- Whales have bought 14 million ADA in the last fortnight.

- ADA was overbought, but the $0.55 region seems a good entry area.

If everything goes as expected, the price of Cardano will increase [ADA] will increase in the coming days. The reason for this prediction may be related to the way whales have collected the token over the past fourteen days.

To reach this conclusion, AMBCrypto checked the balance of ADA holders’ addresses.

Cardano whales will resume the voyage

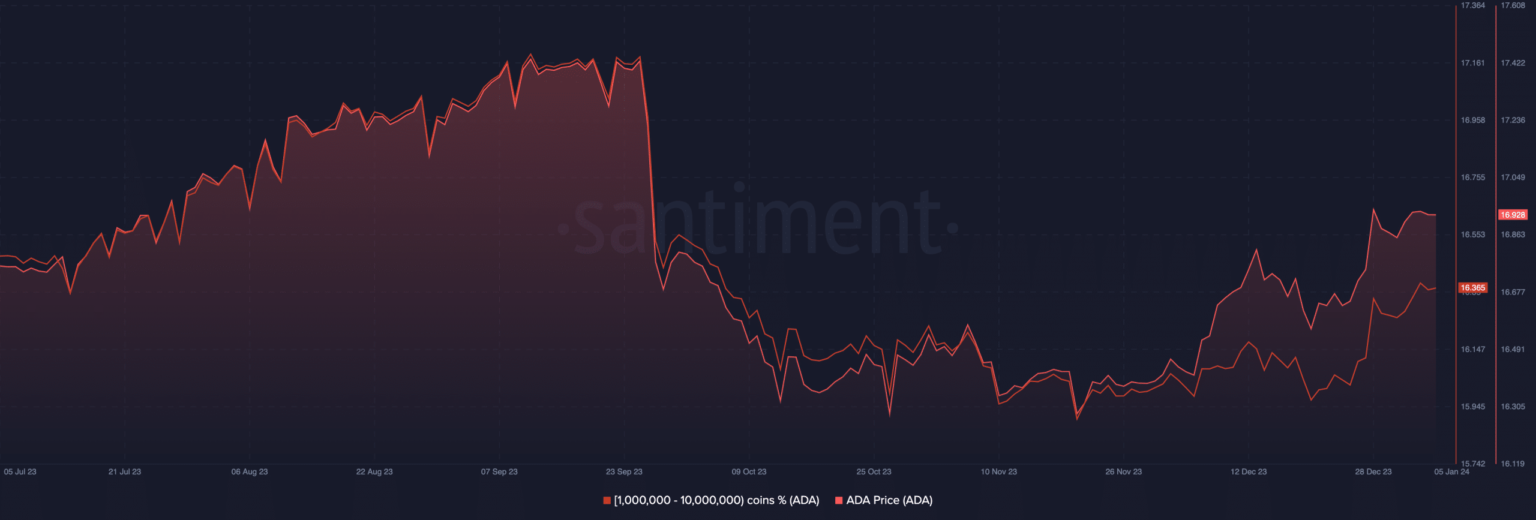

Using Santiment’s data, we found that the cohort of 1 to 10 million people had this increased the number of ADA owners. On December 20, the supply of this cohort was 15.96%. But at the time of writing, that percentage had risen to 16.36%.

Source: Santiment

Recently, ADA was hit by the widespread price drop caused by Bitcoin [BTC] to dump. But before the abrupt move, the native Cardano token changed hands at $0.63. Despite the drop to $0.55, ADA’s 30-day performance remained up 29.14%.

However, it’s important to note that this wasn’t the first time whales were involved in a buying spree. In November 2023, AMBCrypto reported a similar incident.

The accumulation during that period foreshadowed an ADA price rally. So, given the history of cryptocurrency, it is not out of place to expect the same outcome.

Signals say: “It’s time to buy”

Can ADA repeat the same feat? This leads us to analyze the state of affairs from the technical side. According to the 4-hour chart, the Aroon Down (blue) had fallen to 21.34%. The Aroon Up (orange), on the other hand, had left the 01.06% of January 4.

At the time of writing, the Arron Up had risen to 14.29%. Although this increase was mild, it signals a situation where bullish momentum is slowly returning. However, the Relative Strength Index (RSI) showed that the impact on the price may not be quick.

At the time of writing, the RSI was 33.14, indicating how Cardano recovered from the oversold level. For the token to rise back to $0.60, buying pressure must increase.

Source: TradingView

However, indications from the Directional Movement Index (DMI) show that this is not yet the case. The +DMI (green) at press time was 10.78. AMBCrypto also observed the -DMI (red) which was 38.16.

For the price of ADA to rise, the Average Directional Index (ADX) must stop supporting the -DMI (red). Should the +DMI rise above the -DMI and the ADX (yellow) remain above 25, the price of the ADA could be higher.

In addition, we examined the adjusted price-DAA divergence. At the time of writing, the metric fell to -65.50%.

Is your portfolio green? ADA Profit Calculator

For context, the Adjusted Price-DAA Divergence shows how much difference in the Daily Active Addresses (DAA) an entry or exit causes.

Since the price fell more than the DAA, it means an entry opportunity may have occurred before a potential bull market begins.

Source: Santiment