- BonkDAO’s token burn reduced supply by 1.8%, but BONK faced resistance at $0.00003517.

- Market sentiment remained bearish, with high short interest and weak technical indicators for BONK.

BonkDAO’s decision to burn 1.69 trillion Bonk [BONK] tokens as part of the “BURNmas” event have attracted attention in the crypto community.

With $54.52 million worth of tokens removed from circulation, BONK’s total supply will be reduced by 1.8%.

This could have major consequences for the market. At the time of writing, BONK is trading at $0.00003144, reflecting a decline of 6.50% in the last 24 hours.

Given this deflationary move, the question arises: will this affect BONK’s price and market sentiment going forward?

What is the outlook for BONK’s price action?

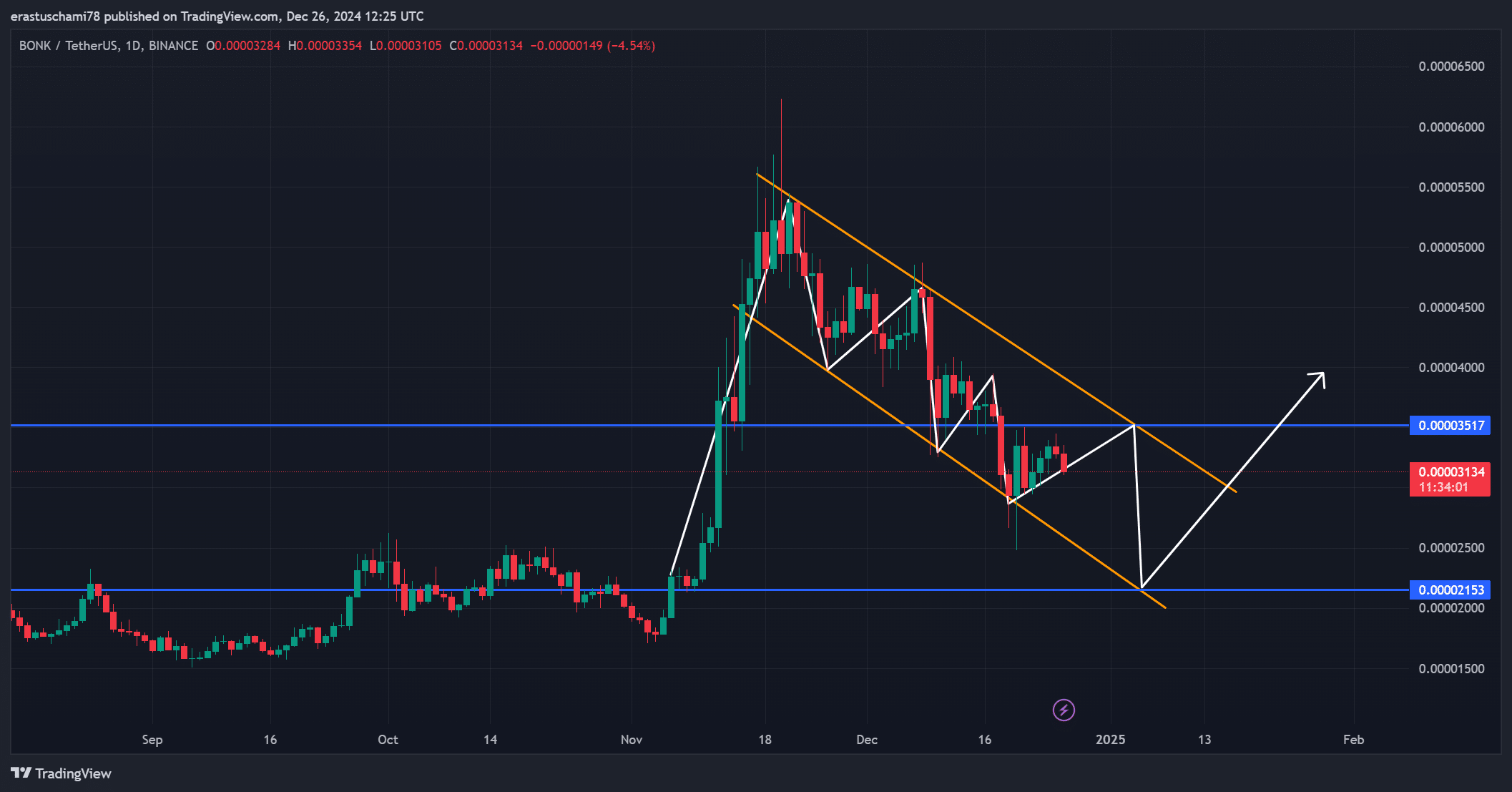

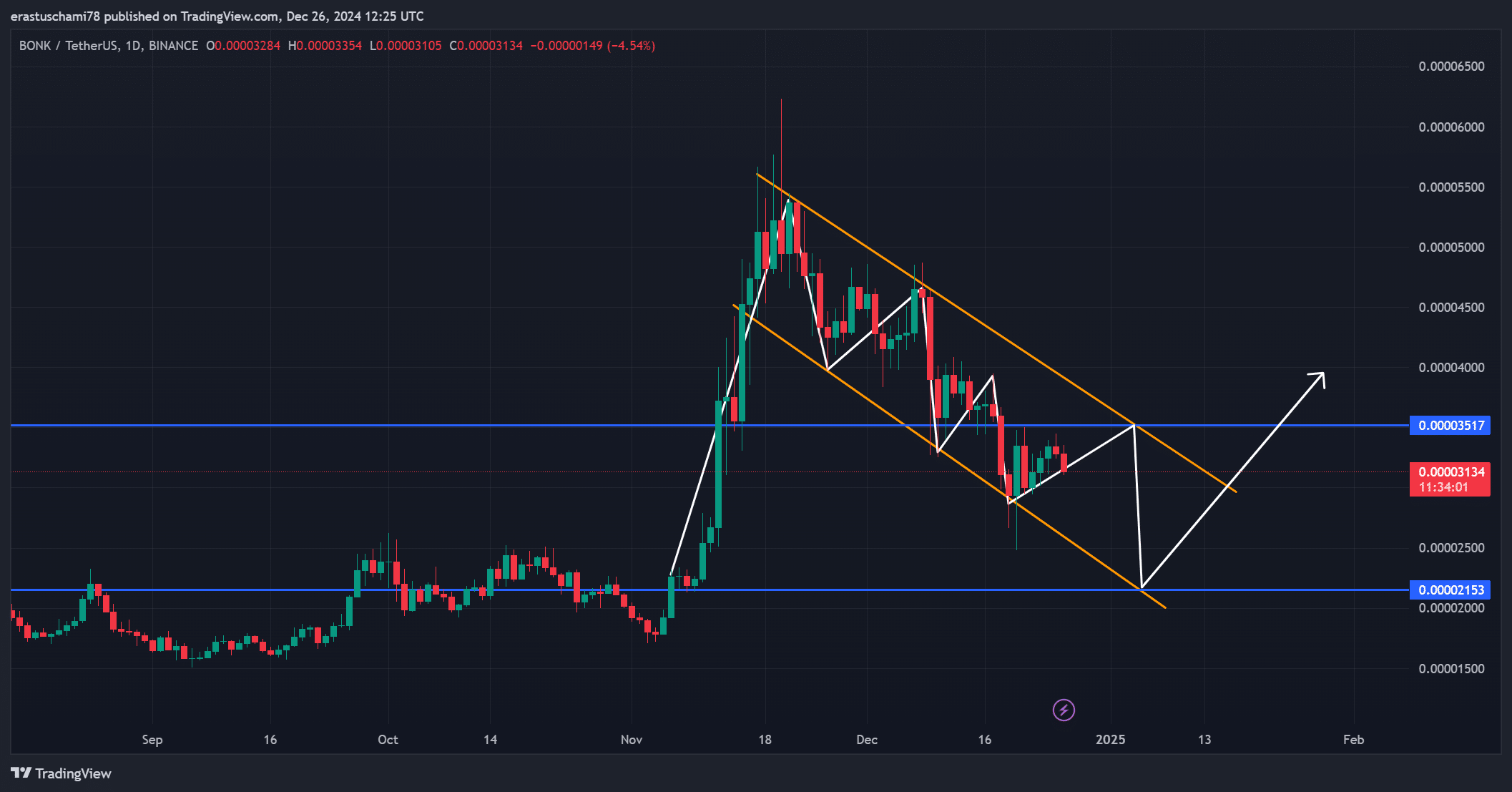

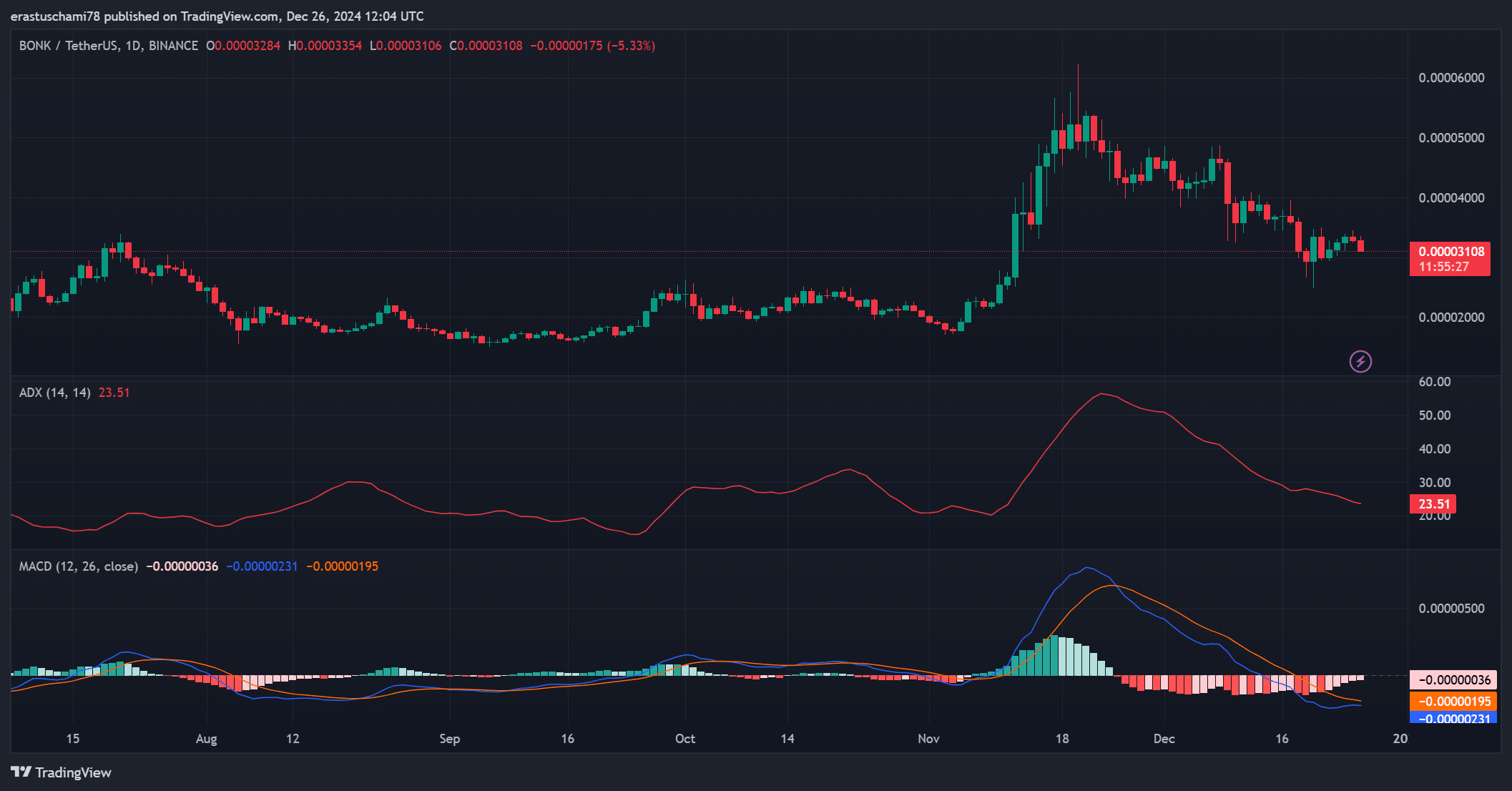

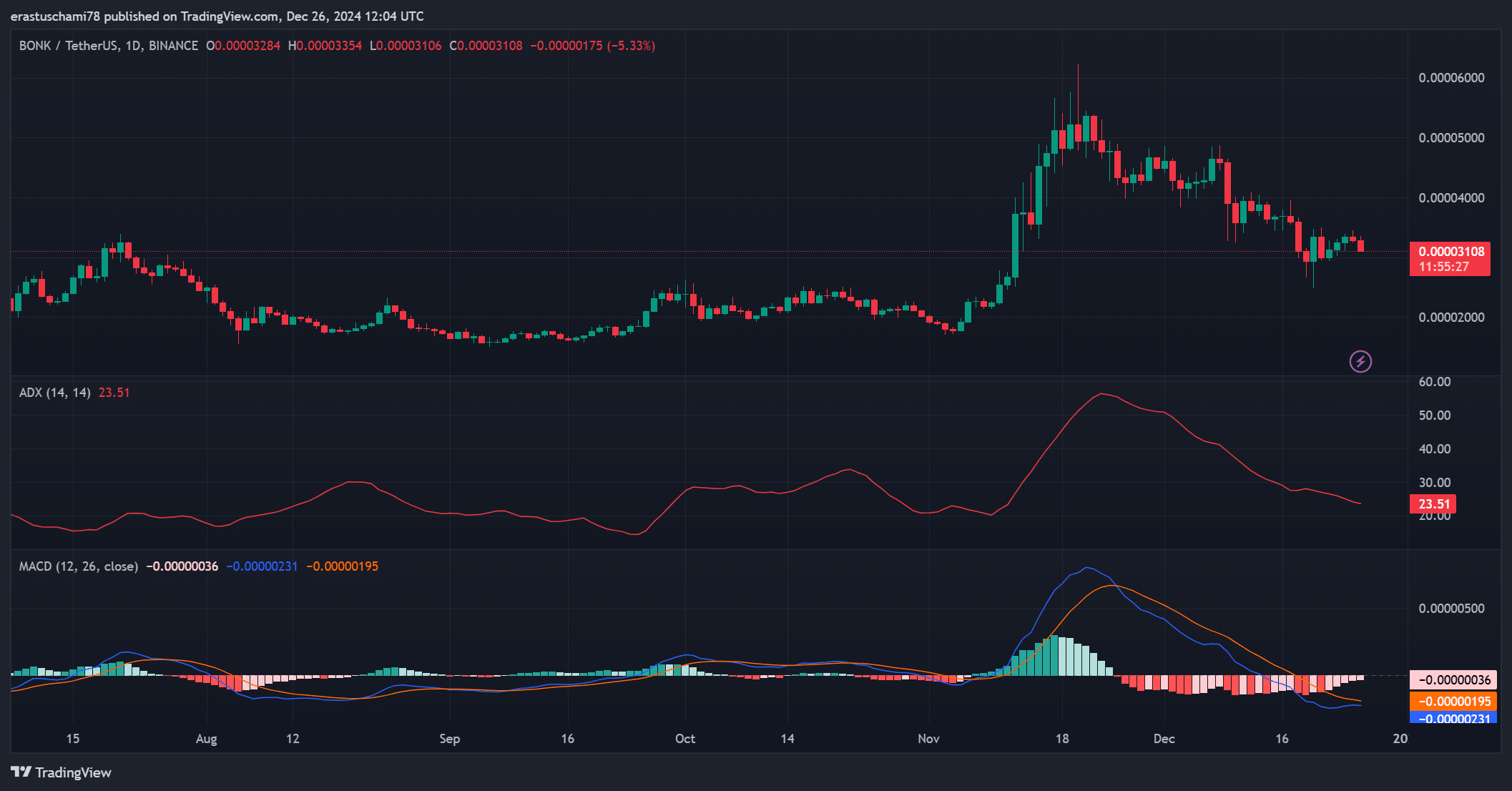

BONK’s price action is showing a pattern of resistance, especially at the $0.00003517 level. This resistance point could pose a barrier to further upside unless substantial buying volume comes into play.

However, with BONK trading at $0.00003144 at the time of writing, it faces challenges in breaking through this resistance without more market support.

The 6.50% drop in the past 24 hours indicated that the ongoing trend was still in a consolidation phase.

Source: TradingView

From Social Volume

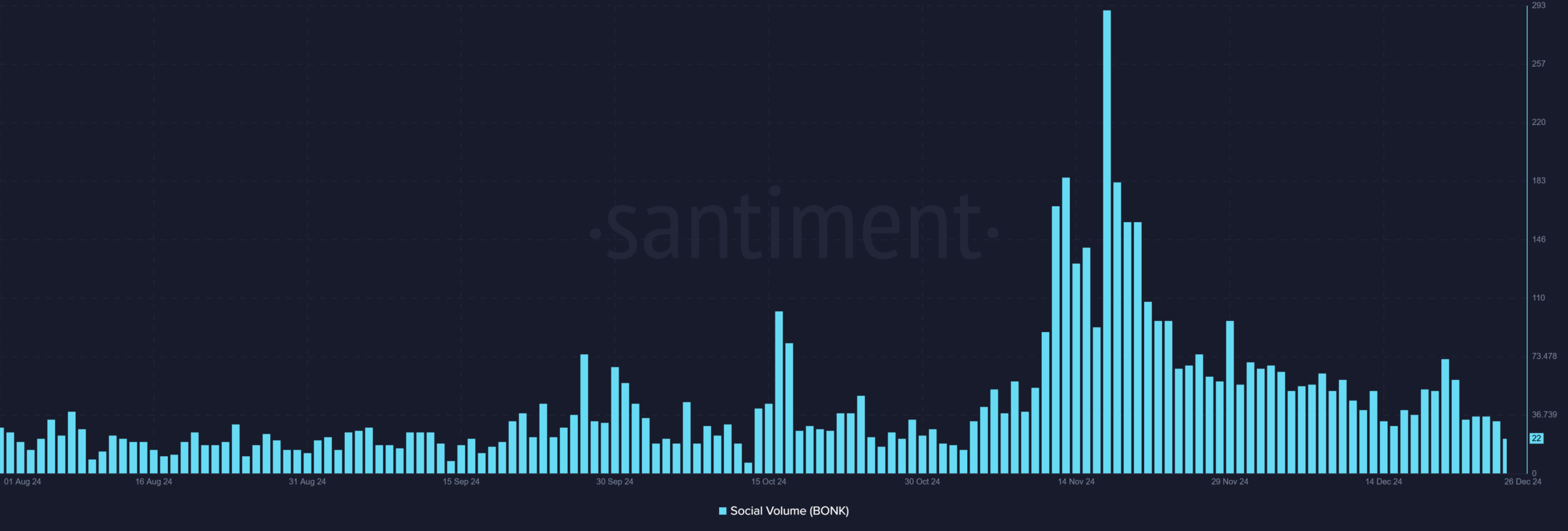

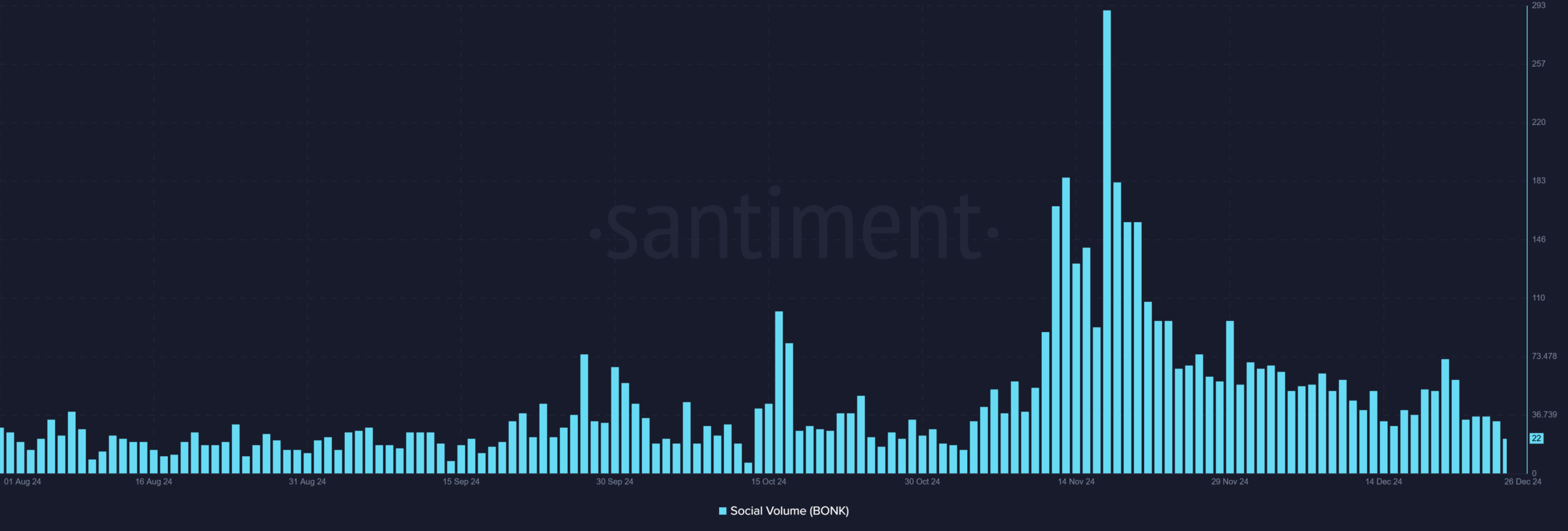

Social Volume data painted a picture of declining interest in BONK. In mid-November, social mentions peaked at over 290, but by December 26 they had dropped to just 22.

This significant reduction in social engagement suggested that the excitement surrounding the symbolic burning was fading.

While high social volume often signals strong price action, this decline could be an indicator that the market is turning away from BONK, waiting for another spark to reignite momentum.

Source: Santiment

Are traders betting on a further decline?

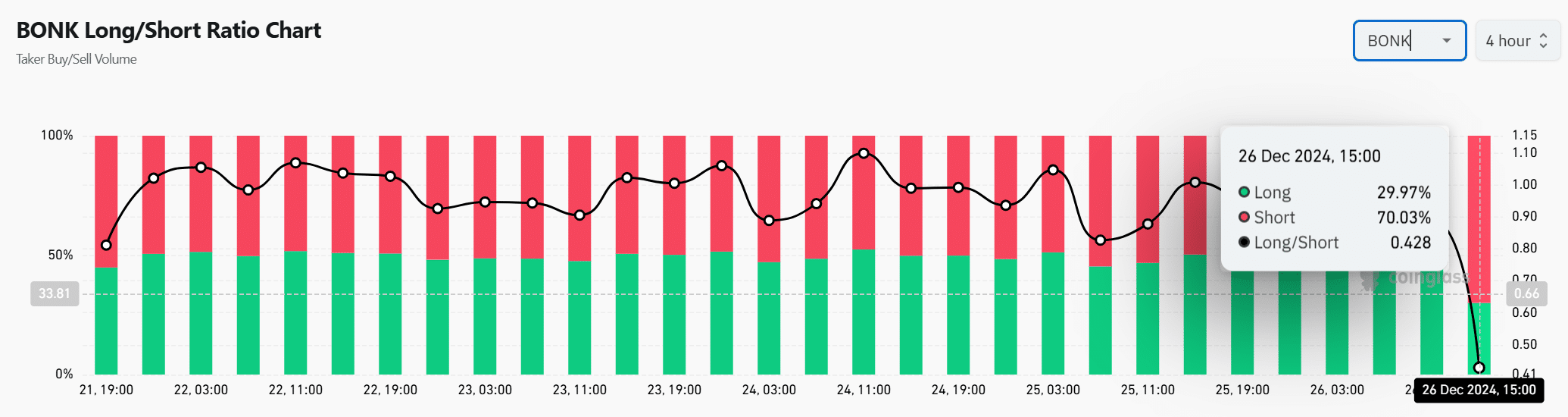

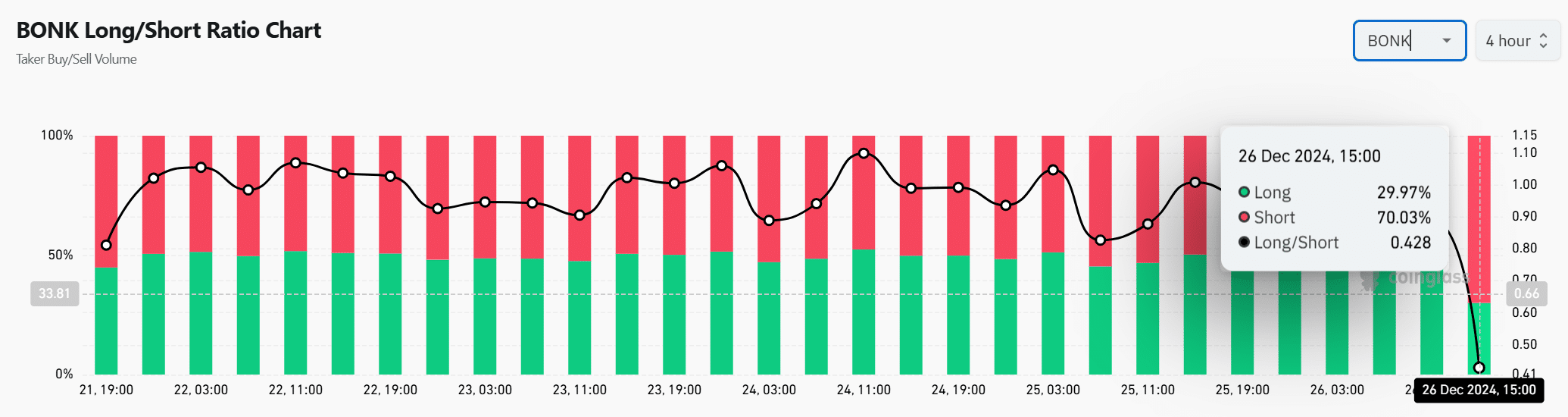

Market sentiment is strongly leaning towards short positions. On December 26, only 29.97% of positions were long, while 70.03% were short.

This shows that traders expect a further decline in the BONK price.

The high short interest indicates a bearish outlook, although it could lead to a short squeeze if the market moves in an unexpected direction.

Source: Coinglass

What do technical indicators suggest for price development?

The technical indicators are showing mixed signals. The Average Directional Index (ADX) stands at 23.51, indicating a weak trend, while the Moving Average Convergence Divergence (MACD) shows a negative value of -0.00000036.

These indicators suggest that while a small rally is possible, the market does not have strong momentum to sustain a significant price increase in the near term.

Source: TradingView

Market sentiment

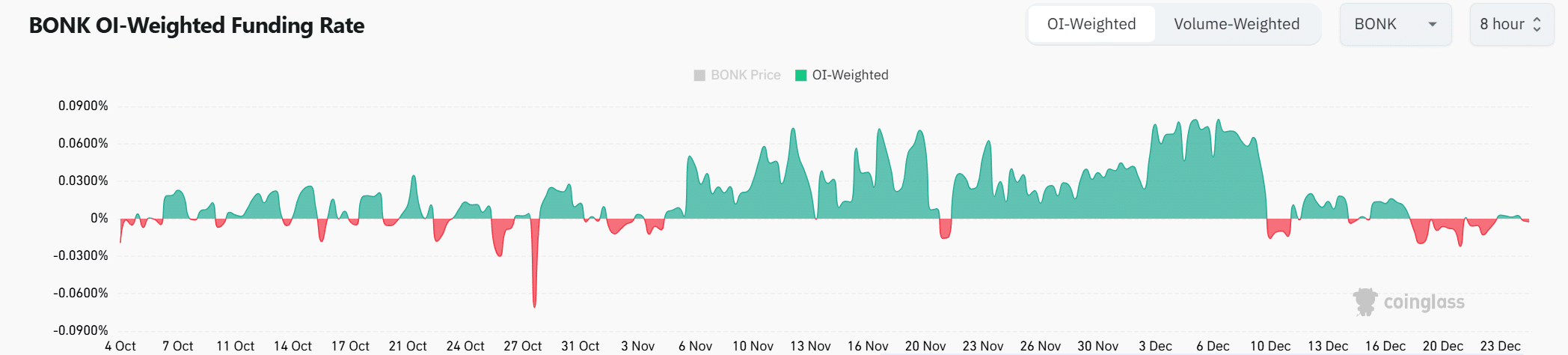

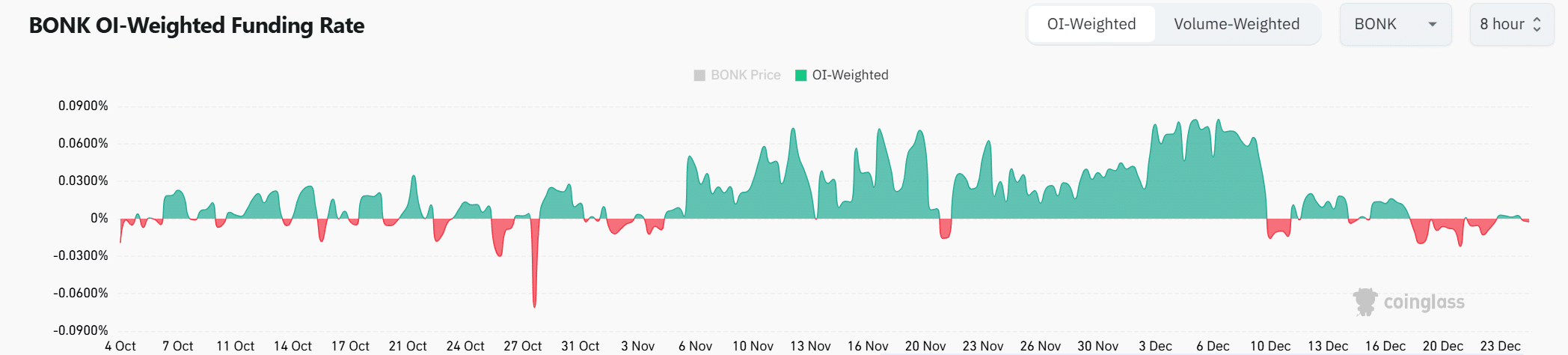

The OI-weighted financing rate has fluctuated between -0.09% and 0.09% in recent months and was 0% at the time of writing.

This indicated that traders were uncertain about the direction of the market and were hesitant to take large positions, resulting in a neutral market stance.

Source: Coinglass

Read Bonk’s [BONK] Price forecast 2024–2025

Although BonkDAO’s token burn event reduces BONK’s supply, current bearish sentiment reflected in social volume, long/short ratios and weak technical indicators suggested that this deflationary action would not cause a significant price increase in the near term.

Without new catalysts, it is therefore unlikely that BONK will experience a substantial price increase.