- BTC recorded its highest daily number of active addresses on August 2.

- The recent surge in network activity, increase in loss-making trades, and growing negative sentiment are all indicators of a near-term price rally for Bitcoin.

The number of daily active addresses trading Bitcoin [BTC] rose sharply in August, reaching a three-month high of 1.07 million on Aug. 2, data from Santiment showed. The number of addresses that have completed BTC transactions today is still growing and reached 1.03 million.

📈 #Bitcoin‘s address activity rose to its highest level in 3.5 months in August. This increase in utilities, combined with large loss trades and negative sentiment, is a strong sign that a short-term (minimum) $BTC price increase is more likely. https://t.co/5PzjYROX5T pic.twitter.com/G2tevAWdSM

— Santiment (@santimentfeed) August 3, 2023

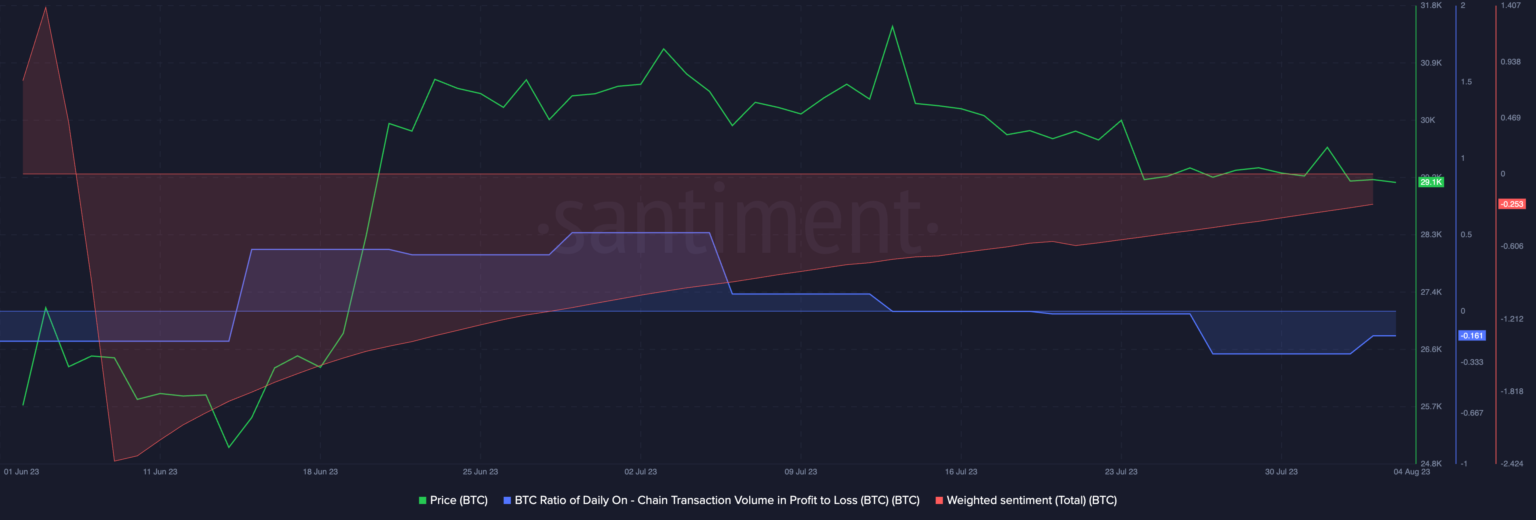

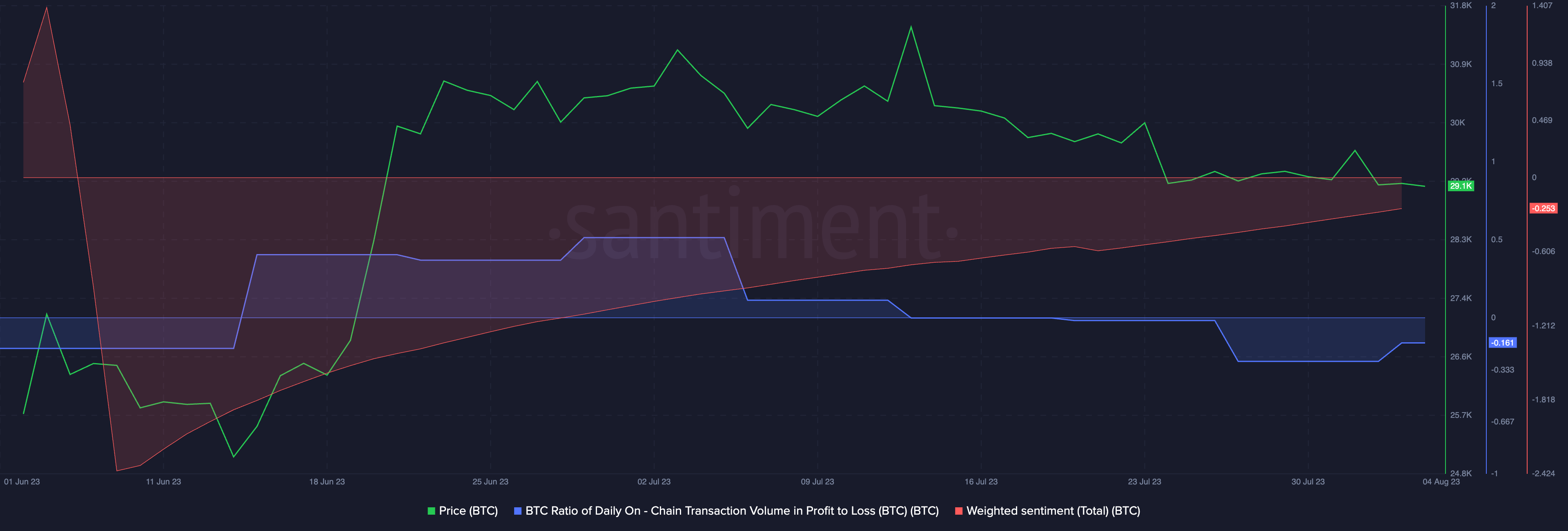

As the number of daily active BTC addresses increases, the number of transactions involving the cryptocurrency that have resulted in losses has also increased. An examination of the currency ratio of daily on-chain transaction volume in profit to loss revealed this.

This indicator measures the value of an asset’s trades that return the profit to the value of the trades, resulting in a loss within one day. When the indicator registers an increase and is above the zero line, market participants are making more profit than loss. Conversely, market participants record more losses when this metric returns a value below zero.

BTC’s ratio of daily on-chain trade volume in profit to loss was -0.161 at the time of writing, suggesting that more BTC trades were generating losses at the time of writing.

Furthermore, weighted sentiment remains negative as the currency remains in a narrow price range. According to Santiment, BTC’s weighted sentiment was -0.25 at the time of writing.

According to Santiment:

“This increase in utility, combined with large losing trades and negative sentiment, is a strong sign that a near-term (at the very least) price increase of $BTC is more likely.”

But is the king coin ready for such a leap?

Finally a reason to smile?

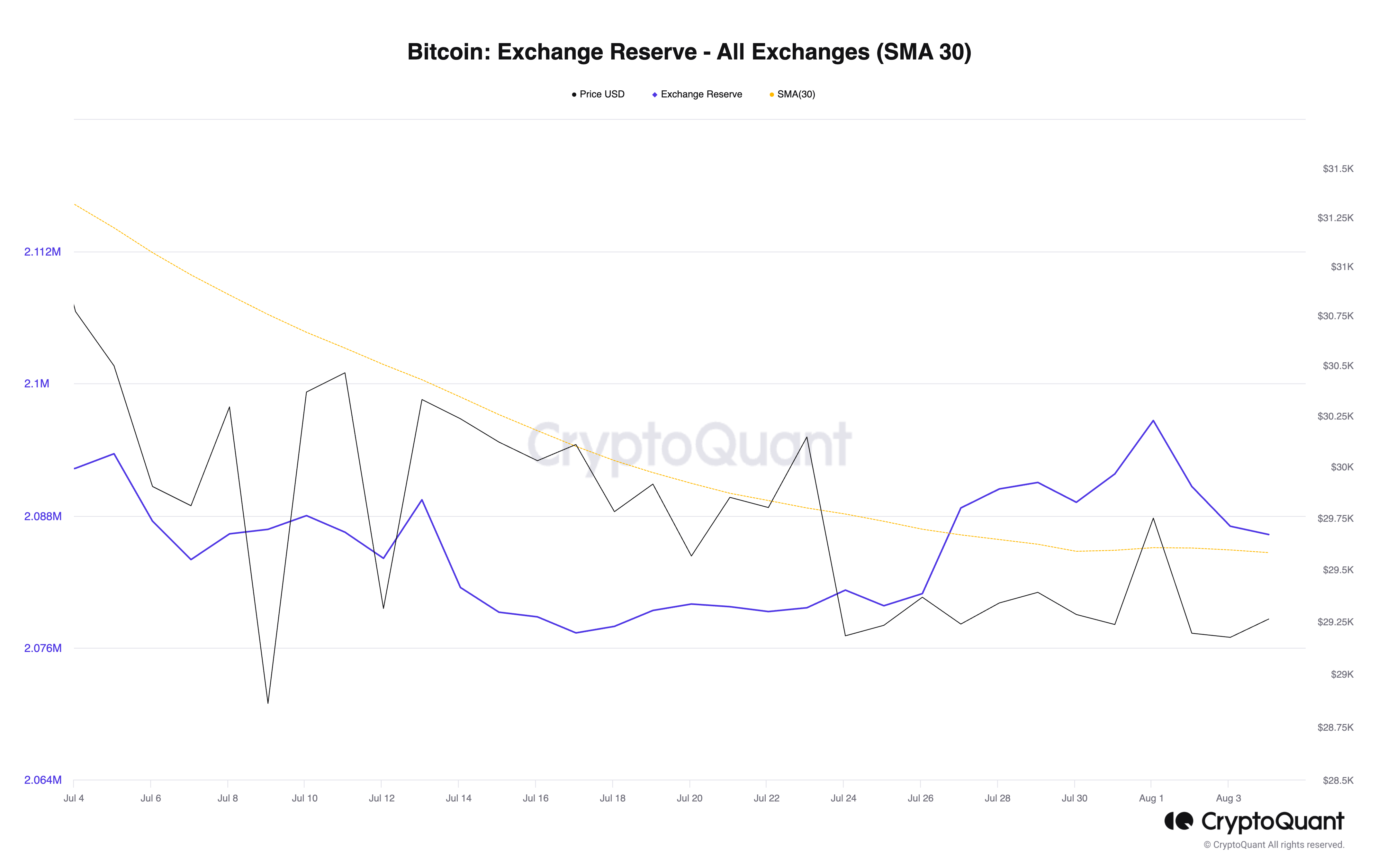

Despite strong resistance at USD 30,000 and trading in a tight range over the past two months, BTC holders have been reluctant to sell their coins, according to an analysis of exchange activity.

A look at foreign exchange reserves based on a 30-day moving average revealed a 1.4% drop over the past month. This metric tracks the total number of BTCs held within cryptocurrency exchanges.

When the value of BTC exchange reserves increases, it indicates higher selling pressure as more coins are forwarded to exchanges for further sale. On the other hand, a decline suggests a reduction in BTC distribution and often presages a rise in price.

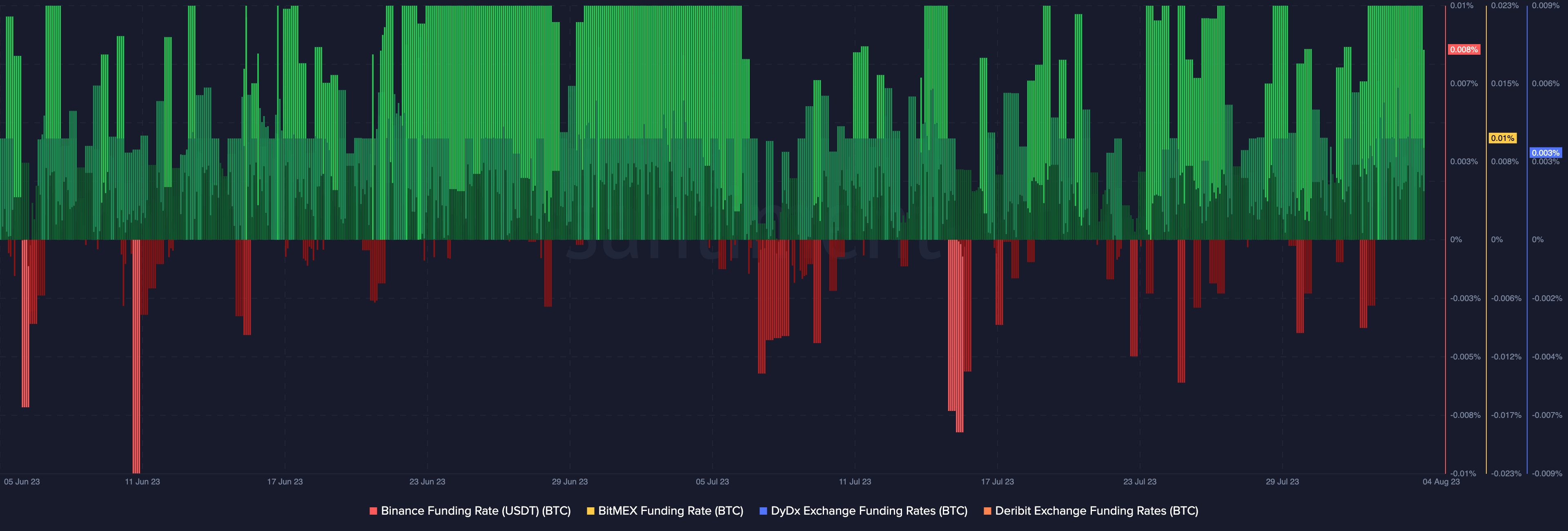

In addition to the decreasing number of BTC sales, most traders are betting on a price increase. This is evidenced by futures funding rates on leading exchanges, which show that there are more longs than shorts. This is a positive sign as it suggests that many traders believe that the price of Bitcoin will rise in the near term.

While these on-chain indicators point to near-term price growth, it remains important to pay attention to macro factors that can negatively impact BTC’s price.