- Canary Capital has applied for a trx ETF used with the sec.

- Despite the ETF application, Tron stands for a strong bearish sentiment.

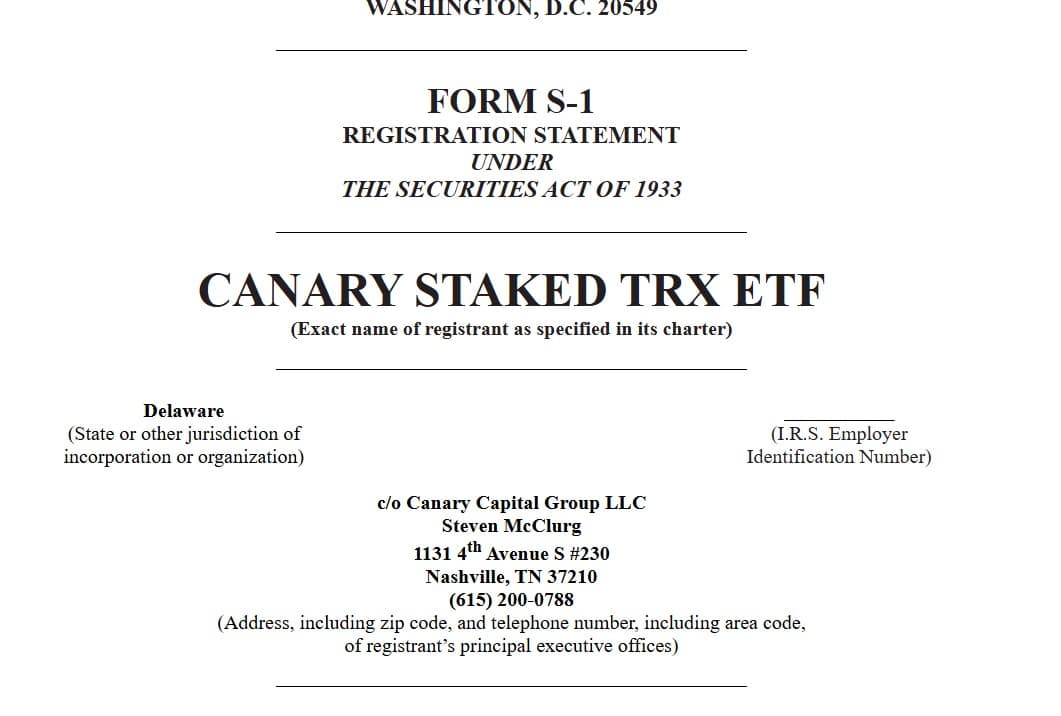

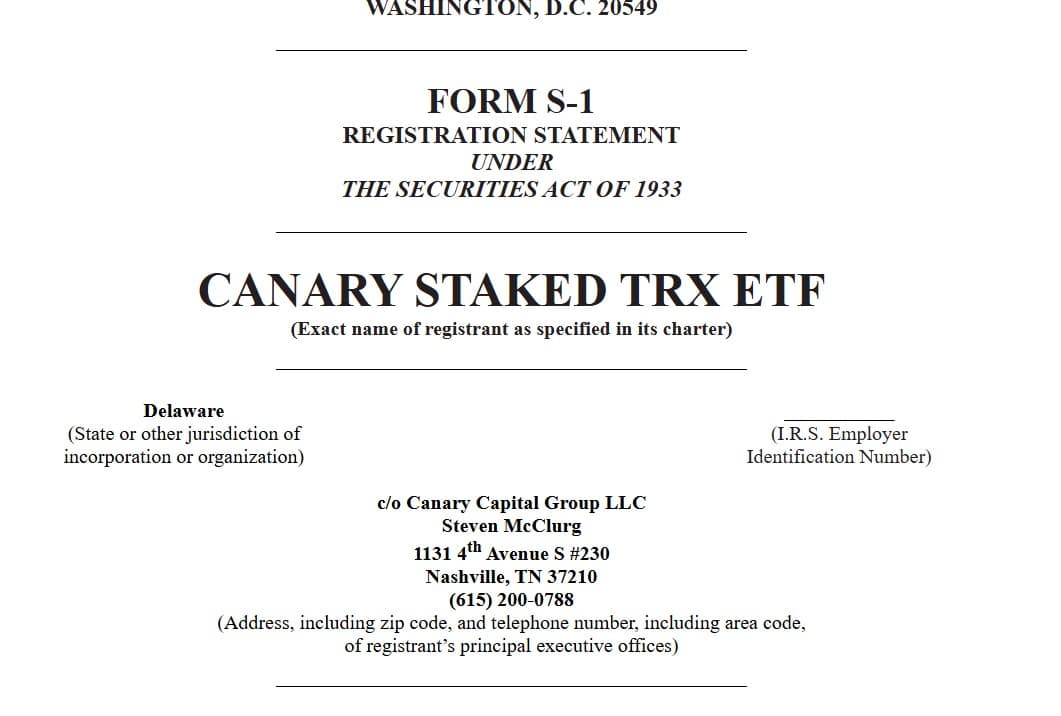

According to reports, Canary Capital, an asset manager of the United States, has submitted to mention an ETF tools for native token TRX. According to the company, the proposed product canary is called Stusted TRX ETF.

According to the submitThe funds mentioned are intended to keep Spot TRX and use to generate extra yield. Investors have regulated access to the strike of rewards and market bbloting via the ETF.

If approved, Canary Capital will manage the ETF activities and supervise the general performance.

Source: Sec.gov

In the past four months, in an attempt to take advantage of a pro-Crypto SEC in the United States, there has been an outpouring of submissions aimed at mentioning ETFs.

Since the start of the Trump administration, American supervisors have received several archives.

Canary has submitted in the midst of this ETF racing for various Altcoin ETFs, including Litecoin [LTC]XRP, Hedera [HBAR]Sky [SUI]and pudgy penguins [PENGU].

Is an ETF the boost that TRX needs for recovery?

Although it is expected that so good news has a positive effect on the price movement, this still has to be reflected. As far as Tron remains in a strong downward trend.

At the time of writing, Tron even acted at $ 0.24. This meant a decrease of 1.28% on daily graphs. The Altcoin has fallen by 2.8%on weekly cards.

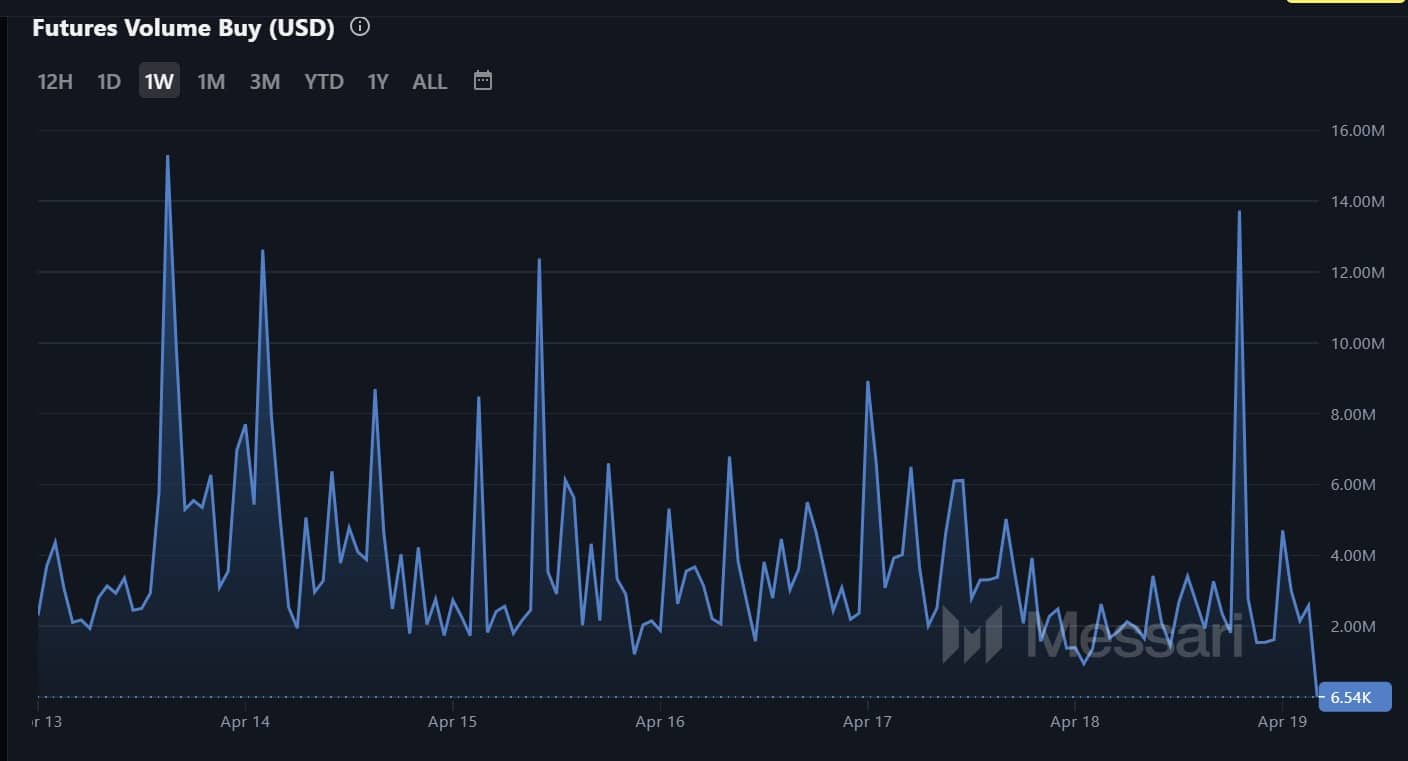

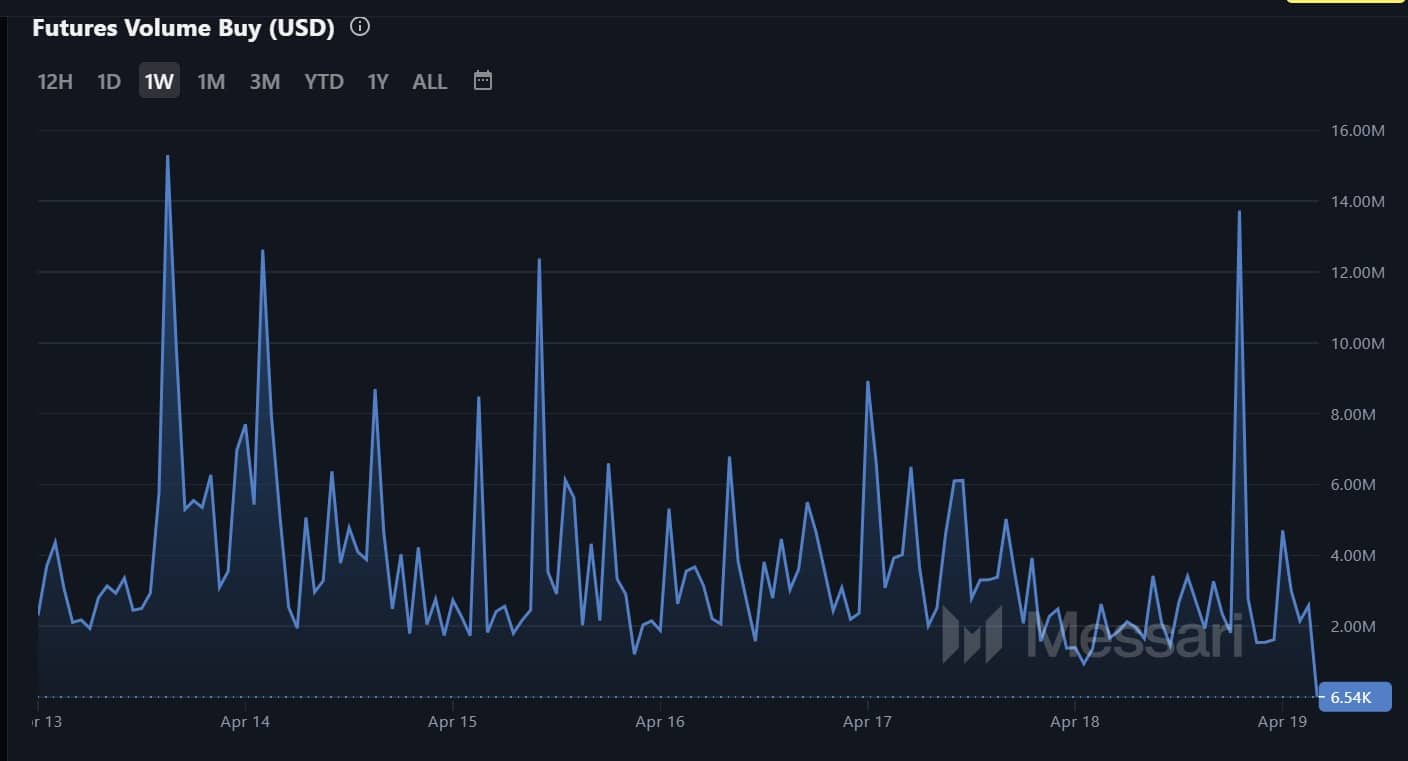

In the midst of these losses, the question and the assembly of bearish sentiments slows down. To begin with, Tron buyers have almost disappeared from the market. Futures Buy Volume has also fallen to a weekly low of $ 6.5K.

Such a decrease suggests that investors are currently missing the motivation to believe in a potential upward trend. As such there is a weak bullish conviction in the market.

Source: Messari

According to the financing speed (volume weighed), there is a decrease in the demand for long positions, whereby the financing percentage is stored at a monthly low within negative territory.

When the metric is set up in this way, this suggests that investors are failing aggressive Tron because they expect prices to fall.

Source: Messari

That is why an ETF would be a game change for Tron and his native token. An ETF will create space for more adoption as institutional investors enter the market, which leads to a higher demand.

From now on, the application has not positively influenced the Trx price action. If the development on the market is felt, we could see TRX $ 0.259 reclaim.

However, if the prevailing market sentiment applies, a decrease to $ 0.23 is inevitable.