- BNB’s price has fallen by more than 3% in the past seven days

- Few of the on-chain metrics remained bearish despite the 24-hour recovery

If Bitcoin [BTC] struggled to increase the price like several altcoins BNB also met a similar fate. However, in the past 24 hours, things started to change. If the latest data is to be believed, altcoins could soon register a bull rally, a rally that could allow BNB to recover from the latest losses.

BNB turns green

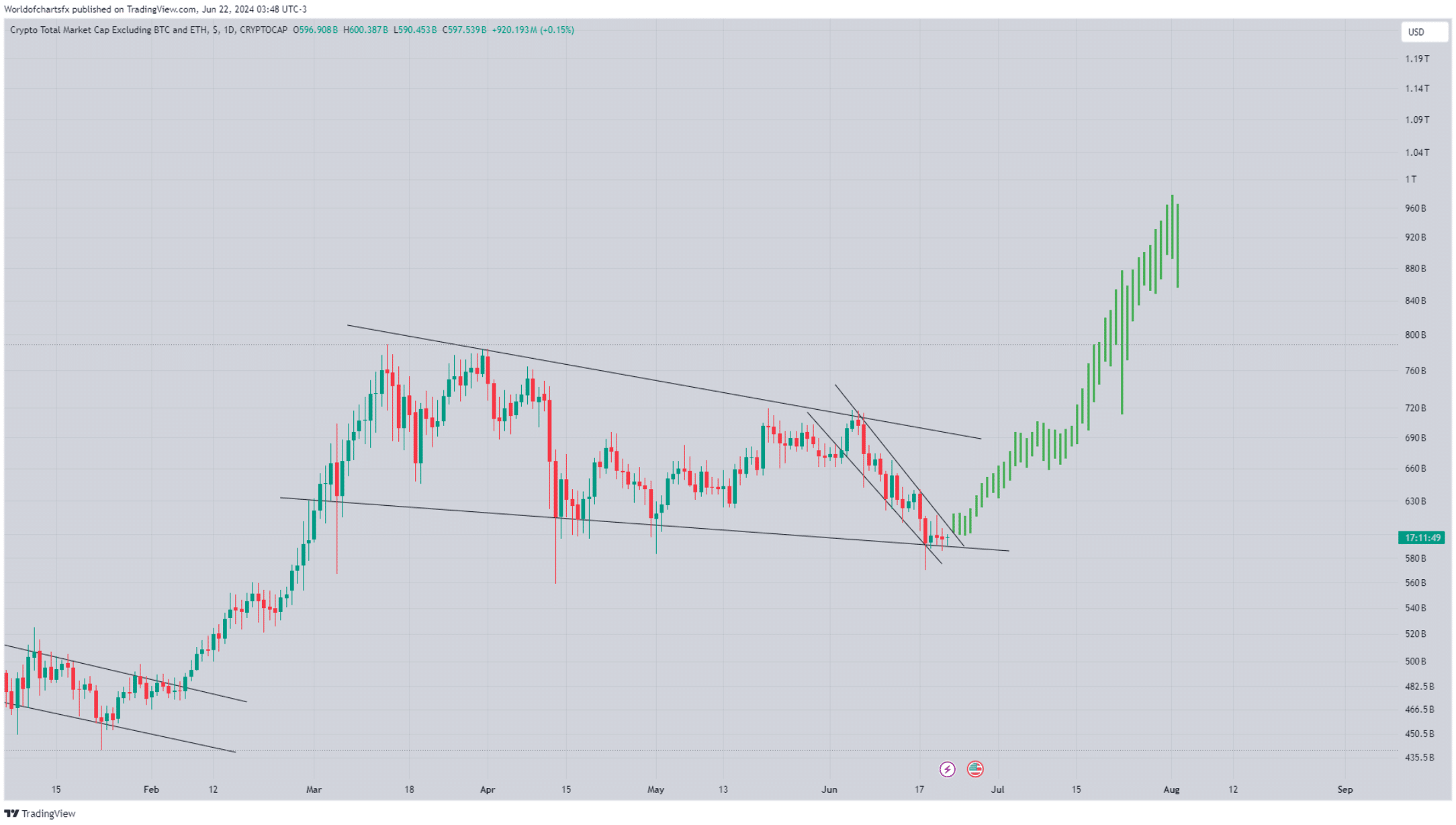

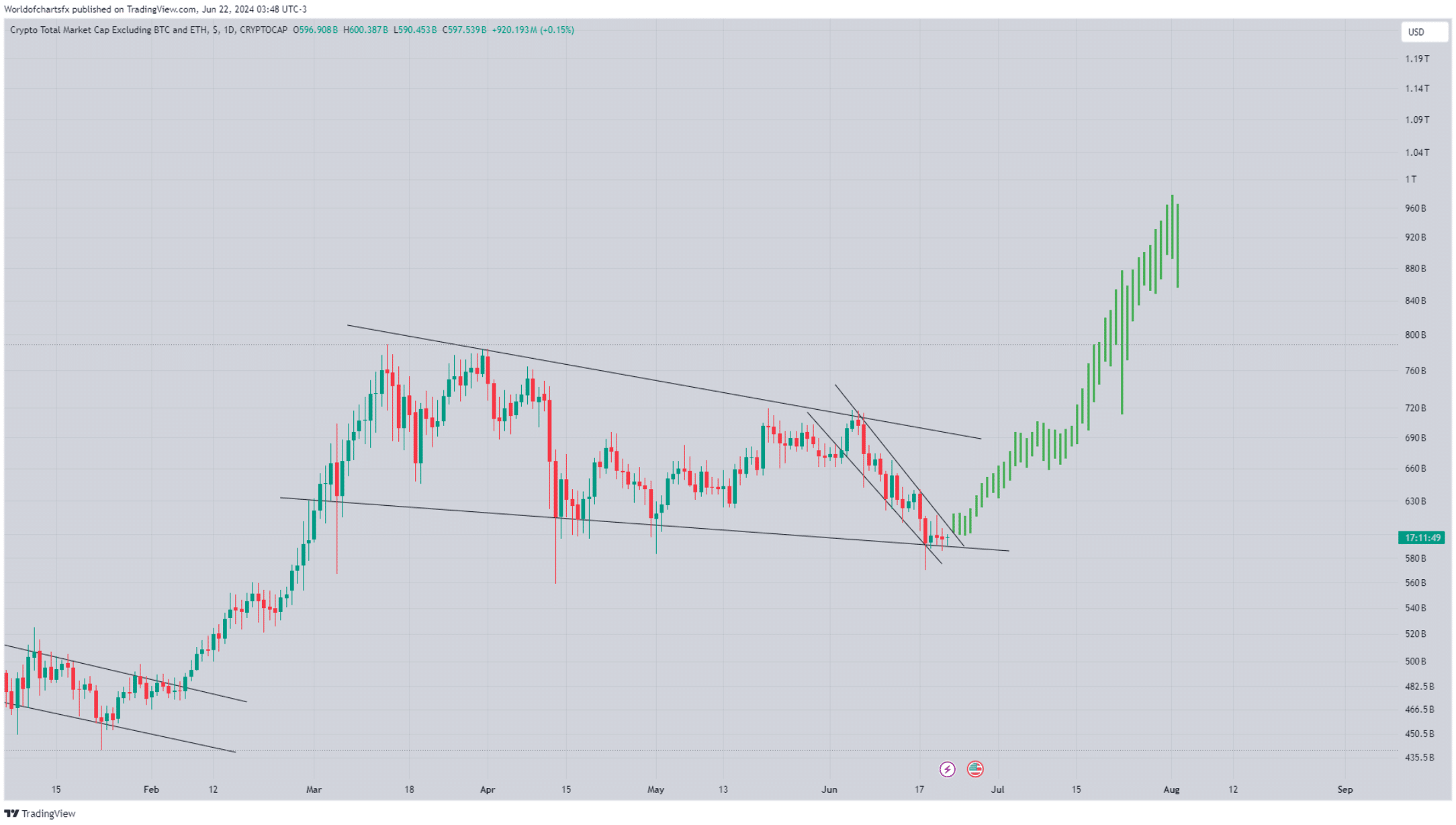

World Of Charts, a popular crypto analyst, recently shared one tweet to draw attention to an interesting development. Likewise, the market cap of altcoins is now moving within a pattern on the charts.

Source:

The bullish falling wedge pattern already appeared on the chart in March and at the time of writing it was testing the pattern’s lower support. If altcoins manage to test that pattern, investors could see altcoins rise, which could in turn turn BNB bullish.

At the time of writing, BNB seemed to be recovering somewhat. According to CoinMarketCap, BNB has fallen by more than 3% in the past seven days. On the contrary, the altcoin posted some gains in the past 24 hours.

Will BNB remain bullish?

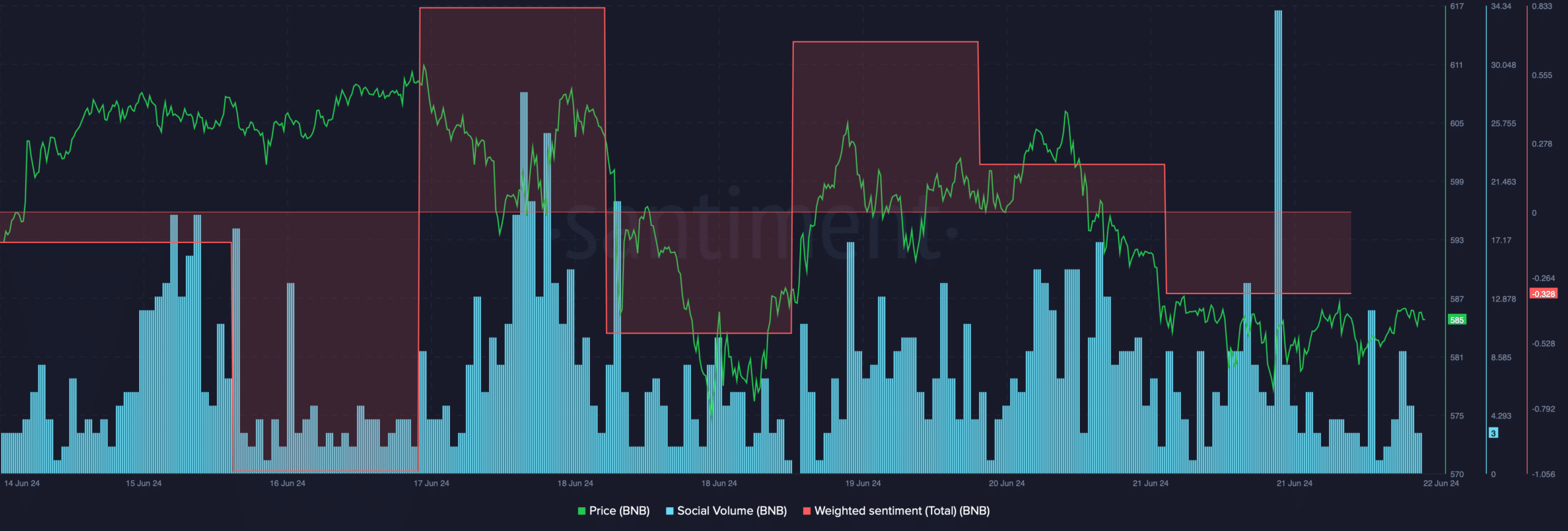

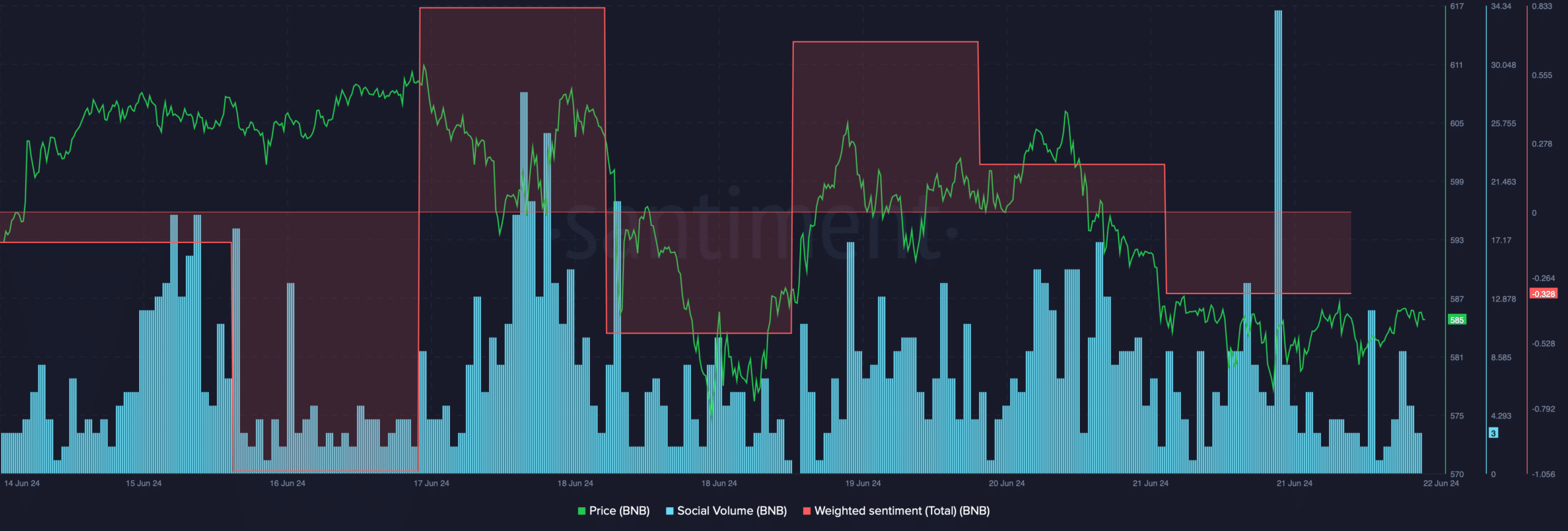

As there were chances that BNB would recover from last week’s price drop, AMBCrypto took a closer look at the coin’s condition to better understand what to expect. According to our analysis of Santiment’s data, BNB’s social volume rose sharply on June 21, highlighting a rise in the coin’s popularity in the crypto space.

In addition, our look at CFGI.io’s facts revealed that BNB’s fear and greed index was at 37% at the time of writing. This meant that the market was in a ‘fear phase’. Historically, when the fear and greed index shows that the market is in a ‘fear phase’, it is usually followed by a price increase.

Source: Santiment

However, not everything was in the currency’s favor. For example, the coin’s weighted sentiment was negative. A decline in this measure indicates the dominance of bearish sentiment in the market.

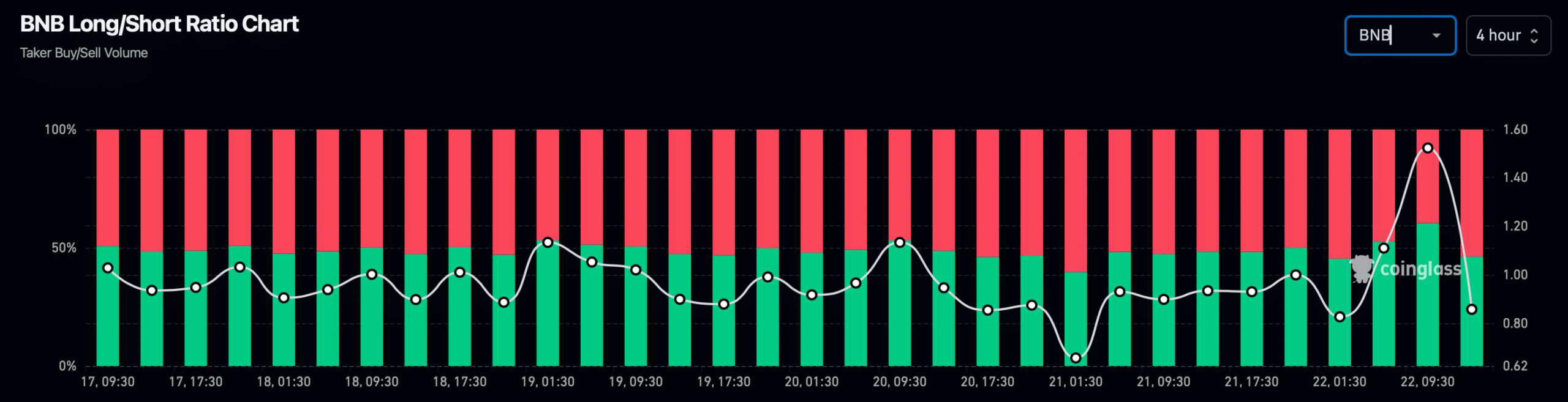

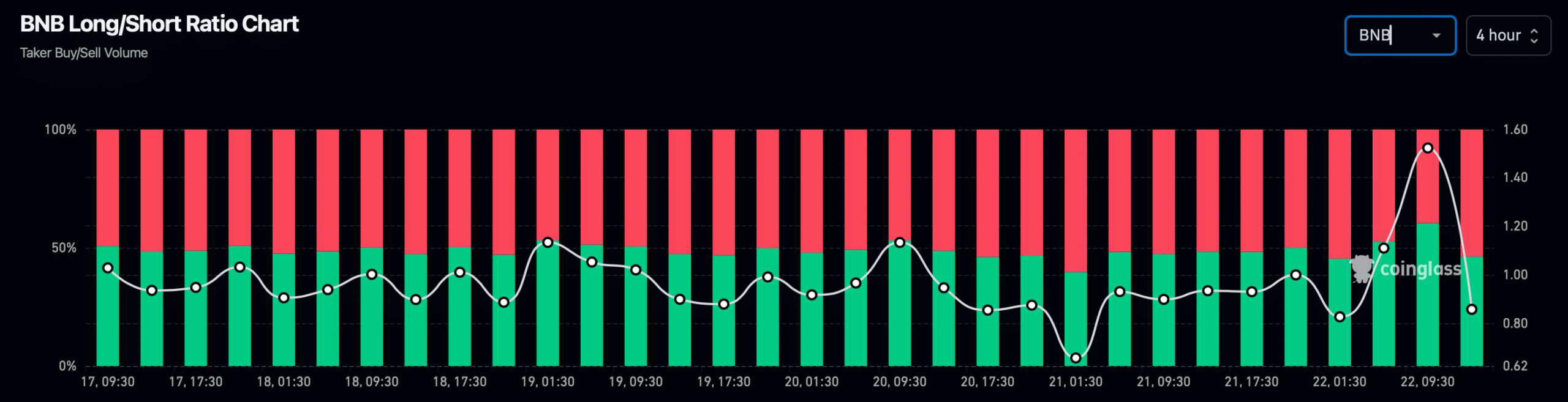

Moreover, Coinglass data showed that BNB’s long/short ratio showed a sharp decline. A low long/short ratio indicates a higher proportion of short positions compared to long positions in a trader’s portfolio. The aforementioned finding underlined the dominance of the bears, with a greater emphasis on selling or shorting assets.

Source: Coinglass

Read Binance coin [BNB] Price prediction 2024-2025

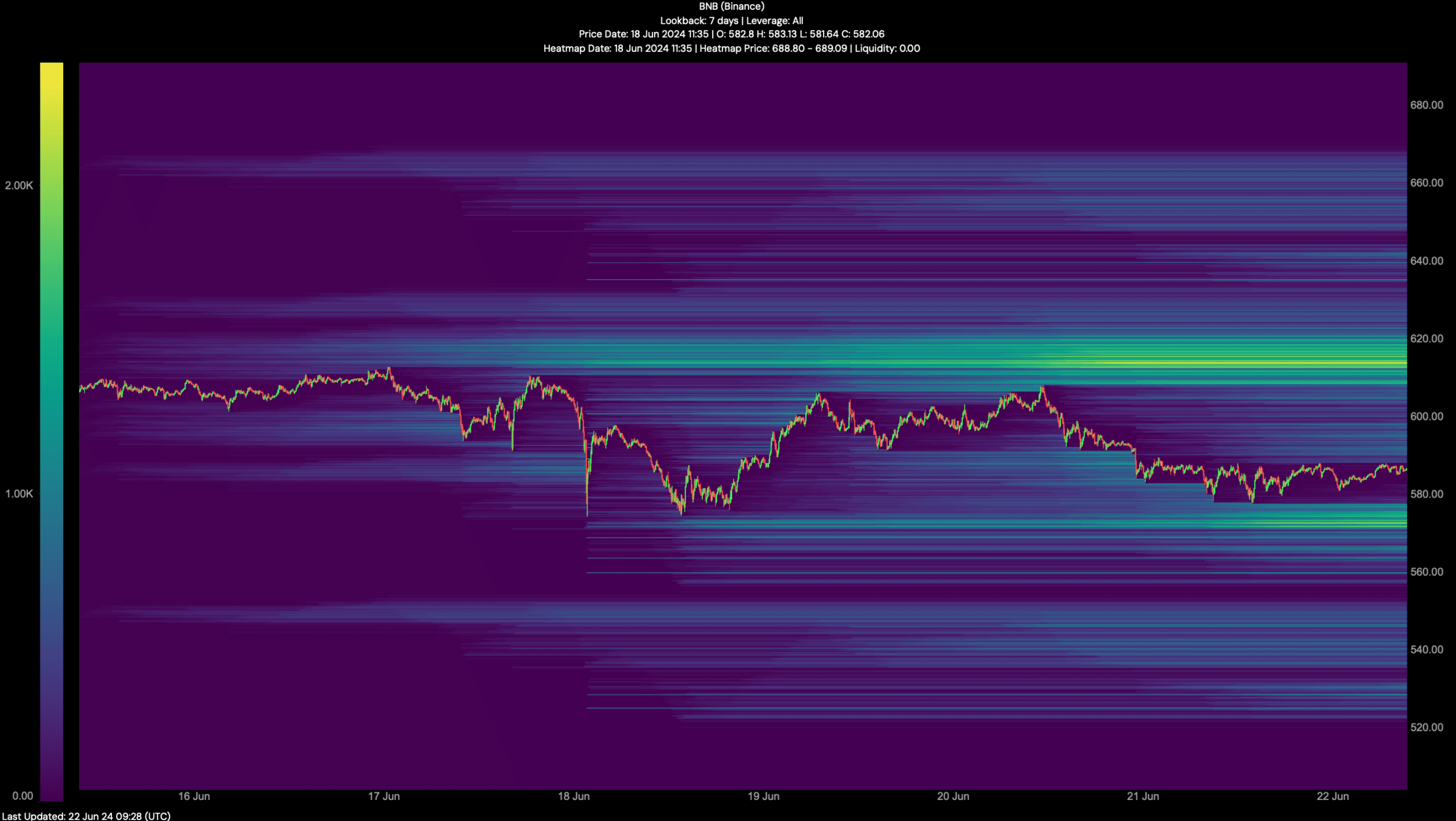

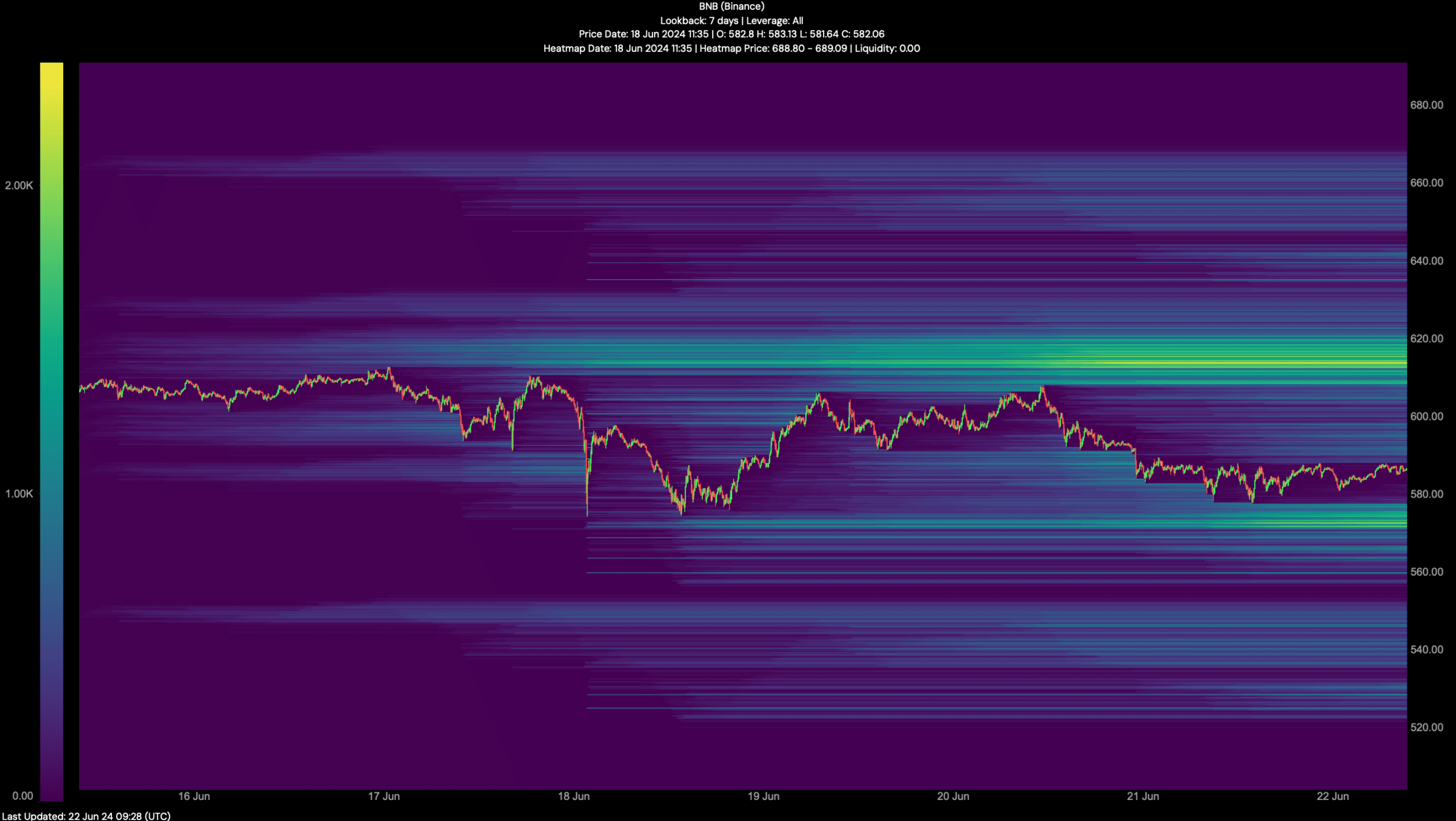

If the bears take over again and push the price of the coin down, investors could see the BNB drop to $571 soon. However, if the bulls manage to beat the bears, there is a chance that BNB will reach $613 in the coming weeks.

Source: Hyblock Capital