The crypto market is looking to consolidate after a major price correction earlier this week. One market that has taken the brunt of this correction is the BRC-20 token, which has suffered a major drop in its market cap.

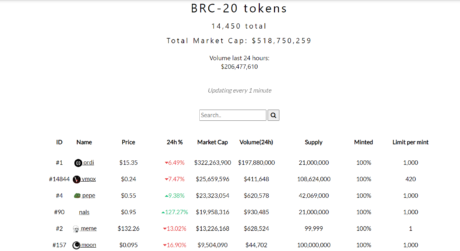

According to brc-20.iotracking the nascent market for tokens minted on the Bitcoin blockchain, the market cap of all BRC-20 tokens went from $990,000,000 to $379,000,000 between May 8 and May 11, a drop of 62%. At the time of writing, the market cap of BRC-20 tokens has recovered and stands at around $570,000,000, making it a 40% dip within the seven-day trading period.

Related Reading: Bakkt streamlines the Apex Crypto platform by removing 25 tokens

The BRC-20 market is largely tied to the capitalization of the ORDI token, which dominates more than 80% of trading volumes. At the time of writing, it is currently trading around $15, down from its all-time high of $28, set earlier this month. ORDI’s importance in this market means that price fluctuations directly and significantly affect the market cap of BRC-20 tokens.

A deep dive into BRC-20 token

BRC-20 is an experimental standard for issuing and transferring fungible tokens on the Bitcoin network. The deployment, issuance and transfer of these tokens is done through a JSON data input. Hence its relationship to Bitcoin’s NFT Ordinals.

The creation of this standard is credited to a developer known as Domo on Twitter. On March 8, the computer scientist announced his progress in this area and acknowledged that it would be difficult for him to continue this test. For this reason, he preferred to share the project with others to experiment with. Since then, the ecosystem has exploded, with more than 14,000 tokens launched, according to brc-20.io.

Although the name BRC-20 is a reference to Ethereum’s ERC-20 standard. However, both standards differ in several characteristics, mainly because of the differences between the networks they operate in, Bitcoin and Ethereum.

First of all, Bitcoin’s BRC-20 tokens do not have the ability to interact with smart contracts, while ERC-20s do. Other limitations of the BRC-20 tokens compared to Ethereum’s are that they cannot have decimals, cannot be burned or frozen, and have additional features such as approval or delegation.

Read related: PayPal plummets despite increasing crypto holdings

BRC-20 tokens are not without controversy

Some Bitcoin maximalists have criticized the growing popularity of BRC-20 tokens for their effect on the Bitcoin network. There is growing congestion on the Bitcoin network and it broke the record for the average number of transactions processed per block with an astonishing 4,373 transactions, an all-time high. Nevertheless, proponents of this token standard argue that it extends the Bitcoin blockchain to new capabilities and provides new use cases for the leading cryptocurrency.

– Featured image from iStock, charts from brc-20.io and Tradingview