- Bitcoin had risen 3% over the past seven days at the time of writing.

- Due to June’s lackluster action, Bitcoin ultimately recorded a negative return of almost 7%.

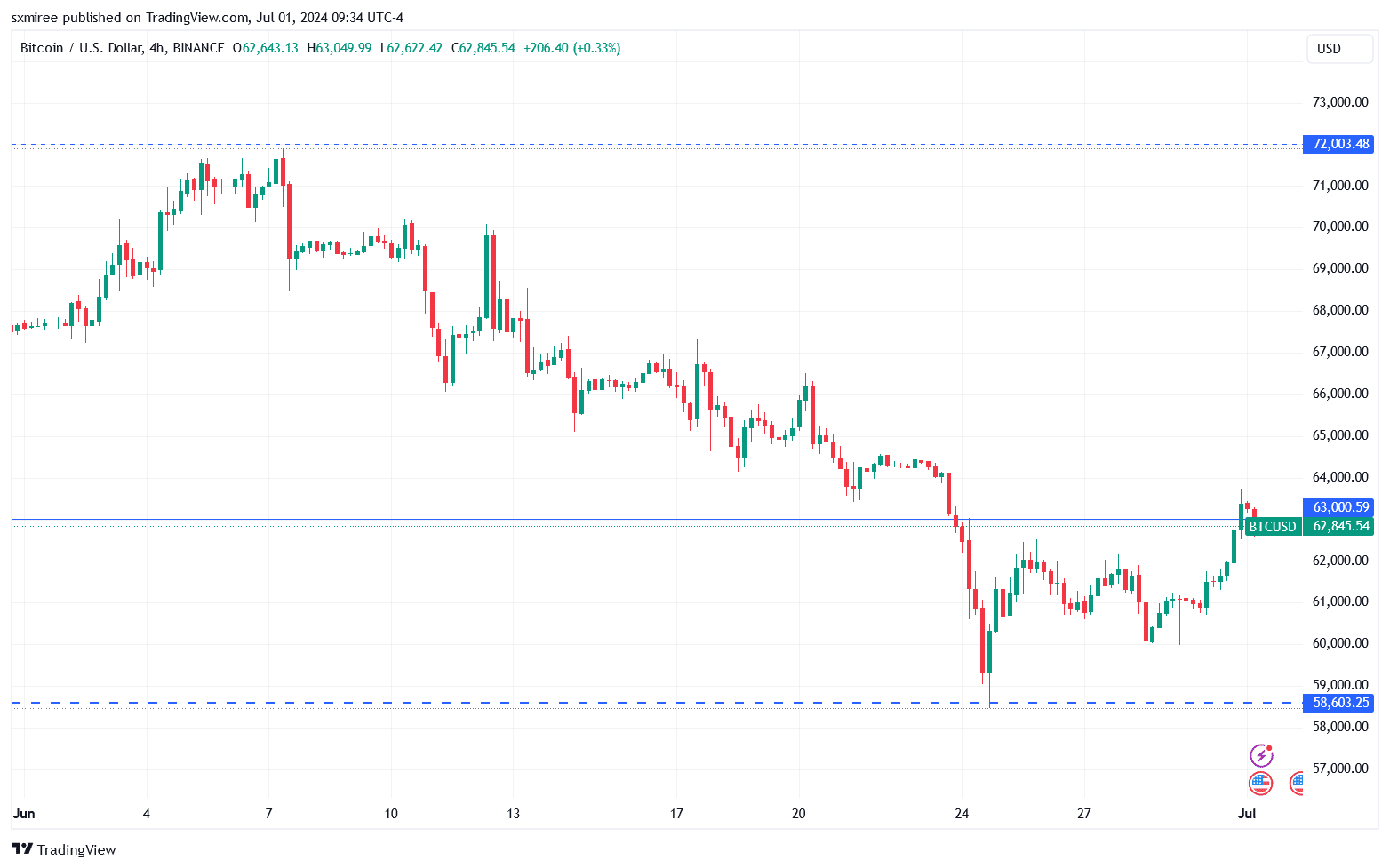

Bitcoin [BTC] traded promisingly above $63,000 over the weekend as bulls attempted to gain higher ground ahead of the monthly close.

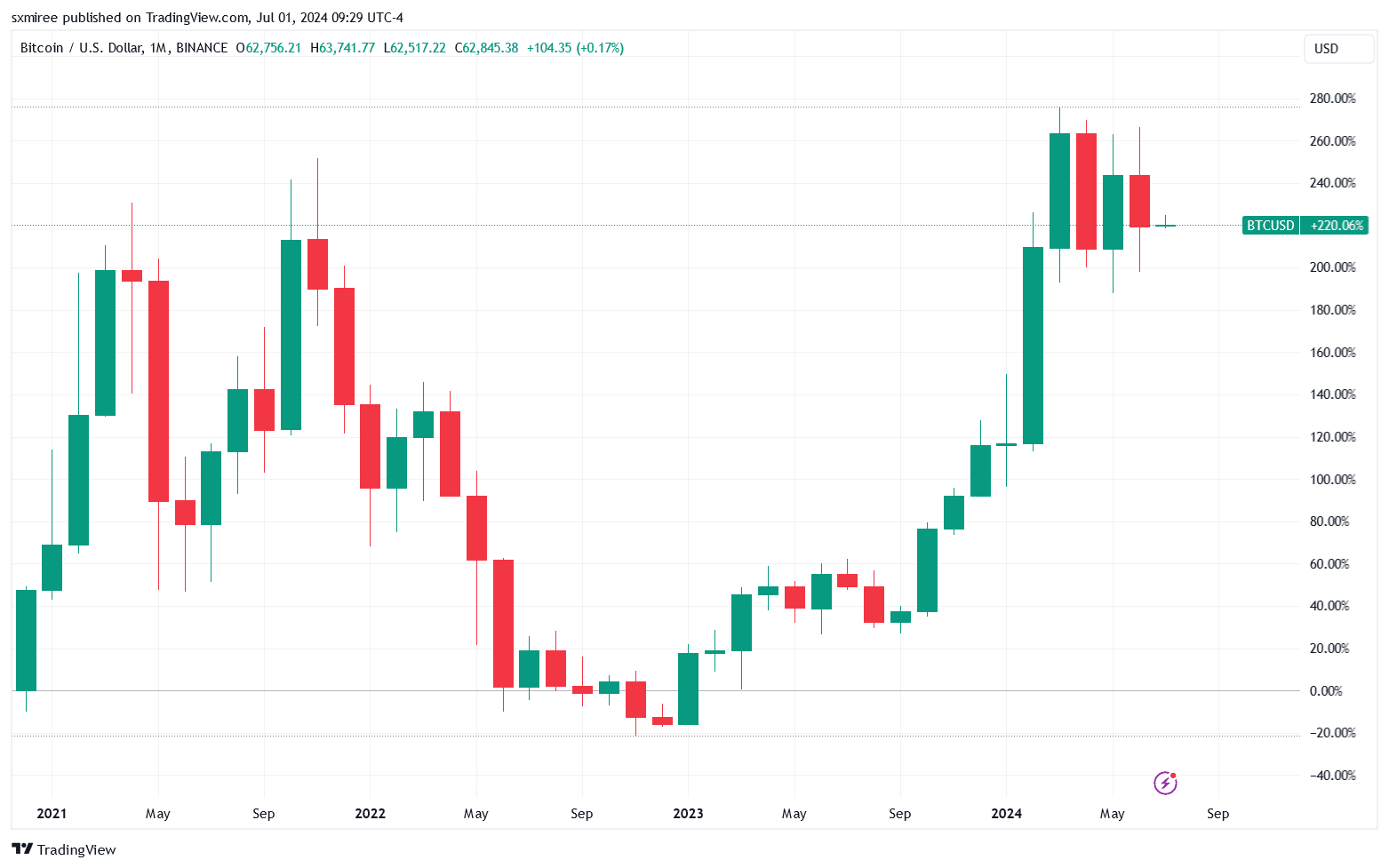

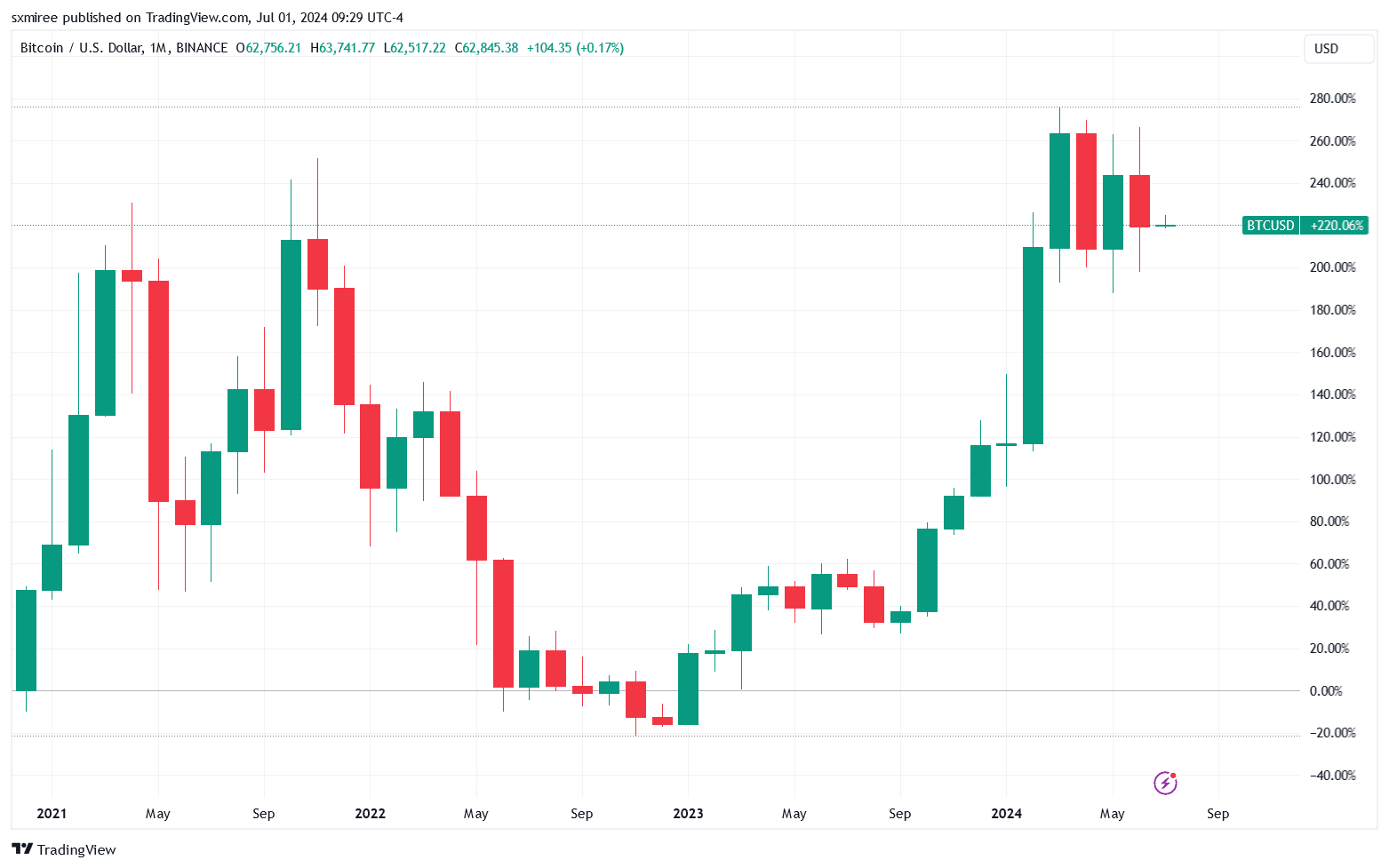

Although they successfully defended the crucial psychological support level of $ 60,000, stimulated by price increases on the last day of the month, the BTC/USD couple nevertheless printed red monthly and quarterly candles.

Source: TradingView

Here’s what’s ahead for the leading cryptocurrency:

Bitcoin price action

Due to the Matte Action of June, Bitcoin finally recorded a negative return of almost 7% over the entire month and about 12% for the just closed quarter.

The BTC/USD pair is confronted in the second half of the year with more price volatility, after a weak achievement in the past quarter, in which the couple booked two trips under $60,000.

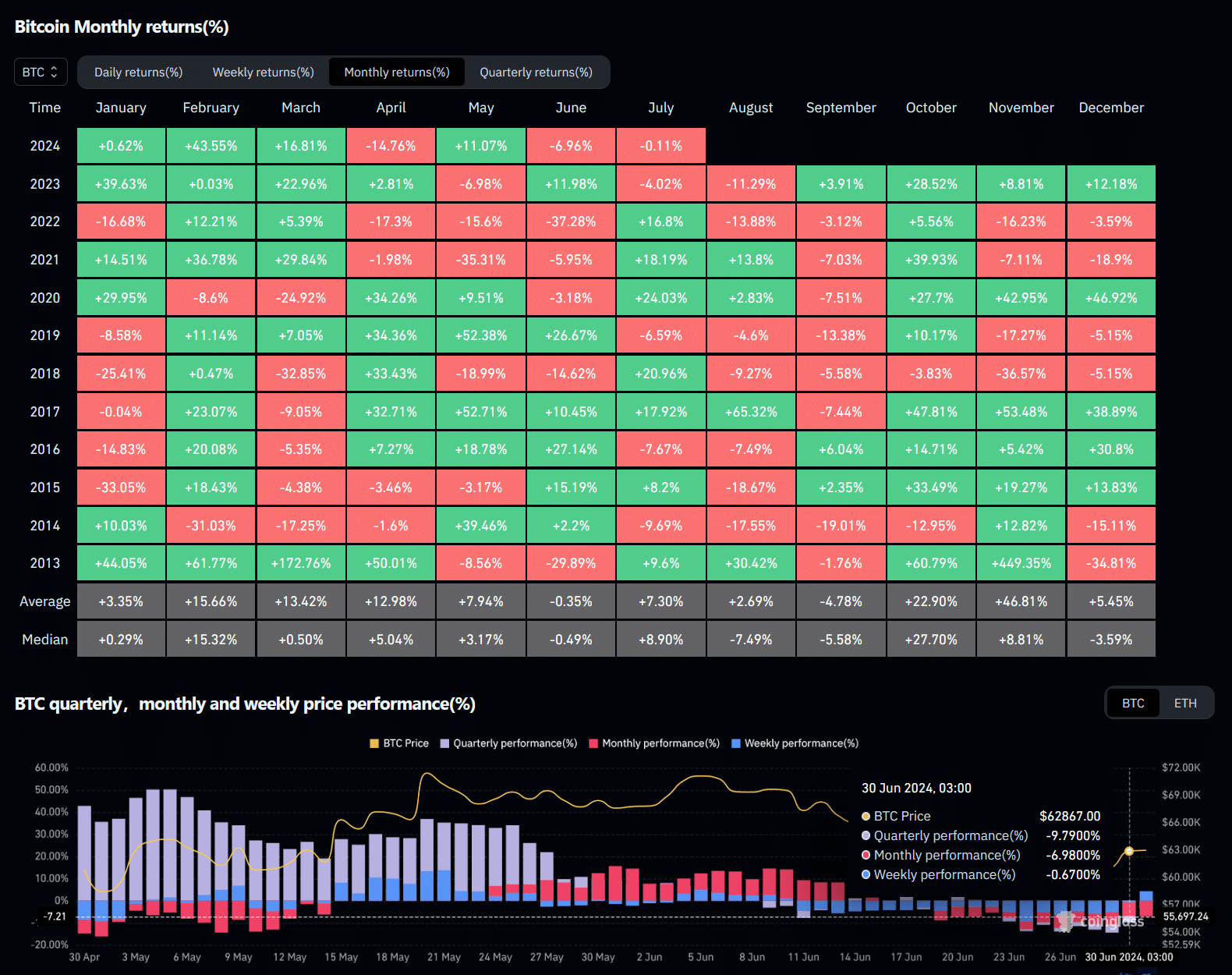

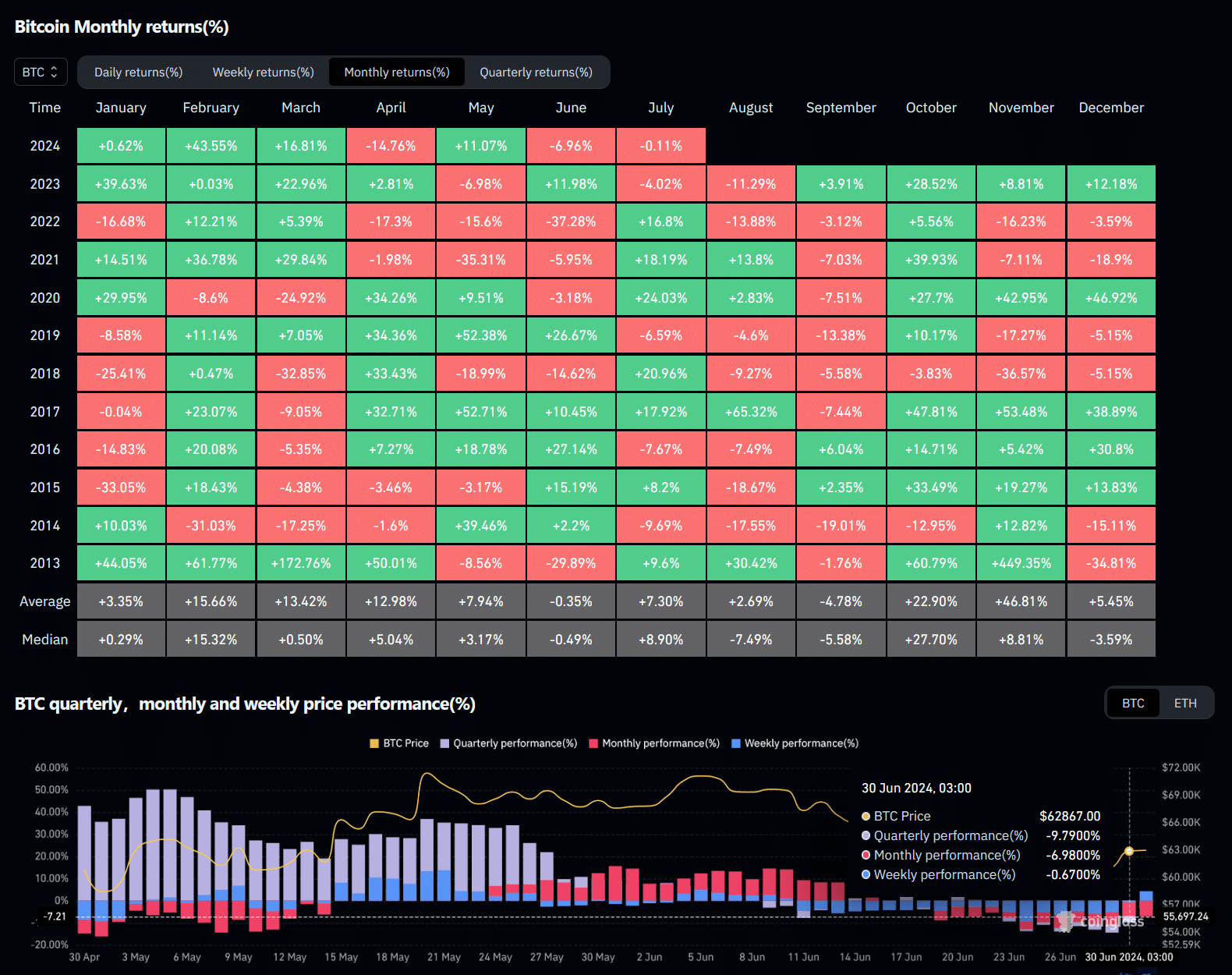

Source: Coinglass

The fundamentals indicate that Bitcoin still exists ready for potential upside in Q3. Bitcoin’s price has made a historic recovery in July, after negative returns in June, with an overall average return of 7.3% and a median return of 8.9%.

While Coinglass historical data confirms Bitcoin’s July recovery story after June’s slump, some market participants aren’t entirely sold on a bullish setup.

Macroeconomic image

Uncertainties remain in the macro picture as we enter the new month. This week, markets welcome mild catalysts in the form of US macroeconomic data releases, which could provide insight into central bankers’ views on inflation and interest rates.

Fed Chairman Jerome Powell is expected to speak at a European Central Bank conference in Sintra, Portugal on Tuesday, followed by the release of minutes from the previous Fed meeting on Wednesday.

Stock markets will reopen on Friday and welcome the June US jobs report.

Signs of decreasing inflation so far have made market commentators bet on an interest rate reduction cycle by the American Federal Reserve somewhere this year.

Markets broadly prediction two interest rates of 25 basis points each by the Fed before the end of the year according to CME’s FedWatch tool. These potential interest rates by the FED could lead to a greater inflow of investors into alternative assets such as cryptocurrencies.

In his annual economic report However, the Bank of International Settlements (BIS) warned on June 30 against premature easing of monetary policy.

The BIS advised at its annual general meeting,

“A premature easing could reignite inflationary pressures and force a costly policy reversal – all the more costly as credibility would be undermined. Indeed, the risks of unanchored inflation expectations have not disappeared, as pressure points remain.”

Market participants will need to keep an eye on the next meeting of the Federal Open Market Committee (FOMC), scheduled for July 30-31, to get a better sense of the Fed’s policies.

Read Bitcoin’s [BTC] Price forecast 2024-25

BTC/USD technical analysis

Bitcoin regained $63,000 during the July 1 trading session, reaching an intraday high of $63,700. However, from a technical perspective, Bitcoin is still showing weakness within the $58,500 to $72,000 range despite Monday’s price action.

Source: TradingView

A close below the 20-exponential moving average (EMA) around $63,650 could see the crypto slide back towards critical support at $60,000.