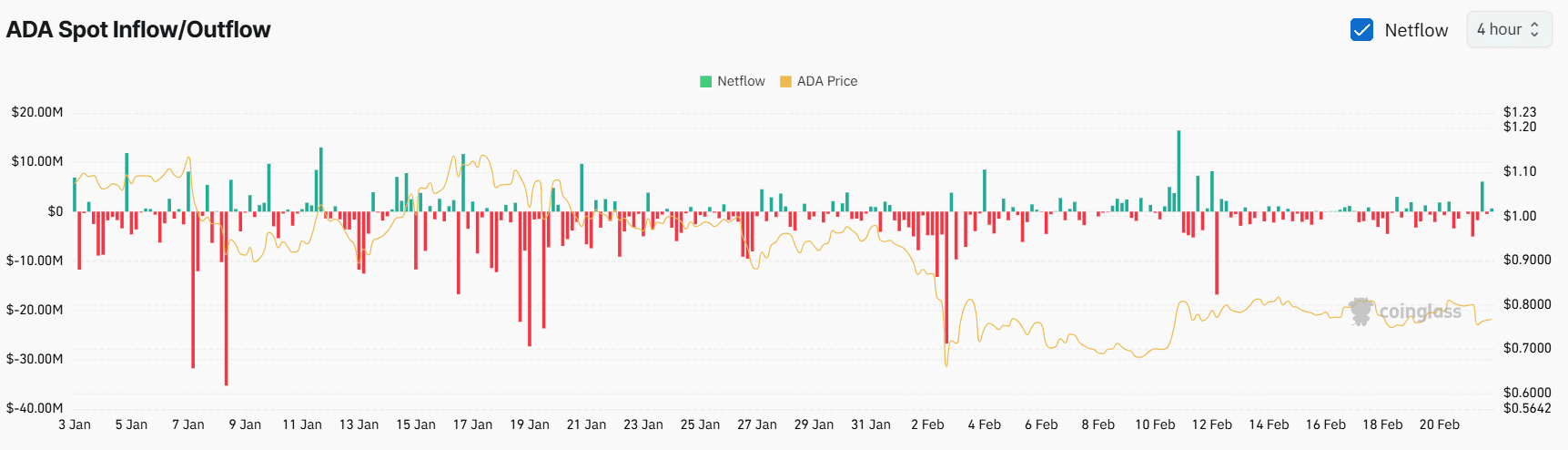

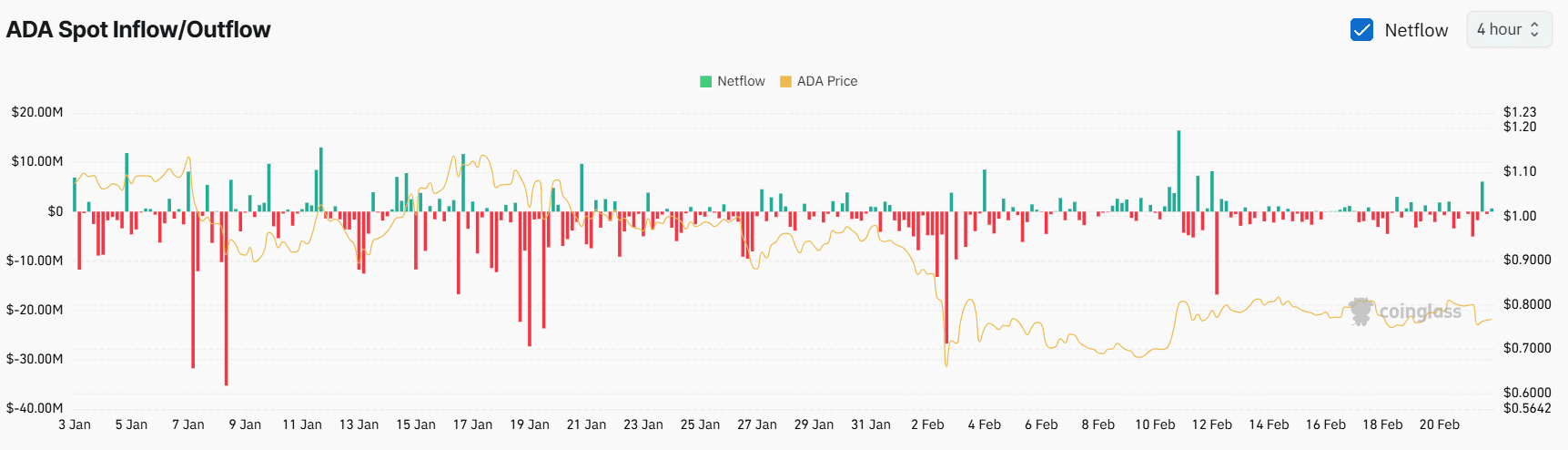

A glimpse of intake and outflow

In the light of all these factors, investors and holders seem to be confused in the long term. Especially because some dump, while others accumulate tokens, according to on-chain analysis company Coinglass.

Data from Spot -Inflow/outflow even showed that after the raid the stock markets saw the $ 7.35 million inflow into ADA -Tokens. However, because it remained active, scholarships later saw an outflow of $ 6.50 million in ADA, which indicates potential accumulation. Both enrolls and outflows were recorded within a 12-hour period after the Bybit-Hack.

Source: Coinglass

On the contrary, data from on-chain analysis company Intotheblock has shown that the large transaction volume of ADA decreased by 8% of a sign of reduced whale participation in the midst of market insecurity.

With on-chain statistics that signal mixed sentiment and Ada floats around a critical level of support, $ 0.74 remains the most important price level to view. An outbreak or breakdown of this zone will indicate the next major movement of the token.