- BNB rose over 5%, but technical indicators pointed to a possible bearish divergence.

- Transaction volumes on the BNB chain have fallen by more than 33% in the past week, indicating declining network activity.

Binance coin [BNB] was the biggest gainer among the ten largest cryptos by market capitalization, after rising more than 5% in the past 24 hours.

BNB was trading at $533 at the time of writing, a significant jump from the 24-hour low of $503. Despite these gains, BNB risked a bearish reversal if the bullish trend in the broader market does not hold.

Will BNB’s bullish momentum hold?

The price of BNB reflects that of Bitcoin [BTC]. Therefore, the likelihood of these token gains continuing to rise depends on whether the broader market maintains positive sentiment.

BNB’s daily chart showed a possible bearish divergence. While the price rose, technical indicators suggested that the uptrend remained weak after BNB formed a double top pattern on the daily chart.

BNB formed the first peak in late July after the price jumped from below $500 and tested a key resistance at $600. Later, a downtrend followed, forming a neckline at $464.

The uptrend resumed before failing again after reaching $600.

BNB will confirm a bearish breakout if it falls below $464. However, this bearish thesis will be debunked if the current uptrend continues and BNB breaks resistance above the second peak.

Source: TradingView

The Relative Strength Index at 47 showed that despite the gains, sellers remained in control. The RSI line had to cross above the signal line to confirm the bullish momentum and negate the double top pattern.

Another key indicator that showed a weakening uptrend was the Directional Movement Index (DMI). The positive DI (blue) remained below the negative DI (orange), showing a potential bearish reversal.

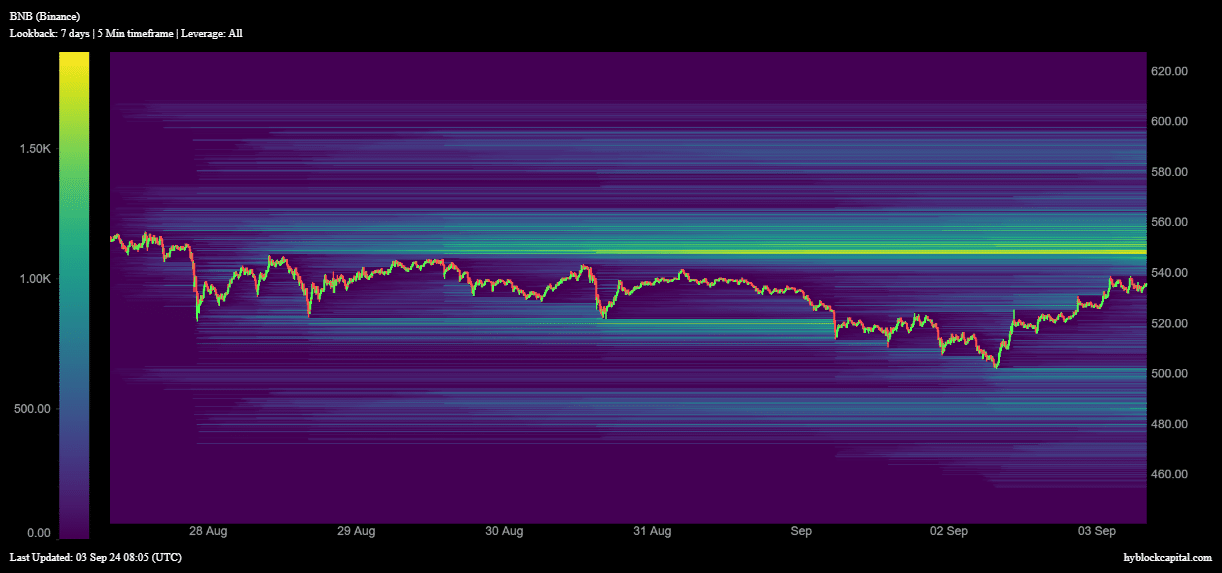

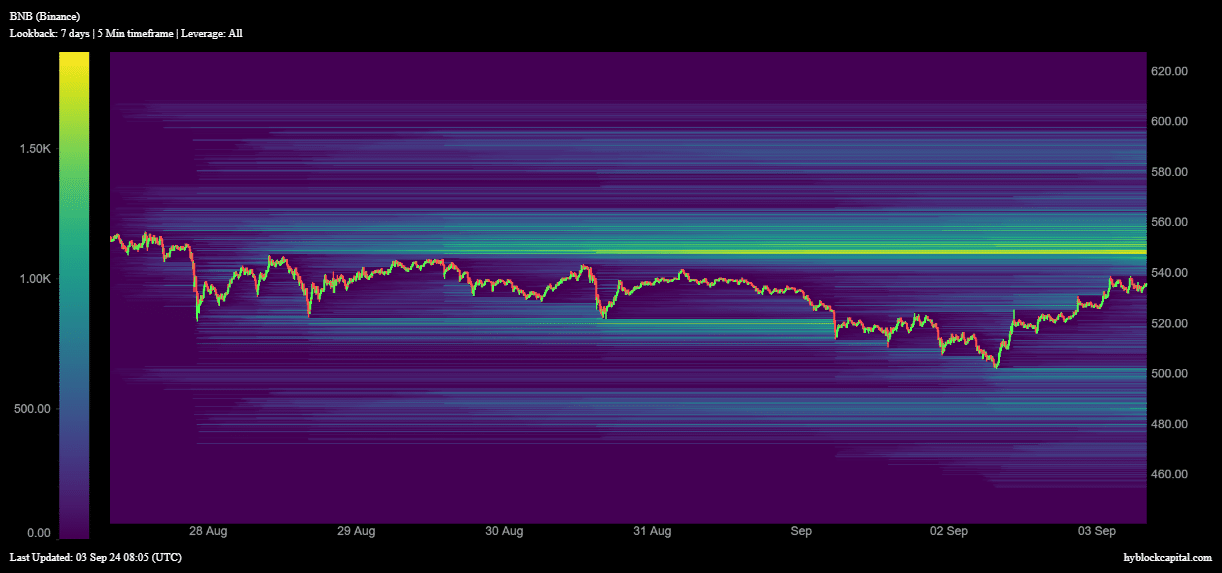

Data from Hyblock Capital showed a high concentration of liquidations at $548. Therefore, this level could be a strong resistance point as traders buying into the rally take profits once BNB approaches $548 to contain losses.

Source: Hyblock Capital

BNB Chain sees usage decreasing

Usage of the BNB chain has also declined, which could further hinder BNB’s ability to recover.

Data from DappRadar showed that the number of unique active wallets on the network has dropped by 25% over the past seven days. Volumes are also down more than 30% from approximately $850 million to $350 million.

Read Binance Coin’s [BNB] Price forecast 2024–2025

This declining network usage could indicate reduced market interest in BNB.

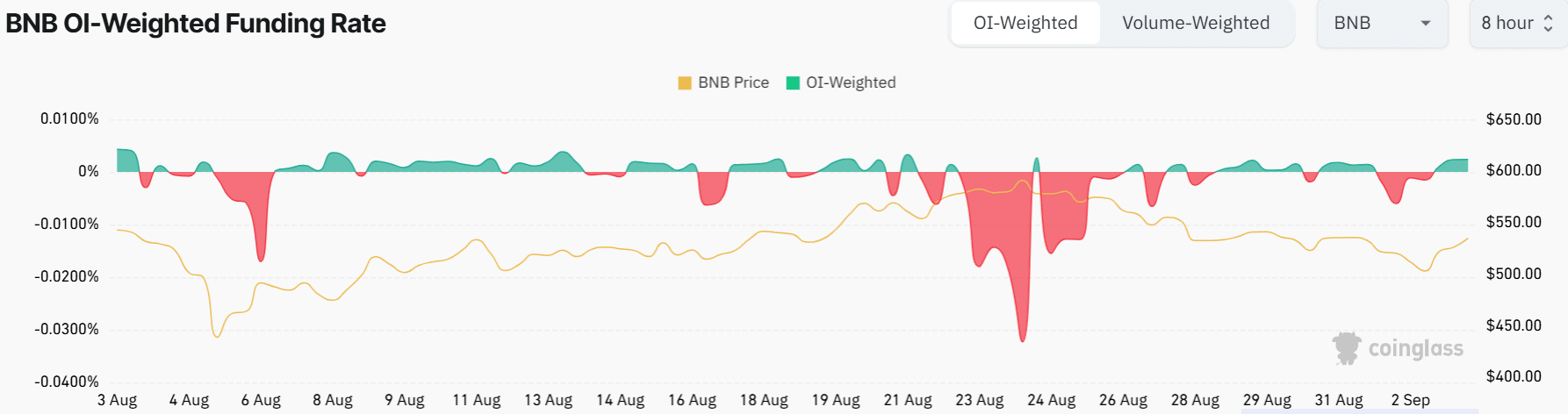

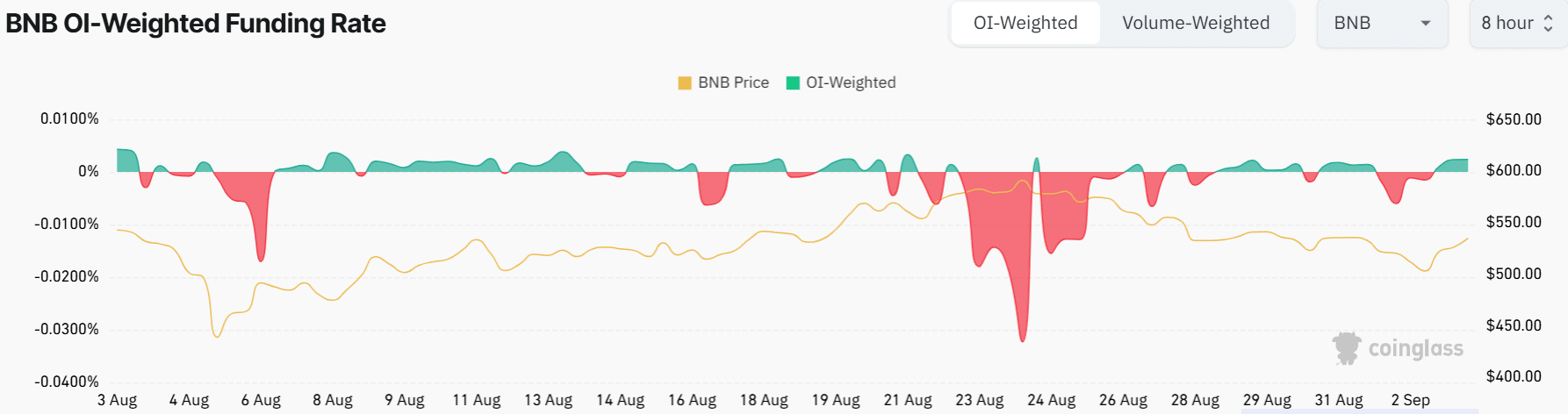

Coinglass data shows that BNB funding rates have been mostly negative over the past month, indicating general bearish sentiment among traders.

Source: Coinglass