- Runes on Bitcoin’s blockchain can save traders from huge losses in the coming months.

- Staking on the Ethereum blockchain is on the rise, raising concerns about its future as “money.”

Ahead of the May 2024 FOMC (Federal Open Market Committee) meeting, the crypto market saw a significant decline. Bitcoin fell to $56,494 – a level last seen on February 28, 2024. Market sentiment shifted to the side of fear as investors rebalanced their portfolios in anticipation of no rate cuts.

Bitcoin’s MVRV ratio (7-D) fell to -8.099% at the time of writing. On average, Bitcoin holders found themselves underwater. It suggested that the market value was significantly lower than the price at which most bought BTC.

It can also be taken as a sign of undervaluation. According to AMBCrypto’s market report for the month of April, Bitcoin will continue its downward journey for the majority of trading sessions in May.

Source: Santiment

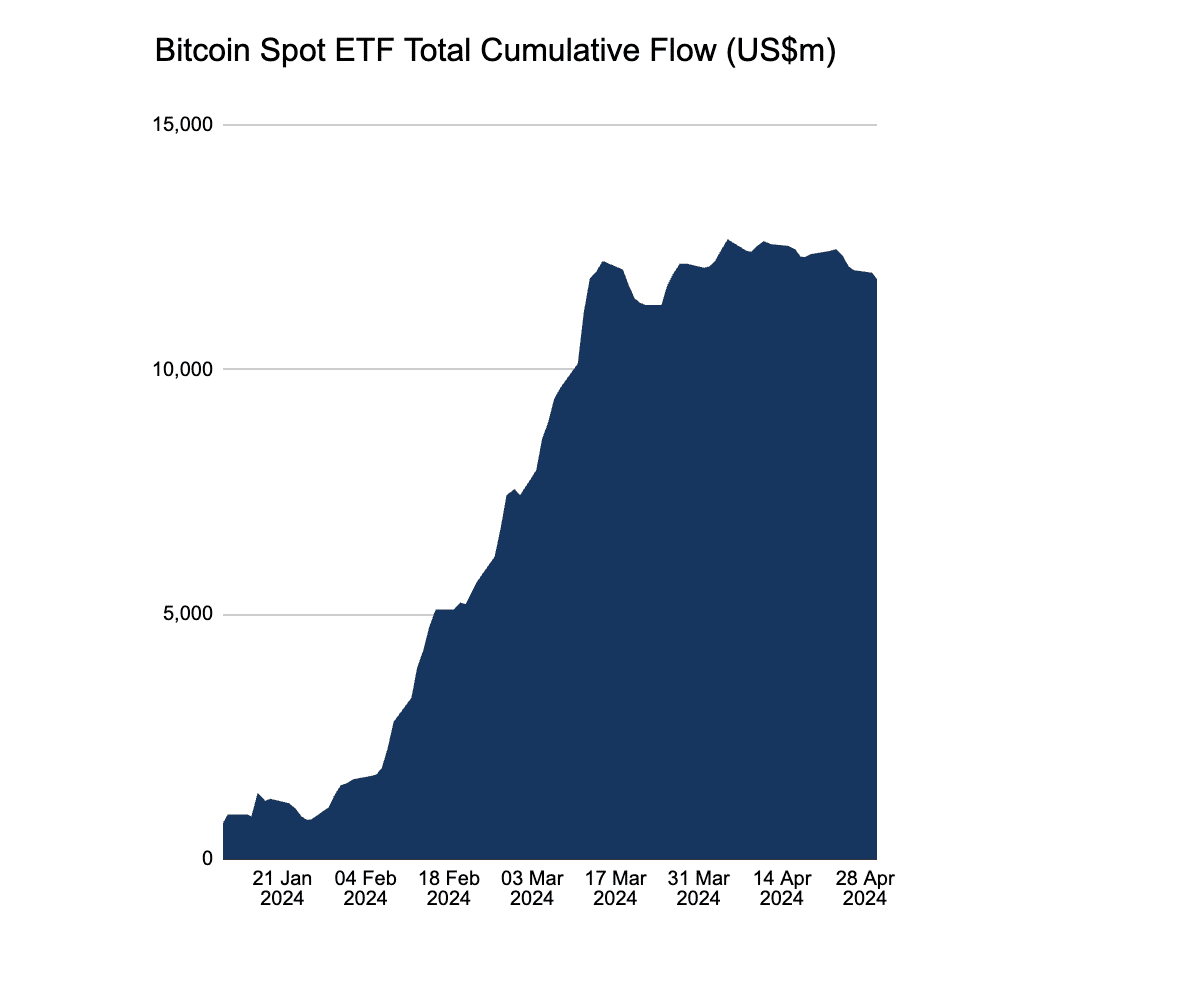

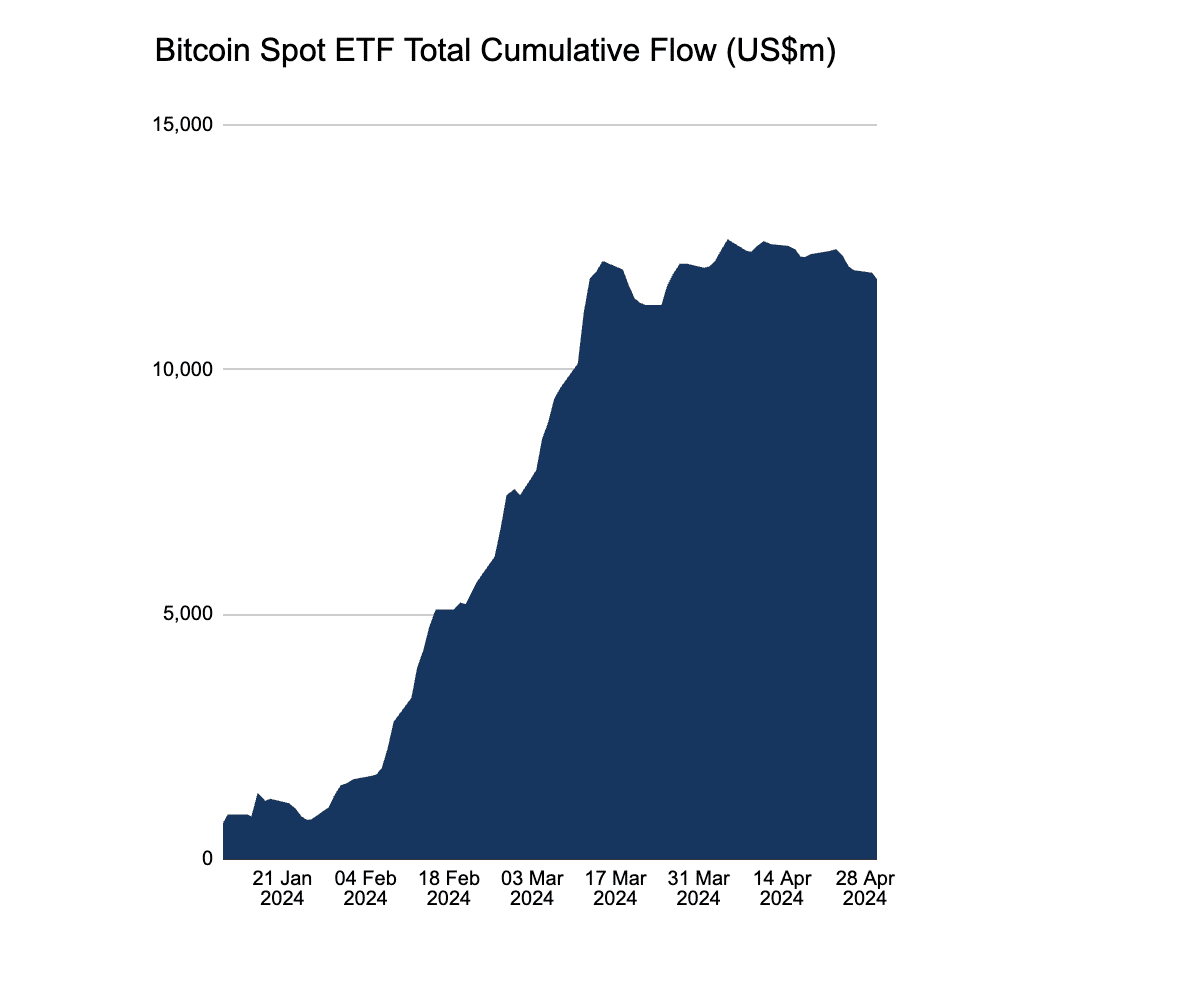

However, the report discusses three factors (related to BTCFi, Options ETF and Solana) that could reverse the king coin’s trajectory. Investing through BTC ETFs will have a greater impact on the price, compared to expected Fed rate cuts or geopolitical tensions.

Since April 24, BTC ETF outflows have exceeded inflows. On April 30, outflows of $161 million were recorded – the highest in the past three days.

However, AMBCrypto’s report sheds light on a new perspective: it reveals that numerous institutions are seeking approval for Bitcoin ETFs. If these ETFs get the green light in May, it could lead to a significant increase in demand, potentially driving the price north.

The savior of Bitcoin – Runes

The rise of DeFi on the Bitcoin blockchain could prevent traders from suffering huge losses in the coming months (AMBCrypto’s report dives into the full details).

Interestingly, the seven-day moving average of Bitcoin’s market capitalization to transaction fee ratio fell below that of Ethereum. It highlighted a massive increase in activity on the Bitcoin network since the launch of the Runes Protocol. Basically, this ratio indicates how much money flows into a cryptocurrency in relation to the transaction fees paid.

Performance of Altcoins in April

Following Bitcoin, the price of other cryptocurrencies also fluctuated significantly. April was a volatile month for most altcoins. The broader market witnessed a downturn due to geopolitical tensions and inflation fears. However, some sectors flourished, such as gaming tokens.

According to AMBCrypto’s report, Ethereum’s dominance is being challenged by Solana, whose DeFi market share is steadily rising. Meanwhile, an Ethereum ETF is still awaiting SEC approval, and betting on the Ethereum blockchain is increasing, raising concerns about its future as “money.”

View AMBCrypto’s market analysis – April 2024 edition

Dive into April market trends, valuable data and exclusive insights to help you navigate May’s market moves.

The report delves deeply into important topics such as:

- Rising popularity of DeFi on Bitcoin

- America’s love for memecoins

- Decline in USDT dominance

- Solana’s TVL masterpiece

- Recovery of the NFT market

- Market forecast for May

You can also download the full report here.