Since the price of Bitcoin hit a new annual high of $31,840 last week, only to reverse the bullish breakout in a matter of hours and plummet to $30,000, there has been a strange calm in the market. Ever since June 23rd, BTC has been in the trading range between $29,800 and $31,300, with every escape attempt up and down failed within a very short time.

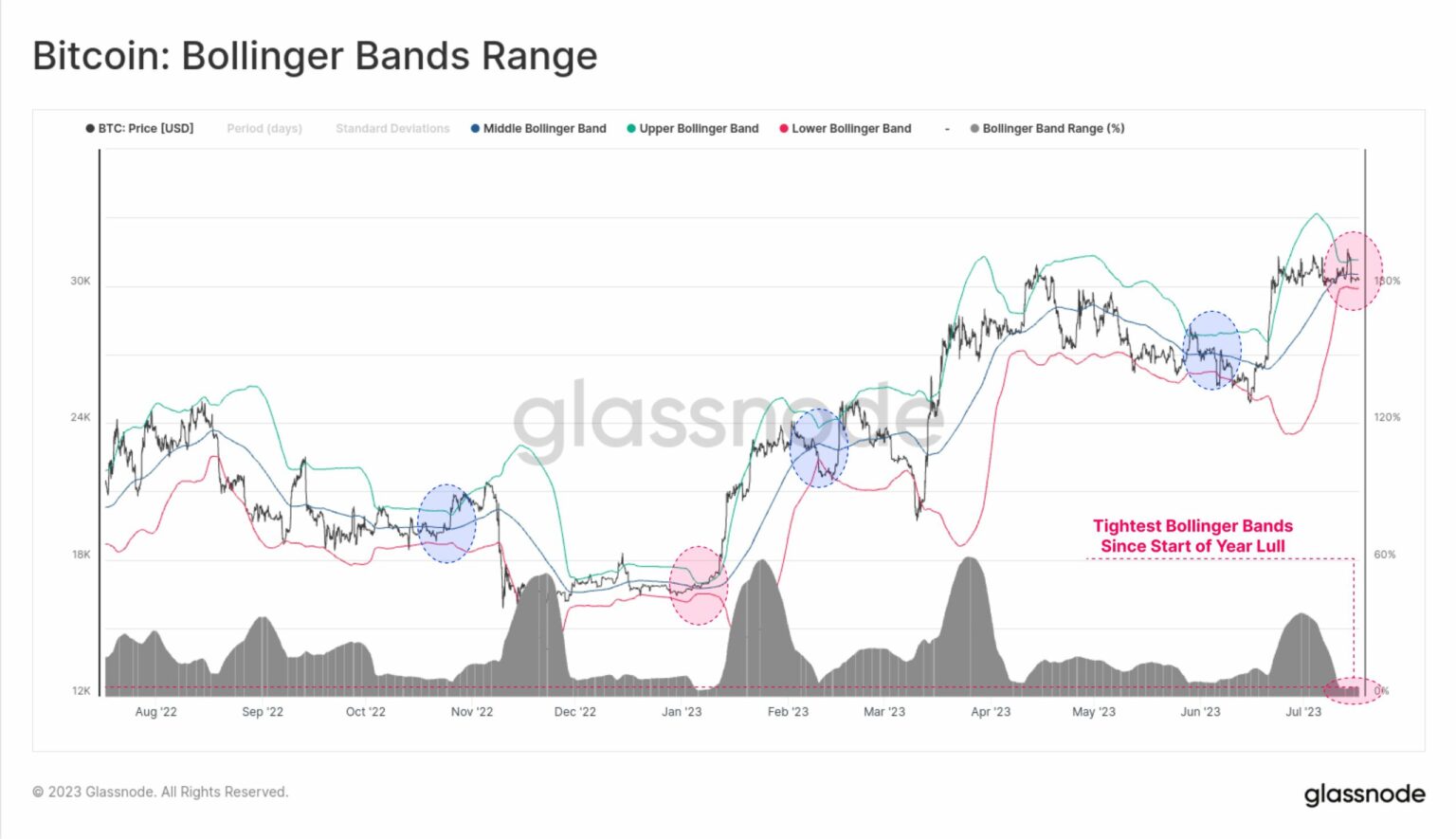

However, one of the most prominent technical indicators, the Bollinger Bands, predict that this calm will soon be over. Created by esteemed trader John Bollinger, these tapes provide valuable insights into market volatility and potential price levels.

Bollinger Bands predict major movement for Bitcoin

The Bollinger Bands consist of three different lines on a price chart: the middle band, the upper band, and the lower band. The middle band is a simple moving average (SMA) that shows the average price over a period of time. The upper and lower bands are derived from the middle band, with the upper band usually placed two standard deviations above the SMA and the lower band two standard deviations below it.

The primary purpose of the Bollinger Bands is to measure market volatility. When the price of an asset fluctuates significantly, the bands widen, indicating greater volatility. Conversely, during periods of reduced price movement, the bands contract, indicating lower volatility. This contraction is commonly referred to as a “squeeze” in which the upper and lower bands move closer together, forming a narrowing price channel.

When the Bollinger Bands compress, the potential for significant price movement looms. The pressure suggests that the market is in a state of temporary equilibrium, similar to a coiled spring ready to release its stored energy. The direction of the breakout determines whether it is a bullish or bearish signal.

Up or down?

Glassnode, a respected on-chain data provider, today highlighted the current state of the Bitcoin market, noticing remarkably low volatility. The 20-day Bollinger Bands are experiencing extreme pressure, with a price range of just 4.2% separating the upper and lower bands. This suggests that Bitcoin is currently in a period of limited price movement, “making this the quietest Bitcoin market since the lull in early January.”

As Bitcoin investors may recall, the Bollinger Bands squeeze in January marked the end of a long-running downtrend. After the collapse of the FTX, the BTC market was in a state of shock paralysis, which was eventually resolved by Bollinger Bands squeeze, leading to a 42% price increase in 26 days.

The pressure from the Bollinger Bands, combined with declining trading volumes, creates a scenario of increasing pressure on the Bitcoin market. As trading volume decreases, the potential energy stored in this coiled spring increases.

According to CryptoCon analysts, it is a bullish scenario favored currently. “If Bitcoin volatility goes low in a bear market, it is very bearish. If volatility goes low in a bull market, it’s insanely bullish,” the analysts say. As Bitcoin is unanimously seen as the start of a new bull market, a strong upward move could be in store.

Featured image from iStock, chart from TradingView.com