- A report came out listing reasons why ADA could decline even if market conditions improved.

- Activity on the Cardano network dropped, as did the use of stablecoins.

If you are a long term Cardano [ADA] holder, or plan to hold for a short time, you agree that the token has at times underperformed compared to its peers.

At the time of writing, ADA’s price was $0.53, representing a decline of 11.30% in the last 30 days.

The fact that the price is up 50.65% in the last 365 days means it could still be worth holding. However, K33 Research disagrees.

According to the research-led digital investment firm, you shouldn’t think twice before selling all your ADA.

Although AMBCrypto believed this was a hasty conclusion, the company still provided its conclusion reasons. In its report released on January 15, K33 noted:

“There is nothing going on in the Cardano network other than exchange transfers and a group of pocket holders making up blockchain activity.”

The investigation also noted that ADA bagholders were “manufacturing” blockchain activities, and that nothing significant seemed to be happening on the chain.

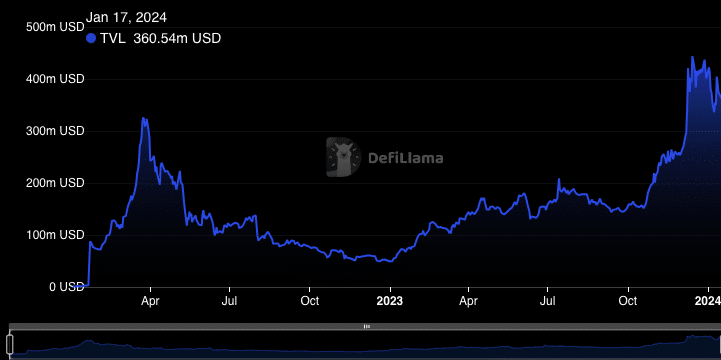

We took it upon ourselves to check if there was any truth in what K33 said. The first metric AMBCrypto decided to consider was the Total Value Locked (TVL). At the time of writing, DeFiLlama showed that Cardano’s TVL was $359.27 million.

The TVL measures the total value of assets or locked stakes in an ecosystem. Compared to other blockchains such as Solana [SOL] and ether [ETH]it was clear that Cardano was lagging behind.

Source: DeFiLlama

However, TVL is not enough to propose ADA holders to liquidate their tokens. But if you consider the availability of stablecoins on-chain, you might reconsider.

At the time of writing, the stables at Cardano were worth $19.18 million. On Ethereum this amounted to $69.53 billion, while Solana had $1.88 billion. Stablecoins are the cryptocurrency of choice when trading altcoins via DeFi.

This value therefore suggests that Cardano lacked significant activity, which the company believes would make ADA obsolete in the short term. The fact that it has delayed the launch of USDM stablecoin could also be a sign of doubt.

In addition, AMBCrypto evaluated the active addresses on the network.

At the time of writing, the 24-hour active addresses were available fallen to 43,100. But on January 12 and 16, the statistic rose to 70,000 and 60,000 respectively. At that time, there were many users on the blockchain.

However, the recent decline indicates that the number of participants involved in successful transactions has declined. In terms of price action, this decline is a bearish indicator. If not curtailed, this could impact the price of ADA.

Source: Santiment

Furthermore, ADA of the trio ETH, ADA, and SOL remained well below its September 2021 value. While SOL was down 44%, ETH was down 30% from that point.

However, ADA’s price remained at a -77% decline from its value during that period. This led K33 to conclude that,

“ADA has not developed in line with other ‘stronger’ smart contract tokens as markets have improved, which is a strong indicator of a dying coin.”

Realistic or not, here is ADA’s market cap in terms of ETH

However, you should know that K33 is not the benchmark for deciding which crypto survives or falls away. This does not mean that the research should be ignored.

But other statistics and future developments would reveal whether it would be a good decision to sell ADA now or keep it.