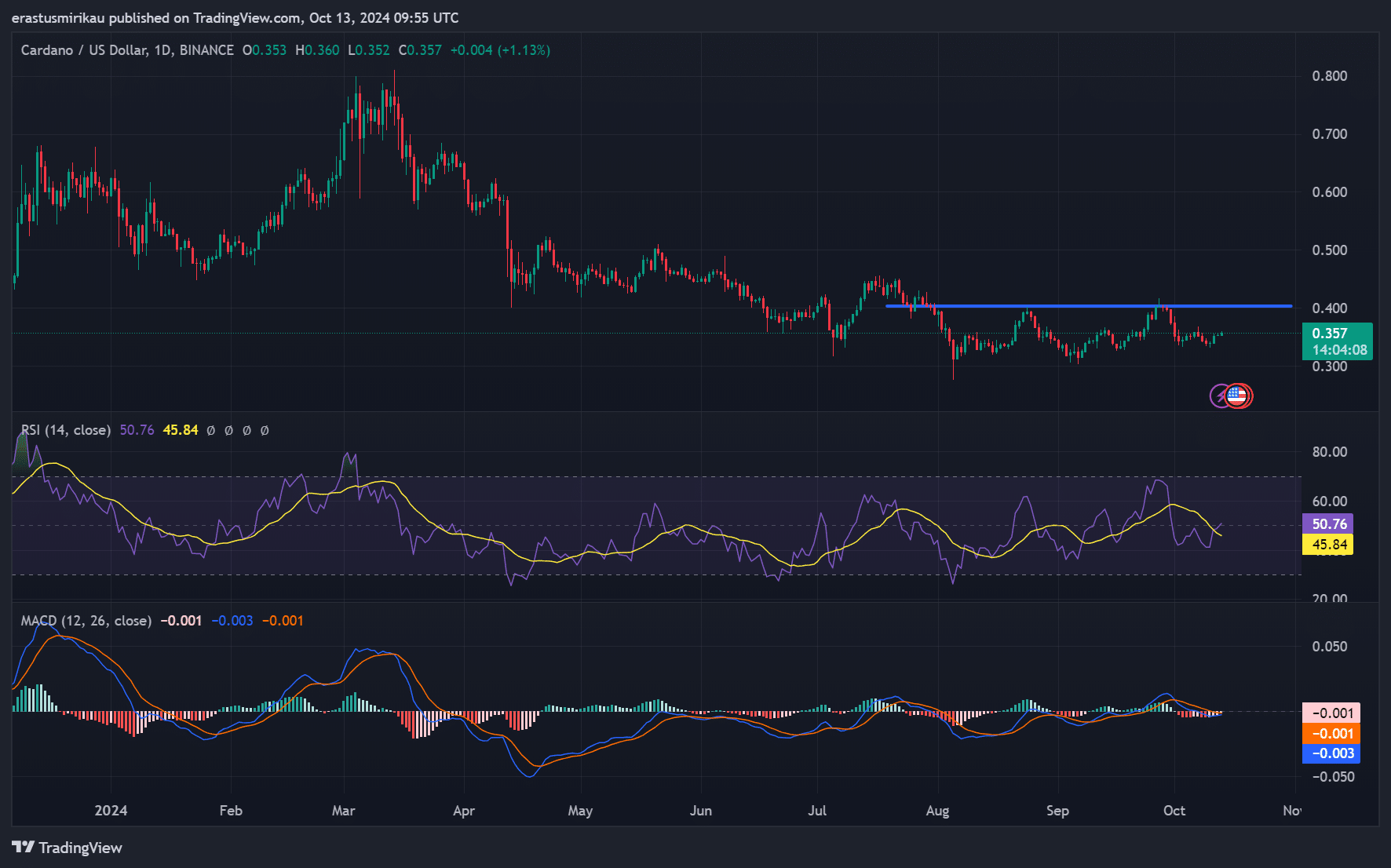

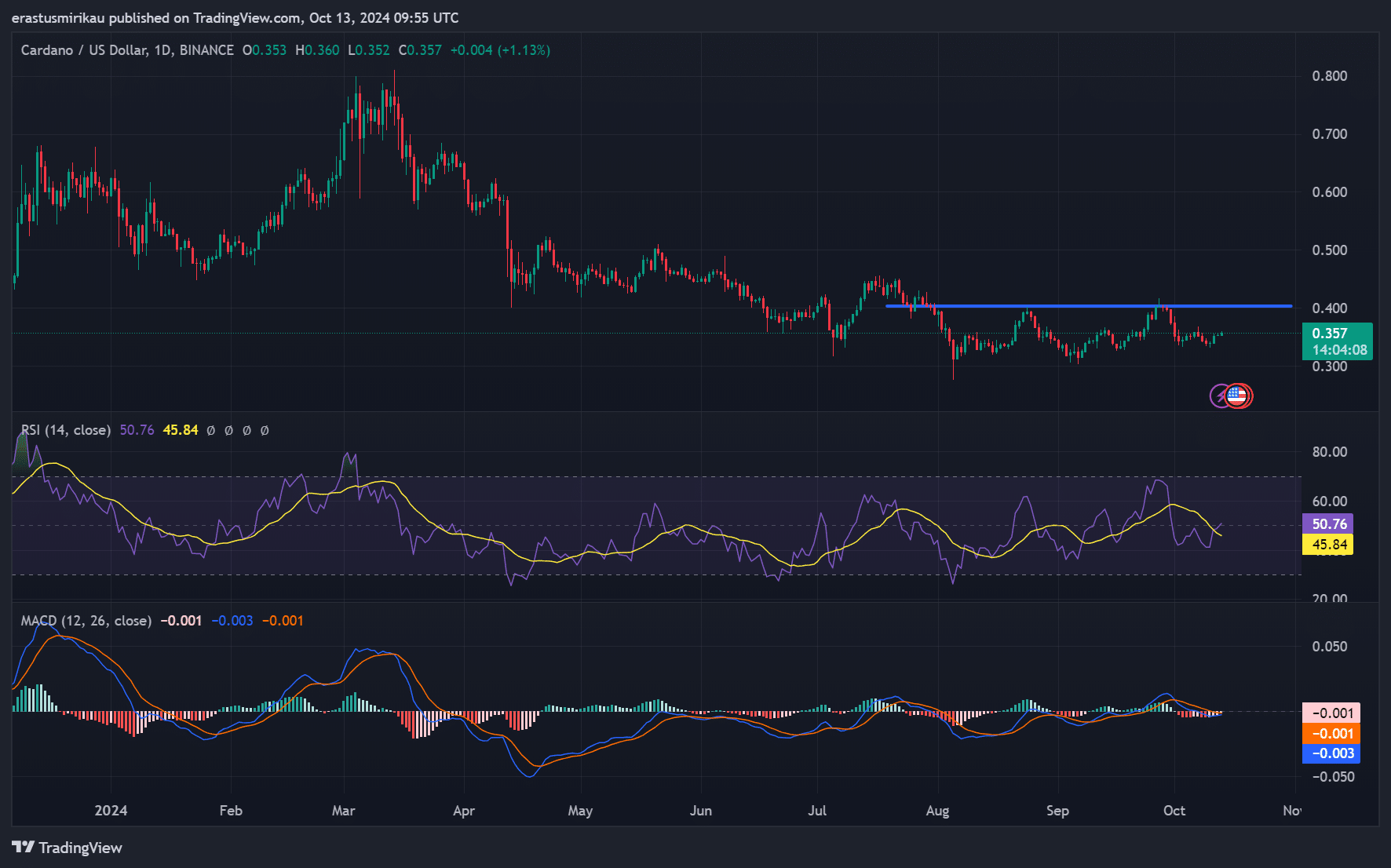

- ADA showed neutral momentum, with the RSI at 45.84 and near key resistance at $0.40.

- Market sentiment remained cautious, with stable Open Interest indicating low volatility.

Cardano [ADA] is attracting investors’ attention as both the public and smart money sentiment reflect a strong bullish outlook. At the time of writing, ADA was trading at $0.3564, up 0.94% from the last day.

With resistance at $0.40 looming, traders are eager to see if Cardano has what it takes to break this key level and start a potential bullish rally.

Can ADA build enough momentum for a breakout?

ADA’s technical analysis yields mixed signals. The RSI, which stood at 45.84 at the time of writing, showed that the ADA was in a neutral zone, neither overbought nor oversold.

So there is room for upward movement as buying pressure increases.

Furthermore, the MACD is approaching a zero crossing, indicating a possible shift in momentum.

However, this could also signal consolidation if buyers fail to act, leaving ADA in a cautious state as it hovers below resistance.

Source: TradingView

Signals on the chain: is ADA building strength?

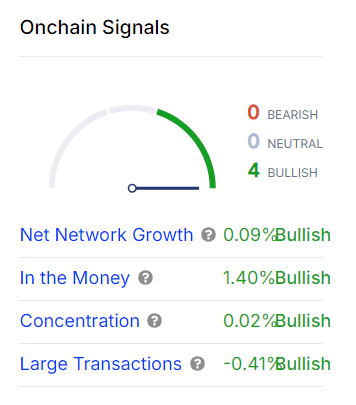

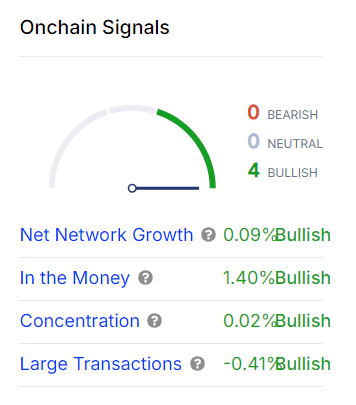

In terms of on-chain data, Cardano showed modest but positive signals. Net network growth rose 0.09% and 1.40% of ADA holders made a profit, as reflected in the in-the-money measure.

Furthermore, ADA’s concentration measure was stable, with no significant changes in the positions of major holders.

However, the number of large transactions fell slightly, by 0.41%, indicating that institutional investors were taking a cautious approach.

So while the fundamentals pointed to strength, they don’t yet point to a big rally.

Source: IntotheBlock

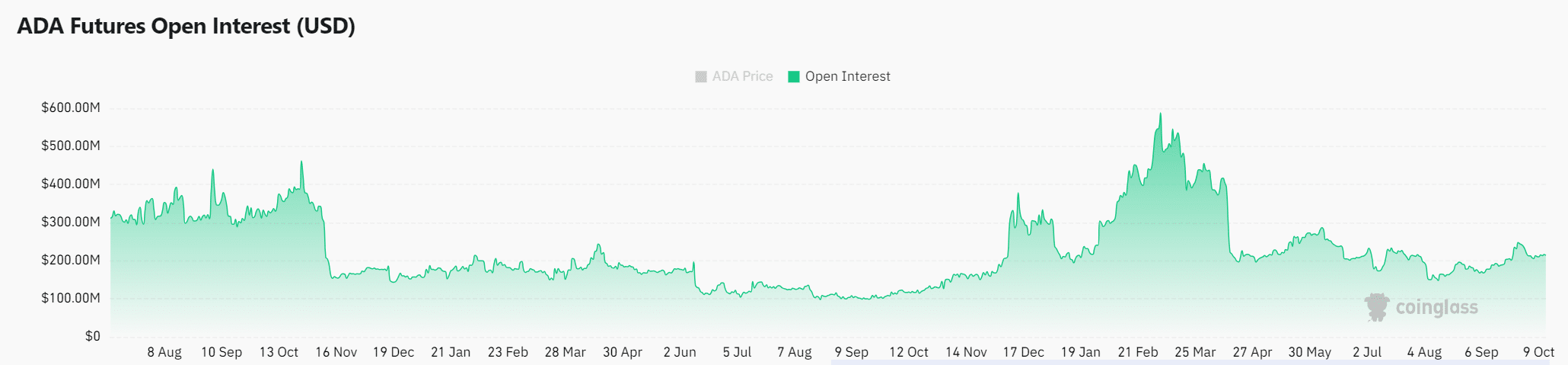

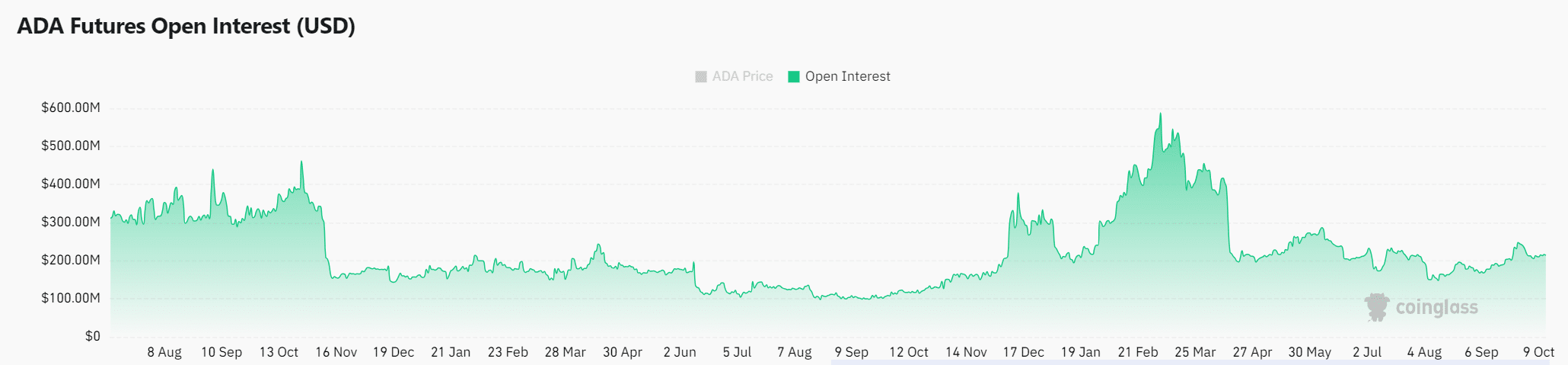

Open Interest: steady growth, cautious optimism

Open interest for ADA increased 0.71% and now stands at $216.17 million. This steady rise in interest suggests that traders are cautiously optimistic about ADA’s potential to break the $0.40 resistance.

Moreover, the gradual increase in Open Interest indicates growing participation without overwhelming bullish momentum. Therefore, ADA seems ready for a move, but traders are waiting for stronger signals.

Source: Coinglass

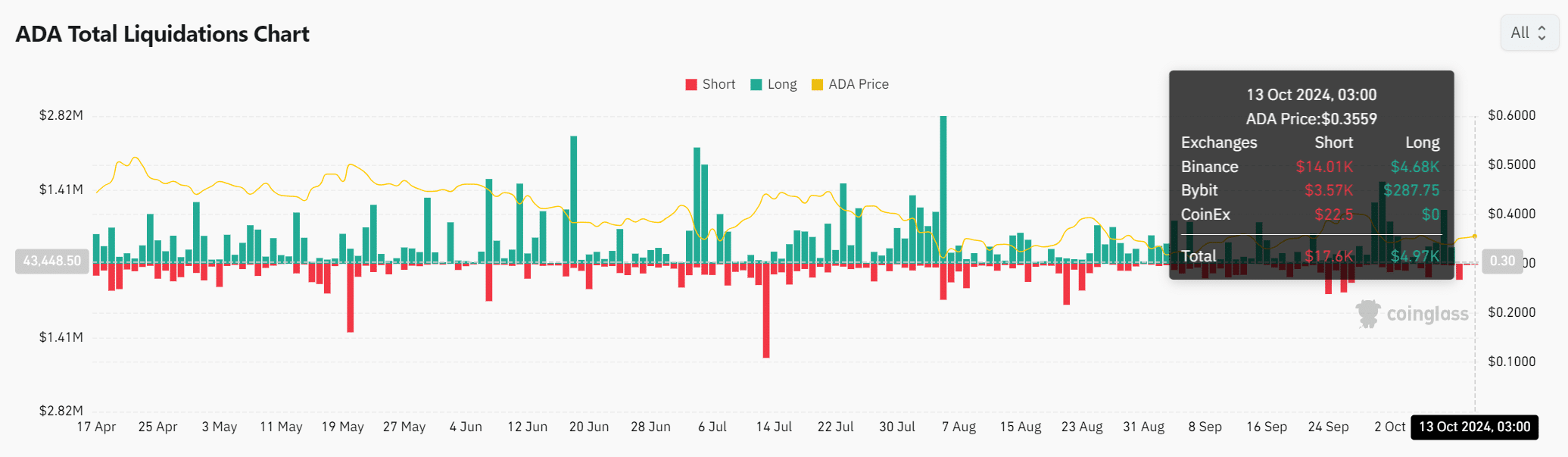

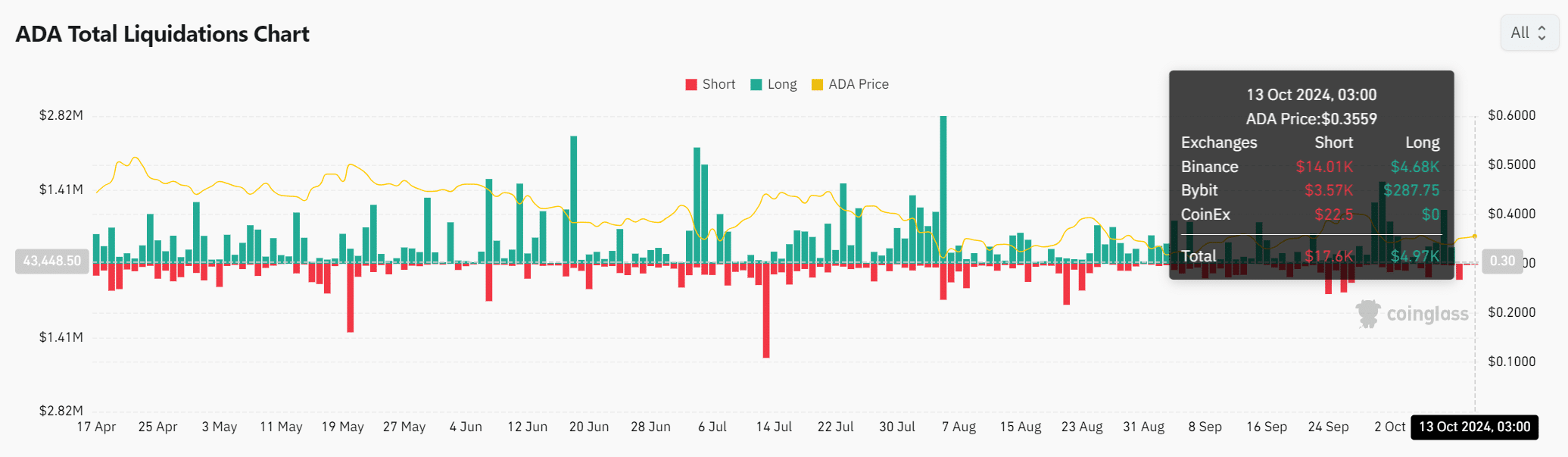

ADA Liquidations: The Calm Before the Storm?

The total liquidation data reflected a balanced market, with $17.6K in short liquidations and $4.97K in long liquidations.

This indicated minimal market disruptions, implying that traders were not aggressively betting on price movements in either direction. Therefore, the market remained calm, waiting for a decisive push.

Source: Coinglass

Read Cardanos [ADA] Price forecast 2023-24

Is an outbreak likely?

Cardano’s indicators show potential for a breakout, but the market is not there yet.

While the technical and on-chain data point in the right direction, the tentative increase in Open Interest and low liquidation numbers suggest that Cardano may need more bullish momentum to break the $0.40 resistance.