In a comprehensive assessment of global market dynamics, Bloomberg Intelligence analyst and Chartered Market Technician (CMT) Jamie Coutts has weighed in on the shifting sands of financial asset volatility. With bonds potentially falling out of favor and Bitcoin cementing its place as a hedge against degradation, traditional portfolio models may be on the cusp of a renaissance.

Major portfolio shift towards Bitcoin?

Coutts tweeted“It appears we are about to see a substantial increase in volatility across all markets given the direction in which rates, the USD and global M2 are moving. Despite what lies ahead, there has been a major shift in the volatility profiles of global assets relative to Bitcoin in recent years.”

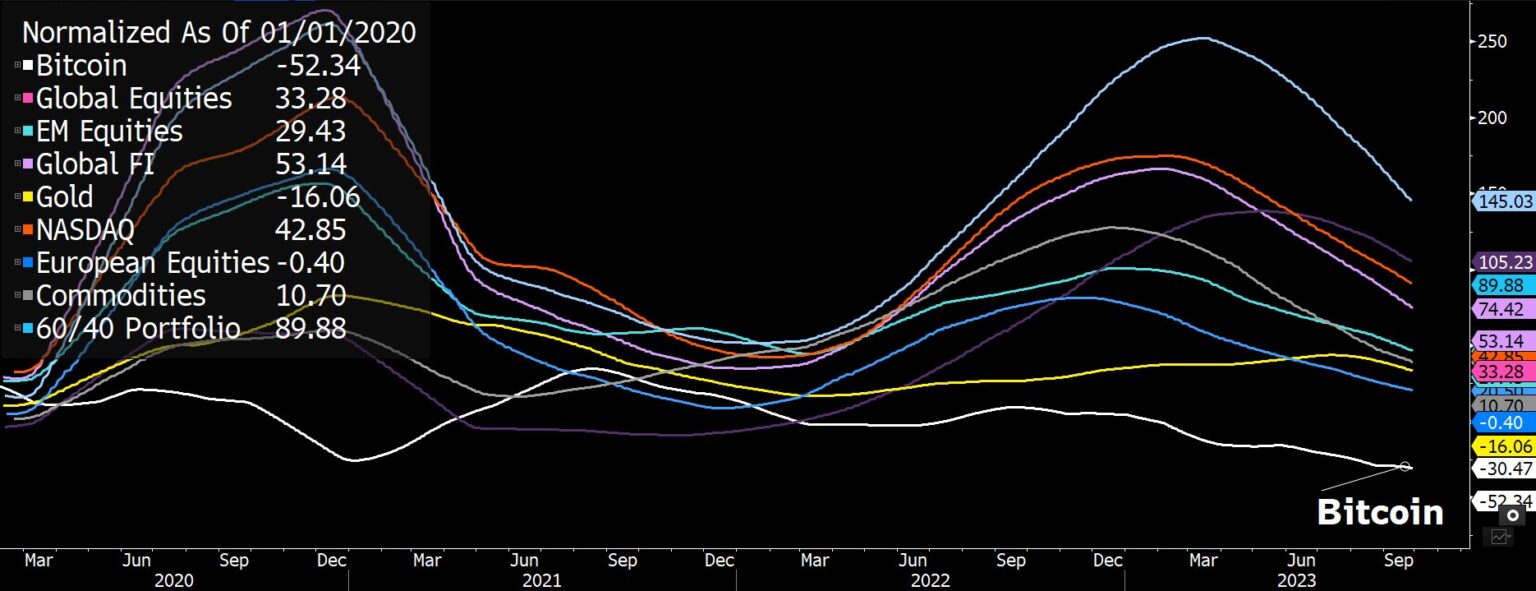

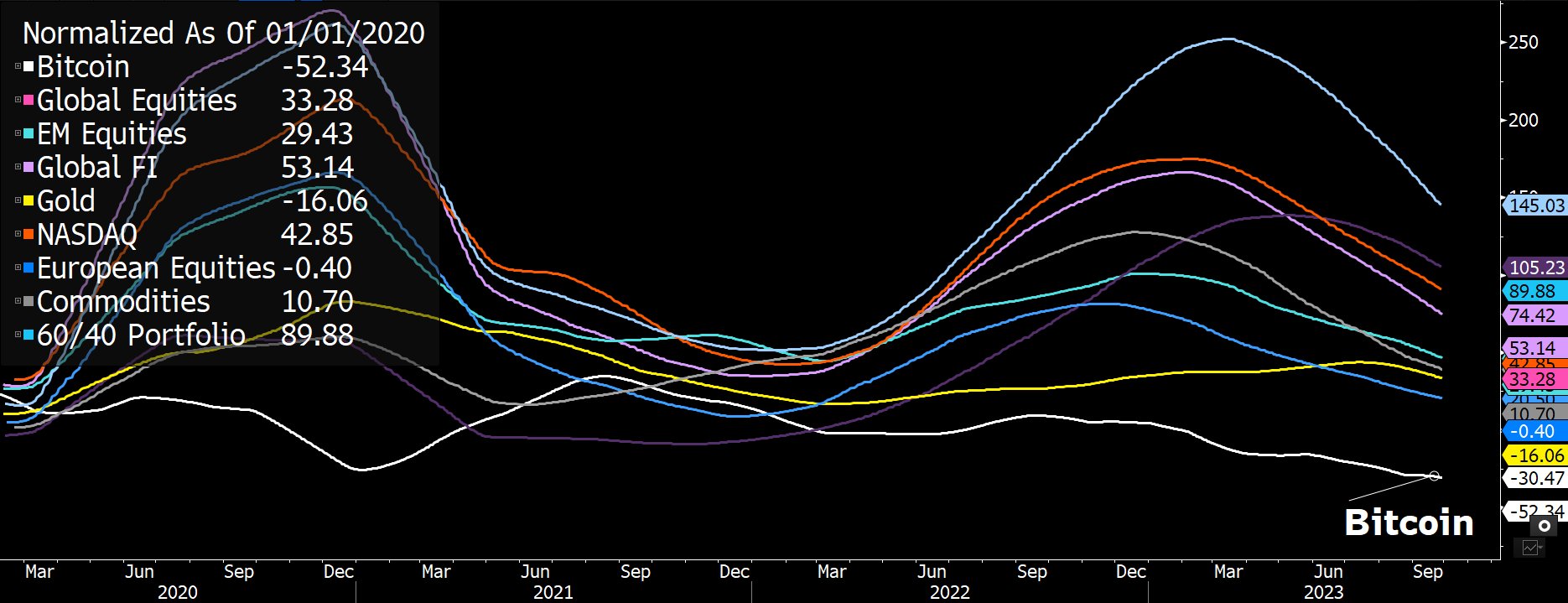

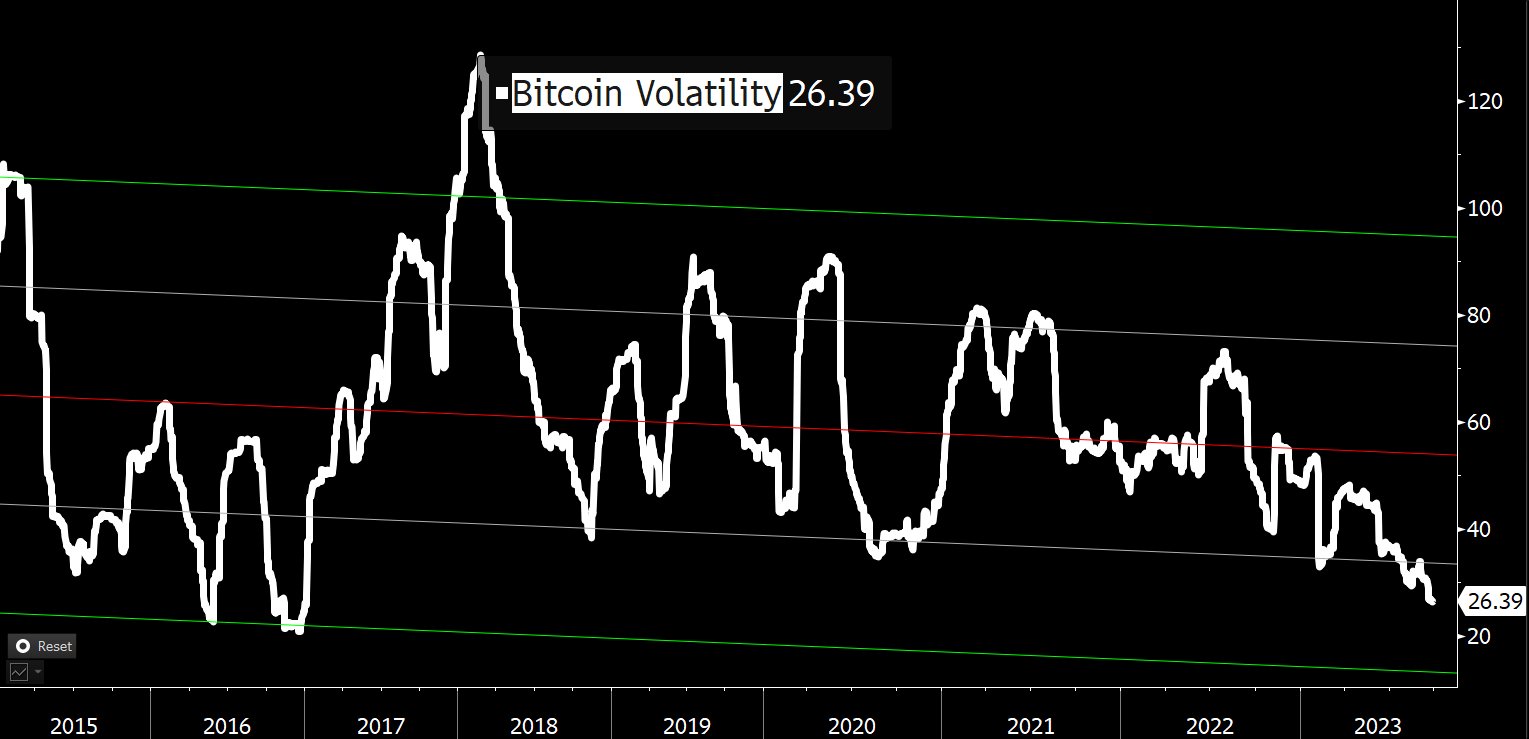

A comparative analysis by Coutts shows that the volatility profiles of Bitcoin and Gold have decreased since 2020, while the volatility of most other assets has increased.

His analysis shows that traditional 60/40 portfolio volatility is up 90%, NASDAQ volatility is up 53%, and global stock volatility is up 33%; Meanwhile, Bitcoin’s volatility alone fell by 52%, as did gold’s volatility, which fell by 6%

Coutts further explained that after Bitcoin’s “hypervolatile” phase from 2011 to 2014, the cryptocurrency’s volatility has been on a downward trajectory. From a peak above 120 in early 2018, this benchmark currently stands at 26.39.

However, Coutts remains skeptical about Bitcoin’s short-term prospects given the deteriorating macro environment: “Given that BTC volatility is near the bottom of the range, plus a deteriorating macro environment: the US dollar (DXY) has risen , 10-year government bond yields have risen, M2 money supply has risen. It is difficult to see how BTC (and all risk assets) can sustain this setup.”

BTC vs. Global asset classes

On the plus side, from an asset allocation perspective, Coutts sees the real question as whether “Bitcoin can add value as risk diversification and improve risk-adjusted returns.” Comparing risk-adjusted returns using the Sortino ratio during the last bear market, Bitcoin’s performance is not the best.

In the 2022 bear market, Bitcoin’s Sortino ratio is -1.78, positioning BTC above global stocks, the NASDAQ 100, and the traditional 60:40 portfolio. However, it lags the S&P 500 (-1.46), European stocks (-1.01), gold (+0.1), silver (+0.28) and commodities (+1.25).

Elaborating on Bitcoin’s cyclical behavior, Coutts added: “The problem with BTC is that its relatively short history makes inferences difficult and one-year periods are certainly not significant. The best we can do is multiple cycles. Clearly, sticking to the full cycle has been a winning strategy.”

Evaluating the Sortino Ratio over the past three Bitcoin cycles (2013-2022), Coutts found that Bitcoin leads the way with a score of 2.46, outperforming the NASDAQ 100 (+1.37 ), S&P 500 (+1.25) and global equities (+1.05). .

BTC: Best Bet Against Money Printing

In this scenario, concerns about debasement further strengthen Bitcoin’s proposition. Coutts emphasized this saying: “And if allocators want to outpace the monetary cut, bonds are not the way to go over most time frames.” He identified Bitcoin as the top choice for portfolio realignment against monetary reduction.

Citing the huge difference between asset returns in terms of money supply (M2) growth over the past decade, he highlighted Bitcoin’s dominance with a staggering ratio of +8,598, followed by NASDAQ (+109), S&P 500 (+25) and global equities (-7.5).

In a closing statement, Coutts said: “In the coming years it is conceivable that allocators will begin to shift towards better hedges against relegation. BTC is an obvious choice.” Furthermore, he suggests that Bitcoin could replace bonds by securing at least 1% of the traditional 60/40 portfolio.

At the time of writing, BTC was trading at $26,433.

Featured image from Shutterstock, chart from TradingView.com