- BNB became the best performing top 10 asset over the past 24 hours.

- If accumulation continues to increase, BNB could head towards $400.

Binance [BNB]the native cryptocurrency of the Binance exchange, seems to have received a wake-up call to take back its place from Solana [SOL]. On December 27, BNB price rose past the psychological resistance of $300.

As a result of the breach, BNB was able to record an increase of 10.15% in the last 24 hours.

At the time of writing, the coin was back in fourth position with a market capitalization of $50.92 billion. A few days ago, AMBCrypto explained how SOL took the place of BNB due to its incredible increase in value.

However, the past 24 hours have not been rosy for SOL, whose performances are worth emulating throughout the year.

Binance Coin: Back in fourth place

During the same period, when BNB jumped, the value of SOL fell by 6.99%. It is worth noting that Binance Coin has faced some challenges.

On several occasions, the coin has faced fear, uncertainty and doubt (FUD) due to the regulatory issues of the underlying exchange.

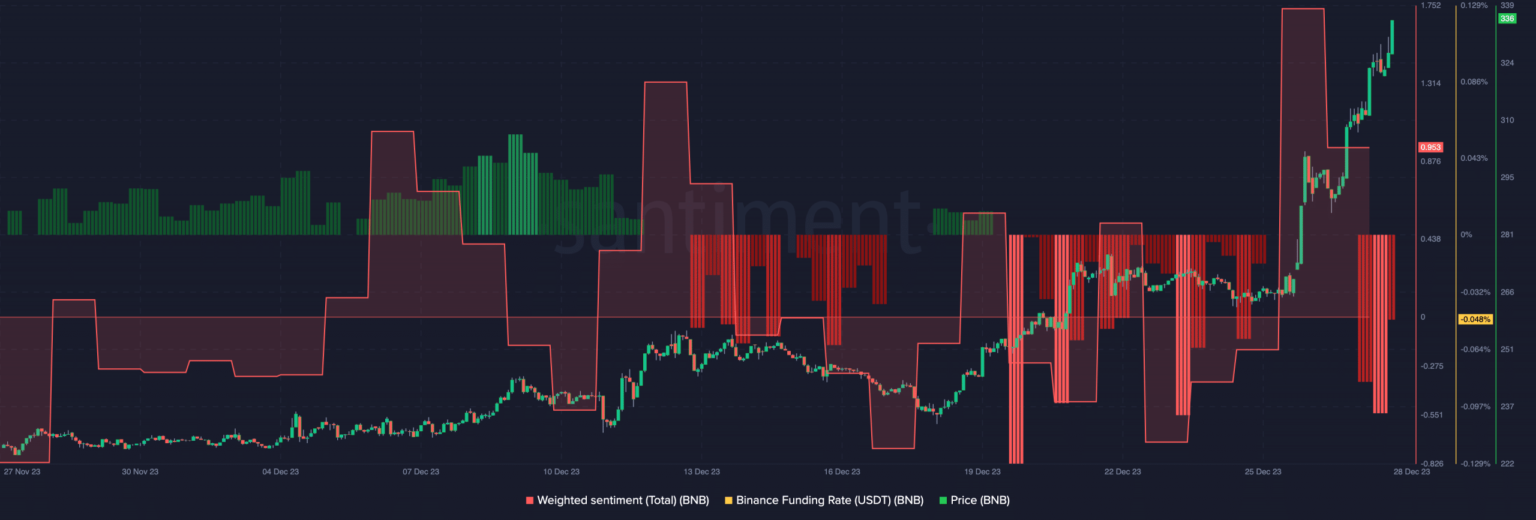

Despite the price increase, traders are bearish on the Binance Coin. According to Santiment data, BNB’s funding rate was -0.048%. Similarly, weighted sentiment also fell to 0.953.

The drop in the metric was evidence of the fact that it was negative sentiment around BNB had not yet faded.

Source: Santiment

While many may think this view implied a “doomsday” for BNB, AMBCrypto’s analysis viewed the trend as positive for the price.

A look at the chart above shows that weighted sentiment and funding rates were in the red on December 14th.

However, that position laid the foundation for a price increase. The same thing happened around December 23rd. Days later, the BNB price exceeded $300. If the metrics remain the same, shorts risk being liquidated.

Can’t the outbreak be stopped?

But it is also important to mention that on-chain data alone may not be sufficient for BNB prediction. That was why the next phase that AMBCrypto considered was the technical prospects.

On the 4-hour BNB/USD chart, the currency formed an asymmetrical triangle between December 18 and 25.

Asymmetrical triangles are patterns that indicate a possible cryptocurrency breakout shortly after a consolidation period. Between the said period, BNB fluctuated between $260 and $275.

But the breakout was spotted at $266. This gave rise to the wave that started on the 27th.

However, the Relative Strength Index (RSI) showed that the currency was overbought. So it’s likely that BNB will see a bit of a turnaround.

But on the other hand, the accumulation/distribution (A/D) value increased. This increase is a sign of buying pressure.

Source: TradingView

Is your portfolio green? View the BNB Profit Calculator

So if BNB holders don’t decide to distribute, chances are the coin price will be close to the $400 region. If this happens, a move to surpass the All-Time High (ATH) could be validated in the expected 2024 bull market.

However, this may not happen as early as January.