- Arbitrum and optimism emerged on top of the tier 2 sector in terms of net deposits.

- In the DeFi space, Arbitrum showed the most growth.

Despite the market uncertainty, the overall state of the L2 sector remained positive.

Realistic or not, here is ARB’s market cap in BTC terms

Arbitrum and optimism take charge

Optimism [OP] and Arbitrum [ARB] emerged as the leading platforms for layer 2 scale solutions in 2023.

They have experienced growth in terms of net deposits, with $631 million flowing into Optimism and an impressive $1.67 billion into Arbitrum.

However, it is critical to note that not all layer 2 solutions have seen the same success. In the case of Polygon and zkSyncEra, they faced significant value outflows of $393 million and $171 million, respectively.

When categorizing these protocols, we see a remarkable trend. Optimistic rollups, a specific type of layer-2 scaling solution, have generated significant positive net flows this year.

In contrast, ZK rollups and other types of layer 2 solutions experienced outflows of $101 million and $393 million, respectively. These numbers indicate a diversification in the adoption and success of layer 2 solutions within the crypto ecosystem.

The substantial net deposits into Optimism and Arbitrum this year could have a positive impact on the tier 2 sector. They indicate growing trust and use of these platforms, making them more prominent in the crypto space.

Among L2 rollups is #Optimism And #Arbitrum have seen the highest amount of net deposits YTD. There are $631 million in net inflows from Optimism and $1.67 billion from Arbitrum. #Polygon And #zkSyncEra have seen the most valuable flight YTD, with net outflows of $393 million and $171 million respectively. pic.twitter.com/KJneOjZY6i

— Galaxy Research (@glxyresearch) November 2, 2023

On the other hand, the net outflow from Polygon and zkSyncEra raises concerns. It suggests that not all layer 2 solutions are equally successful, and that some face challenges in maintaining user interest and investment.

Breaking down the protocols by type, bullish rollups saw positive net flows YTD, while ZK rollups and other types of L2s saw outflows of $101 million and $393 million, respectively. pic.twitter.com/KkmJkIfbGu

— Galaxy Research (@glxyresearch) November 2, 2023

This diversification in adoption shows that the layer 2 sector is evolving, with different solutions finding their place.

It’s a sign of the market’s maturation as users explore platforms that best suit their needs. However, competition remains fierce.

Arbitrum thrives in DeFi

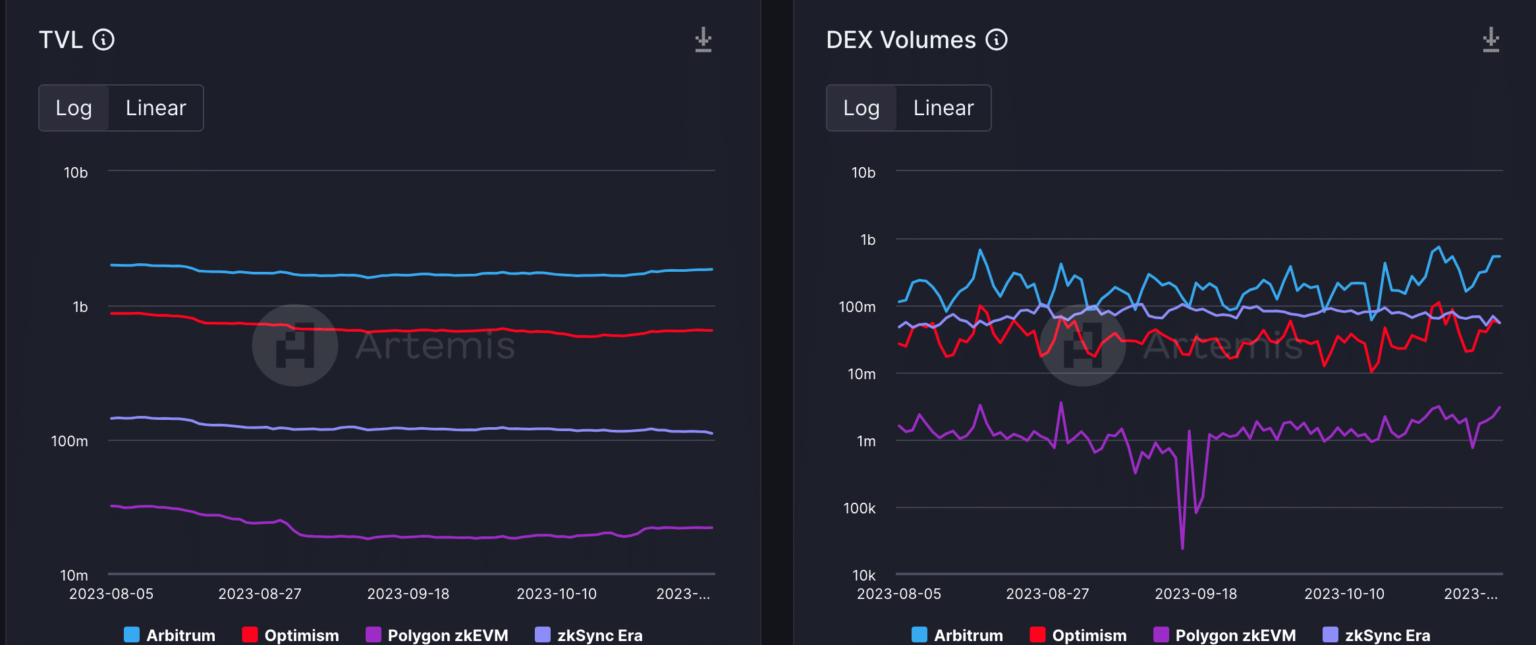

As for the DeFi sector, Arbitrum was seen to have surpassed other protocols in this space in terms of TVL (total value locked), it ranked number one.

This higher TVL is a good sign for Arbitrum. It shows that users have confidence in the platform. In terms of DEX volumes, Arbitrum also performed well and outperformed other solutions.

Is your portfolio green? View the ARB Profit Calculator

DEX volumes in DeFi refer to the total amount of cryptocurrency trading taking place on decentralized exchanges. It shows how active and popular these exchanges are.

When Arbitrum has higher DEX volume than other protocols, it means more people are trading on Arbitrum’s decentralized exchange.

Source: Artemis