- Short-term holders of Bitcoin were still selling their coins at high profits, indicating a correction could be in play.

- However, the Funding Rate, Premium and OI fractal for 2024 suggested that BTC could reach a peak of $160,000 if it recovers.

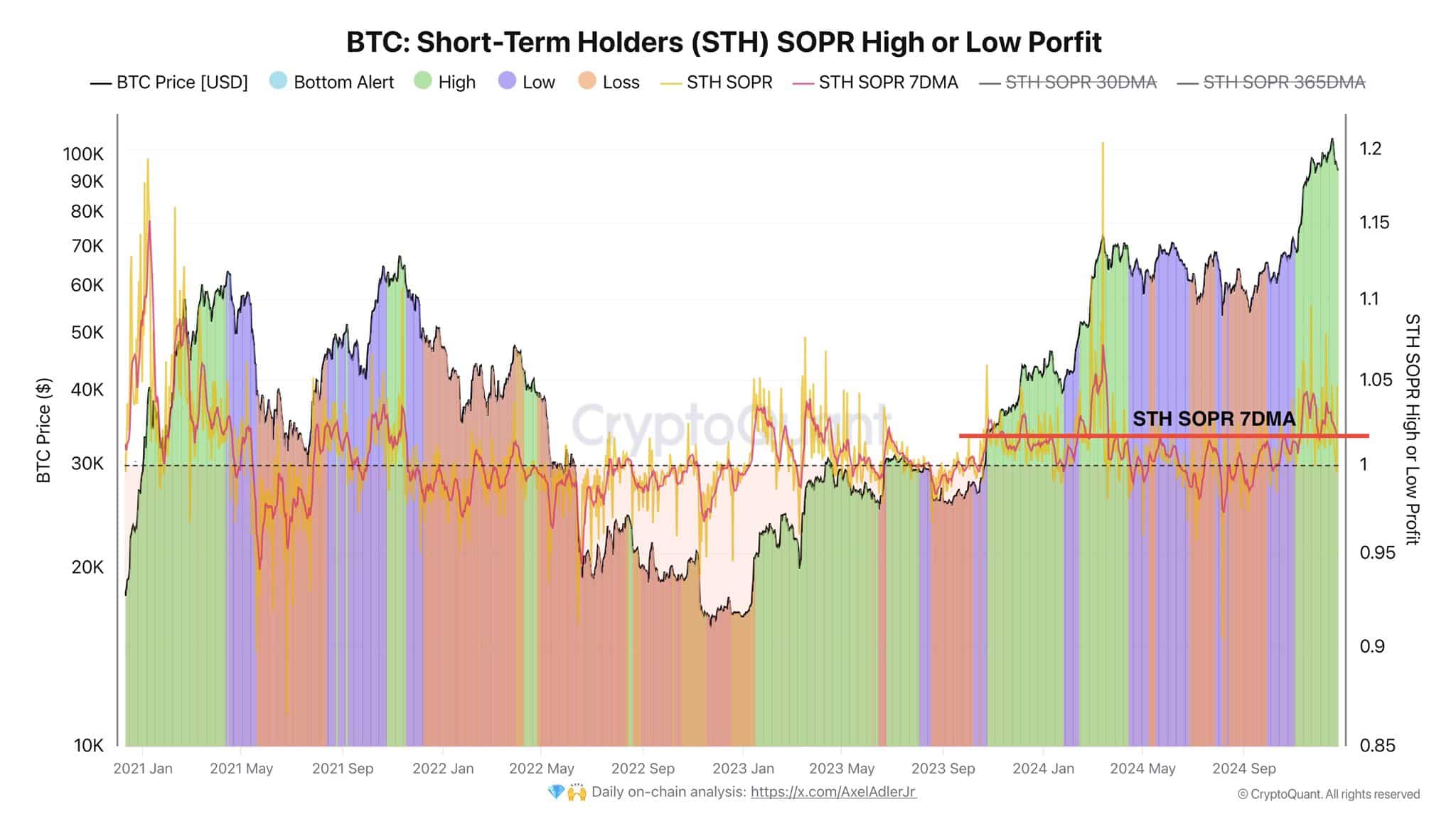

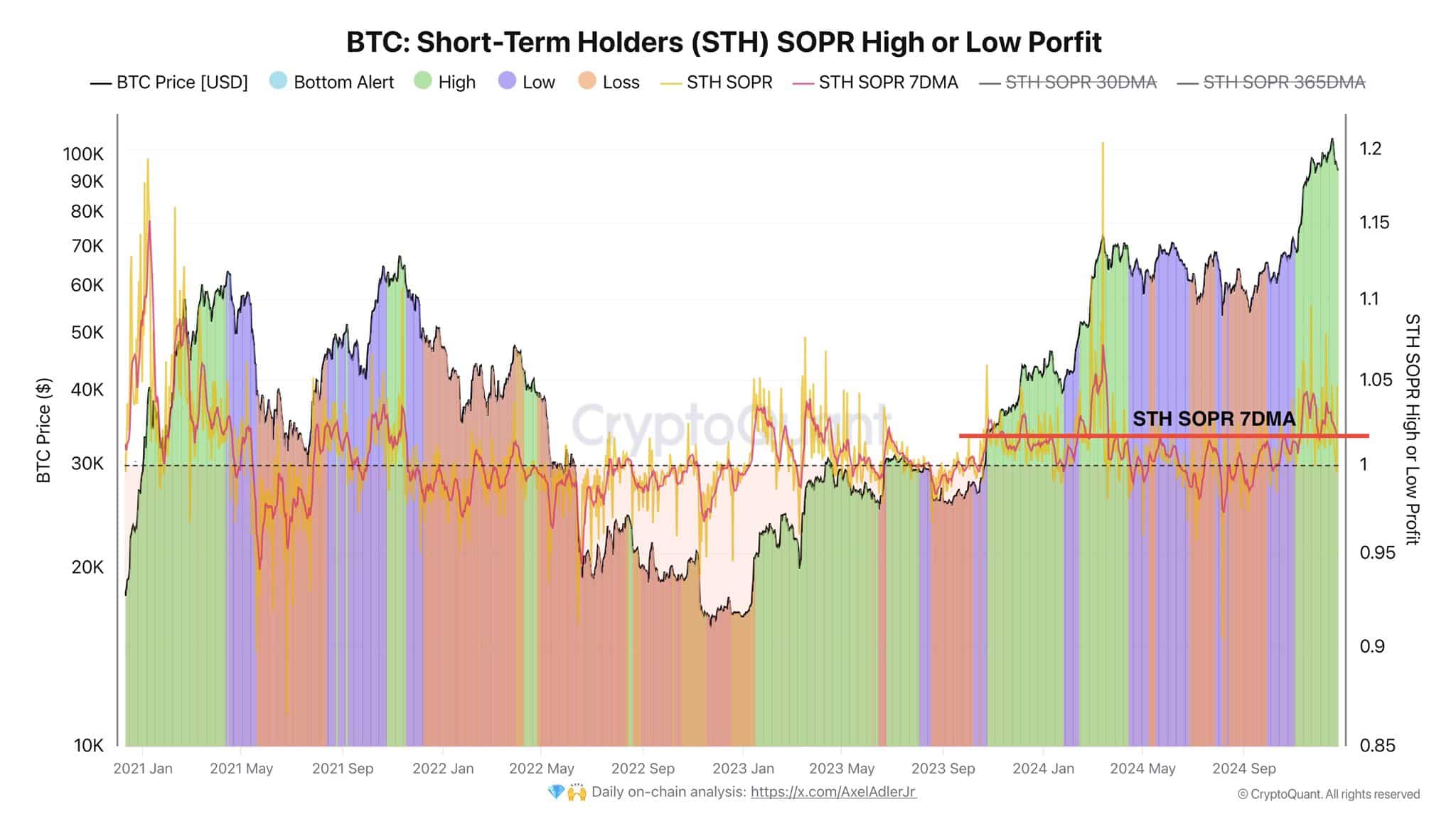

The values of Profit ratio spent output (SOPR) for Bitcoin [BTC] short-term holders (STH) were high, indicating that STHs were selling at a profit, often in line with price highs.

However, if the SOPR fell below 1, it reflected a sale at a loss, which usually corresponds to price corrections or declines in the market.

This consistent profit-taking by short-term holders could portend potential adjustments. If demand were to decline while profit-taking remained high, the price could come under downward pressure, leading to corrections.

Source: CryptoQuant

Conversely, if SOPR values indicated losses and continued to decline, this could indicate reduced selling pressure, allowing Bitcoin to find stability or support levels, possibly around $90,000.

Thus, STHs influenced the short-term direction of the market based on their profit or loss realization.

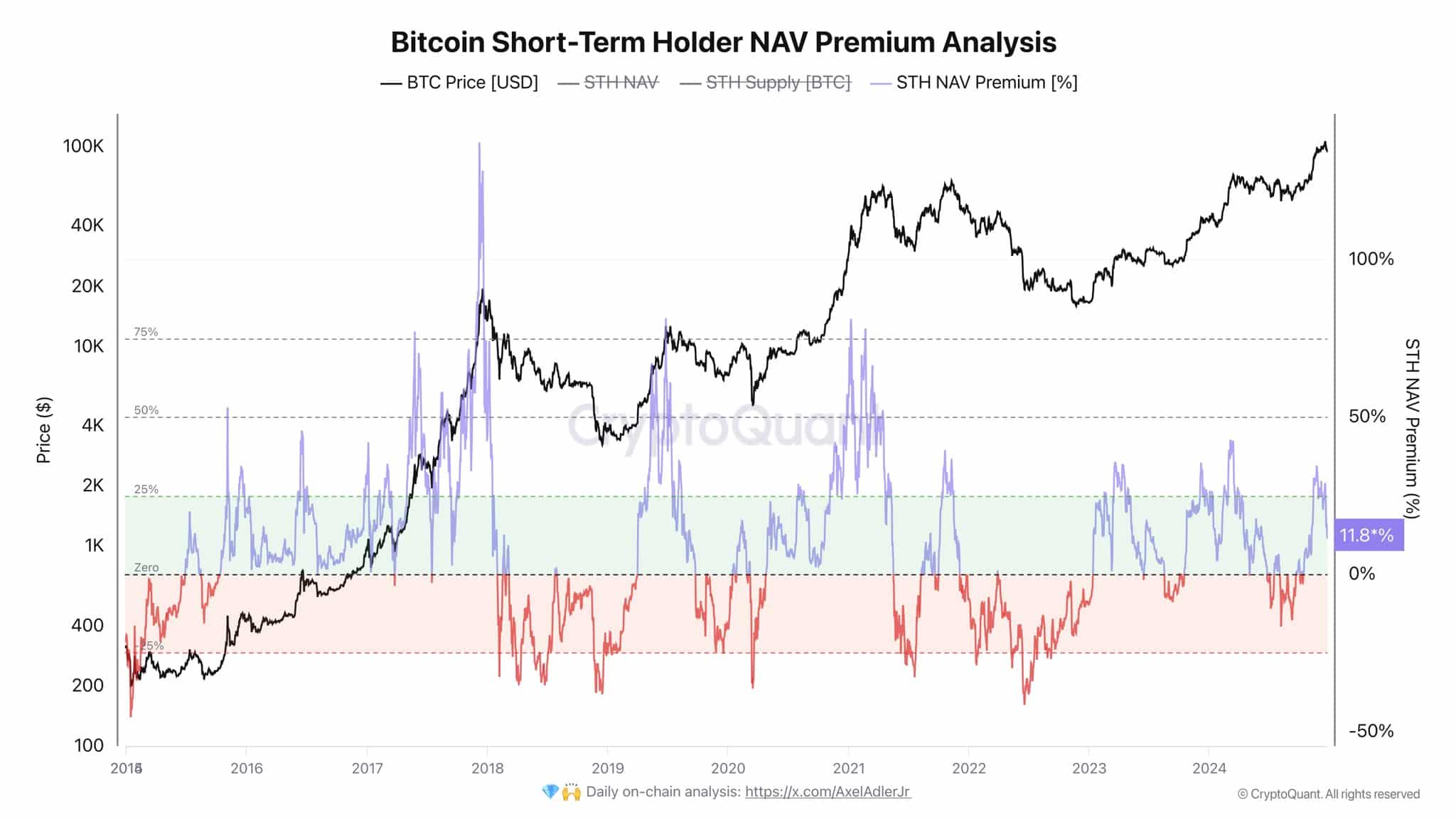

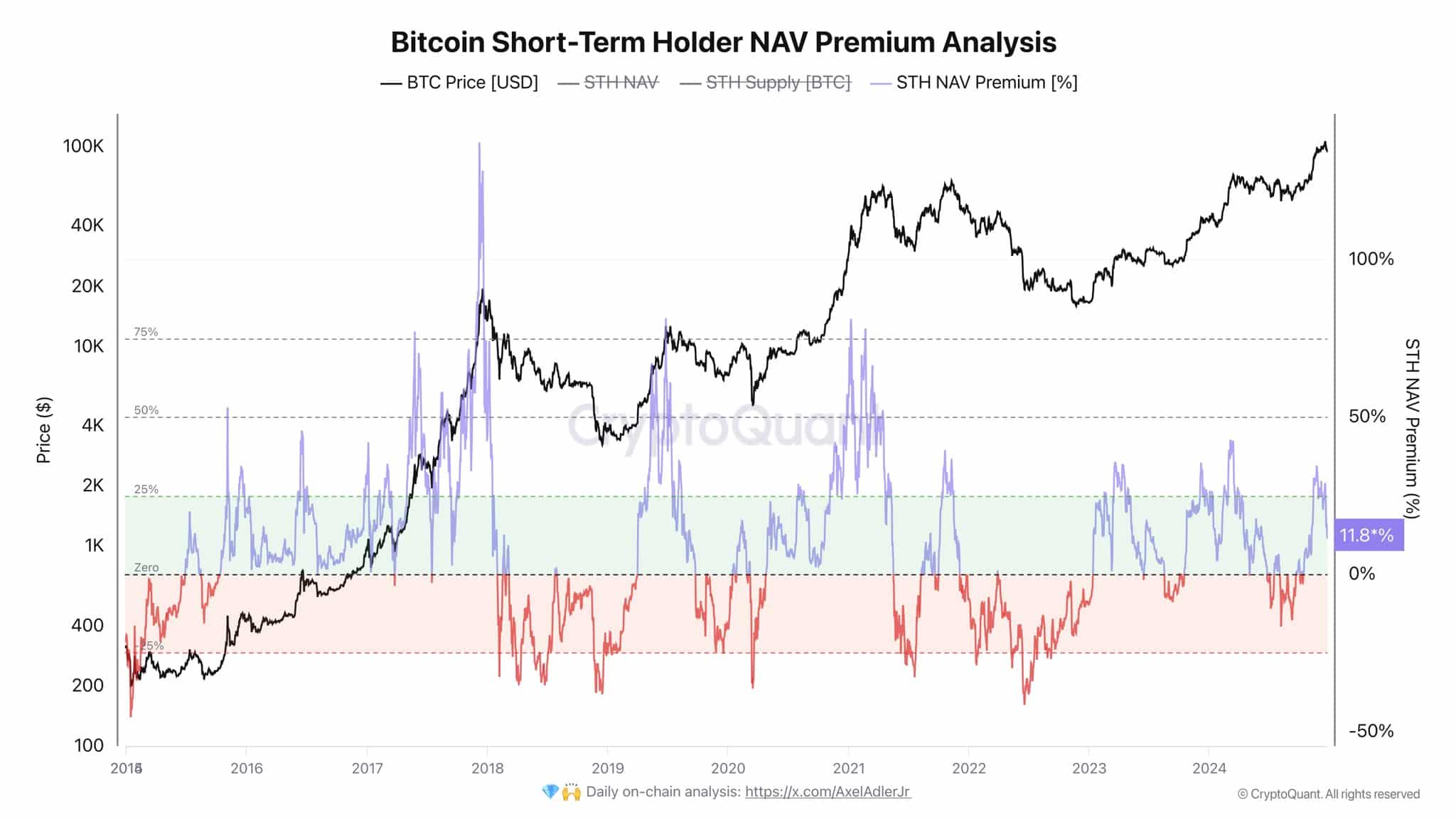

NAV premium for STHs and MACD signals

Furthermore, STH NAV Premium fell from levels above 30% to 11.8%, further supporting the expected price correction.

Previously, as the STH NAV premium approached zero, there was a slowdown in sales activity.

This meant that holders tended to hold on to their assets, expecting market conditions to improve. The repeating trend of the NAV premium falling to zero coincided with reduced volatility.

Source: CryptoQuant

According to the current value, there is potential for a decrease in selling pressure if it falls below zero, which could support the price of BTC if the trend follows historical patterns.

This scenario mentioned periods when the price stabilizes or rises, following sub-zero declines in the STH NAV.

Also, the MACD showed bearish crossovers at high levels, which has historically correlated with price corrections. Previously, such crossovers led to a drop in the price of Bitcoin by around 30%.

Bitcoin’s price peaked near historical resistance levels, in line with the bearish signals. This suggested that if BTC follows previous patterns, another significant correction could be on its way.

Source: trading view

This meant that BTC could move below the $90K level at the fourth target, after the current bearish crossover.

Bitcoin’s funding rate, premium and OI

However, Bitcoin’s Open Interest (OI) appeared to return to a supportive trendline, indicating a possible stabilization or recovery in the price.

This move reflected a previous correction pattern, which if repeated, could push Bitcoin’s price towards the $160,000 mark in the first quarter of 2025.

The funding rate, premium and OI were historically similar to those during the previous correction.

Source:

Read Bitcoin (BTC) price prediction 2024-25

In particular, the realized P/E ratio and STH realized price, currently at $86,000, indicated key levels where sentiment could shift, potentially dampening further corrections and strengthening the trajectory towards $160,000.

This analytical perspective, based on historical patterns and current on-chain metrics, offered a cautiously optimistic view of BTC’s short-term development.