In recent days, the general cryptocurrency market has experienced a remarkable price decrease. In the midst of this, Ethereum (ETH), the world’s second largest cryptocurrency per market capitalization has reached a crucial level for the first time since 2023 near $ 1,800. However, investors and holders in the long term regard this level as an ideal buying option.

Main level for Ethereum (ETH)

Today, March 13, 2025, a prominent crypto expert shared a message on X (formerly Twitter), which stated that the most important level for Ethereum is $ 1,887, with whales and investors gathering 1,63 million ETH tokens. This message attracted enormous attention from Crypto enthusiasts and inspires whether it is a bullish sign for investors or an ideal buying option.

Ethereum (ETH) Technical analysis and upcoming levels

According to the technical analysis of experts, ETH is in the vicinity of a crucial level of support of $ 1,800. However, if it does not hold on to this level, a huge price decrease can take place in the coming days.

Based on recent price action and historical patterns, if it remains active above the level of $ 1,800, it could rise by 20% in the coming days to reach $ 2,200. On the other hand, if ETH falls and a daily candle closes under $ 1,780, it can fall by more than 16% to reach $ 1500.

From now on, ETH’s relative strengths index (RSI) is close to the over -sold area, which indicates a low strength in the active and suggests that the price can fall in the coming days.

Current price momentum

At the time of pressure, ETH is near $ 1,840, with a price fall of more than 2.5% in the last 24 hours. During the same period, however, the trade volume fell by 30%, which indicates lower participation of traders and investors compared to previous days.

Traders who exceeded the levels

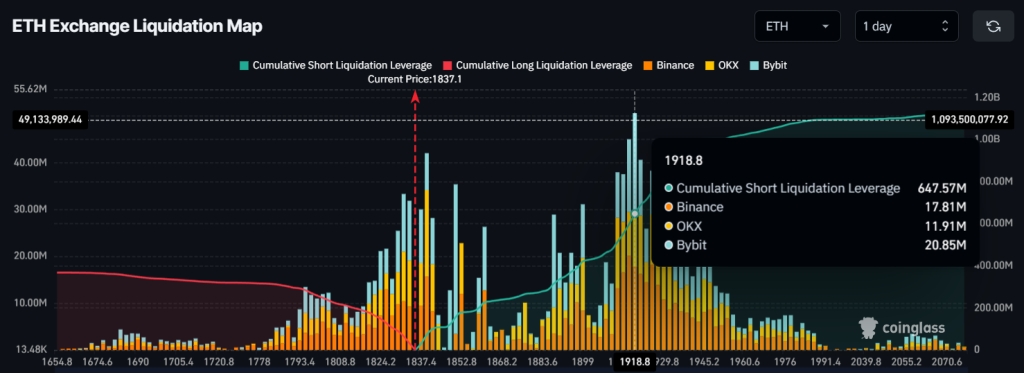

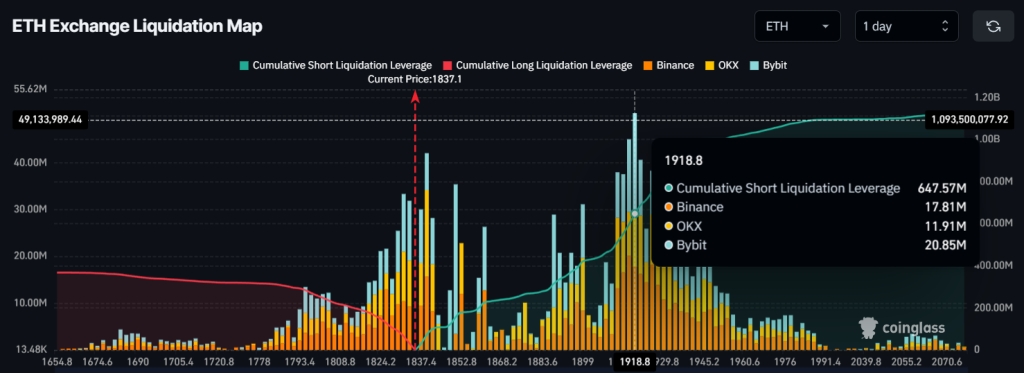

Looking at the price fall, intraday traders seem to have a bearish prospect, as reported by the on-chain analysis company Coinglass.

Data shows that traders are used too much for $ 1,795, which currently have $ 285 million in long positions. In the meantime, another level level level is $ 1,920, with traders for $ 650 million in short positions.

This on-chain meter partly confirms that traders are currently Bearish on ETH and believe that the price will not rise above the level of $ 1,920.