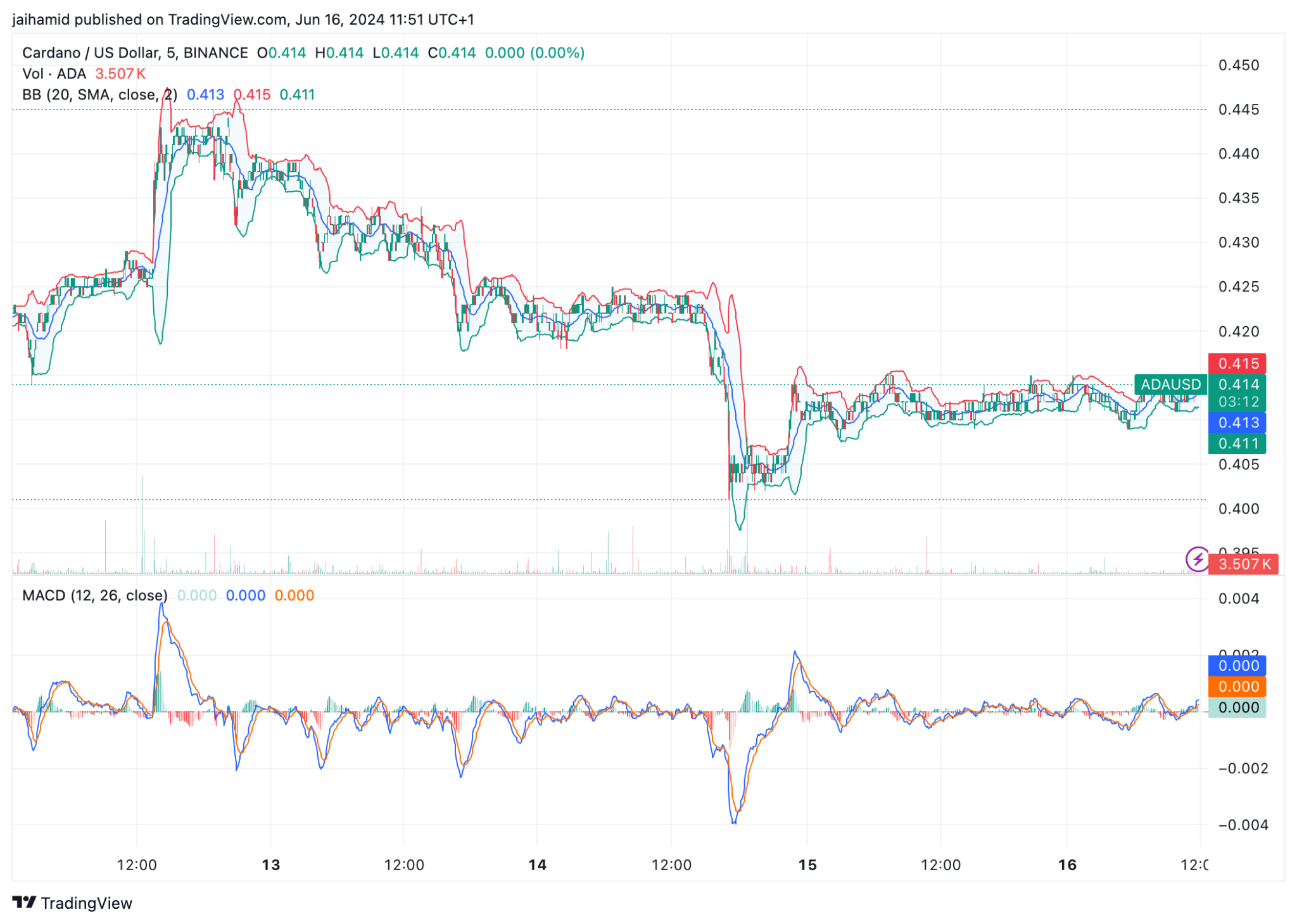

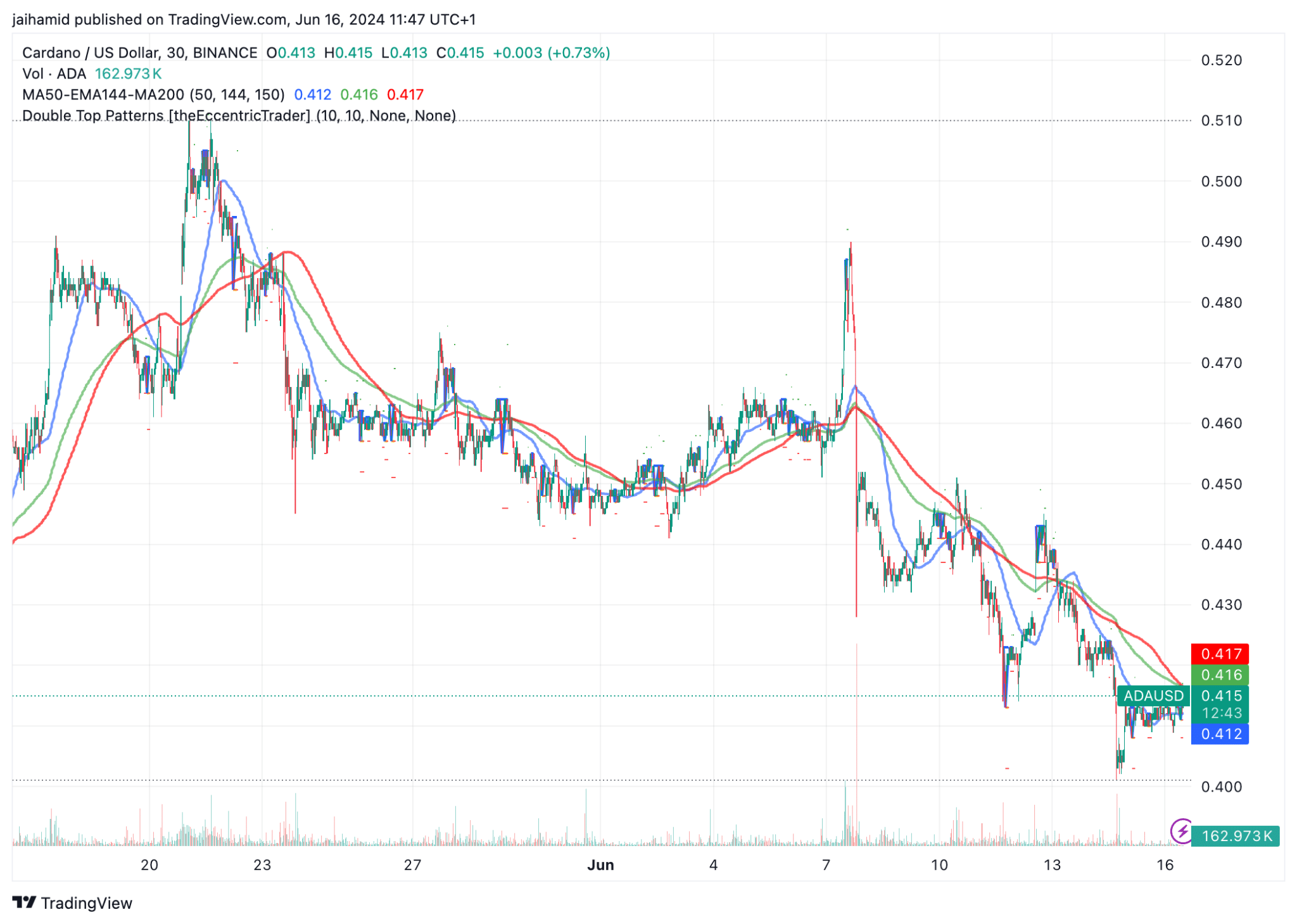

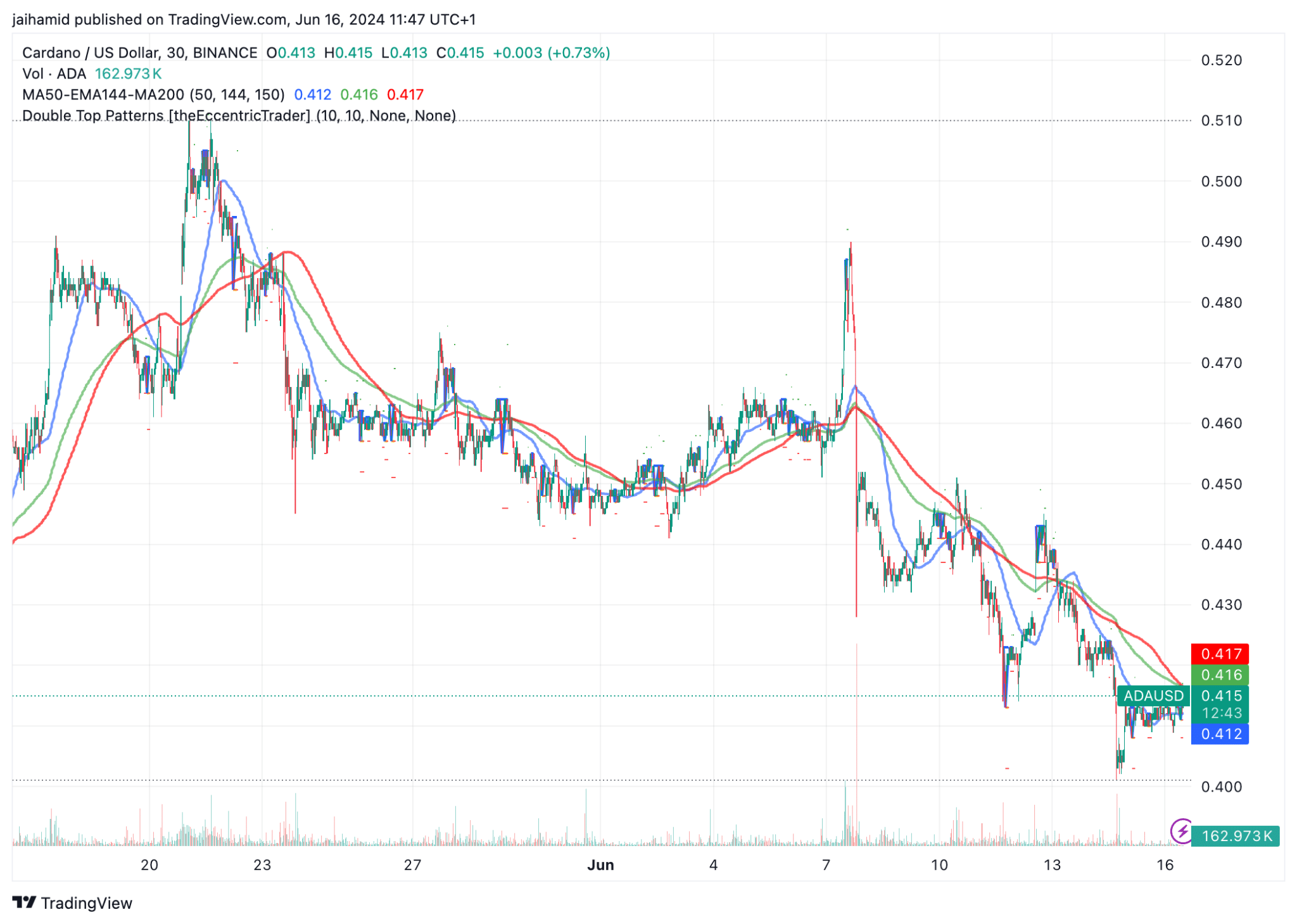

- ADA’s price has been on a bearish trend, with consistent lower highs and numerous double top formations.

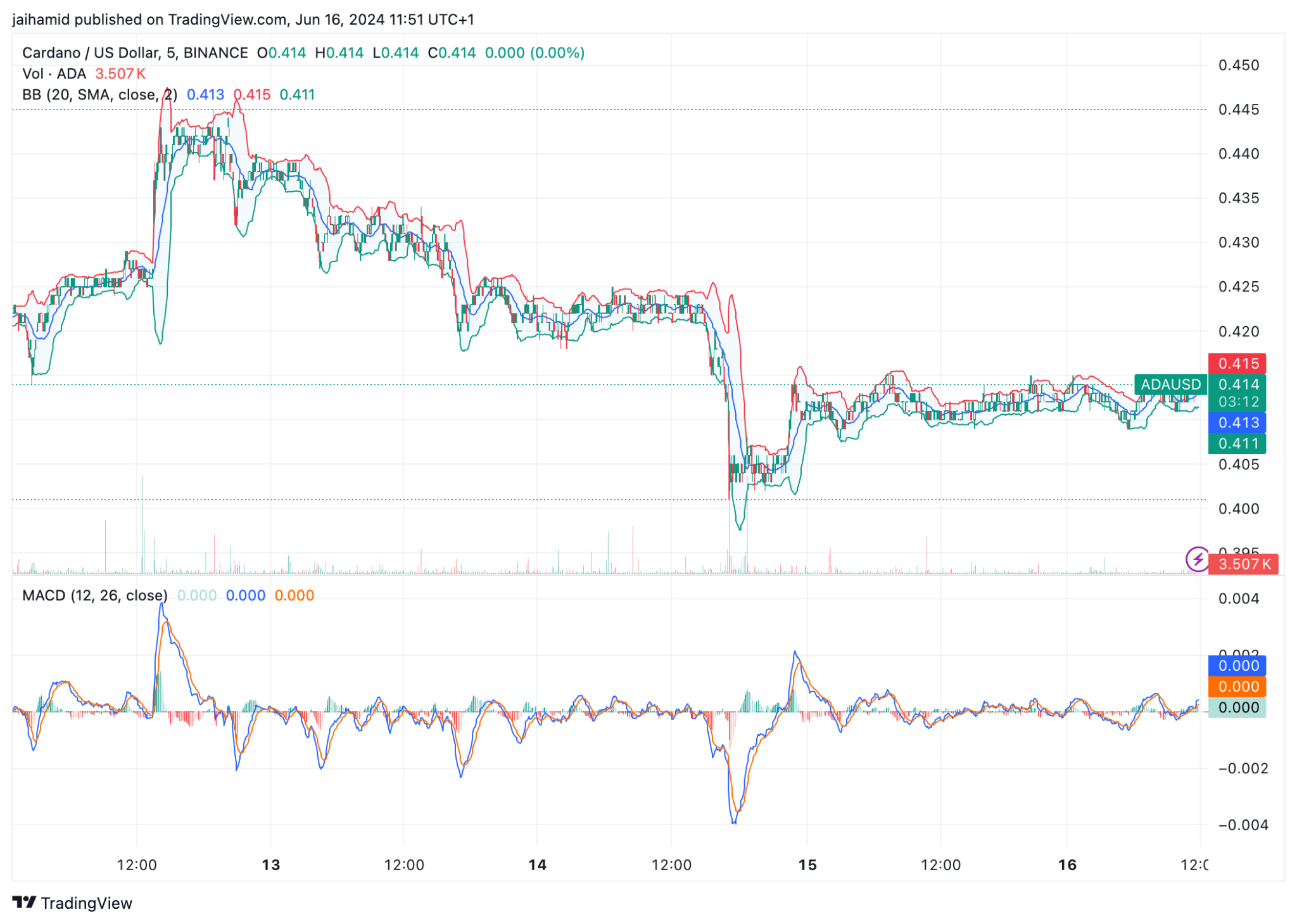

- A tight Bollinger Band and a flat MACD indicate low volatility.

Despite the weak performance over the past month, Cardano [ADA] showed signs of strong support, as evidenced by on-chain data.

Additionally, the network has seen a rise in total value locked (TVL) in DeFi applications, reaching levels that were twice as high during the 2021 bull market.

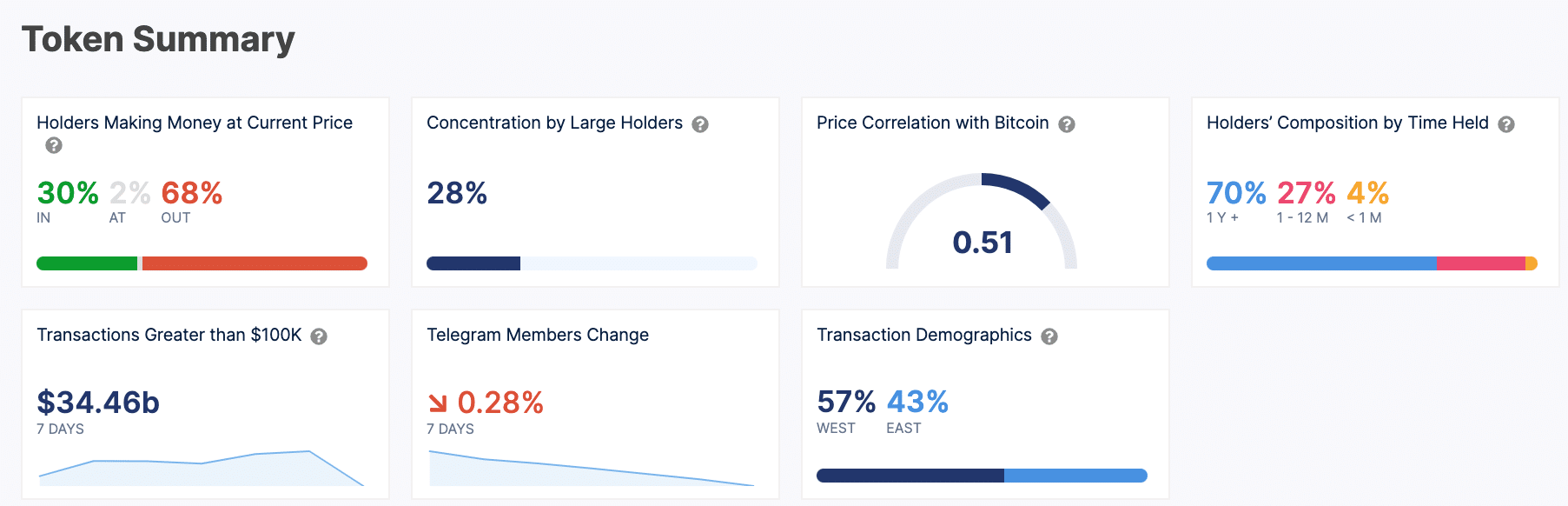

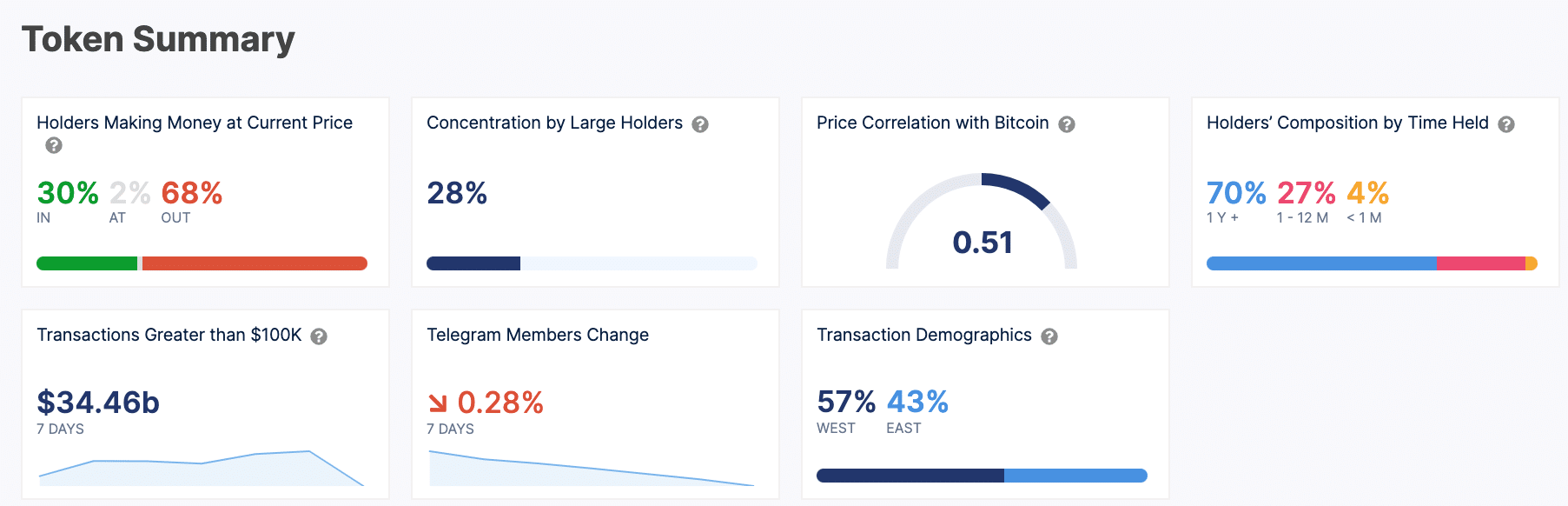

Data from IntoTheBlock shows that only 30% of ADA holders are currently making a profit, meaning a significant portion of the market is experiencing losses.

Source: IntoTheBlock

Since 28% of the ADA is owned by large investors, the token exhibits a fairly high level of whale control, which could impact price stability and potential manipulation risks.

From ADA’s large-scale investors

This past week, the massive volume of $34.46 billion in large transactions highlighted massive institutional or large-scale investor movements, which could be either inflows or outflows, reflecting active, high-stakes involvement in ADA.

ADA’s price was on a downward trend at the time of writing, which was especially noticeable due to the continued lower highs of early June. This trend was in line with bearish sentiment.

Source: TradingView

The Bollinger Bands on this chart are relatively tight, which often indicates low volatility.

ADA’s price is hovering closely around the mid-band, indicating a lack of major bullish or bearish momentum, consistent with a consolidation phase.

The Moving Average Convergence Divergence (MACD) levels off to zero, which strengthens the sentiment of the bands.

There were numerous double top formations in the chart below, which are typically viewed as bearish reversal indicators.

Source: TradingView

Furthermore, ADA’s price was below all moving averages, which can be considered a bearish signal. When price is below these lines, they generally suggest that overall momentum is to the downside.

The price of ADA has fluctuated between higher resistance points and lower support levels.

Is your portfolio green? Check out the ADA profit calculator

The chart shows that every time ADA tries to recover, it encounters resistance and fails to reach a new high, instead adjusting to lower peaks, which outline the double top patterns.

Interestingly, the RSI fluctuates between 50 and 60, indicating a neutral market with a slight tendency towards bullish sentiment.