- VELO could see an 81% upside, supported by solid market sentiment and whale accumulation.

- Oversold RSI and narrowing Bollinger Bands suggested a potential price breakout for VELO.

Velo [VELO] has been turning heads in the market lately, with some analysts suggesting the token could see significant upside momentum.

An analysis shared by a crypto analyst named Javon Marks on the

But does the data support this optimistic outlook?

At the time of writing, VELO was trading at $0.01611, up 8.94% daily. This reflected the rising interest and positive sentiment surrounding the token.

Moreover, the token has maintained a healthy market cap of $119 million with strong trading volumes of $21.69 million over the past 24 hours.

TThese numbers indicated solid market interest, but does this translate into sustainable growth?

Does Whale Accumulation Drive VELO Growth?

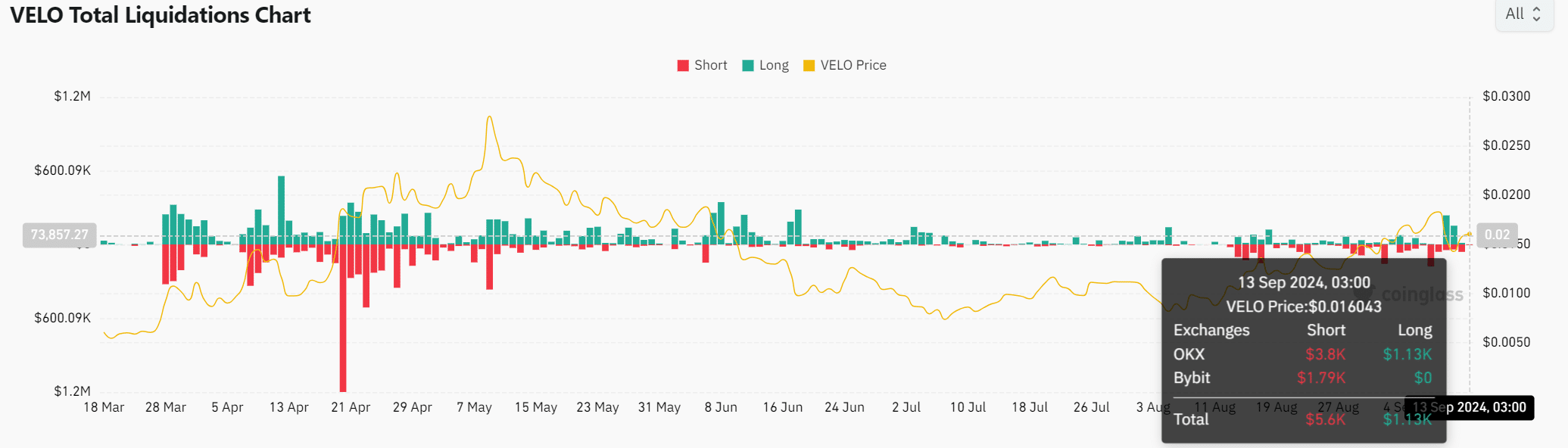

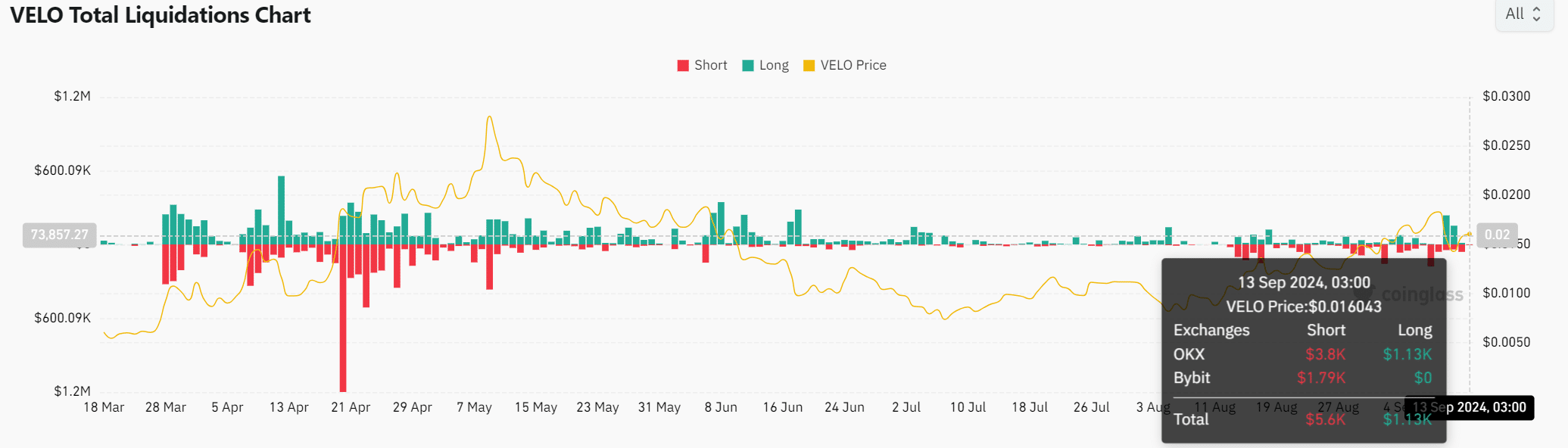

Whale activity has been a major driver of many bullish moves in the cryptocurrency markets. On-chain data showed that VELO has seen a significant accumulation of whales, which is evident from the total liquidations graph.

The balanced mix of $5.6K in shorts and increasing volume of $1.13K in long positions suggested whales and larger investors were confident in VELO’s upside potential.

Furthermore, despite recent liquidations, there has not been a sharp decline in VELO’s price.

This stability often indicates that whales are accumulating tokens without causing price shocks, which is a sign of confidence in the potential for future growth.

Source: Coinglass

Can technical indicators support a breakout?

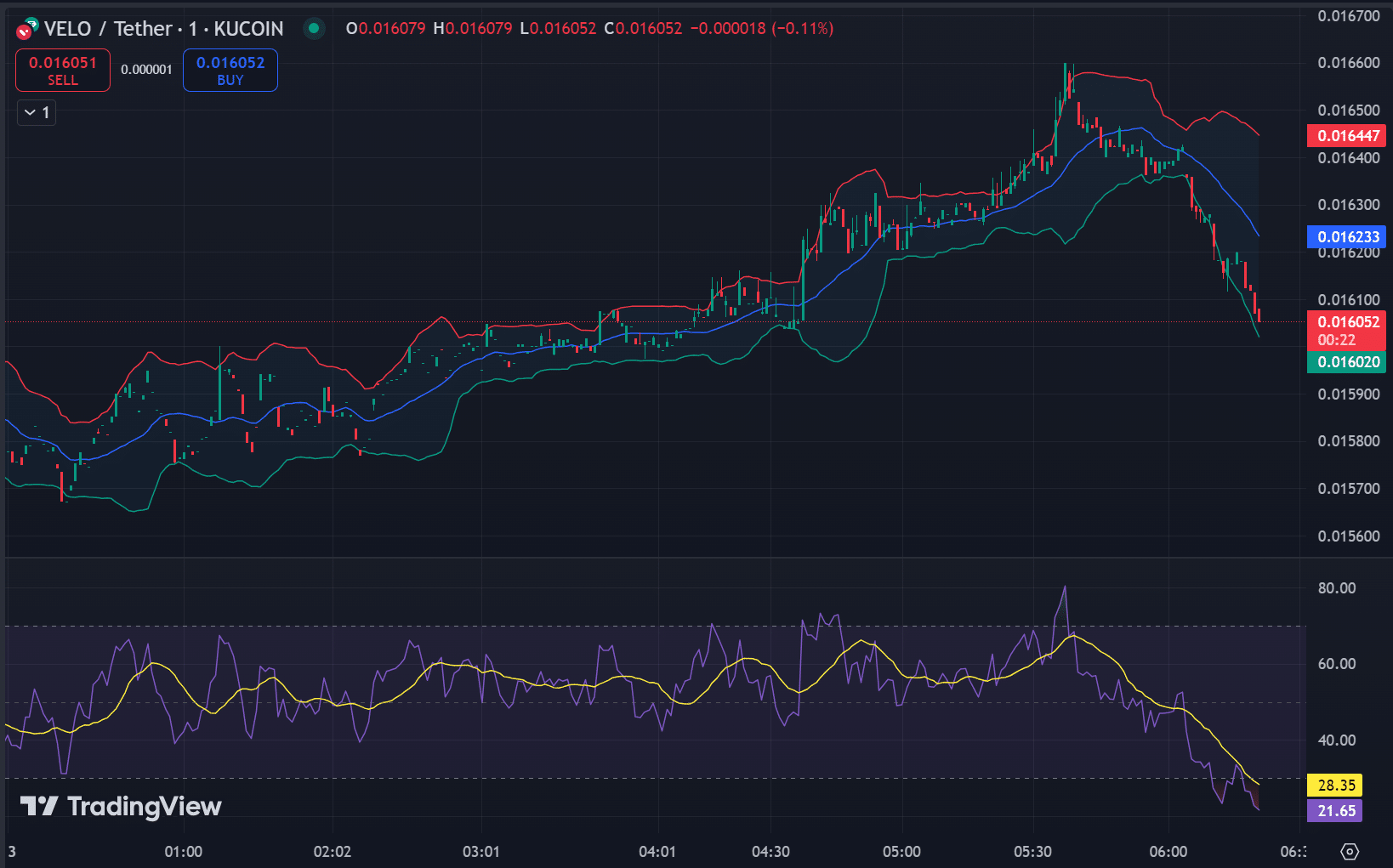

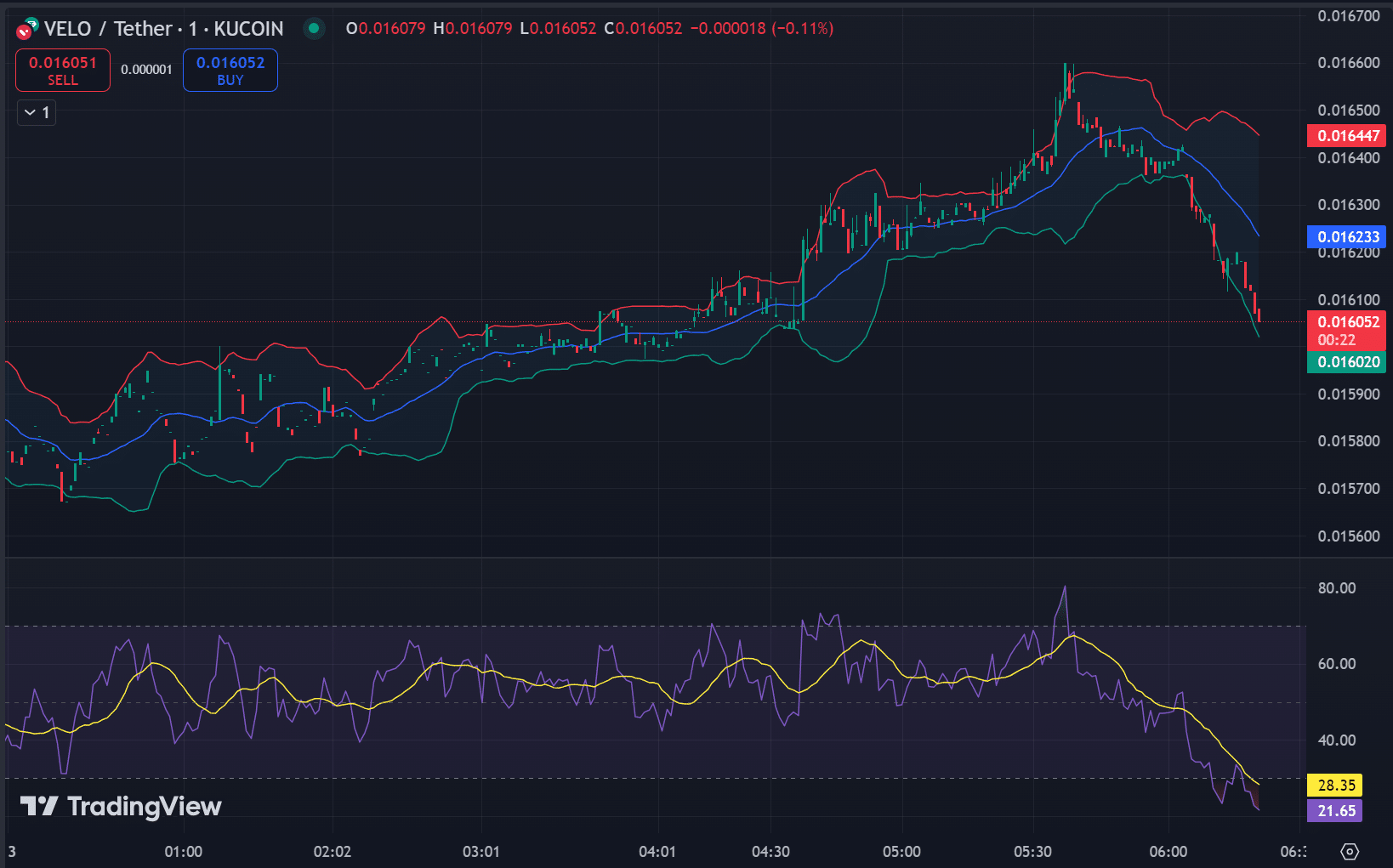

The RSI (Relative Strength Index) at the time of writing was 28.35, indicating that VELO was in an oversold zone. This generally suggested that selling pressure was easing, and that a reversal may be in store as buyers begin to act.

Similarly, according to the Bollinger Bands, VELO was approaching the lower band, at $0.01602 at the time of writing, while the upper band was at $0.01644. This tightening indicated low volatility, and approaching the lower band often signaled potential upside.

Source: TradingView

Together, these indicators suggested that VELO could stage a recovery soon, but a break above key resistance levels will be essential for continued upside momentum.

What is the likely outcome?

Although analysts suggested an increase of 81%, the actual technical situation offers a more cautious outlook.

Read Velos [VELO] Price forecast 2024–2025

For VELO to make such a significant move, it must first break above the current resistance at $0.016 and maintain momentum.

Market sentiment, whale accumulation and oversold conditions support a potential near-term upside, but traders should wait for confirmation of a breakout before expecting an 81% rally.