The BNB Smart Chain (BSC) saw mixed performance in the second quarter (Q2) of the year, as the broader cryptocurrency market cooled after a strong price increase in March. While BNB, the BSC’s native token, remained largely flat, down 5% quarter-on-quarter (QoQ), the key statistics showed both positive and negative trends.

Binance Smart Chain Revenues Plummet

According to a recent report According to market intelligence platform Messari, the chain’s revenue, which measures total fees collected by the network, fell 28% quarter-over-quarter to $48.1 million in the second quarter, although it fell only 8% year-over-year from 52 $.4 million in the second quarter of 2023.

According to the report, this decline was largely driven by the decline in the price of BNB, as revenue in the network’s initial token terms fell by 51%, from 165,100 BNB to 81,300 BNB.

Related reading

The report also highlighted a decline in network activity on average daily transactions down 10% quarter-on-quarter to 3.7 million and average daily active addresses fell 18% quarter-on-quarter to 1.1 million. This trend was not isolated to the BSC, as on-chain activity on most smart contract platforms declined in the second quarter after a strong first quarter.

Despite the overall decline, the report found notable shifts in user preferences within the BSC ecosystem, as decentralized exchange (DEX) Uniswap experienced a significant increase in daily transactions, up 630% quarter-on-quarter, while the previously dominant PancakeSwap saw a decline of saw 46% quarterly.

Strike increases by 30%, TVL decreases

Messari also highlighted that total BNB deployed rose 30% quarter-on-quarter to 30.4 million BNB, with the total dollar value of funds deployed rising 24% to $17.7 billion. This ranks the Binance smart chain as the third-highest Proof-of-Stake (PoS) network by stake value, although it still trails the Solana blockchain by a significant $38.4 billion.

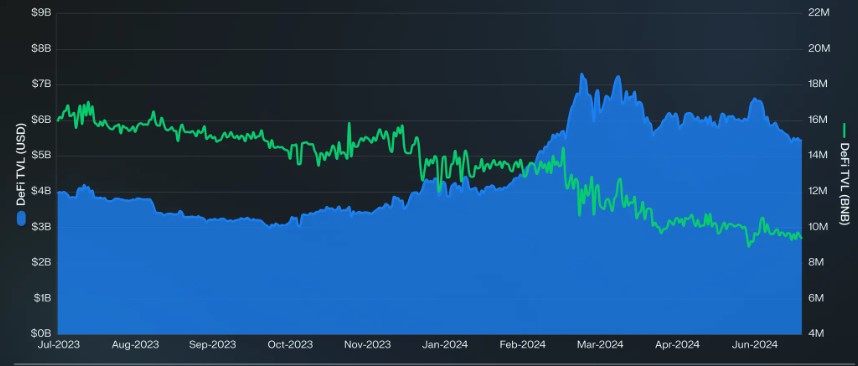

However, the BSC’s decentralized finance (DeFi) ecosystem saw a 24% quarter-on-quarter decline in total value locked (TVL) to $5.5 billion, mainly due to a 41% quarter-on-quarter decline in lending through the DeFi Protocol, Venus Finance.

The company notes that this indicates that the overall decline in value locked was partly due to the decline in the value of the BNB token, which ended the quarter at a low of $567 after hitting an all-time high of $722 in March.

Despite these fluctuations, Messari reported that Binance Smart Chain maintained the third-highest trading volume on the decentralized exchange (DEX) during the second quarter of the year, with a total volume of $66 billion, behind only Ethereum (ETH) and Solana.

BNB price analysis

At the time of writing, the BNB token was trading at $586, up over 2% in the past 24 hours. However, according to CoinGeko, trading volume fell 3% to $830 million over the past 24 hours. facts.

Since Friday, the token has been consolidating between $570 and its current trading price, following the lead of the market’s largest cryptocurrencies, after a failed attempt on Monday to break through the nearest one. resistance wall at $590, which is the last obstacle preventing a rise to the $600 mark.

Related reading

Conversely, the most important level to watch for BNB bulls is the 200-day exponential moving average (EMA), noted on the daily BNB/USDT chart below, with the yellow line just below the current price, which could act as an important support for the token, potentially preventing further declines.

Featured image of DALL-E, chart from TradingView.com