Binance founder and former CEO Changpeng Zhao (CZ) recently proposed a 3x or 10x reduction of BSC gas costs. Barely 24 hours later, the Binance Smart Chain gas costs reduced by 10x, with a reduction of 90%. The movement Builders and users helped enormously.

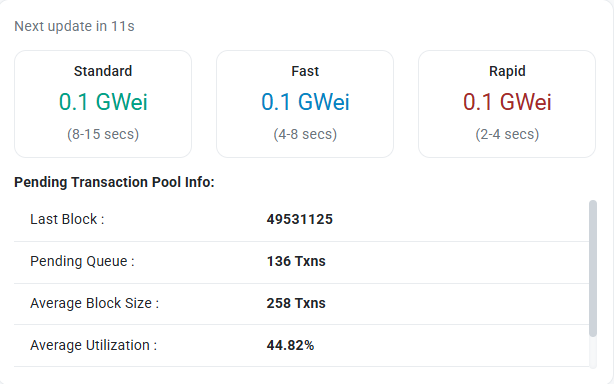

In an exclusive at Beincrypto, the BNB Chain core development team breaks down the story behind the dramatic reduction of 90% gas costs. Moving from 1 Gwei to 0.1 Gwei, they clarify governance mechanics, market stimuli and the changing position of the chain in the Layer-1 versus Layer-2 Stack War.

CZ may have lit the spark, but Validators control the fire

The story about the dive of the Binance Smart Chain’s Gas Fege This May from 1 Gwei to 0.1 Gwei was quickly attached to a single catalyst: a tweet from Binance founder Changpeng Zhao.

This is in the midst of a space that is often dominated by headlines. However, behind the scenes there is something deeply unfolding.

Validature-driven Hercalibration of the dynamics of network prices is tailored to a strategic push to anchor the role of the BNB chain in a multi-layered, scalable blockchain-quill.

An exclusively speaking against Beincrypto, a spokesperson for BNB Chain Core Development drove the idea that this was a top-down decree by Changpeng Zhao.

“Because the minimum gas price institution is not part of the consensus mechanism, it is a market dynamic as chosen by validators. The community of validators responds to calls from CZ, but in the end it is their decision,” said the spokesperson.

BSC gas costs. Source: BSCSCAN

In other words, while CZ’s call led to the debate, the last leverpull came from Validators. The validators include a distributed group balancing network demand, block space facility and protocoleconomy.

Not about rival chains – it’s about market efficiency

Ethereum’s Layer-2 Rollups and the benefits of Solana have not inspired the 90% reduction In BSC gas costs. Instead, the validator sentiment and the expectations of users have made this decision.

“It is driven by the community and a market dynamic of block space. It is also not universally enforced. Some DAPPs and platforms still use higher reimbursement institutions,” the spokesperson added.

That reservation, where gas costs are not uniform about tools and Dapps, explains why some users may not feel the impact yet.

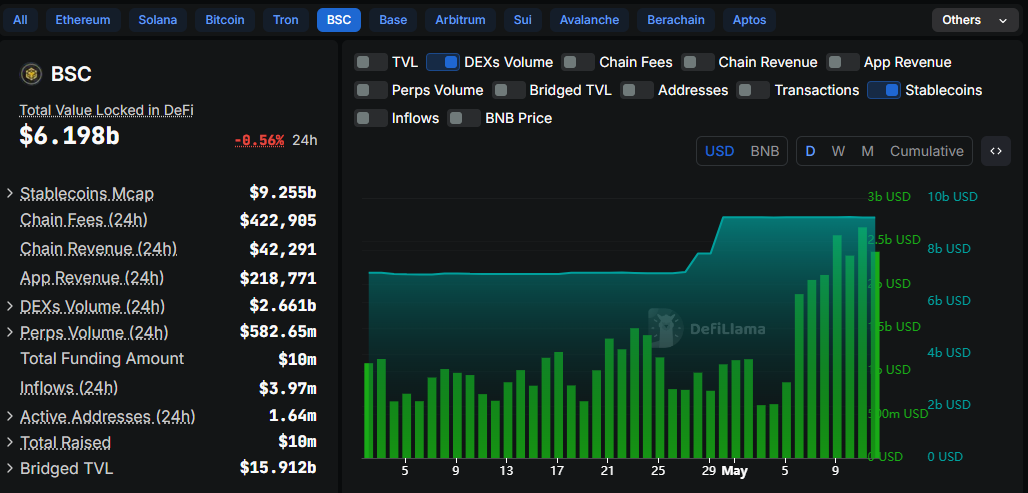

Nevertheless, statistics suggest that momentum is building. BSC has seen recent peaks in Decentralized Exchange (DEX) Trading and Stablecoin transfers, regardless of the latest change in cost.

BSC DEX Handelsvolume and Stablecoin transfers. Source: Defillama

BSC + OPBNB: Two-layer, one vision

While BSC continues to anchor the BNB Ecosystem, the real Masterstroke is in its layered architecture. OPBNB, the high -speed of the network, focuses on 10,000 transactions per second (TPS) and subcent costs. It is the stage for the BNB chain to tension the L1 and L2 stroke fields.

“The BNB chain ecosystem not only positions itself as a single competitive L1, but as a network that offers scalable solutions in different layers. OPBNB lets us compete fiercely in the L2 domain for high-volume, cheap applications, while BSC remains a robust base layer,” the Beincrypto team said.

This duality, a resilient base and scalable layer, becomes a standard among large chains that monitor mass acceptance. According to the BNB Chain Core Development Team, the BNB chain is fully tailored to that thesis.

Sustainable or temporary? Validators contain the dial

Is 0.1 Gwei sustainable? That depends on network load and validator sentiment. With BSC on average only 20% capacity use, congestion risks seem low. However, according to the team, prices have not been established, but is an organic mechanism.

“The price is an individual market choice of validators. They have to adapt to the ever -changing market conditions,” said the spokesperson.

This model led by the market can be the secret weapon of BNB chain be-adapted, scalable and sensitive to community.

What started as a viral suggestion of the founder of Binance has been aged into a response coordinated by the community that reflects the adaptive architecture and governance of BNB chain.

With Defi, Stablecoins and Dapps with a high volume that get a grip and are ready to increase transit, the 90% reimbursement separation is not only about costs-it is about growth.

BNB price performance. Source: Beincrypto

BNB -Token acted from this letter for $ 665.49, an increase with a modest 1.48% in the last 24 hours.