- Bitcoin whale trades are experiencing a significant drop, impacting BTC circulation and exchange balances.

- Regular trades soar to an all-time high, despite BTC remaining below the neutral line on RSI.

In the midst of Bitcoin’s rollercoaster ride [BTC] price fluctuations, the activities of major players in the cryptocurrency market, known as whales, have noticeably slowed down in recent months. This decrease in whale transactions has had an impact on the overall circulation of BTC.

Despite this, mainstream trades have shown resilience and continue to gain momentum.

Read Bitcoin [BTC] Price Forecast 2023-24

Bitcoin whales slow down transactions

from Glassnode data revealed a significant slowdown in Bitcoin whale transactions over the past few months. In particular, BTC inflows to whale exchanges have been remarkably quiet this year, with current transfer volume at $187 million. Compared to the peak inflow value of $1.82 billion, there is a striking drop of 85.4%, highlighting the severity of the reduction in whale trades.

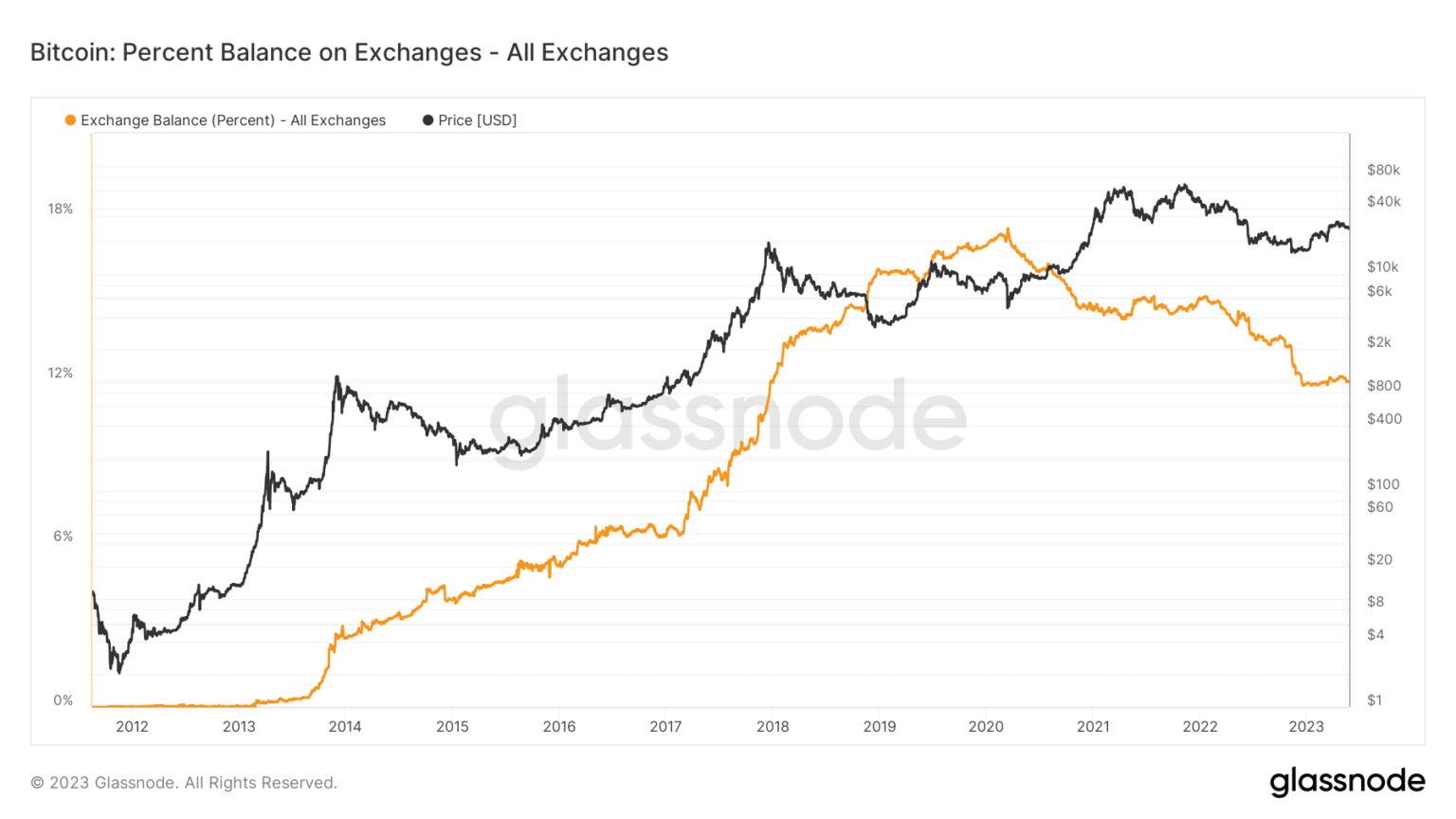

Moreover, this drop has consequently led to a drop in the total BTC balance on the exchanges. According to the BTC exchange balance statistic, the current balance was at its lowest point. It had about 2.3 million BTCs across all exchanges. In addition, this translated into the lowest percentage balance on exchanges based on the current currency balance measure, which was about 11.8%.

Source: Glassnode

Analysis of Bitcoin flows between exchanges

Despite the decline in whale transactions and the decline in BTC balances across exchanges, Bitcoin has maintained a healthy flow of activity across several exchanges. The flow metric, which monitors daily BTC deposits and withdrawals on exchanges, showed notable inflows and outflows.

Source: Glassnode

However, at the time of writing, more withdrawals than deposits were observed on various exchanges. Total inflows currently exceeded 22,000 BTC, while outflows exceeded 31,000 BTC. Overall, there was a relatively balanced volume between inflows and outflows each day, resulting in a smaller aggregated net flow volume.

Transaction reaches historic high

Despite the apparent reluctance of Bitcoin whales to actively participate in the current market, transactions are thriving. At the time of writing, Bitcoin transactions hit an all-time high. The number of transactions had passed 512,000, a remarkable increase of 120%.

Is your wallet green? Check out the Bitcoin Profit Calculator

This unprecedented level showed that retail transactions were gaining momentum and driving the total number of transactions even without substantial contributions from whales.

Source: Glassnode

At the time of writing, Bitcoin was trading at around USD 26,480, making a small daily loss of less than 1%. In addition, it remained positioned below the neutral line on the Relative Strength Index, indicating a bearish trend in the market.