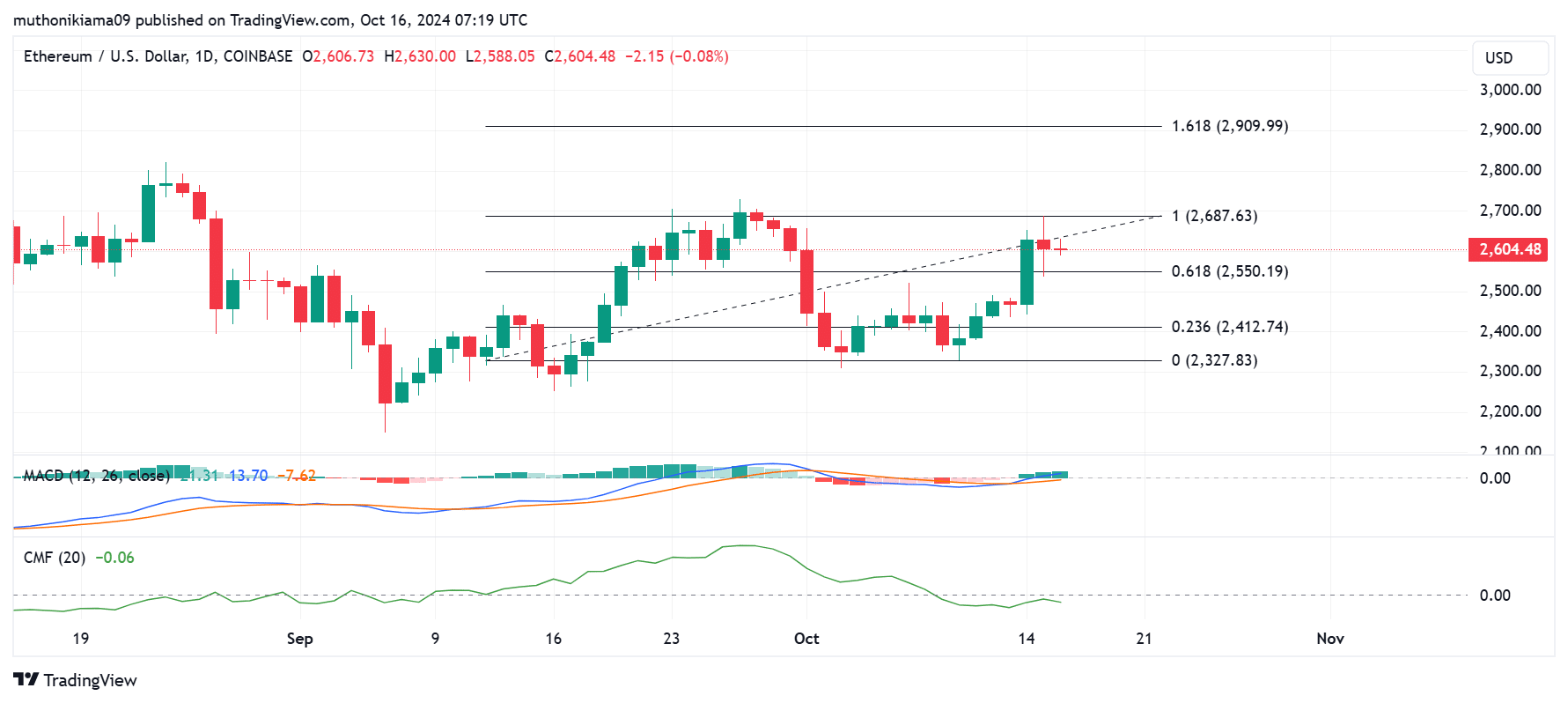

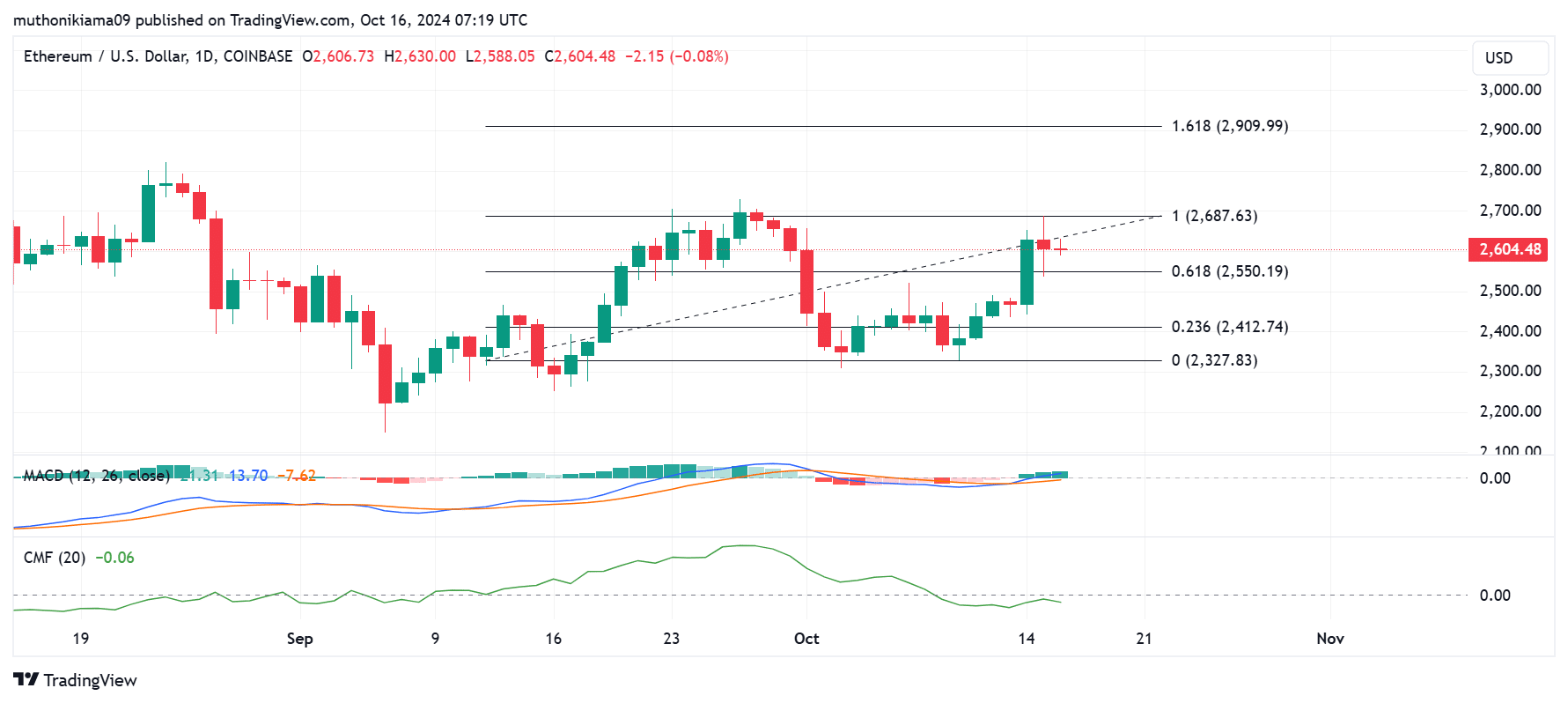

- Ethereum’s MACD indicator on the one-day chart showed a bullish divergence.

- Ethereum exchange outflows and open interest have increased, indicating bullish sentiment.

The crypto fear and greed index then rose to 73 Bitcoin [BTC] broke above $67,000. Despite this bullish bias, Ethereum [ETH] has yet to make significant gains.

The largest altcoin was trading at $2,604 at the time of writing, after a slight decline of 0.4% in 24 hours.

Ethereum is showing a bullish divergence on the daily chart. The moving average convergence The divergence has become positive.

Additionally, the MACD histogram bars have turned green and expanded, indicating that bullish sentiment is gaining strength.

Source: TradingView

However, the Chaikin Money Flow (CMF) had a negative value, indicating that more capital was flowing out of ETH than into the altcoin.

This showed that buyers were still not convinced and could wait for ETH to break a crucial resistance level at $2,687 before entering the market.

If the MACD bullish divergence occurs, ETH will cross this resistance level and set the next target at $2,900. A look at the on-chain metrics shows that this rally is likely.

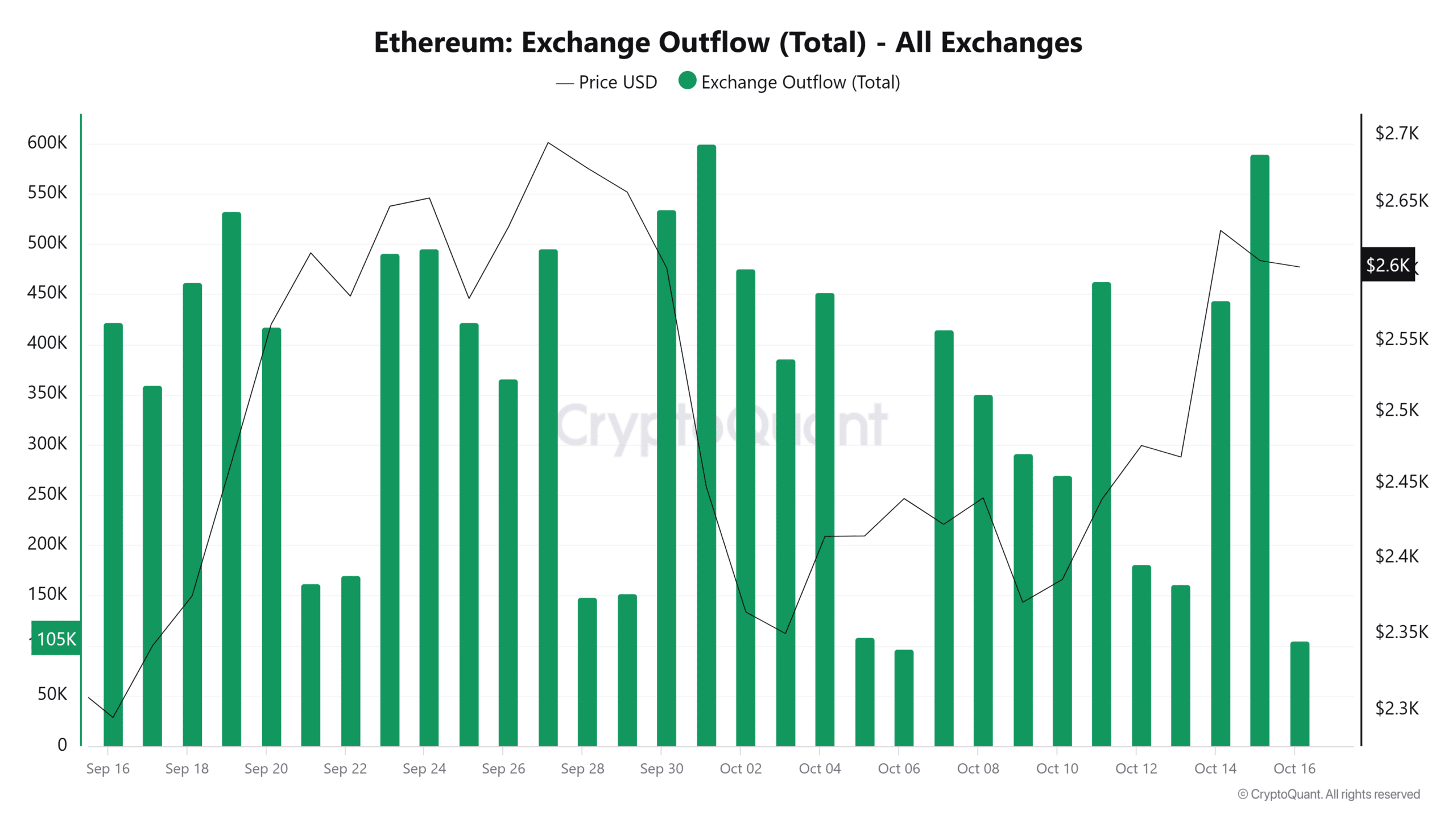

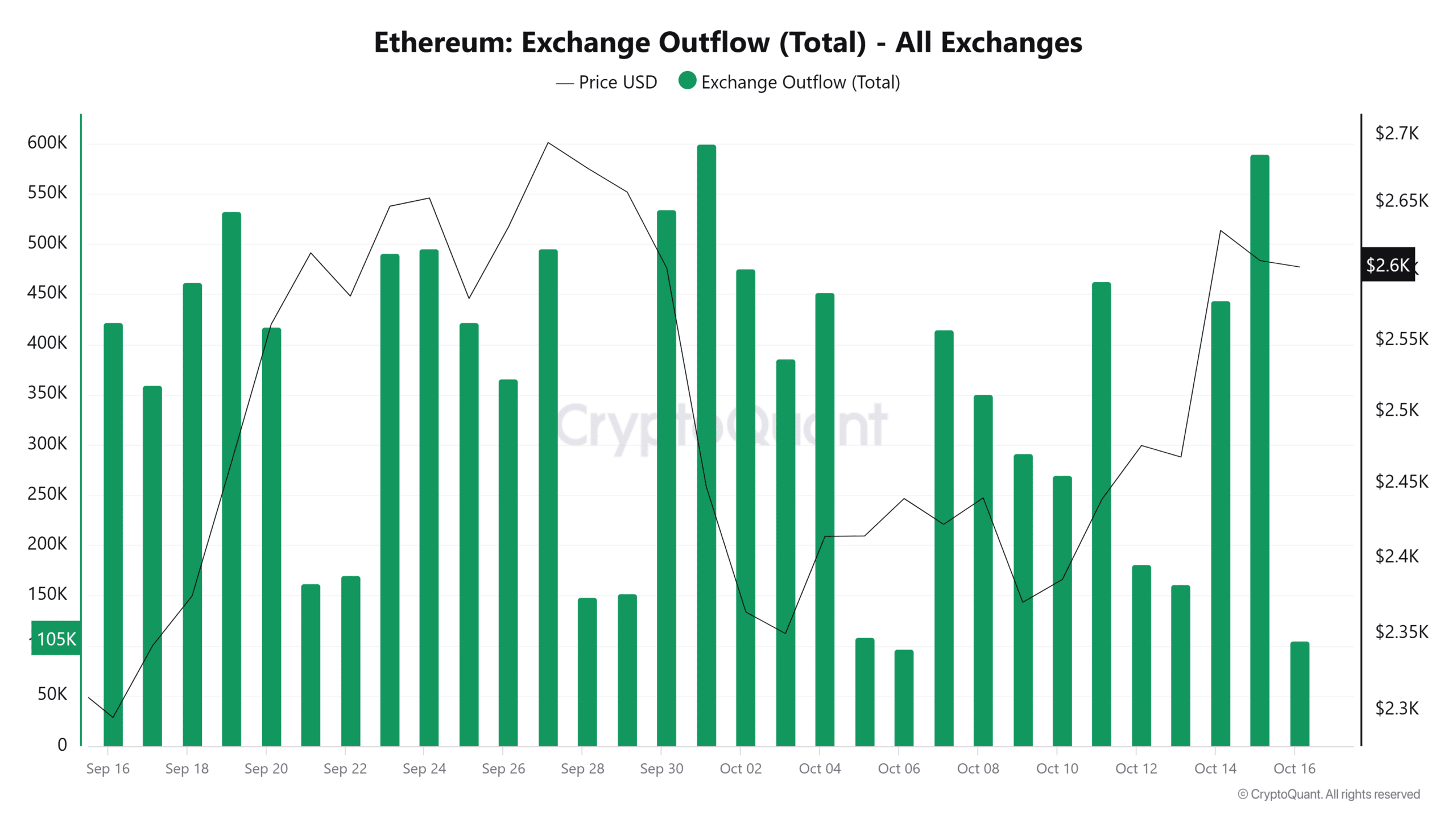

Outflows from Ethereum exchanges hit a two-week high

Ethereum outflows from exchanges rose to a two-week high on October 15 as traders withdrew their tokens from exchanges, showing a lack of intent to sell.

During the day, ETH outflows amounted to 589,611, worth over $1.5 billion.

Source: CryptoQuant

As a result, total Ethereum net flows reached the highest level since late September, suggesting that selling pressure on ETH could ease, paving the way for a price recovery.

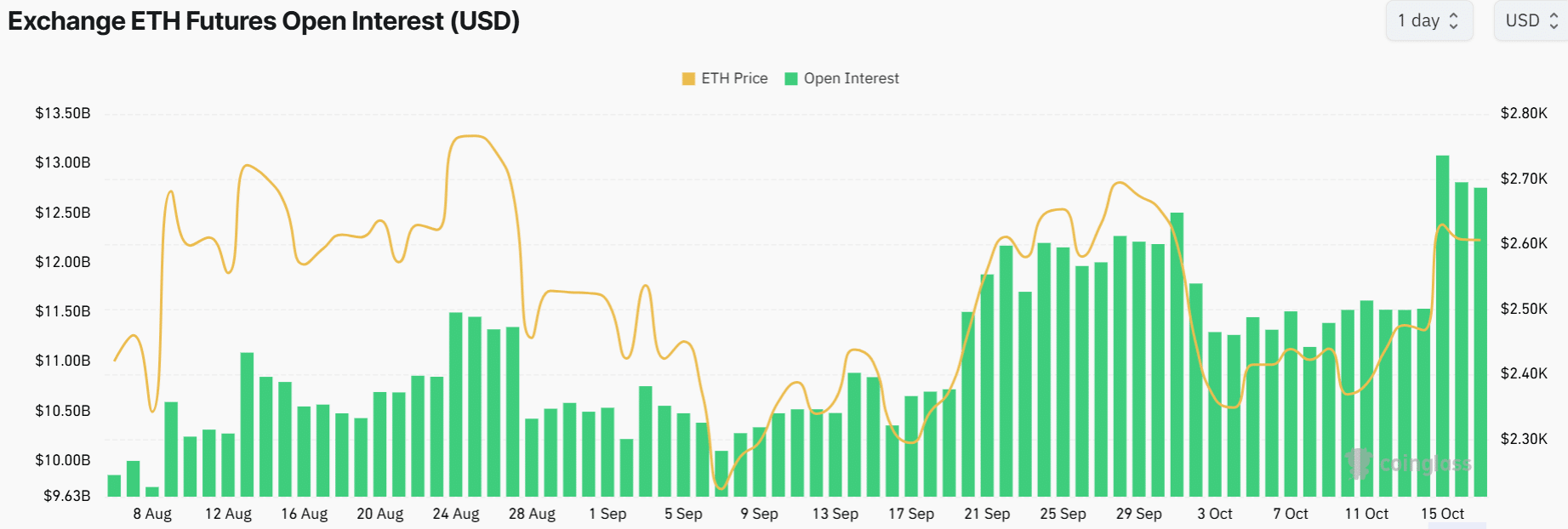

Increasing open interest

Ethereums Open interest can also influence price action. Ethereum’s OI stood at $12.76 billion at the time of writing, showing growing market participation and interest from derivatives traders.

Source: Coinglass

A rise in Open Interest amid a lack of significant price changes indicated that speculative activity towards ETH was increasing.

This could lead to high volatility as traders begin to close out their positions when the price makes a strong move in either direction.

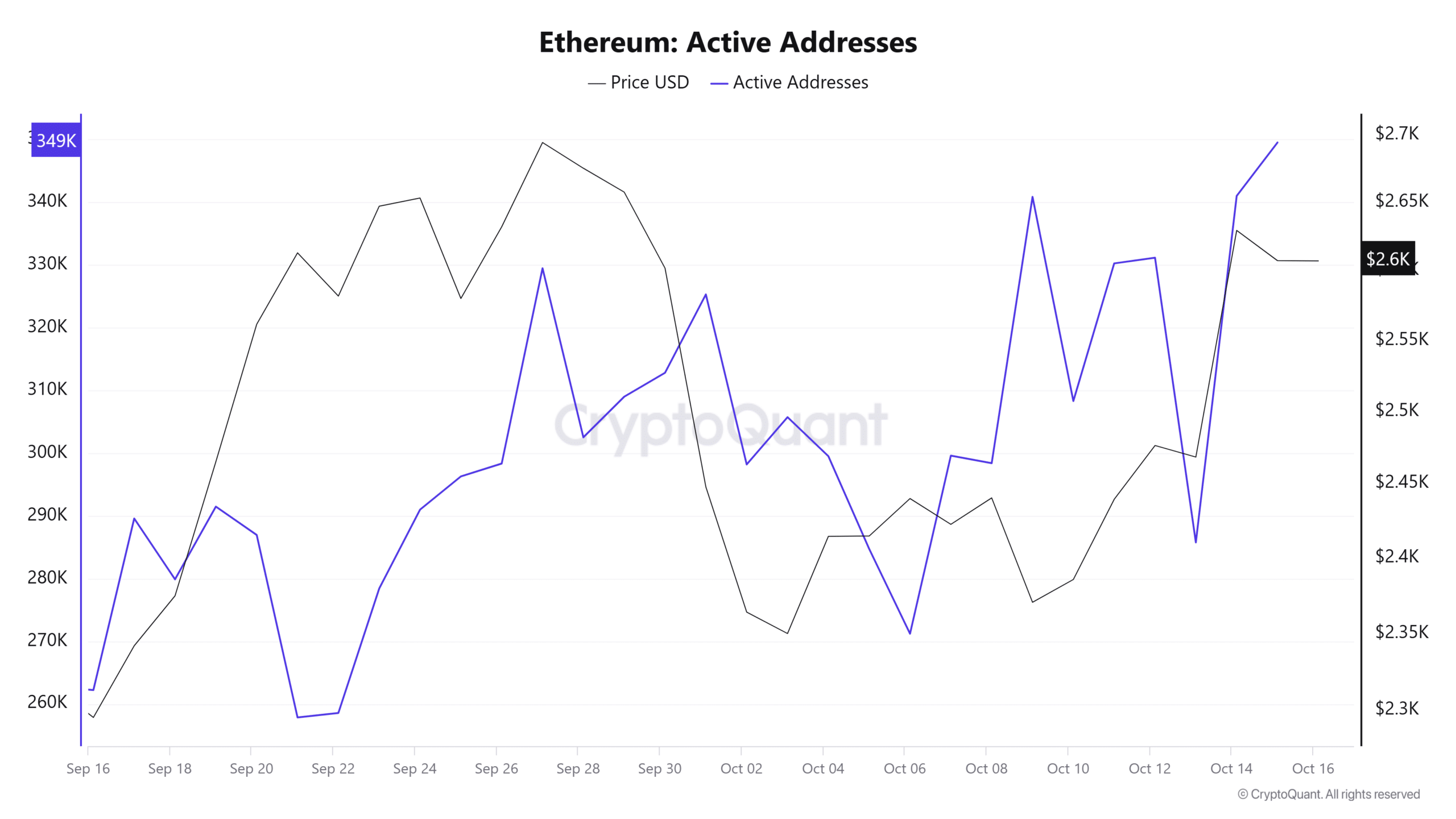

Active addresses are showing bullish signs

The number of active addresses on Ethereum reached 349,507 on October 15, the highest level in the past month. This spike is bullish because it could indicate rising demand for ETH or growing network activity.

Source: CryptoQuant

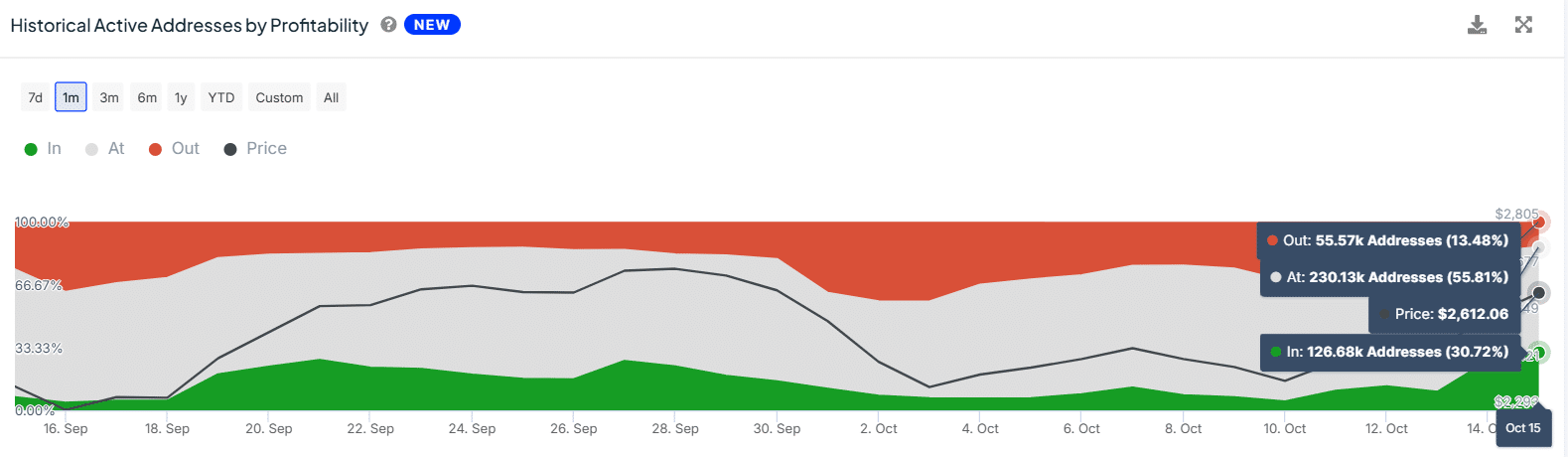

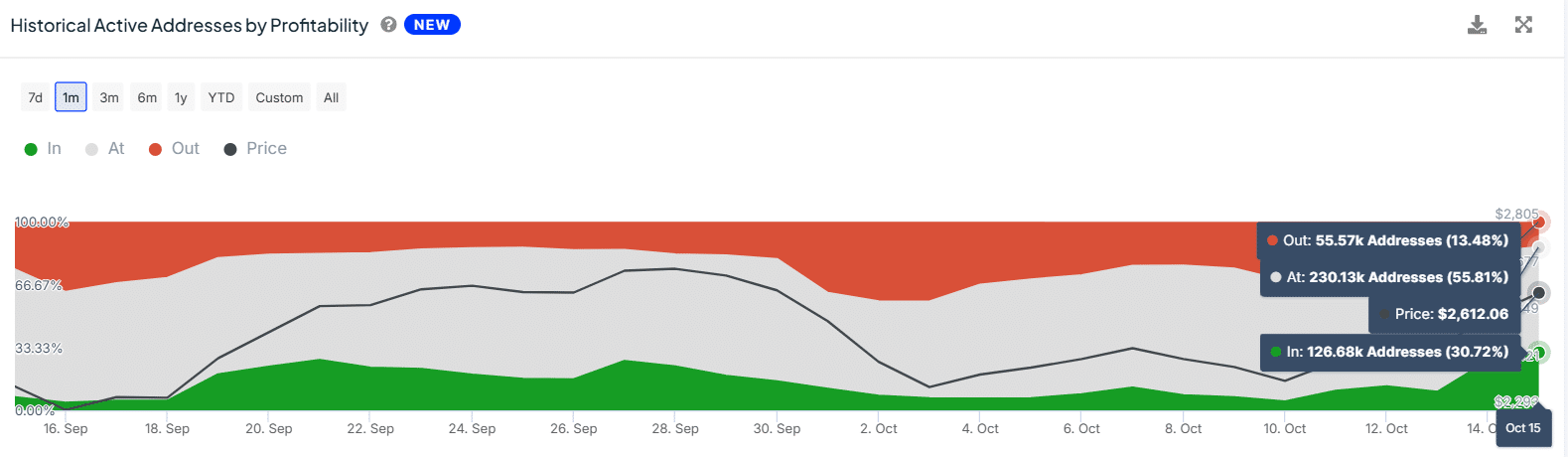

The increase in these addresses also coincided with increasing profitability.

Read Ethereum’s [ETH] Price forecast 2024–2025

Data from IntoTheBlock showed that after the recent price increase, the number of daily active addresses making a profit reached 30%, the highest level in the past month.

At the same time, daily active Ethereum addresses have fallen to 13% with losses.

Source: IntoTheBlock