- Canary Capital Litecoin ETF entering can soon start acting, per analyst.

- The speculative interest in the Altcoin has increased, with almost $ 10 billion in the volume on the chain.

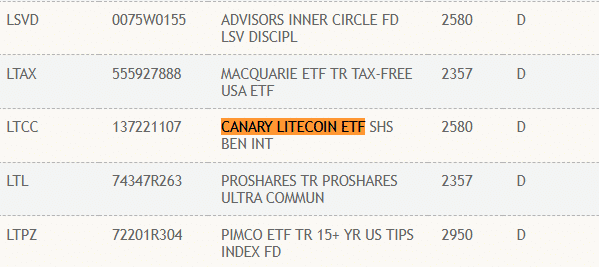

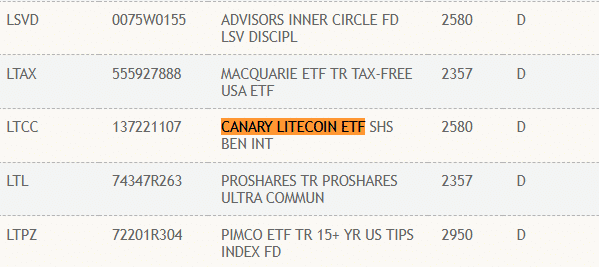

Canary Capital’s proposed Litecoin[LTC] ETF is stated on the Depository Trust and Clearing Corporation (DTCC), so that analysts are asked to speculate that the product could start to act soon.

Bloomberg ETF analyst Eric Balchunas maintained approval opportunities for LTC ETF at 90%. However, he noted that the DTCC list was a preparation for an ETF launch, but not an outright approval signal.

Source: X

LTC ETF speculation

For his part, Nate Geraci from the ETF store of the ETF store the same sentiment, but added that the product could start to act soon, with regard to similarity to the BTC ETF approval process. He said”

“Litecoin ETF” mentioned “on DTCC. Having flashbacks to spot BTC ETFs … This means nothing, but I also probably think that LTC ETF will come to a broker.”

For those who are unknown, the Canary LTC ETF 194-B entry entered the federal register on 4 February.

The SEC could approve or reject the submission within the next 45-90 days after mention in the federal register. That would translate into a likely sec decision around the end of March or early May.

In addition, Grayscale and Coinshares have submitted comparable LTC ETF applications and recognized it by the regulator.

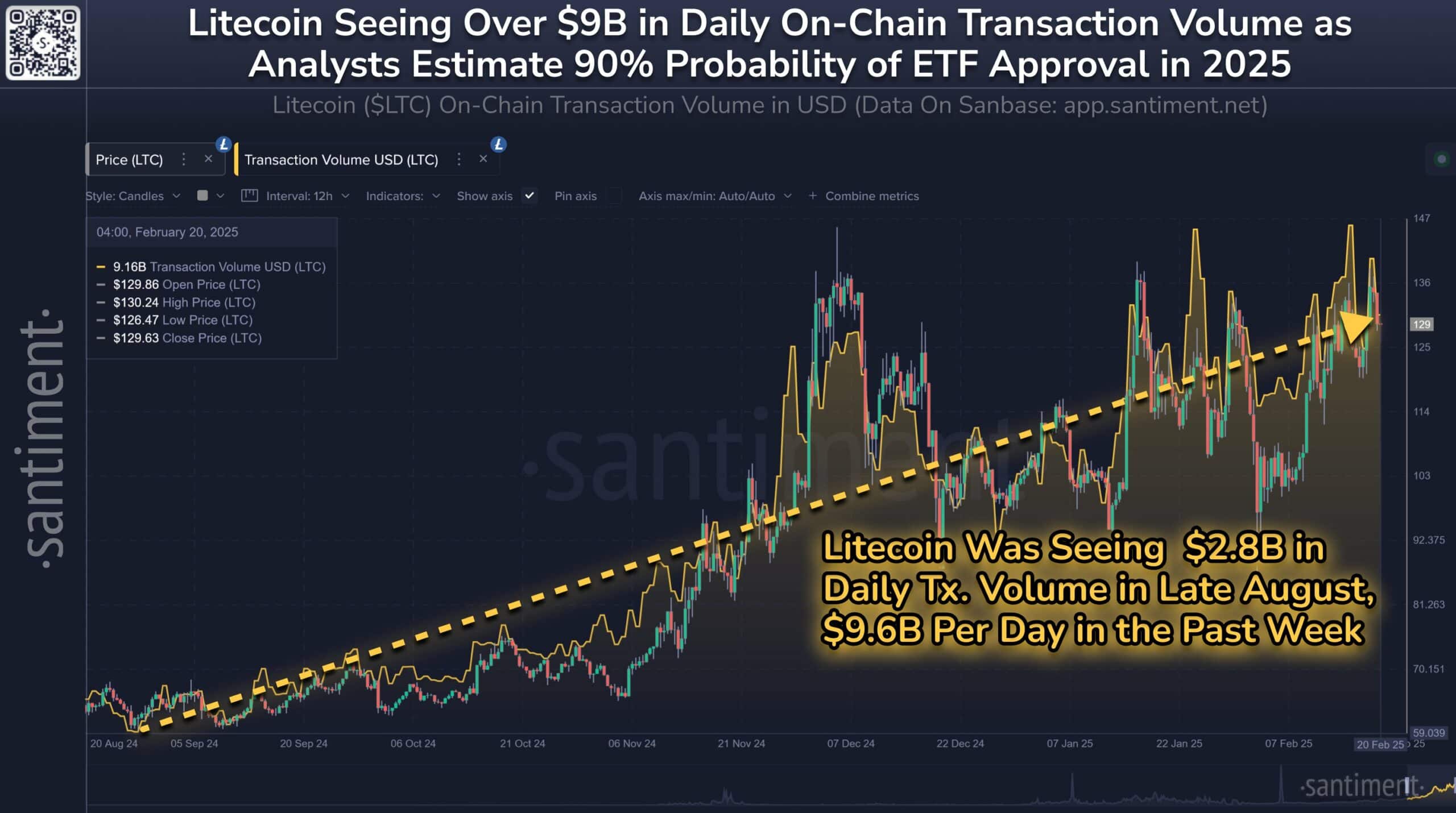

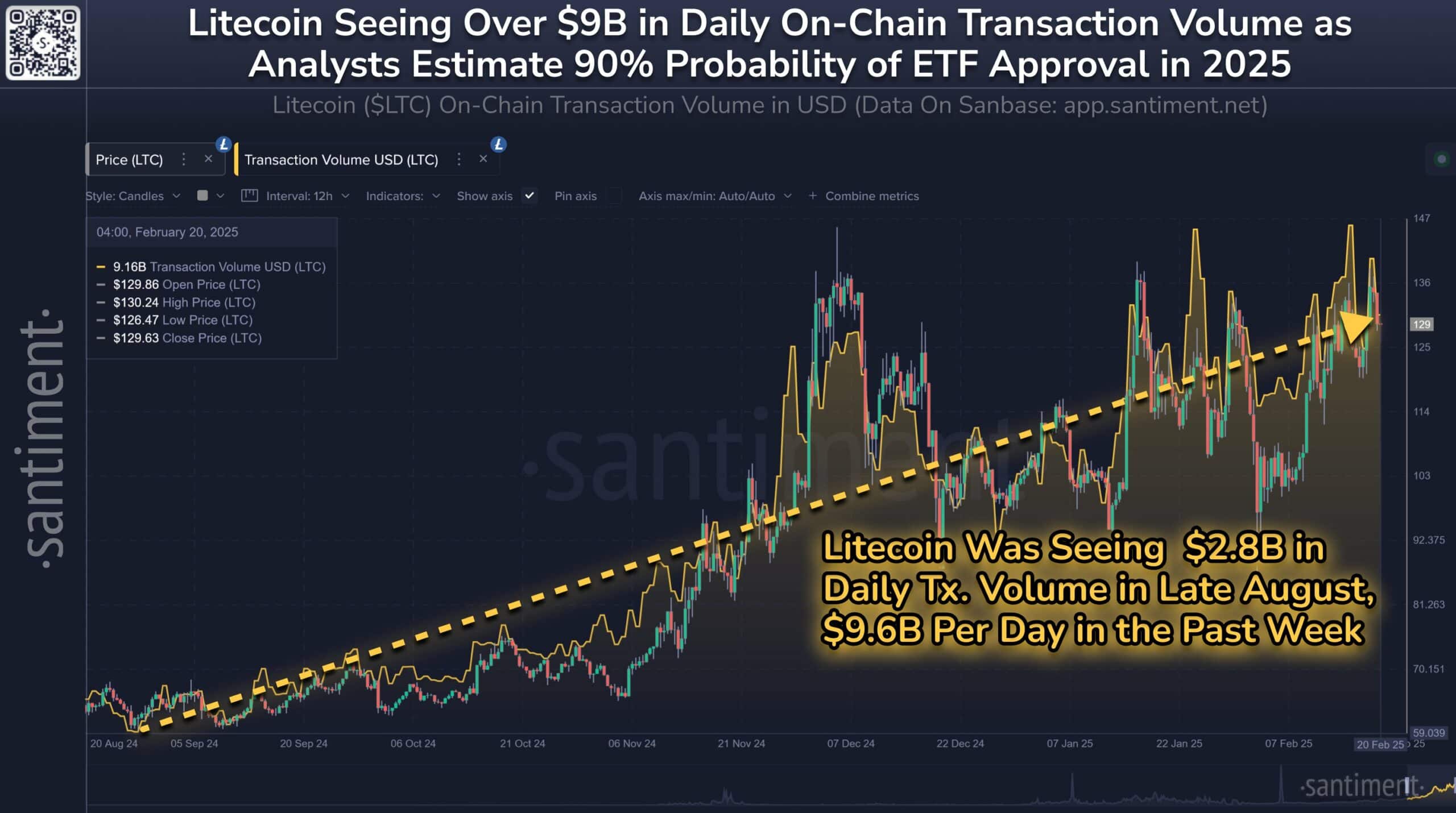

Interestingly, traders on LTC jumped in the midst of ETF speculation. According to SantimentThe market capitalization of LTC increased by 46%, while the daily trade volume alone rose almost $ 10 billion in the past week.

“Part of this growth comes from the strong rise in the network utility, which has incorporated $ 9.6 billion in the daily transaction volume for the past 7 days.”

Source: Santiment

Speculative interest rate was observed in the Futures markets, where traders use leverage to take advantage of opportunities.

According to Coinglass, the open interest (OI) from LTC rose to $ 869 million. During the CyclusSpiek from 2021, the OI rose to $ 1 billion, suggesting that the current speculative interest rate is close to the last cycle heights.

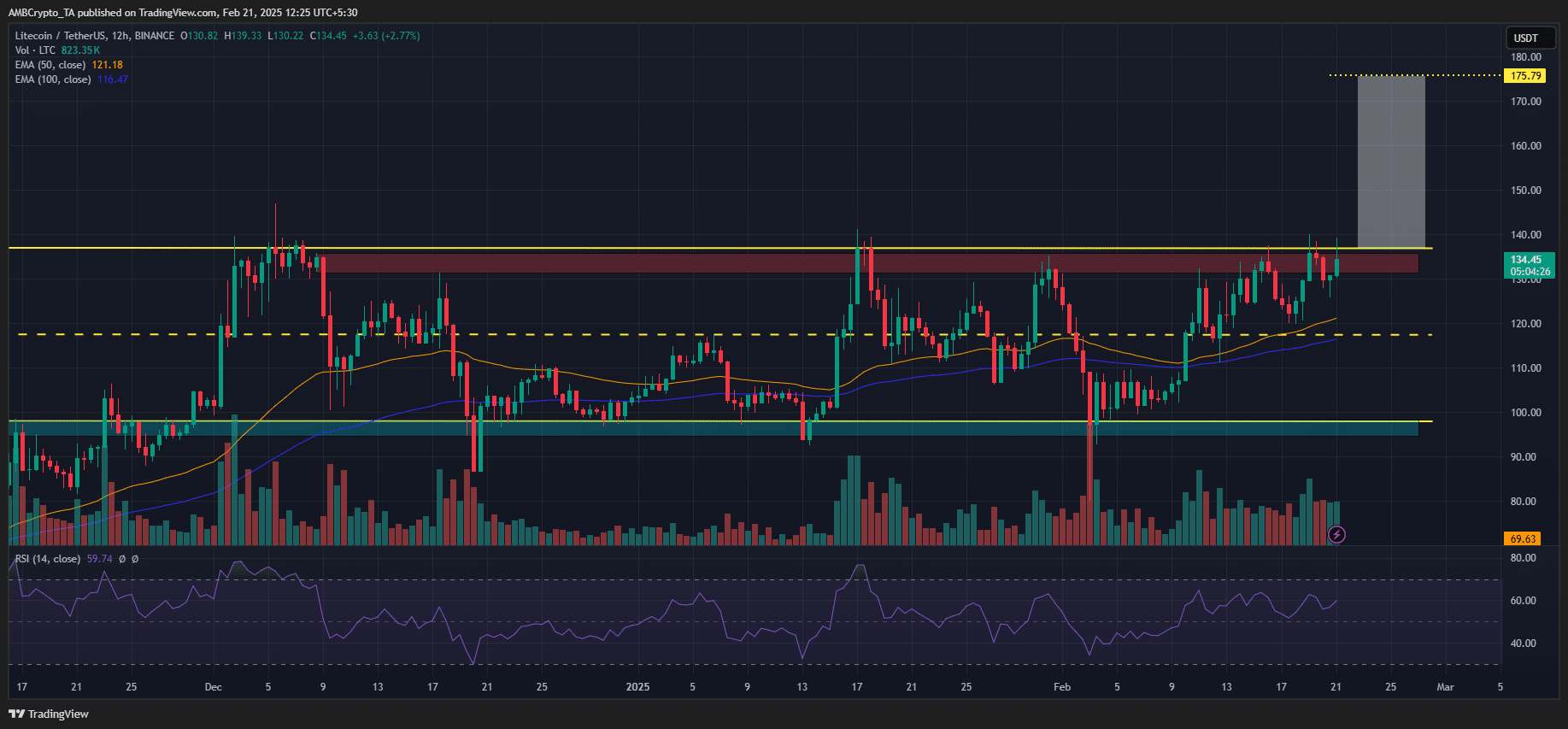

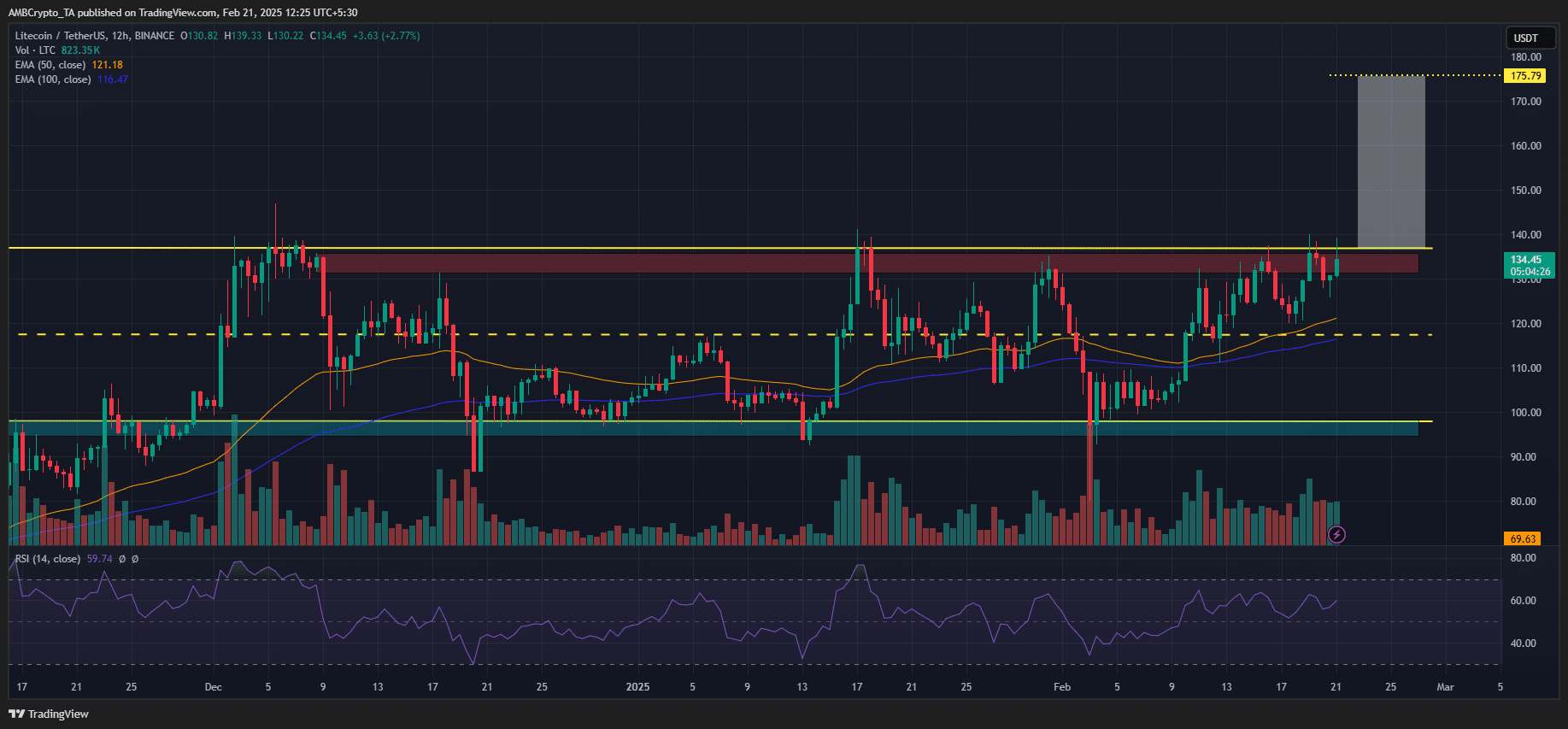

On the price diagrams, LTC was one of the few altcoins who held November win. In February alone, the Altcoin rose by around 37% and appreciated $ 134 at the time of the press.

Source: LTC/USDT, TradingView

But the price action was on an important vehicle in front in the short term and reach. The advancing averages and the middle range near $ 120 could act if buying opportunities if speculation would continue.

But a decisive one Breakout -Rally Can LTC push $ 175.