- Long positions have seen more than $36 million in liquidations, compared to about $6 million for short positions.

- The crypto market has maintained its $1 trillion market cap despite the drop in crypto market caps.

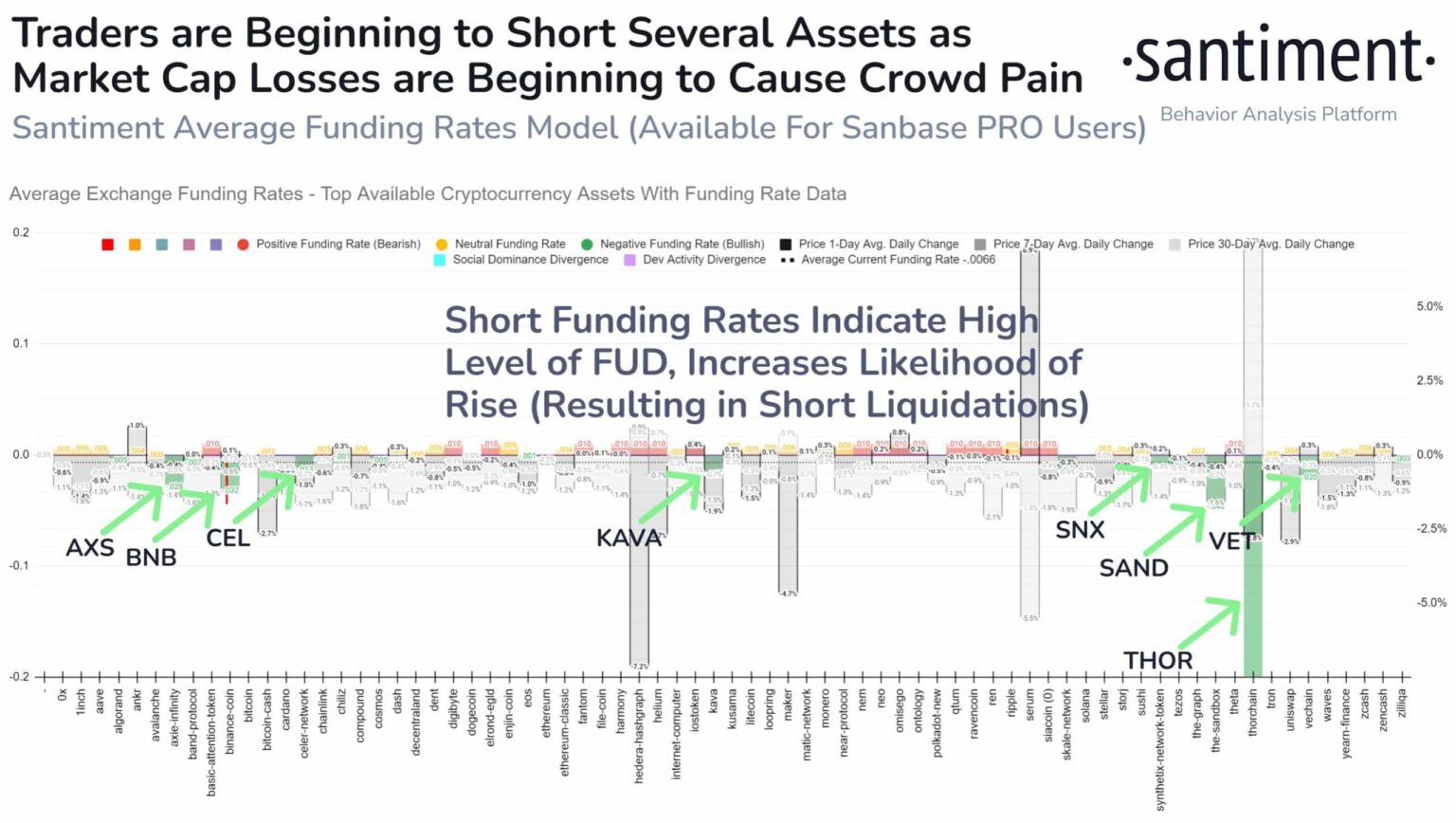

In the past week, most of the leading cryptocurrencies in the crypto market have experienced declines. As a result, some traders have taken short positions in the market, speculating on the continuation of the downward price trend.

The crypto market is seeing more short positions

A recent message from Sanitation showed that the prevailing position in the crypto market was short. Many traders apparently embraced short positions in most assets in response to falling prices.

The escalating short positions, visible through the negative funding rate, can cause Fear, Uncertainty and Doubt (FUD) and lead to more liquidations.

Source: Sentiment

While these short positions can reflect pessimistic market sentiment, they can also serve as a harbinger of a bullish trend. This is because bullish traders could take the opportunity presented by the price dip to initiate buying activity.

Crypto Market Short vs. long positions

According to data from Mint glass, the continued decline in crypto market prices has led to fewer liquidations for short positions than for long positions. An examination of the liquidation chart revealed significant liquidation activity for long positions on August 15 and 16.

The trend has continued as of this writing.

On August 15, long positions were liquidated for more than $122 million, as opposed to about $9.5 million for short positions. Moving to August 16, liquidations of long positions reached $111 million, while short positions endured about $15 million in liquidations.

At the time of writing, long positions have encountered about $37 million in liquidations, while short positions have returned about $6 million.

Source: Coinglass

In addition, the study of the long/short ratio for top assets by market capitalization on Coinglass highlighted the prevalence of short positions. Bitcoins [BTC] short position surpassed $15 billion at time of press, interspersed with long positions totaling more than $13 billion. For Ethereum [ETH]short positions amounted to approximately $5.9 billion, while long positions amounted to approximately $5.4 billion.

So is Ripple [XRP] and Binance Coin [BNB] showed significant figures. At the time of writing, long and short positions for XRP have exceeded $1 billion and $960,241 million, respectively. Meanwhile, BNB’s long and short positions were $241 million and $232 million, respectively, during the same period.

The crypto market maintains its $1 trillion capitalization

Despite the observed decrease CoinMarketCap data indicated that the crypto market had maintained its capitalization above $1 trillion. However, data from CoinMarketCap showed that the collective market cap was down about 1.7% at the time of writing.

In addition, major cryptocurrencies such as BTC, ETH, BNB, and XRP have experienced value drops of approximately 2%, 1.7%, 1.4%, and 2.3%, respectively, in the past 24 hours.

Over the past week, these declines have been more pronounced, with BTC and ETH encountering declines of over 3%, BNB down over 4%, and XRP down over 6%.