Ada, the native token of the Cardano Blockchain, attracted a lot of attention from crypto enthusiasts after the step of an asset manager to submit a Cardano Exchange-Traded Fund (ETF) in the United States. This development has aroused a remarkable interest among traders and investors, resulting in an impressive upward momentum.

Cardano (ADA) loses his profit

While the market rise is pushing ADA near a crucial resistance level, it has actively started with experiencing massive sale, which means that his price is falling-a different disappointment for traders and investors today.

Despite the recent decrease in the ADA topping price, it has actively recovered its upward trend, while above the 200 exponential advancing average (EMA) is moving on the daily period. Moreover, today’s remarkable sales pressure has not had any significant influence on the sentiment of investors, because long -term holders seem to collect token.

Current price momentum

ADA currently acts almost $ 0.77 and has experienced a price increase of more than 11% in the last 24 hours. However, it actively reached an intraday high of $ 0.815 with a win of 16%, but the market lost a considerable part of that profit, probably as a result of continuous profit booking and the current market sentiment.

Nevertheless, the participation of traders and investors to the next level has risen, by more than 120% in the same period.

ADA -Price promotion

According to the technical analysis of experts, ADA has a crucial resistance level of $ 0.85, where it was nowadays confronted with resistance.

Based on the recent price promotion, if ADA continues to collect and breaks the level of $ 0.85, so that a daily candle is closed above it, there is a strong possibility that it could rise by 32% to the $ 1.13 level can be reached in the future.

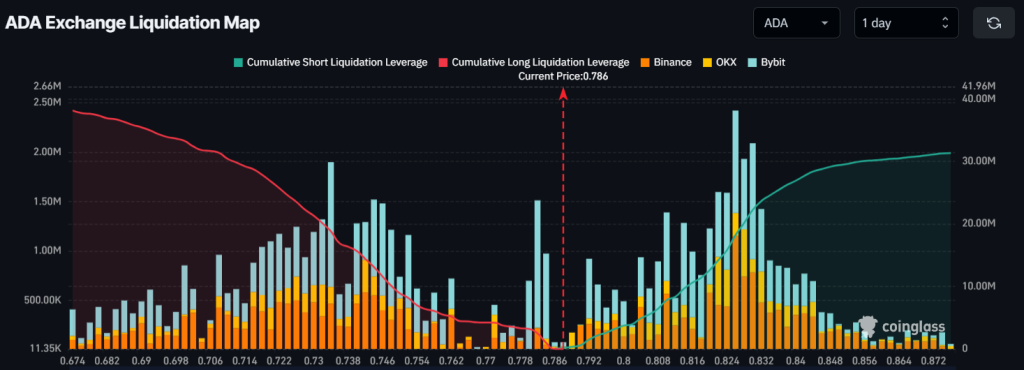

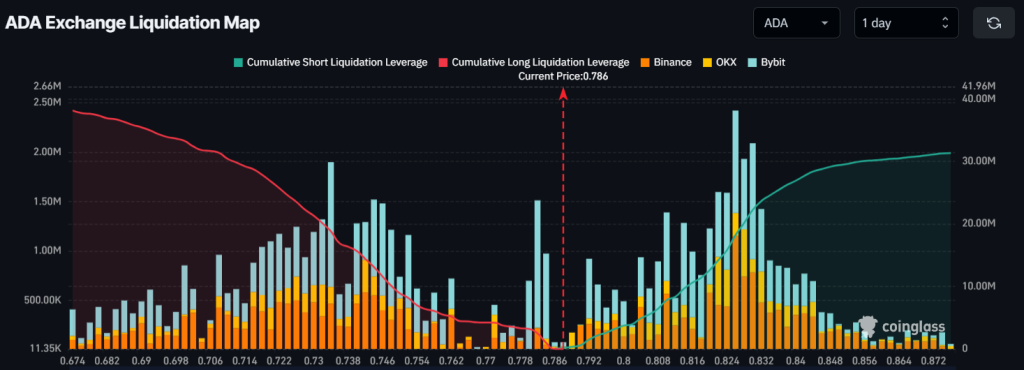

The most important liquidation areas of ADA

Traders are currently following a mixed approach. Currently, the major liquidation areas are almost $ 0.734, where traders with long positions are used too much, with $ 18.80 million in long positions. Conversely, $ 0.826 is another liquidation level, in which traders with short positions are used too much, with $ 18.20 million in short positions.

When combining these on-chain statistics with technical analysis, it seems that holders collect tokens in the long term, while intraday traders benefit from the current market sentiment.