- Whales have bought more than 130 million ADA in the last 72 hours, which indicates a renewed interest.

- ADA is confronted with Beerarish pressure with decreasing active addresses, negative MVRV and liquidation risks.

In the last 72 hours, Cardano has seen a huge increase in whale activity, with more than 130 million ADA. At the time of the press, Cardano [ADA] wax Trade at $ 0.5912, which reflects a decrease of 11.65% in the last 24 hours.

This recent increase in whale purchases can indicate a renewed confidence in Cardano, especially after a period of consolidation.

However, it remains uncertain whether this rise marks the beginning of a strong upward movement or whether it is only a fluctuation in the short term.

Cardano Price Promotion Analysis: Important levels to view

The Cardano price campaign was Beerarish in recent weeks, with Ada recently breaking under important support levels. The price is consolidating within a symmetrical triangular pattern, which suggests potential volatility.

At the time of the press, Ada acted just above the level of $ 0.5928, which serves as crucial support.

If Ada does not hold this level, it can fall further to $ 0.5793. At the top, resistance is seen at $ 0.6793, with a large resistance point at $ 0.9907.

Source: TradingView

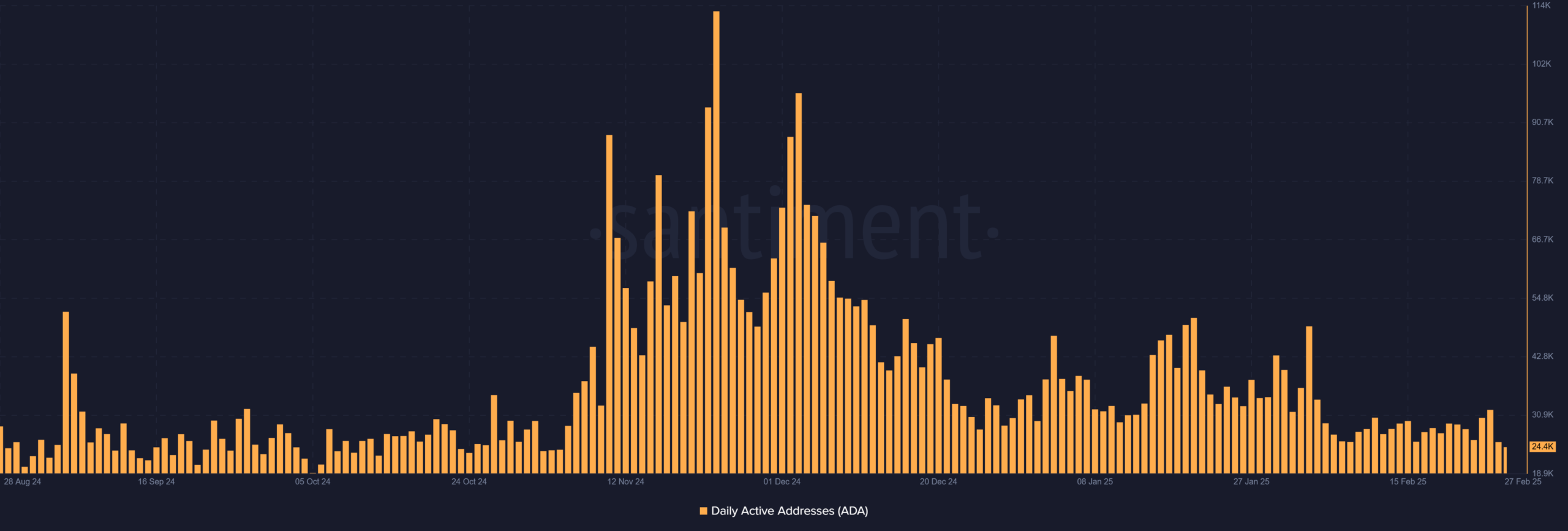

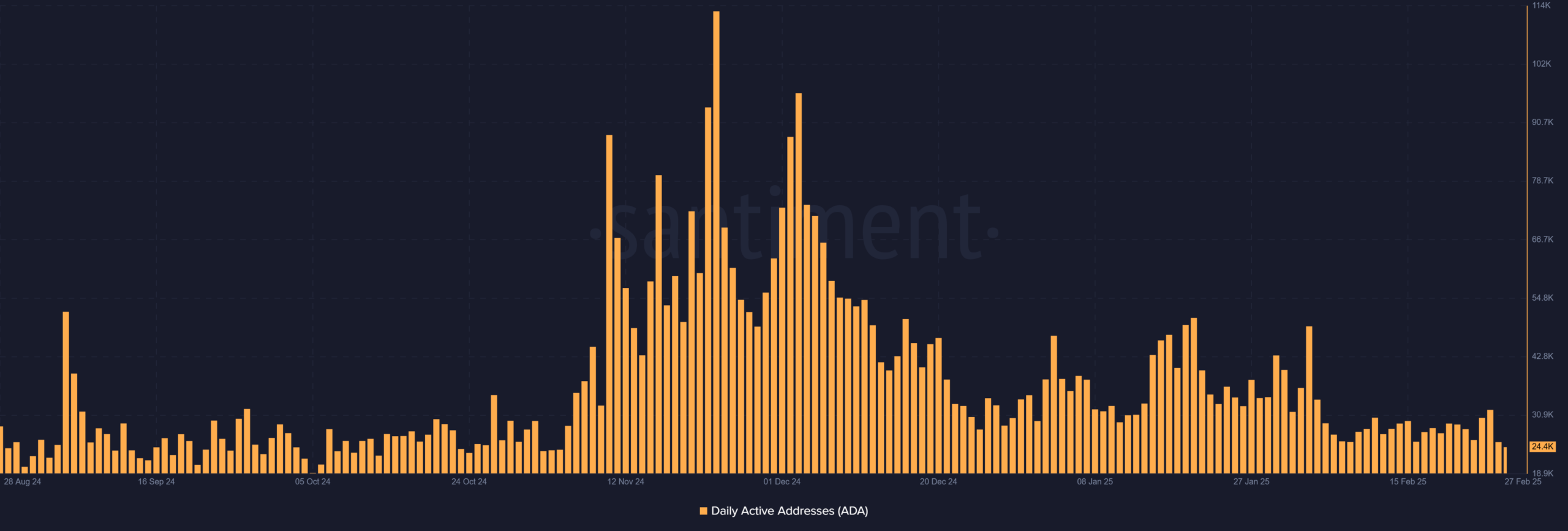

Cardano Daily active addresses: a worrying decline

The daily active addresses of Cardano show a noticeable decline, with only 24,407 active addresses. This is considerably lower than the previous highlights at the end of 2024.

While whales buy large quantities of Ada, the participation of the retail trade is finished. This decrease in active addresses indicates less interest in Cardano among smaller investors, which can lead to a limited upward price momentum in the short term.

Source: Santiment

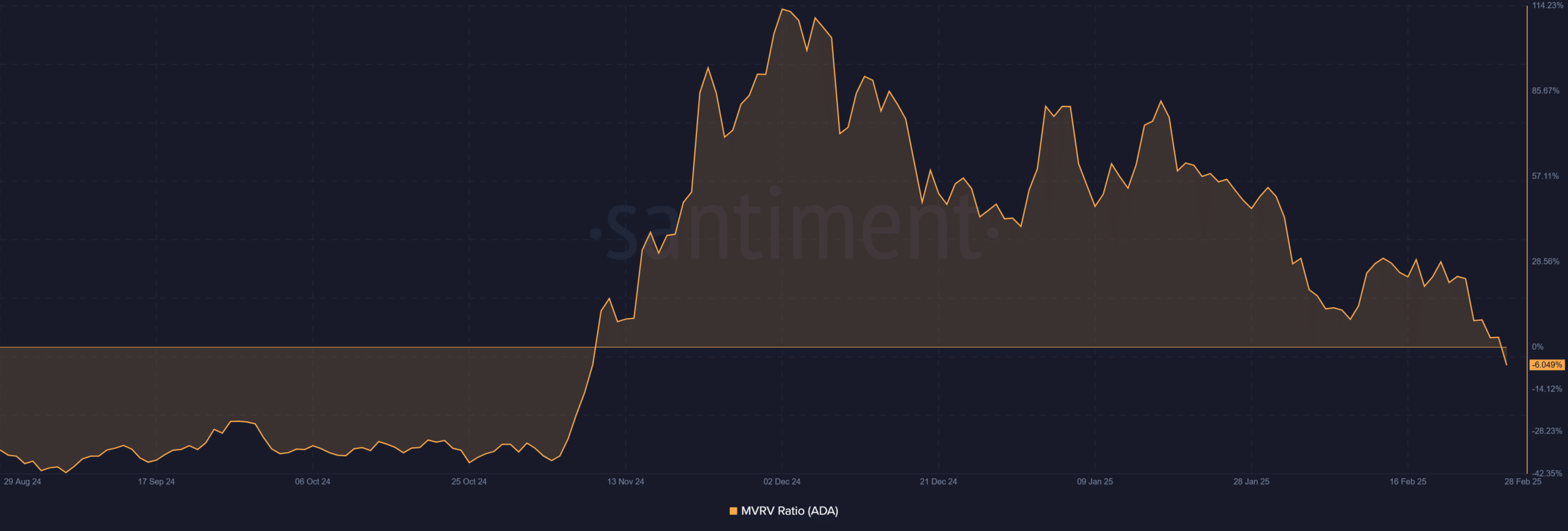

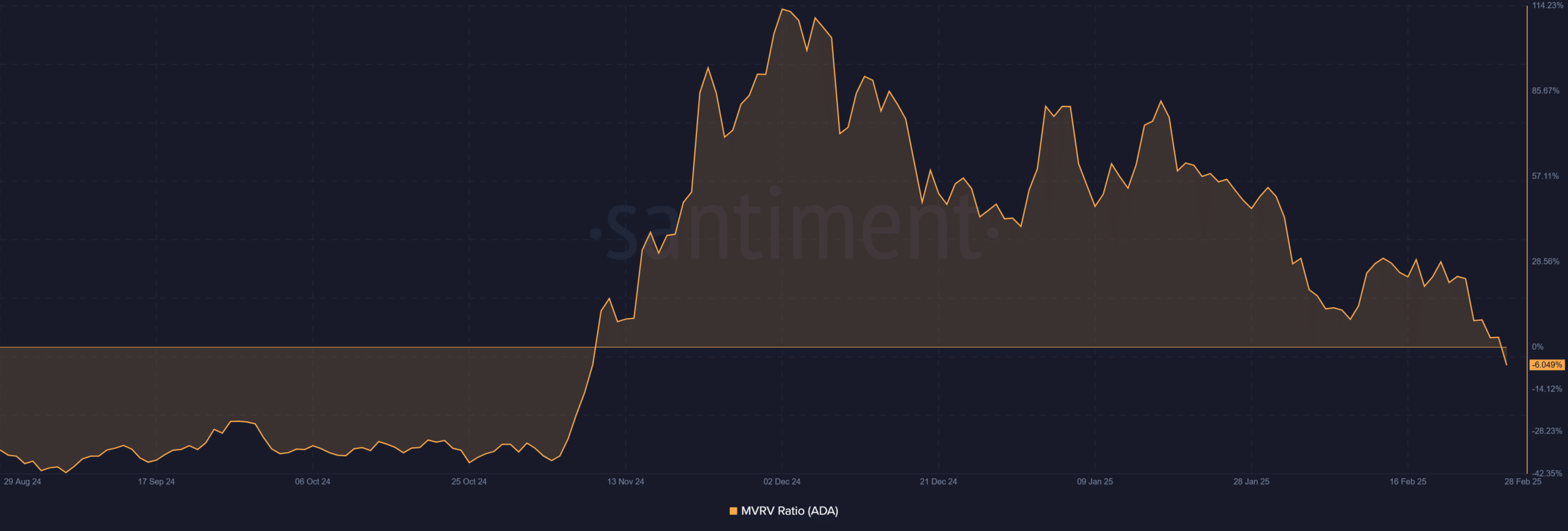

Ada MVRV Ratio: Negative Market sentiment

In particular, the MVRV ratio from ADA fell to -6.05%, indicating that Cardano is currently being undervalued compared to the historical price. This negative MVRV suggests that investors who have bought ADA at higher levels are now losing their positions.

That is why this can lead to fewer buyers in the market further suppressing the price movement.

The negative MVRV ratio also indicates that Sentiment Bearish remains, where fewer investors at these price levels want to take a risk of ADA.

Source: Santiment

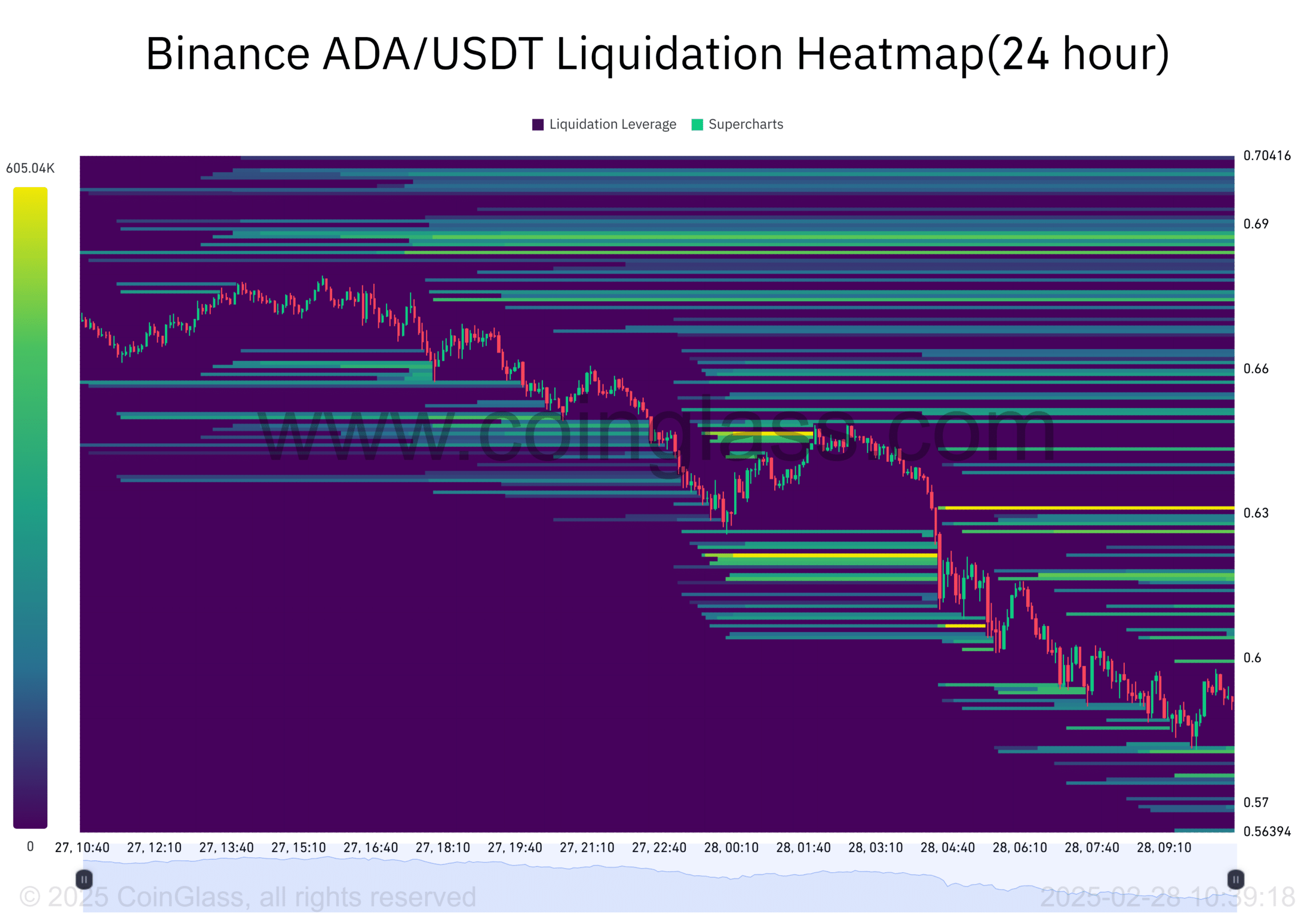

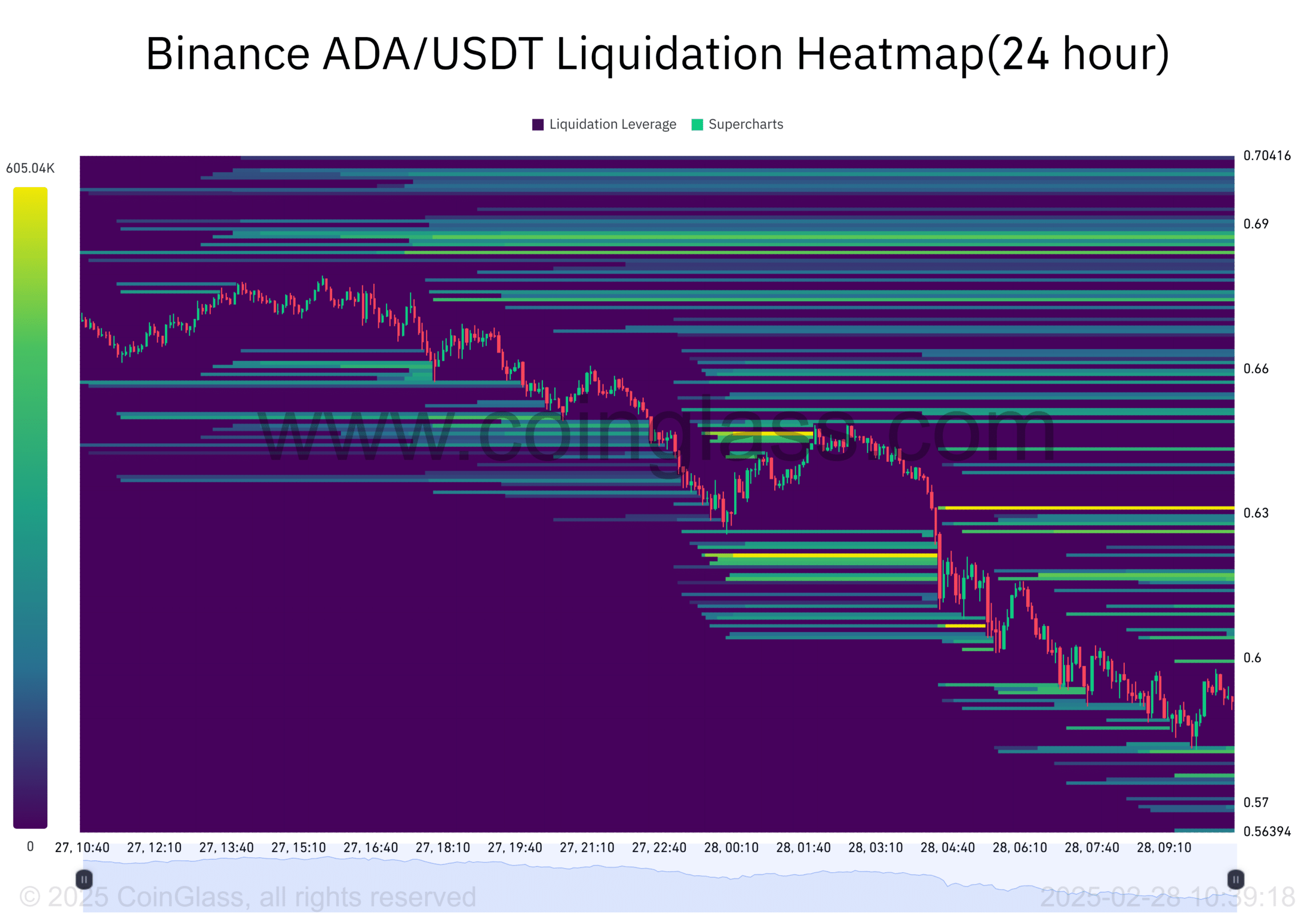

Ada Liquidation Heat Map: Increasing liquidation pressure

The liquidation heat juice shows a significant concentration liquidations below the level of $ 0.60. This suggests that many lifting tree positions are in danger if the price continues to fall.

While Cardano is falling, it could activate a cascade of forced liquidations that would intensify the downward pressure on the price. That is why traders must be careful because the liquidation pressure can lead to a sharper decline if important support levels cannot retain.

Source: Coinglasss

Will whale activity cause a price rally?

Despite the increase in whale activity, ADA faces various challenges, including falling daily active addresses, a negative MVRV ratio and increased liquidation pressure.

These factors suggest that Cardano is currently in a bearish phase, and the whale activity may not be enough to reverse the trend.

In conclusion, unless significant changes occur in market sentiment, it is unlikely that Ada will see a strong rally in the short term.