- Memecoin’s bulls had a slight lead over the bears, based on the indicators

- The liquidation heatmap highlighted local highlights as a short-term objective

Bonk [BONK]was on the verge of turning the $0.0000338 level into support at the time of writing. However, in the past few hours, bulls have faced some resistance at the 61.8% retracement level. In fact, the technical indicators showed that the bulls had a slight advantage.

In light of Bitcoin [BTC] positive performance ahead of the US presidential inauguration on January 20, there could be some bullish hope for the memecoin. And yet, BONK traders should be wary of a failed breakout if BTC’s momentum reverses.

Time for another BONK rejection?

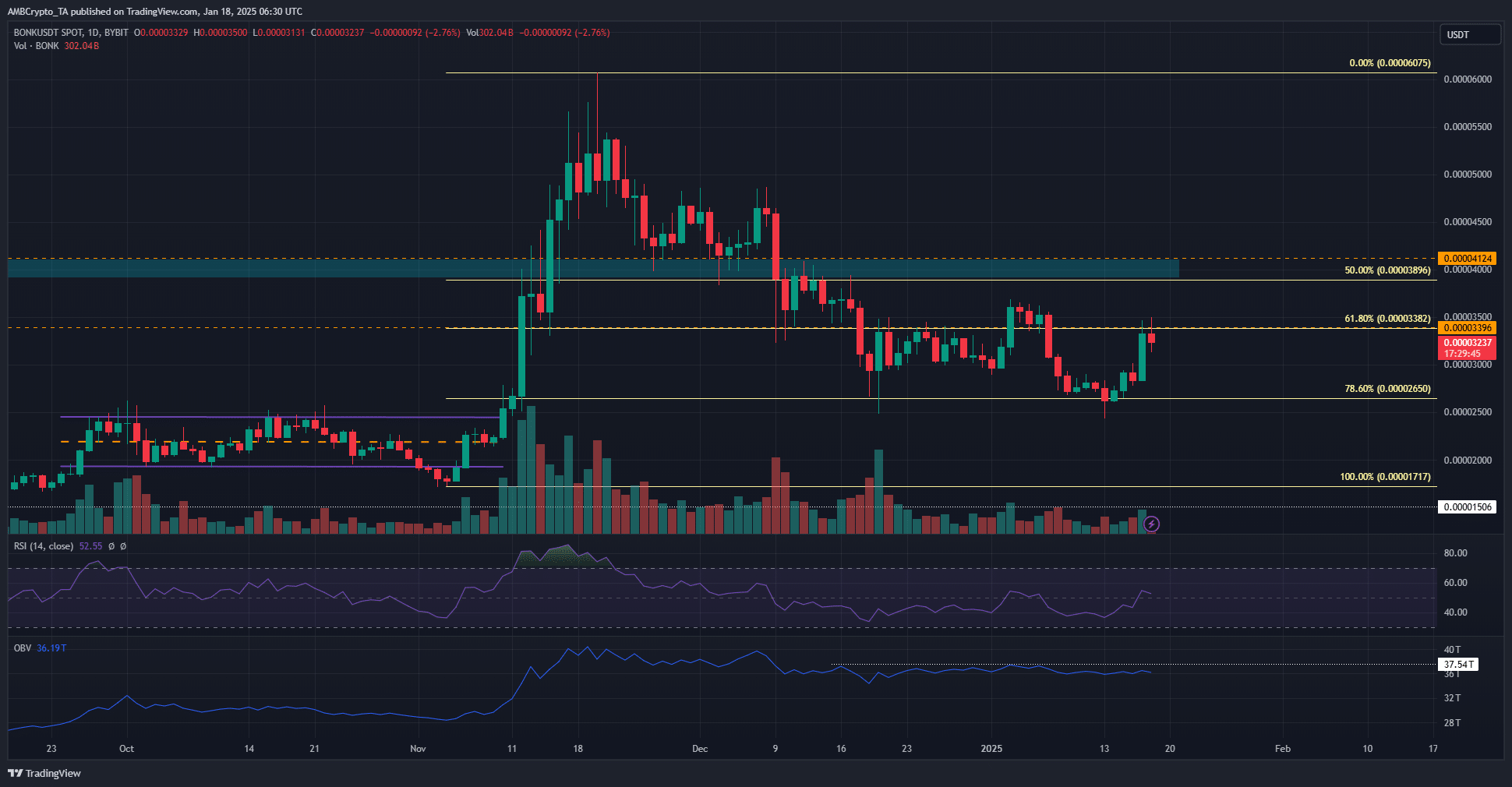

Source: BONK/USDT on TradingView

The daily chart showed a bearish structure after price action showed a lower low last week. At the time of writing, the price was trading just below the 61.8% Fibonacci retracement level at $0.0000338. The RSI poked its head above the neutral 50 to signal a shift in momentum in favor of the buyers.

The OBV has climbed higher over the past month but failed to break a local high. This was another finding with a bullish twist. Despite the memecoin sector’s losses over the past six weeks, BONK buyers still had some strength left.

Resistance level at $0.000037 marked as key for bulls

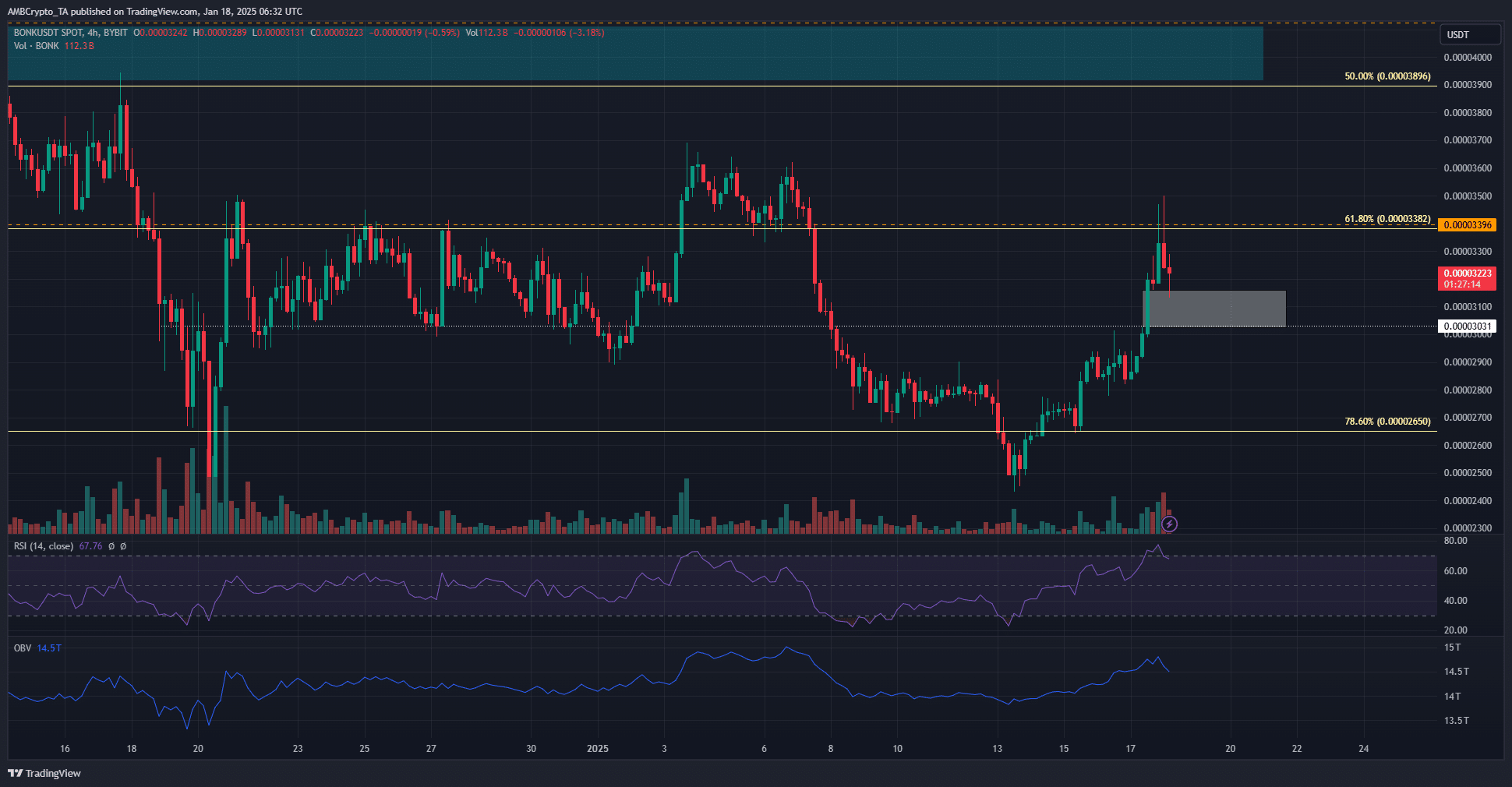

Source: BONK/USDT on TradingView

The H4 chart depicted a fair value difference (white box) just above $0.00003. This level was an important support level in the second half of December.

Therefore, a retest of the FVG or the $0.00003 level would likely provide a buying opportunity.

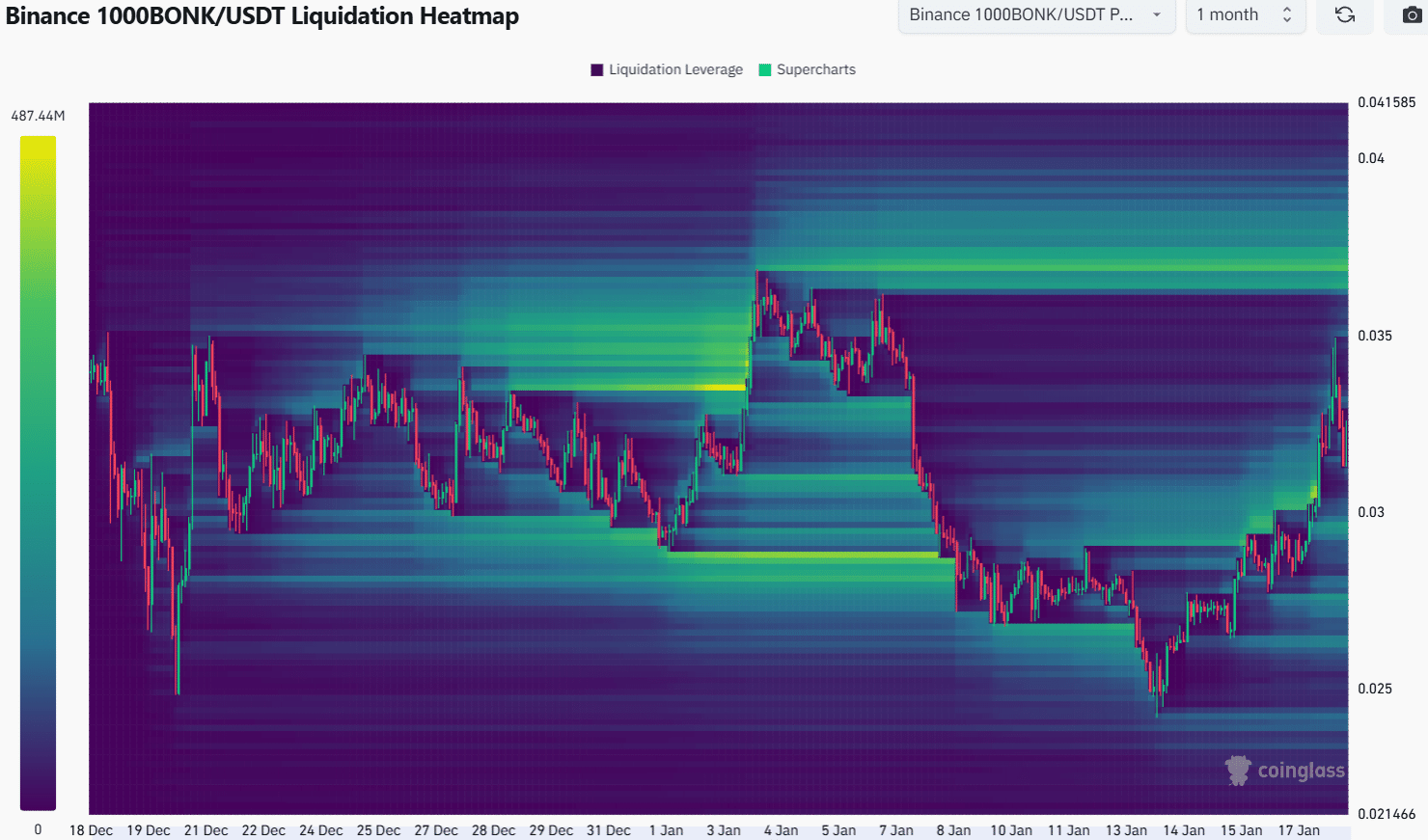

Source: Mint glass

The one-month liquidation heatmap highlighted a cluster of liquidation levels around $0.0000366-$0.0000374. This zone aligned well with the local highs that BONK made in early January at $0.000036.

Read Bonk’s [BONK] Price forecast 2025-26

Therefore, BONK may be likely to move towards $0.000036-$0.0000374 in the coming days. This would provide traders with an opportunity to take profits. However, swing traders may look to enter long positions following a daily bullish break in the market structure, as well as when the OBV moves past local highs.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer