- BNB’s price has fallen by more than 10% in the past seven days.

- Some figures pointed to a trend reversal.

Binance coin [BNB] bears dominated this past week as the coin’s price fell by double digits. However, BNB was testing a crucial resistance level at the time of writing. A breakout above could result in a bull rally.

Let’s take a closer look at what’s going on.

BNB tests a crucial resistance

CoinMarketCaps facts revealed that the price of BNB had fallen by more than 10% in the past seven days. The downtrend continued over the past 24 hours as the coin fell marginally.

At the time of writing, BNB was trading at $604 with a market cap of over $89 billion.

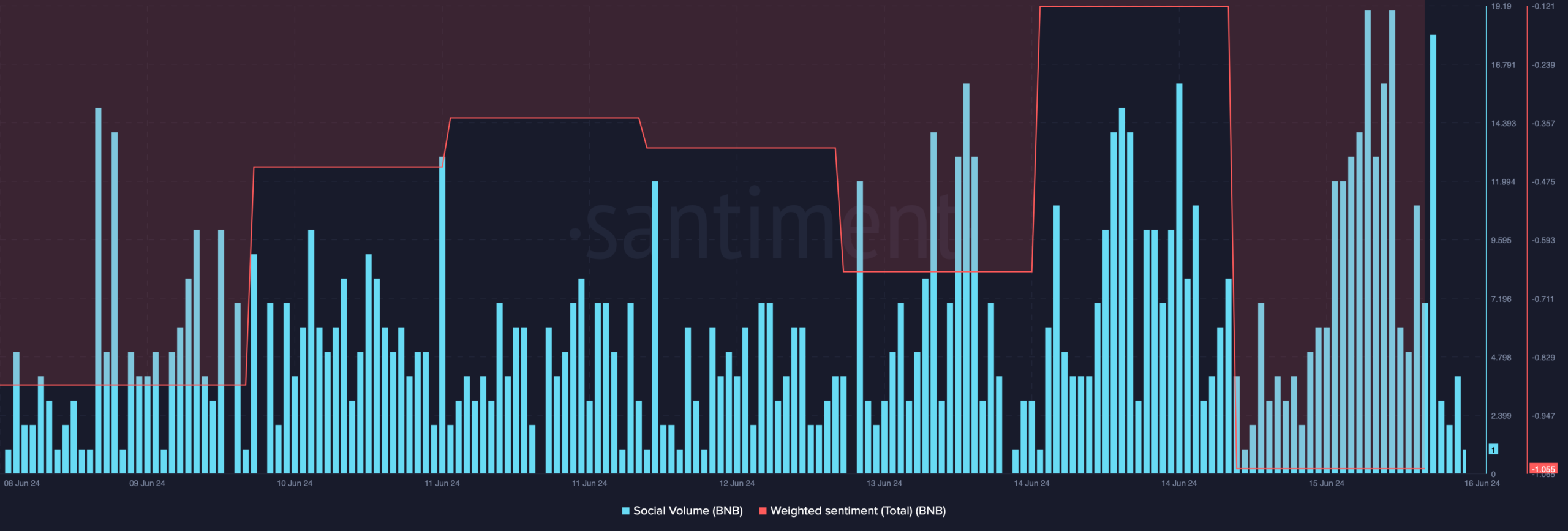

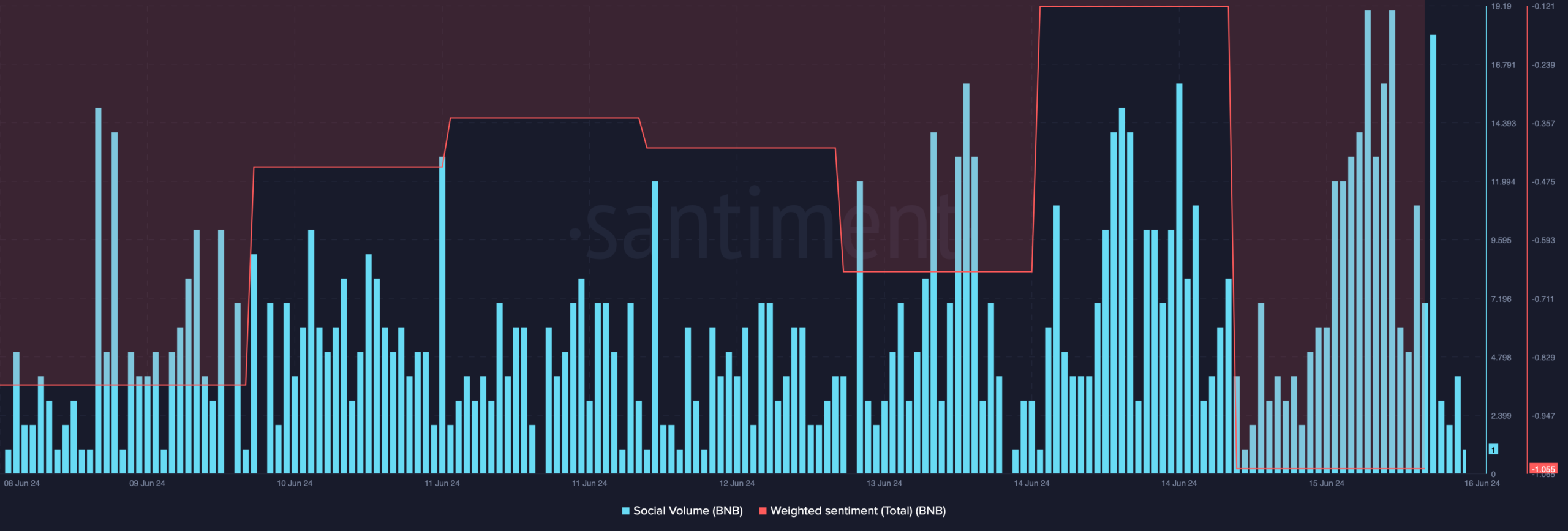

The falling price action made BNB a topic of discussion in the crypto space, which was evident from the rise in social volume.

But the weighted sentiment fell sharply, meaning that bearish sentiment around the coin was dominant in the market.

Source: Santiment

However, things could take a turn for the worse in the coming days as the coin tests a crucial resistance level.

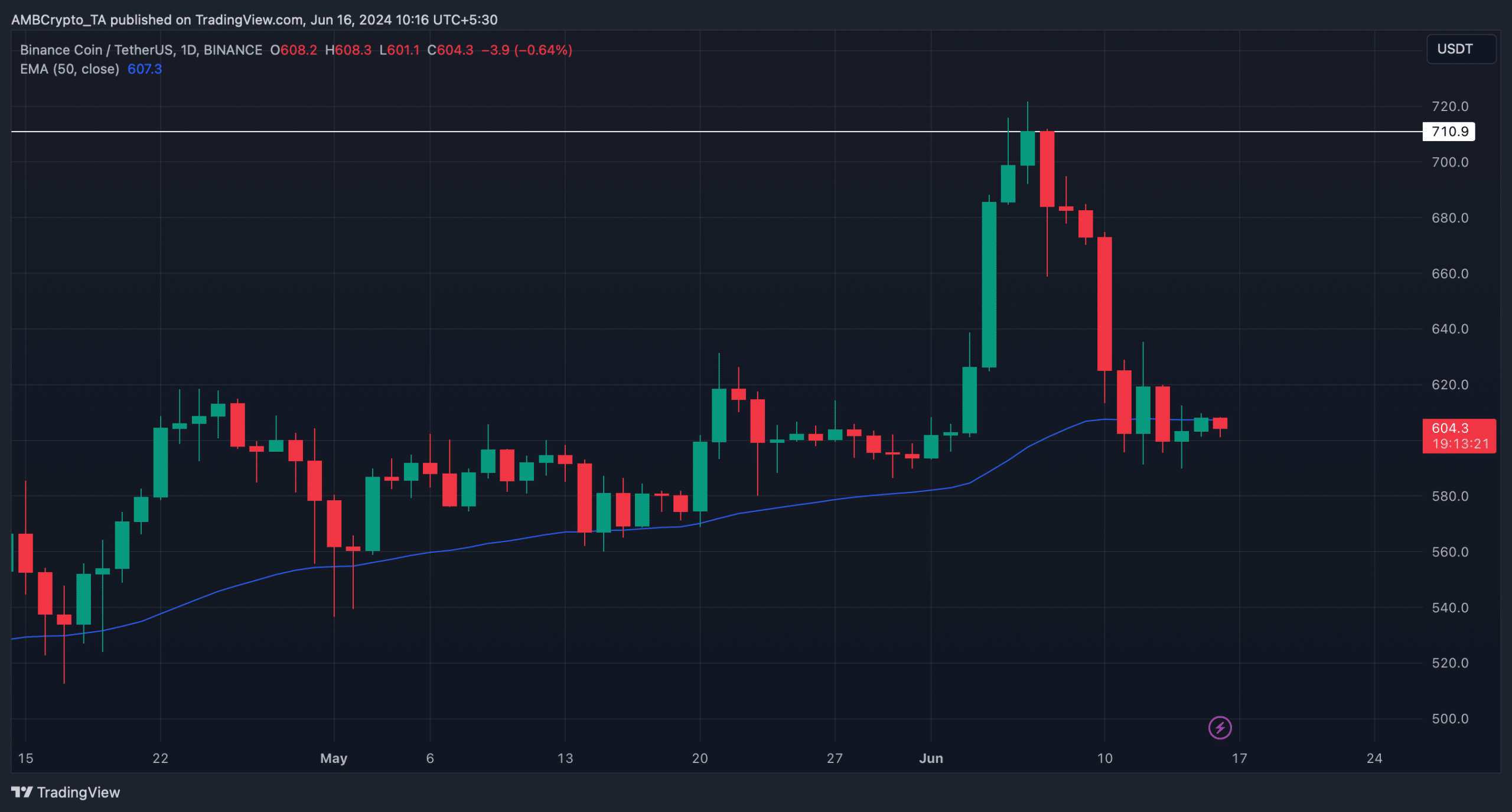

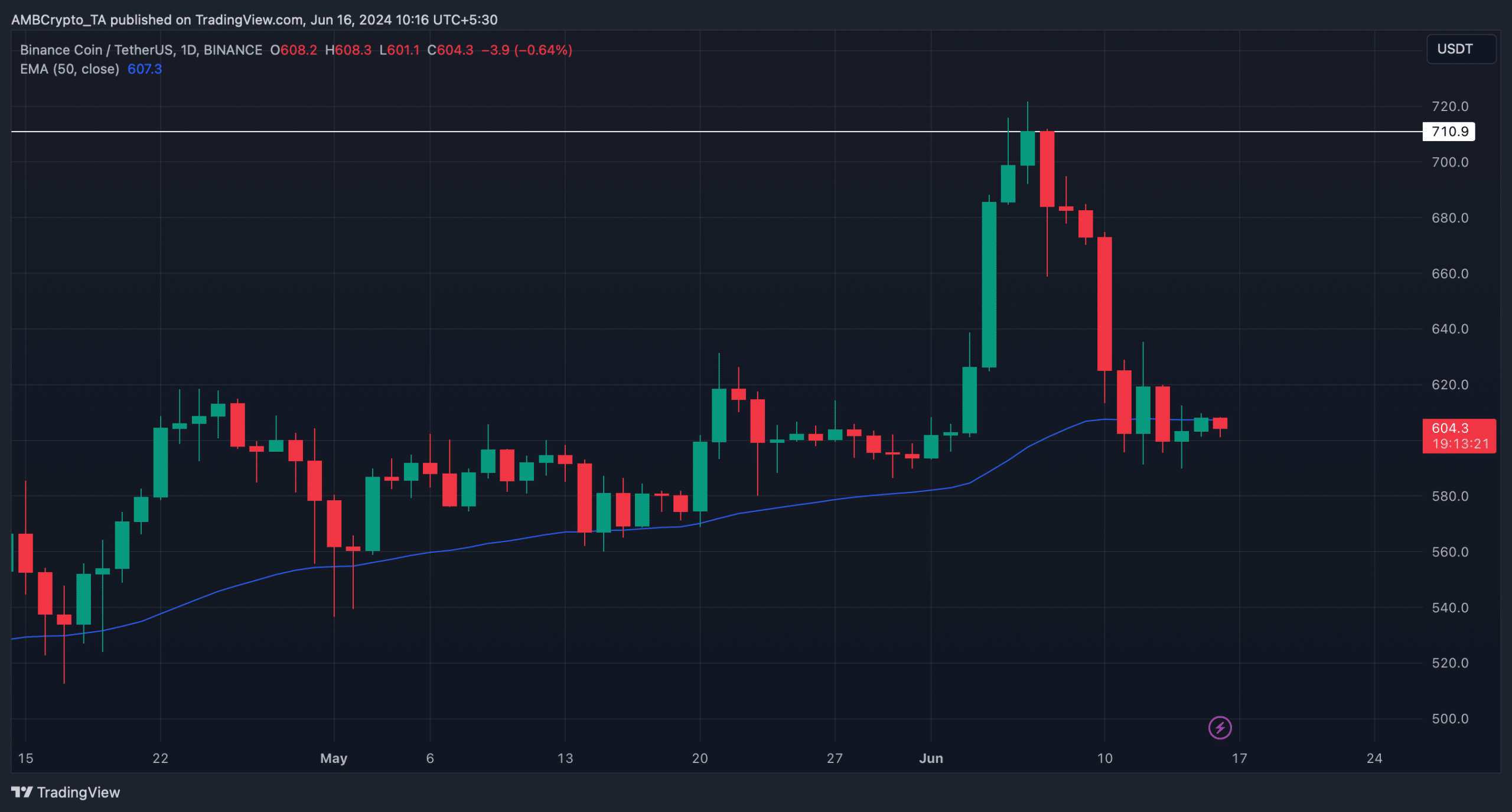

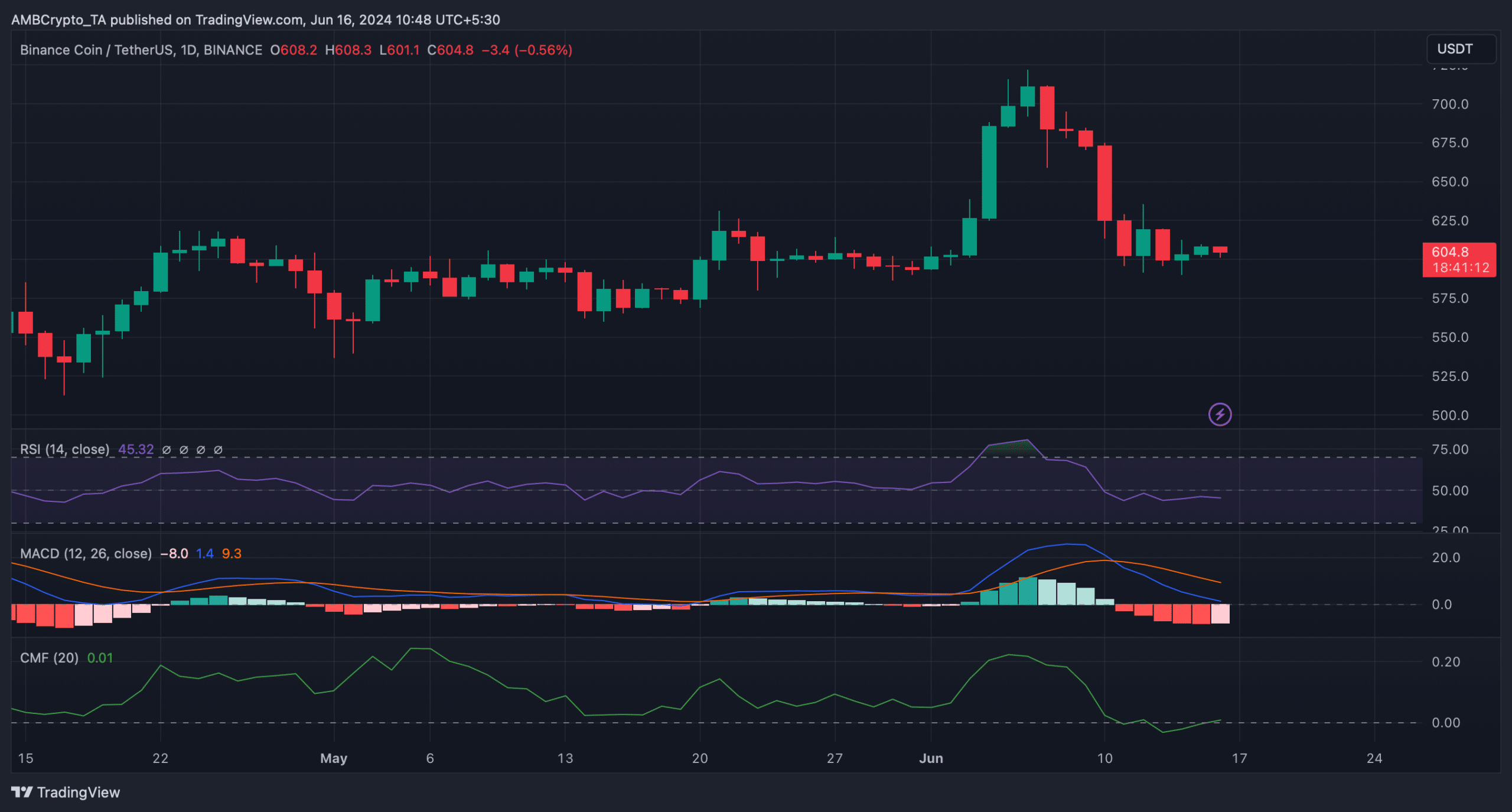

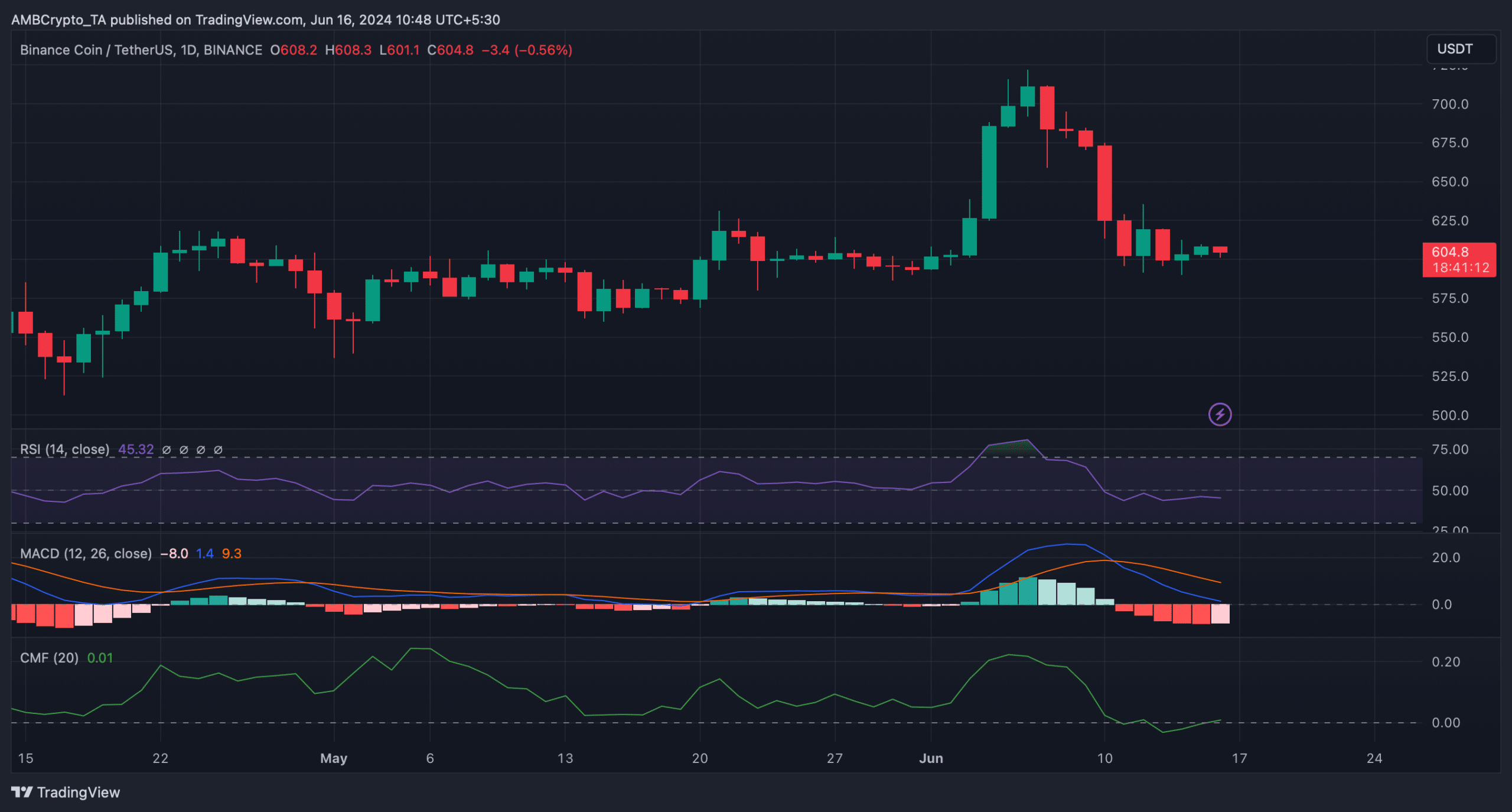

AMBCrypto’s analysis of BNB’s daily chart revealed that the coin was testing its 50-day Exponential Moving Average (EMA). In general, the 50-day EMA acts as a support and resistance level.

Therefore, a breakout above that level usually results in a bull rally.

If BNB manages to break out on this occasion, investors could witness a massive price increase. This may allow BNB to recover another $710.

Source: TradingView

Is a Bullish Breakout Possible?

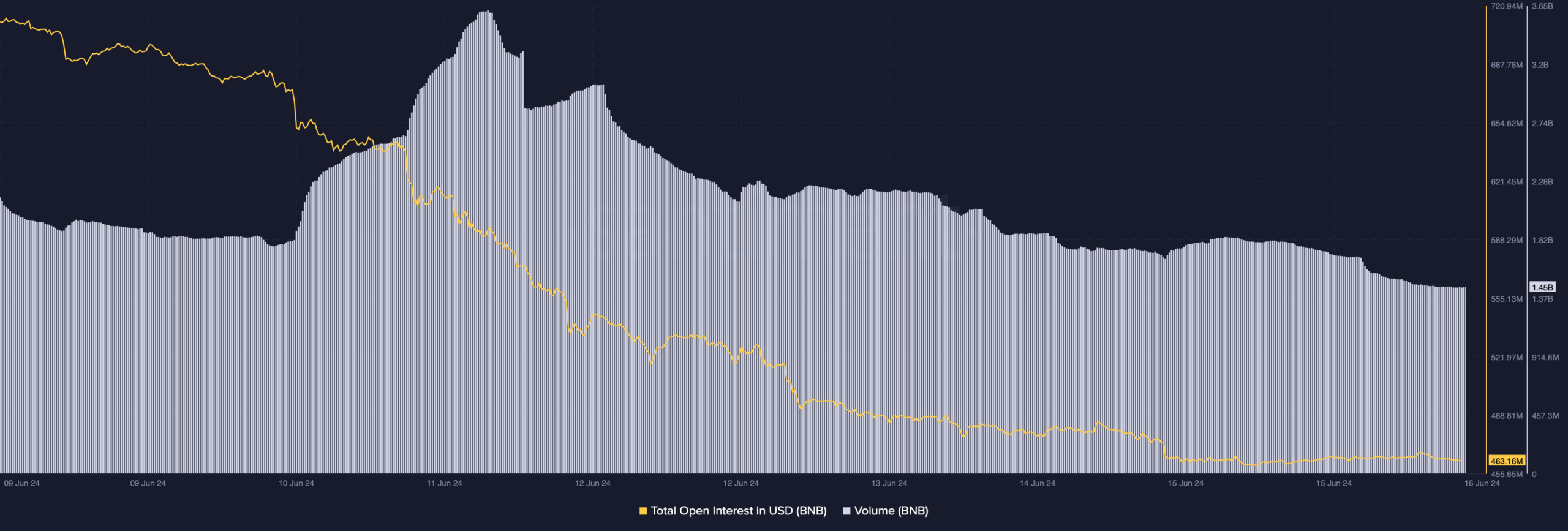

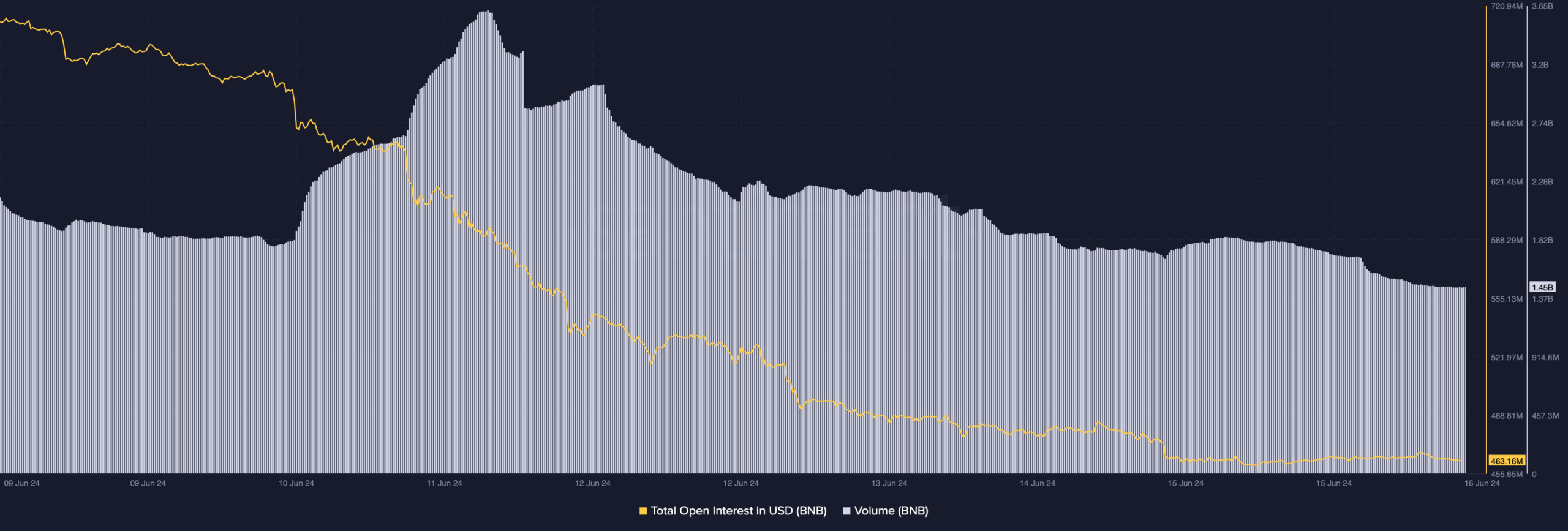

Since there was a chance of a trend reversal, AMBCrypto analyzed Santiment’s data to see if the statistics supported this possibility. We found that BNB’s Open Interest fell along with its price.

A decline in the measure suggests that the possibility of the ongoing price trend changing is high. Moreover, BNB volume also fell, indicating a soon trend reversal.

Source: Santiment

Interestingly, the coin’s Chaikin Money Flow (CMF) also registered an increase and rose above the neutral line at the time of printing. This indicated a possible price increase.

Nevertheless, the remaining indicators were bearish.

For example, the MACD showed a bearish advantage in the market. The Relative Strength Index (RSI) remained below the neutral line, indicating a continued price decline.

Source: TradingView

Realistic or not, here it is The market capitalization of BNB in BTC terms

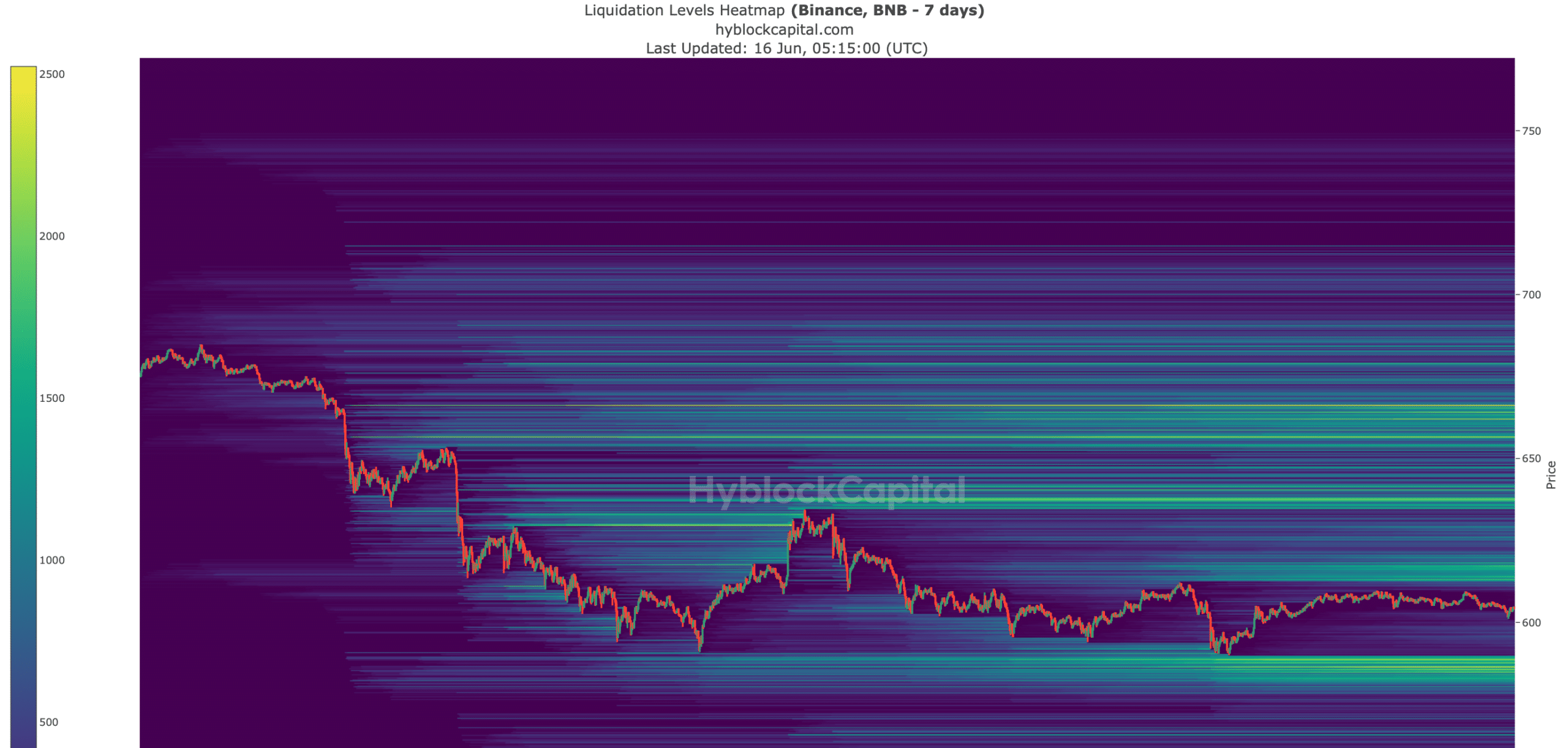

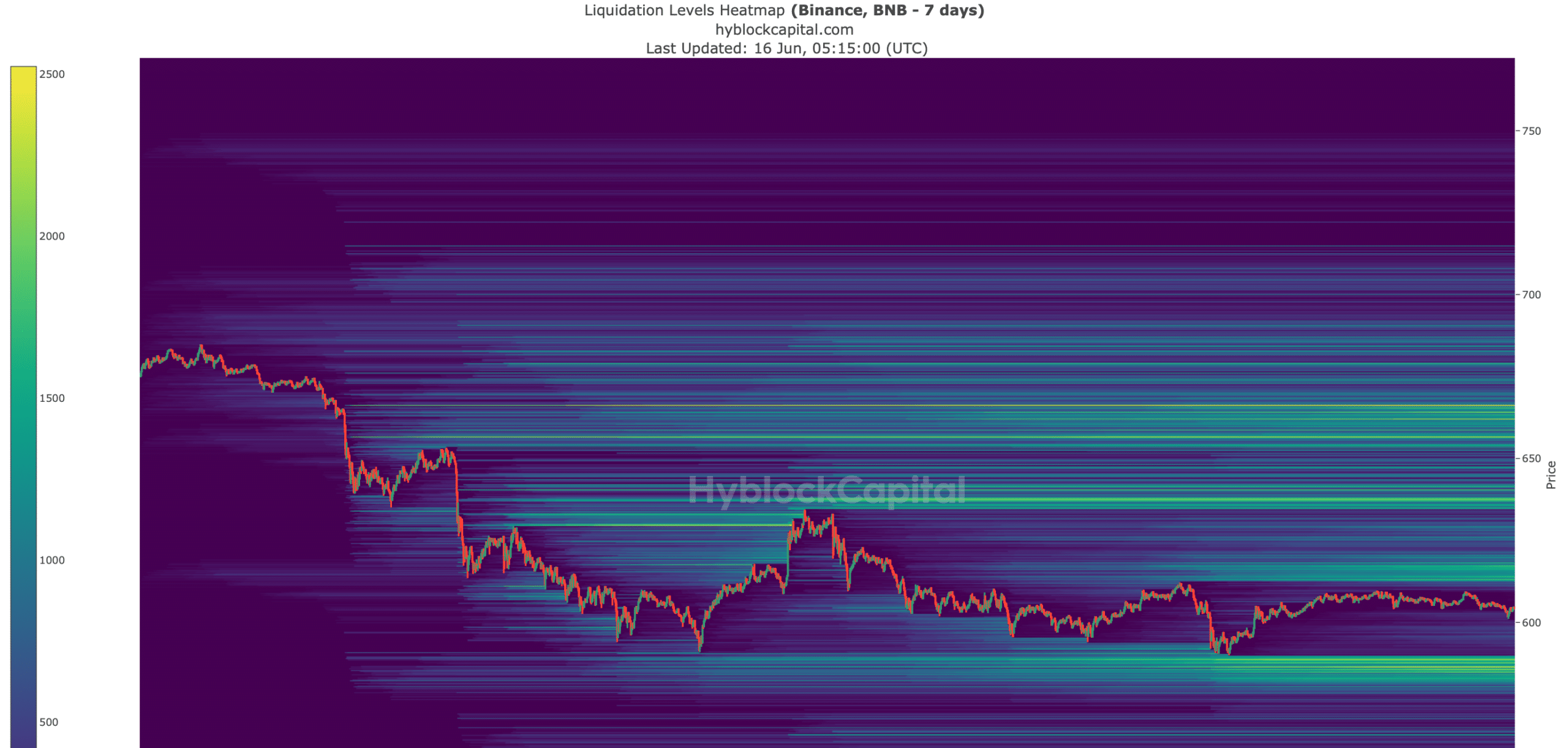

If BNB manages to initiate a bull rally by moving above the 50-day EMA, the coin would witness a high liquidation near $617. High liquidations often result in short-term price corrections.

A breakout above that level could see the coin hit $637 in the coming week. However, if the bearish trend continues, BNB could drop to $603.

Source: Hyblock Capital