- Expectations regarding Spot Ethereum ETFs are high following their launch

- Ethereum’s usefulness, adoption, transactions, and fees could come in handy for the altcoin

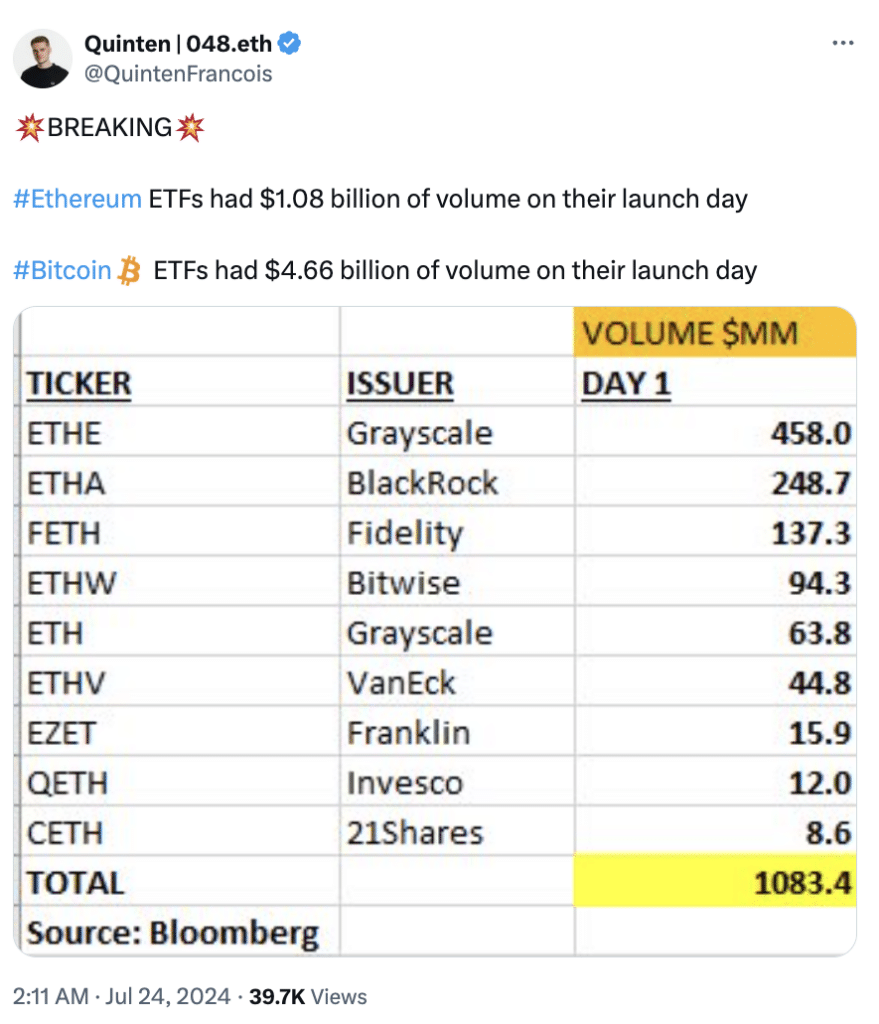

It’s been over 24 hours since Ethereum ETFs went live, and early reports have been quite promising. In fact, the first day of trading reportedly saw over $1 billion in trading volume.

Ethereum ETF trading volumes on the first day of trading indicate that it is off to a good start. However, can it build and surpass Bitcoin ETFs in terms of demand and volume? Maybe, but it’s worth noting that volumes of Ether’s spot ETFs were only a quarter of what its spot Bitcoin ETFs recorded on its first day of trading.

Source: X

Bitcoin may have the first mover advantage, but Ethereum also has some strengths that could boost volumes and signal demand in the future. Here are some of the key factors that could help Ethereum give Bitcoin a run for its money in the spot ETF segment.

Ethereum excels in usability

The newly launched ETF will expose Ethereum to traditional investors. Their investment criteria are different from what the crypto market is used to. For example, they tend to focus on organic growth factors and this is where Ethereum takes the cake.

The network supports smart contracts. As a result, the ecosystem has grown tremendously over the years, with over 4,000 Dapps at the time of writing. Those Dapps support robust demand for ETH in the form of gas fees.

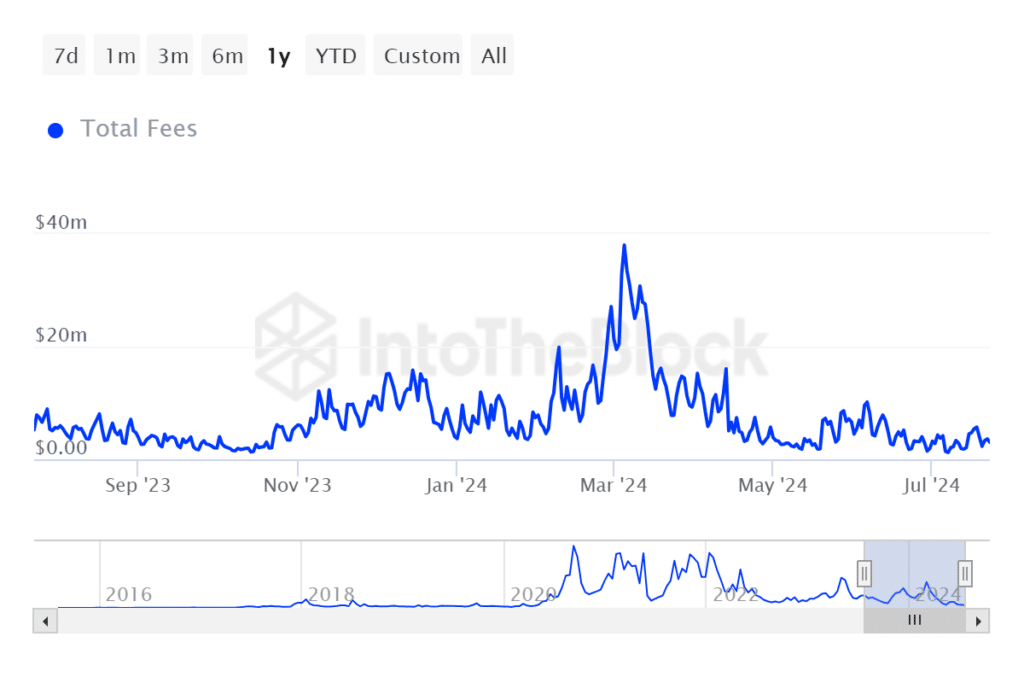

For context, Ethereum fees have ranged from as low as $1.22 million to as high as $38 million in the last twelve months.

Source: IntoTheBlock

Furthermore, Ethereum’s staking model, which provides passive income opportunities, is similar to dividends in traditional financial markets. Traditional investors may find that attractive.

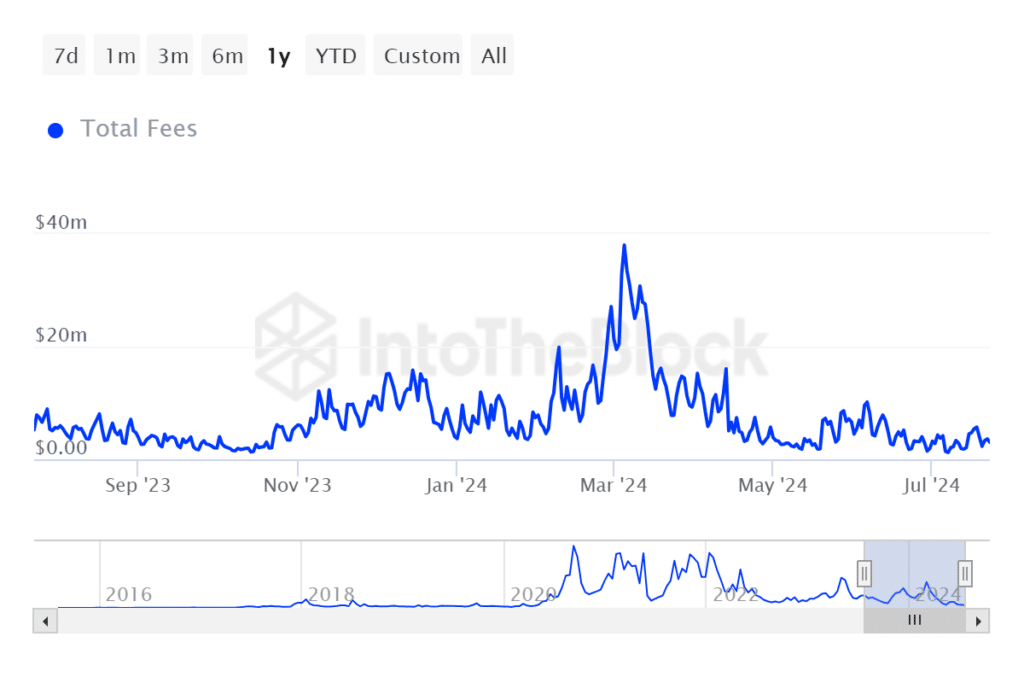

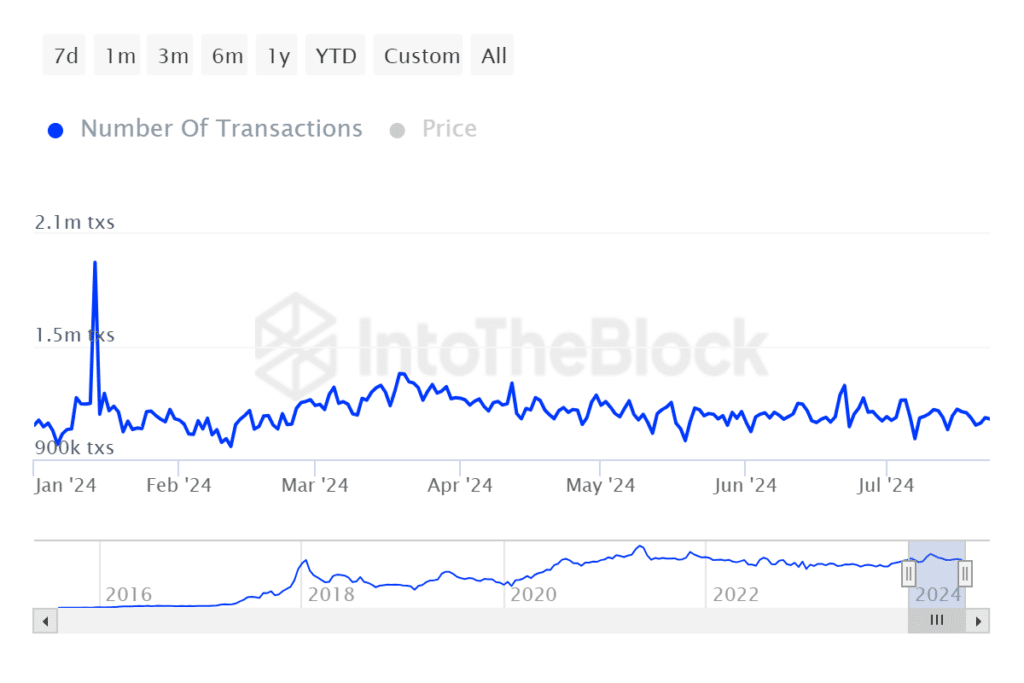

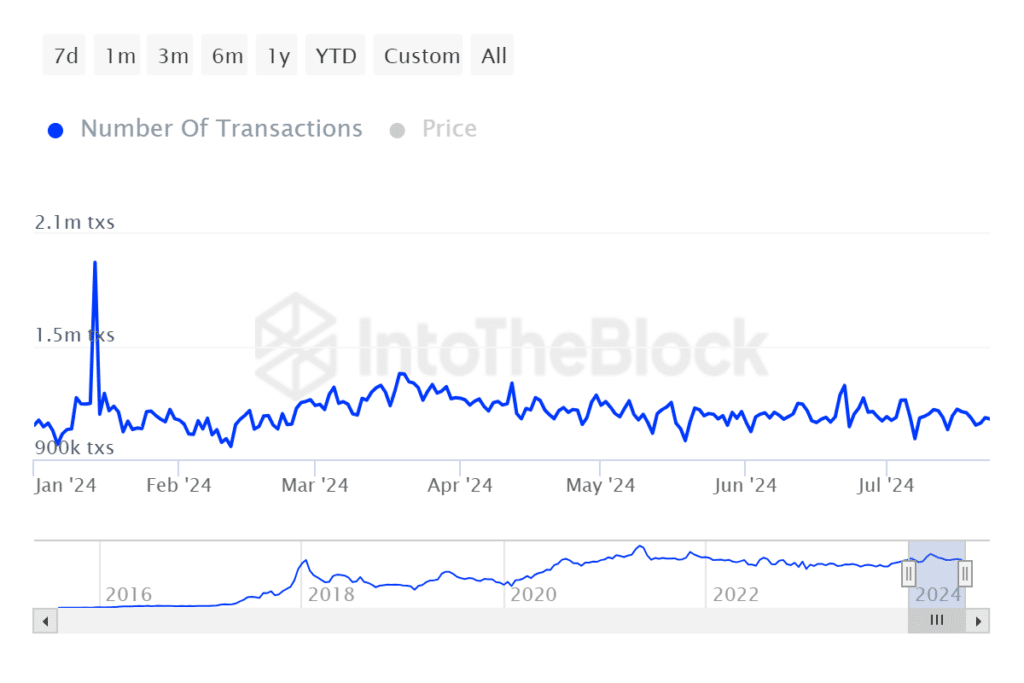

Ethereum transactions also present a healthier picture than Bitcoin transactions. The latter struggles to achieve more than 500 daily transactions on a YTD basis. On the contrary, Ethereum’s daily transactions since the beginning of the year have averaged more than 1 million.

Source: IntoTheBlock

Utility, fees, and transactions highlight the key areas where Ethereum outperforms Bitcoin.

A look at the cryptos on the price front could also be helpful. ETH is trading at a value significantly lower on the charts compared to BTC ($3,450 vs. $66,422 at the time of writing). This may increase the perception that investing in Ethereum ETFs can bring investors higher profits.

After all, profit is the name of the game.

Easier said than done

Ethereum can hold its own against Bitcoin based on what we saw above. However, BTC already has a strong lead and the first mover advantage means that many traders may choose this over the second option. Moreover, Bitcoin’s network also has its winning points, such as its proof-of-work system that is perhaps the pinnacle of decentralization.

Bitcoin also continues to register an influx of institutional demand, despite the rollout of Ethereum ETFs. The coming weeks or months should provide a clearer picture as to which of the two coins will outperform the other on the ETF demand front.