Steven PU, co-founder of Layer-1 Blockchain Taraxa, issued a report on 24 February with a significant gap between claimed and actual blockchain performance.

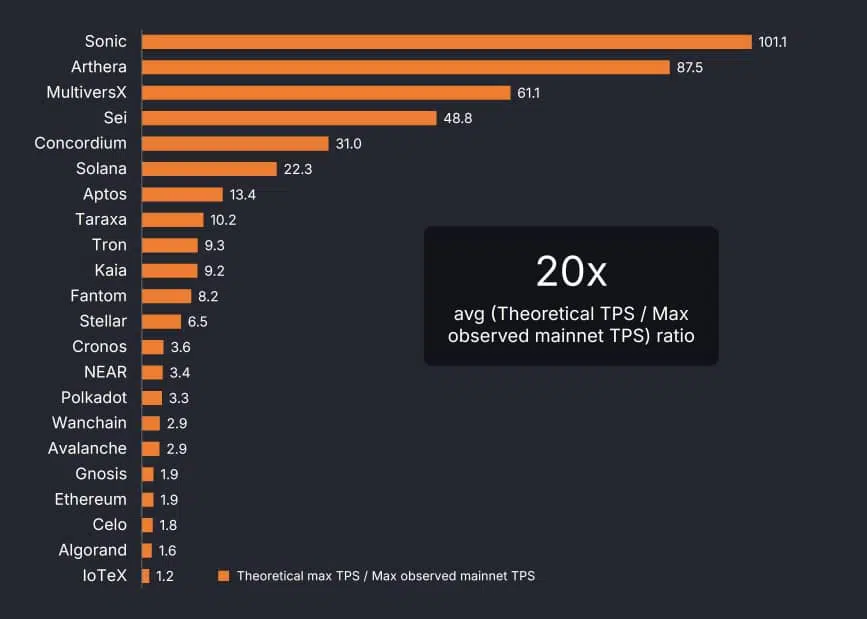

The study analyzes 22 networks using data from Chainspect and shows that theoretical transactions per second (TPS) are emphasized on average 20 times compared to Real-World results. According to the findings, this discrepancy stems from lab-based statistics that do not maintain live maintenance.

The report introduces a new statistics: TPS per dollar issued to a validator junction (TPS/$), with the aim of measuring the cost efficiency instead of just rough speed. Over the 22 chains, theoretical TPS was on average 20 times higher than observed minstet performance, where only four networks with double digits achieve TPS/$ ratios.

PU states that this shows that many blockchains require expensive hardware for modest transaction rates, challenging claims of scalability and decentralization.

“We must all stay with transparent, verifiable performance tricks on the chain,” according to the study.

Source: Chain spect

Maybe you also like it: The TPS claim from Base can be blown up by counting failed transactions

Blockchain scalability questioned

The findings of PU suggest that the focus of the industry on high TPS stakeholders misleads. Bitcoin (BTC) and Ethereum (ETH), for example, give priority to security over speed, while newer chains tackle large numbers that rarely materialize. The TPS/$ metriek could shift how developers assess networks on practical usage scenarios such as payments or supply chain tracking. The report states that,

Max Observed Mainstet TPS for supplied networks, over a 100-block window (TX/s)

It is worth noting that Chainspect specifically excludes transactions that can unfairly inflate these Max TPS -Metriek, such as voice transactions

Taraxa insists on transparency

Taraxa, a proof-of-stake-layer-1 focused on audit logging, framing this as a wake-up call. PU, an entrepreneur trained by Stanford, is urging the dependence of verifiable main data about white paper hype.

This is when the crypto space struggles with adopting thines. Bloated statistics can deform investment and development decisions, in particular in decentralized financial and supply chain use cases that require reliable performance. PU suggests that cost-efficiency statistics such as TPS/$ can re-define how blockchain endurance is evaluated, so that the focus shifts to networks that deliver practical value instead of only high theoretical speeds.

Maybe you also like it: What is Layer-1 Blockchain? Blockchain -layers explained