- BNB records a large growth of the unique address number on the market, trending higher.

- On the daily graph, traders with close stop orders can be forced from their positions, which activates a potential rally.

In the last 24 hours, the market movement is not in full favor of bullish traders, because it fell by 3.57%.

Ambcrypto discovered that this decline by investors with remarkable companies could have been caused by violence, and could resume a repurchase, possibly places Binance currency [BNB] Among the best market amplifiers.

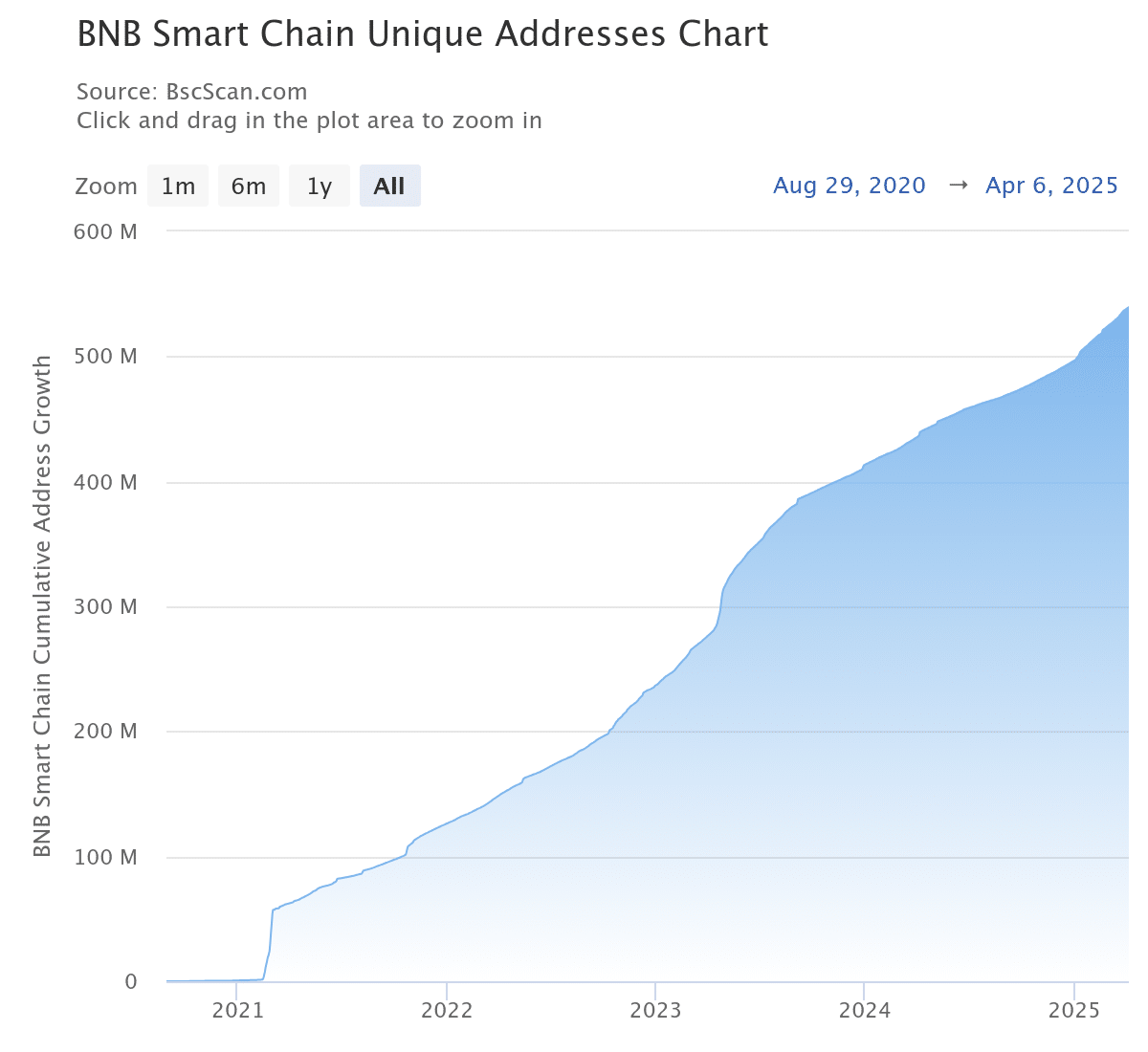

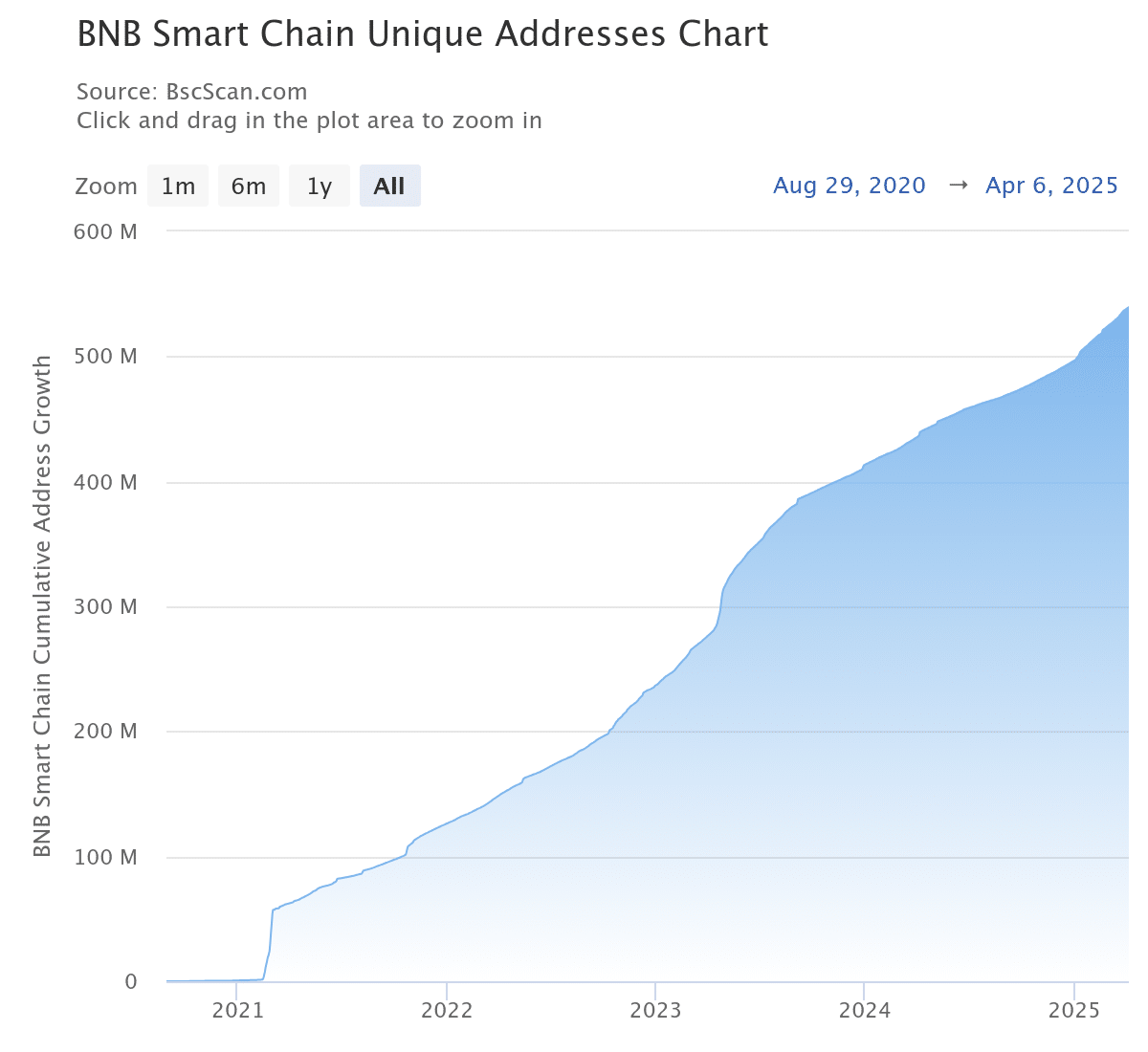

BNB Adoption is growing gradually

BNB’s adoption on the market has grown considerably in the last 24 hours. Unique addresses reached a record of 539 million. This reflects an increase of 268,000 compared to the level of the previous day.

Unique addresses are that are interaction for the first time with the BNB Smart Chain. This includes receiving or sending BNB. They are often treated as an estimate of users in the chain.

Source: BSCSCAN

The growth in unique addresses can be linked to the BNB trade in the last 24 hours. Users have actively purchased or received it during this time.

Moreover, the number of transactions on the chain increased considerably. It reached 4 million within the same period, which indicates a higher participation. This has contributed to the total growth of the asset.

Source: BSCSCAN

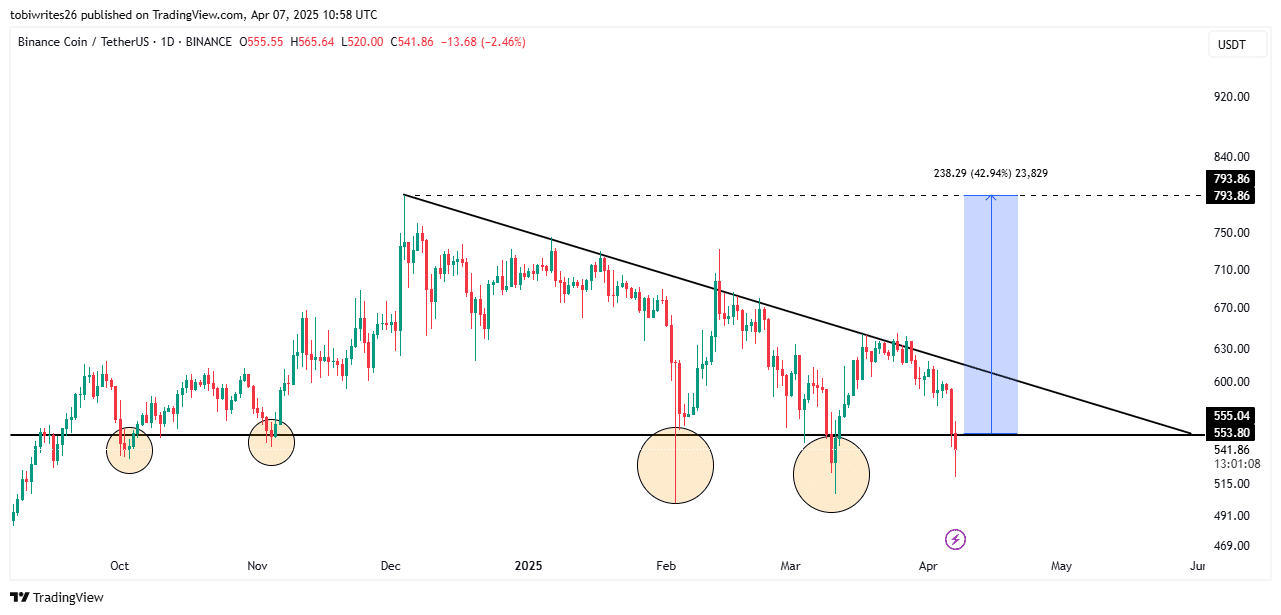

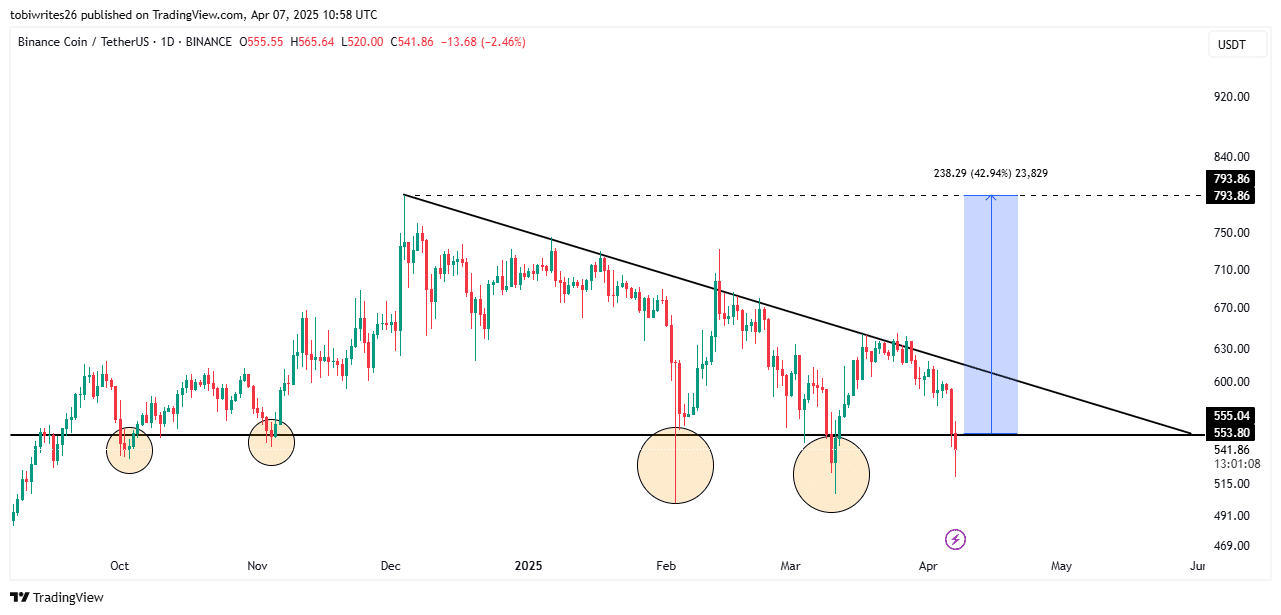

Ambcrypto discovered on the graph that BNB brought a big push to the market in the market, because it acts a historic purchase zone.

Historical zone – Will ‘Paper Hands’ are forced?

On the daily graph, BNB has traded in an important level of support, which forms a bullish triangular pattern, with a large rise on the horizon.

This level is interesting because the first two times that it was actively traded in this zone, it led to a big price staff to the top.

In the latter two cases, however, it has activated the liquidity wipe – or the hunt stops. In these cases the price was a long, downward wick before it quickly reversed.

Source: TradingView

This scenario forces traders ‘paper hand’ from the market. These traders often have stop loss in the vicinity of support levels or low convictions.

In the meantime, large investors benefit from the situation by collecting BNB at reduced prices as the market trends are lower.

If a strong momentum follows this purchase activity, BNB could break the falling resistance line pattern. It can collect 42% up to $ 793, a level that is last seen in December 2024.

Ambcrypto analyzed the market reaction on these reduced prices. They discovered that buying sentiment dominated both the spot and derivative markets, to support the accumulation story.

Traders see accumulation opportunities on the market

Buying activities has been strong on the spot market. In the last 24 hours, $ 9.83 million has been collected from BNB as the prices were lowered, so that the total accumulation has been brought to $ 21.04 million in the last three days.

This accumulation movement emphasizes that traders buy in large volumes to take advantage of the low price of BNB on the Spotmarkt.

The same sentiment exists on the derivatives market, because the Open Interes (OI )weight financing percentage remained positive.

Source: Coinglass

At the time of writing, the OI-weighted financing figure and an important indicator that is used to determine the market sentiment in the BNB Futuresmarkt-a bullish outlook. The lecture determines the market sentiment and shows bullish behavior when it above 0% and bearish behavior below 0%.

At the time of the press, the lecture was 0.0020%, indicating bullish market activity. Long traders actively dominate restless Futures contracts and gambling at a meeting.

If the bullish sentiment continues to grow between both spot and derivative traders, this means that BNB could reach the projected price jump to its high in December.