- Cardano’s technical analysis showed that bulls have reason to be excited.

- Social sentiment remained weak despite breaking past $0.4.

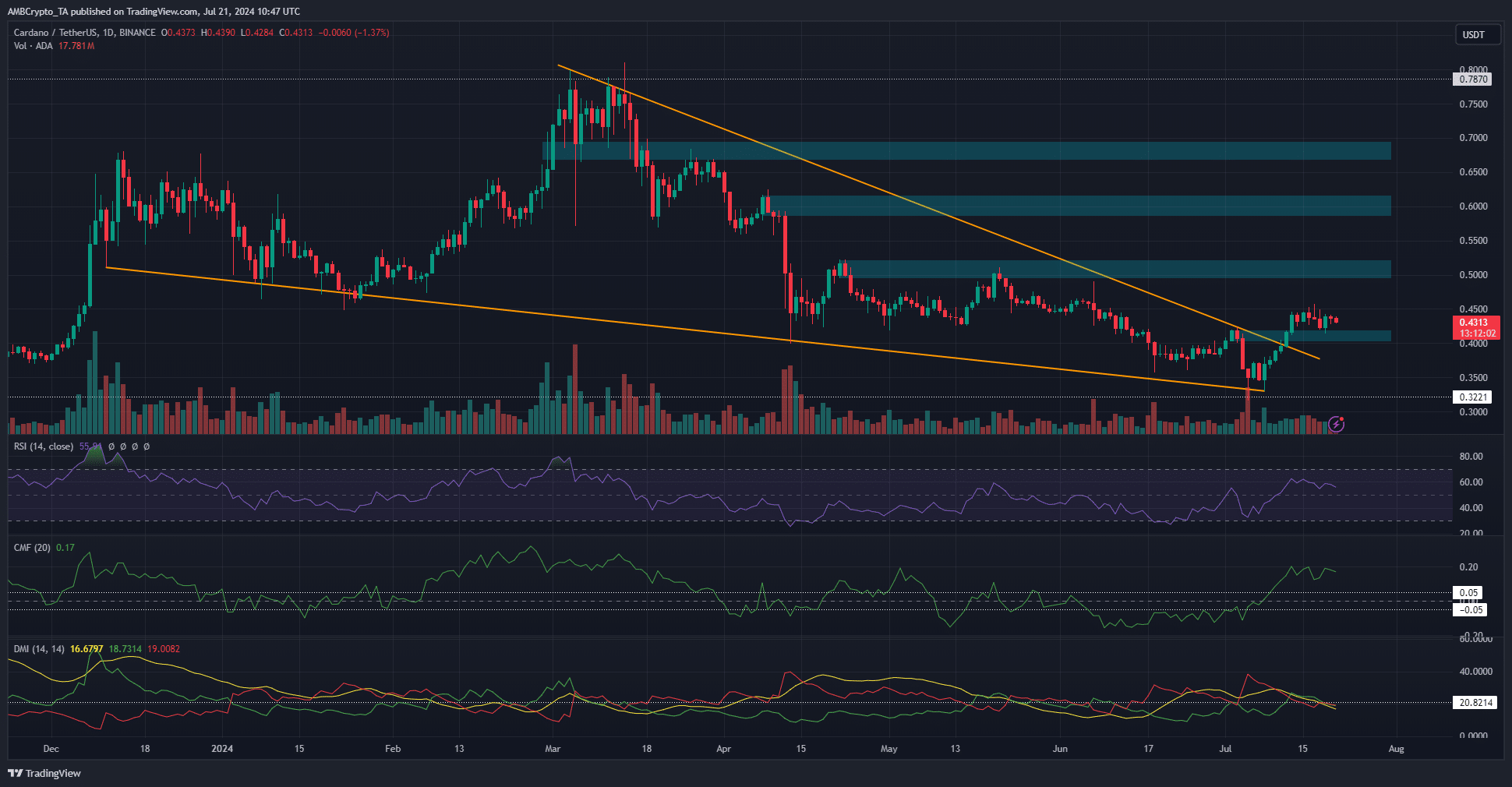

Cardano [ADA] was trading in a bearish wedge pattern until recently, when a bullish breakout occurred. This incident promised a 70% rally for the token, but the bulls will still face many hurdles.

Source: ADA/USDT on TradingView

The price action on the daily chart had a bullish structure. The RSI and the CMF respectively observed strong upward momentum and significant capital flows into the market.

The DMI signaled a potential change in trend on July 13 when the DIs crossed the border.

The former resistance at $0.4 turned into support, and as long as the bulls defended it, another move higher remained likely. AMBCrypto took a closer look at other metrics to gauge market sentiment.

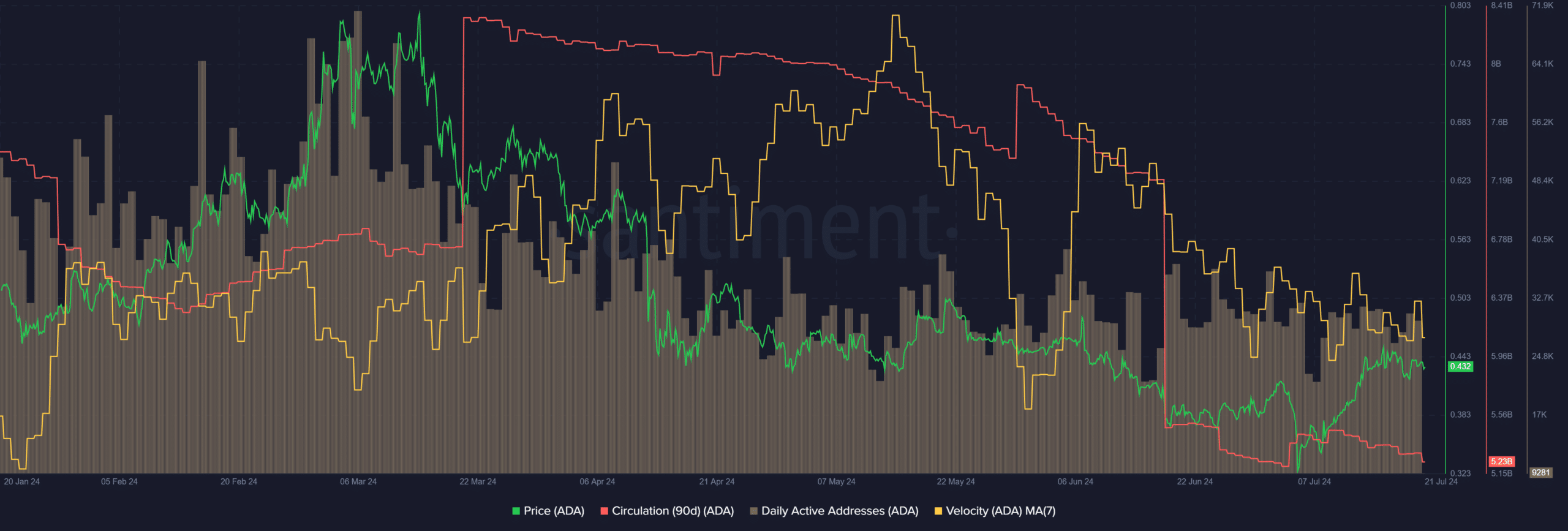

The number of active addresses has been stable since April

The daily active addresses have fluctuated around 32k-34k since April. The number of users has not decreased, despite the downward trend that Cardano has experienced since May, which has been positive.

It indicated the network health and belief in the blockchain even in somewhat difficult times on the pricing front.

Circulation has fallen dramatically over the past two months, a sign of scarcity and reduced transactions. Velocity, which measures how often a token changes hands, has also fallen over the past month.

Together they alluded to accumulation and reduced speculation. This could portend an upward trend in the coming weeks.

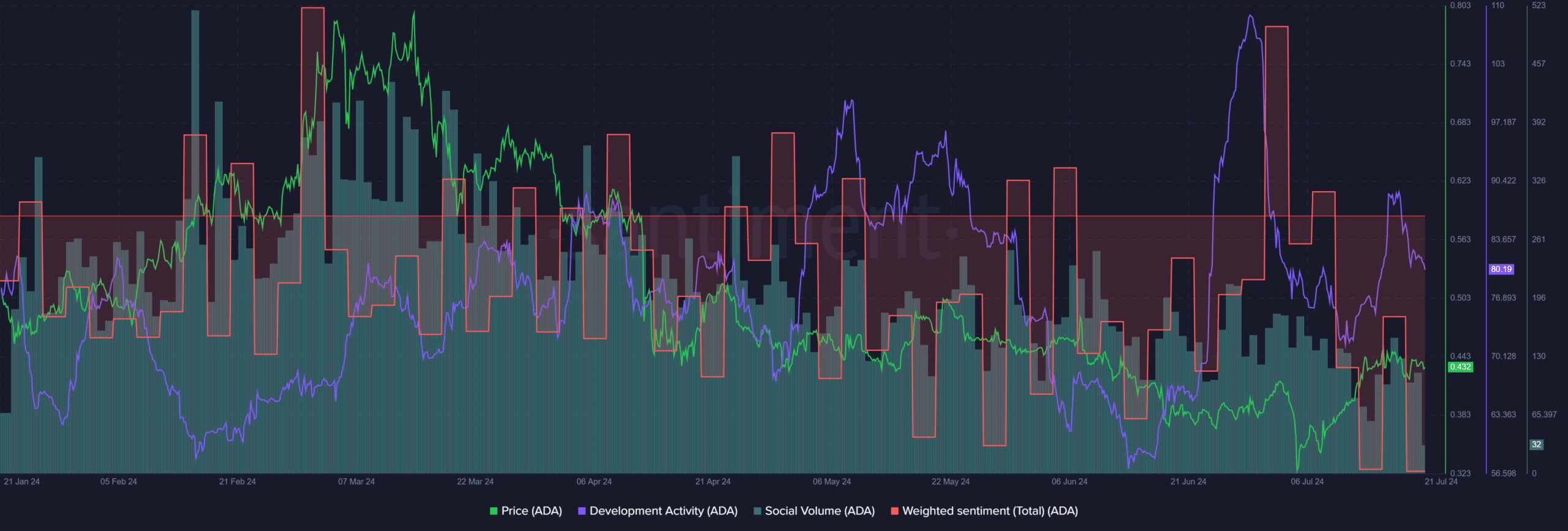

Social standards had weakened

Development activity remained relatively high despite the price decline, which is a strong positive for long-term investors. The three-day weighted sentiment was sharply negative, even though the $0.4 zone now offered support.

Social volume has also slowly decreased since the beginning of May. Together, they showed that social media sentiment wasn’t helping the bullish cause.

Read Cardanos [ADA] Price forecast 2024-25

Chang’s hard fork could send prices heading north with renewed vigor. Traders should also be prepared for the news not to have much impact on price developments.

The available evidence showed that bulls have an advantage, but the social media hype was lacking for Cardano.